Does anyone know why we're still doing tariffs?

The ridiculous policy has taken on a life of its own.

In case you haven’t heard, the Supreme Court just ruled many of Donald Trump’s tariffs illegal:

[T]he Supreme Court ruled that the unilaterally imposed [tariffs] were illegal…No longer does Trump have a tariff “on/off” switch…Future tariffs will need to be imposed by lengthy, more technical trade authorities — or through Congress…

In a 6-3 ruling, the Supreme Court said that affirming Trump's use of the International Emergency Economic Powers Act (IEEPA) would "represent a transformative expansion of the President's authority over tariff policy."…Chief Justice John Roberts said that IEEPA does not authorize the president to impose tariffs because the Constitution grants Congress — and only Congress — the power to levy taxes and duties.

This doesn’t mean that Trump’s tariffs are going to suddenly vanish. More are on the way. There are older laws passed by Congress in the 1960s and 1970s that authorize the President to raise tariffs under certain circumstances. Here’s a summary by the Yale Budget Lab:

[T]he president has other sources of legal authority to enact tariffs without further congressional action. These authorities generally fall into two groups: those that require investigations by federal agencies but have few if any restrictions on the eventual tariffs imposed (Sections 201, 232, and 301) and Section 122, which provides a temporary authority to impose tariffs without an investigation, but is limited to a 15 percent rate for only 150 days. There is another authority, under Section 338 of the Tariff Act of 1930 (otherwise known as Smoot-Hawley) that would allow the President to impose a 50 percent tariff with no investigation or time limitations, but no President has used this authority before, raising again concerns about future legal challenges.

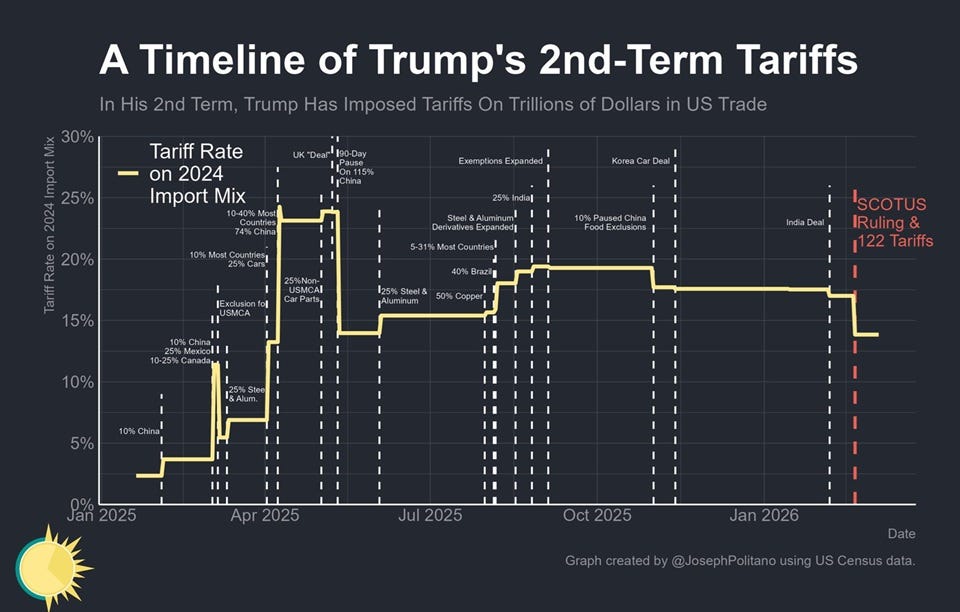

For now, all those other laws still stand, and Trump is going to use at least some of them. He immediately invoked one of the other laws, called Section 122, to put a 10% tariff on all imports from all countries, and then raised that to 15% a day later. This means the overall statutory tariff rate on U.S. imports (or at least, on the mix of imports from 2024), which would have fallen to around 9% after the SCOTUS ruling, will actually fall only a tiny bit:

But tariffs are very complex, and there are a ton of exemptions. Because these tariffs are more blanket than the ones SCOTUS just struck down, and because they interact with other tariffs that are still on the books, the new regime could raise effective tariff rates to even higher levels than before the SCOTUS decision.

That Section 122 tariff is supposed to be temporary — it only lasts 5 months — but Trump can presumably just renew it for another 5 months when it ends, until he gets sued again and it goes back to the Supreme Court. Then if that doesn’t work, he can use the various other laws, getting sued each time. In other words, Trump will be able to keep imposing large tariffs for the rest of his term in office.

So the fun continues. Whee!!

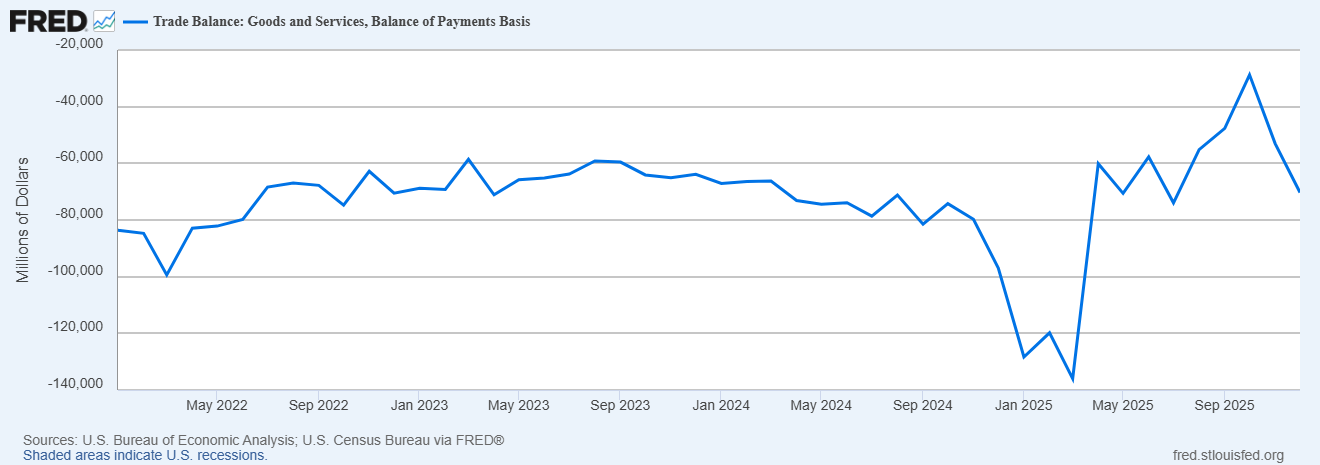

What was the point of these tariffs? It has never really been clear. Trump’s official justification was that they were about reducing America’s chronic trade deficit. In fact, the initial “Liberation Day” tariffs were set according to a formula based on America’s bilateral trade deficits with various countries.1 But trade deficits are not so easy to banish, and although America’s trade deficit bounced around a lot and shifted somewhat from China to other countries, it stayed more or less the same overall:

Economists don’t actually have a good handle on what causes trade deficits, but whatever it is, it’s clear that tariffs have a hard time getting rid of them without causing severe damage to the economy. Trump seemed to sense this when stock markets fell and money started fleeing America, which is why he backed off on much of his tariff agenda.

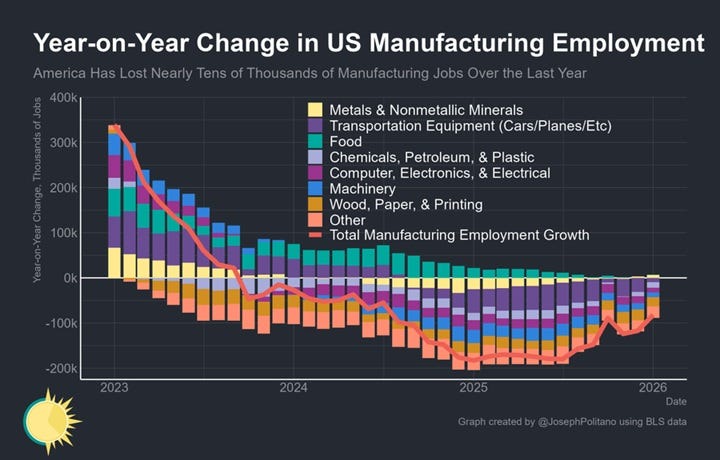

Trump also seemed to believe that tariffs would lead to a renaissance in American manufacturing. Economists did know something about that — namely, they recognized that tariffs are taxes on intermediate goods, and would therefore hurt American manufacturing more than they helped. The car industry and the construction industry and other industries all use steel, so if you put taxes on imported steel, you protect the domestic market for American steel manufacturers, but you hurt all those other industries by making their inputs more expensive.

And guess what? The economists were right. Under Trump’s tariffs, the U.S. manufacturing sector has suffered. Here’s the WSJ:

The manufacturing boom President Trump promised would usher in a golden age for America is going in reverse…Manufacturers shed workers in each of the eight months after Trump unveiled “Liberation Day” tariffs, according to federal figures…An index of factory activity tracked by the Institute for Supply Management shrunk in 26 straight months through December…[M]anufacturing construction spending, which surged with Biden-era funding for chips and renewable energy, fell in each of Trump’s first nine months in office.

And here’s a handy chart, via Joey Politano:

Trump didn’t cause all of the slowdown — it began a few months before he took office — but manufacturers consistently report that tariffs are making things worse. Tariff cheerleaders like Oren Cass, who goes around shouting that economists don’t know anything and that economics isn’t a science, have gone strangely silent in the face of this clear victory for textbook economics.

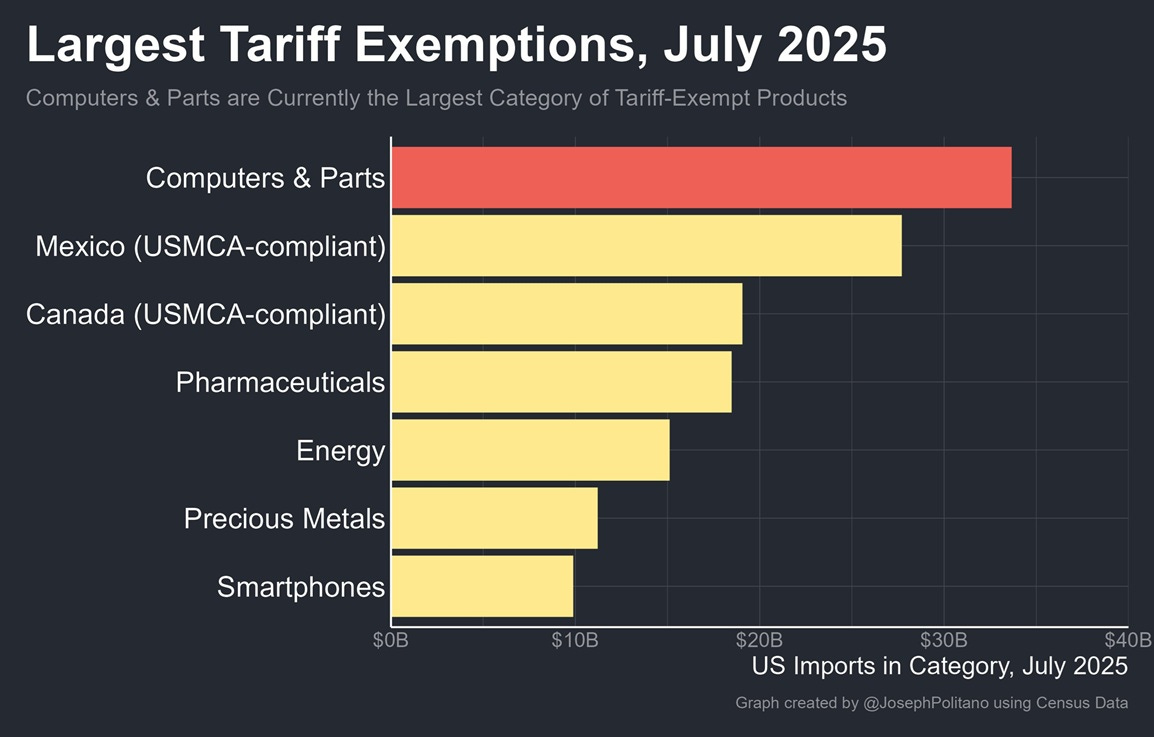

On some level, Trump — unlike pundits like Cass — seems to realize the basic economics of how tariffs hurt American industry. Recognizing the AI boom’s importance to the current economic expansion, he has granted huge exemptions for the computers that are being used to build AI data centers:

Macroeconomically, the tariffs haven’t been as big a deal as initially feared. Growth came in slightly weak in the final quarter of 2025, but that was mostly due to the government shutdown, and will rebound next quarter. Inflation keeps bumping along at a little bit above the official target, distressing the American consumer but failing to either explode or collapse. The President’s cronies have taken to holding up this lack of catastrophe as a great victory, but this sets the bar too low. If you back off of most of your tariffs and the economy fails to crash, you don’t get to celebrate — after all, the tariffs were ostensibly supposed to fix something in our economy, and they have fixed absolutely nothing.

Instead, the tariffs have mostly just caused inconvenience for American consumers, who have been cut off from being able to buy many imported goods. The Kiel Institute studied what happened to traded products after Trump put tariffs on their country of origin, and found out that they mostly just stopped coming:

The 2025 US tariffs are an own goal: American importers and consumers bear nearly the entire cost. Foreign exporters absorb only about 4% of the tariff burden—the remaining 96% is passed through to US buyers…Using shipment-level data covering over 25 million transactions…we find near-complete pass-through of tariffs to US import prices……Event studies around discrete tariff shocks on Brazil (50%) and India (25–50%) confirm: export prices did not decline. Trade volumes collapsed instead…Indian export customs data validates our findings: when facing US tariffs, Indian exporters maintained their prices and reduced shipments. They did not “eat” the tariff. [emphasis mine]

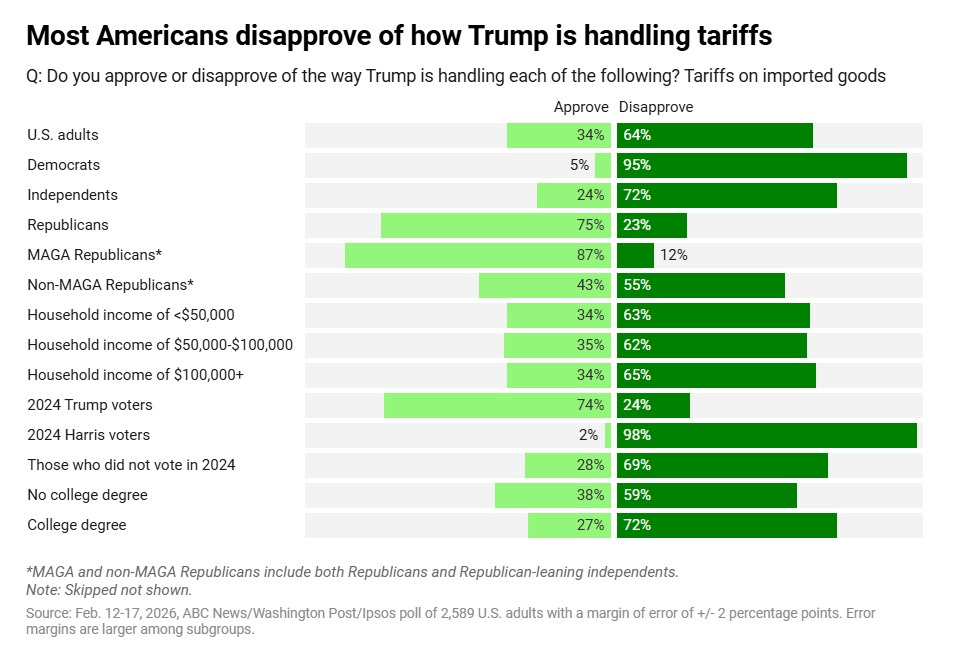

So it’s no surprise that the most recent polls show that Americans despise the tariffs:

A Fox News poll found the same, and Trump’s approval rating on both trade and the economy is underwater by over 16 points despite a solid labor market. Consumer sentiment, meanwhile, has crashed:

Trump has belatedly begun to realize the hardship he’s inflicting on voters. But instead of simply abandoning the tariff strategy, he’s issuing yet more exemptions and carve-outs in an attempt to placate consumers:

Donald Trump is planning to scale back some tariffs on steel and aluminium goods as he battles an affordability crisis that has sapped his approval ratings…The US president hit steel and aluminium imports with tariffs of up to 50 per cent last summer, and has expanded the taxes to a range of goods made from those metals including washing machines and ovens…But his administration is now reviewing the list of products affected by the levies and plans to exempt some items, halt the expansion of the lists and instead launch more targeted national security probes into specific goods, according to three people familiar with the matter.

Tariffs — or at least, broad, blanket tariffs on many products from many different countries — are simply a bad policy that accomplishes nothing while causing varying degrees of economic harm. But despite all his chicken-outs and walk-backs and exemptions, Trump is still deeply wedded to the idea. When news of the Supreme Court ruling reached him, he flew into a rage and accused the Justices of serving foreign interests:

He called the liberals a “disgrace to our nation.” But he heaped particular vitriol on the three conservatives [who ruled against him]. They “think they’re being ‘politically correct,’ which has happened before, far too often, with certain members of this Court,” Mr. Trump said. “When, in fact, they’re just being fools and lapdogs for the RINOs and the radical left Democrats—and . . . they’re very unpatriotic and disloyal to our Constitution. It’s my opinion that the Court has been swayed by foreign interests.”

JD Vance, rather ridiculously, called the decision “lawless”:

Why are the President and his loyalists so incensed over the SCOTUS decision? The tariffs are a millstone weighing down Trump’s presidency, and his various walk-backs confirm that he realizes this. It would have been smarter, from a purely political standpoint, to just let SCOTUS do the administration a favor and cancel the tariffs. Instead, Trump is going to the mat for the policy. Why?

One possibility is simply that Trump hates having his authority challenged by anyone. Tariffs were his signature economic policy — something he probably decided on after hearing people like Lou Dobbs complain about trade deficits back in the 1990s. To give up and admit that tariffs aren’t a good solution to trade imbalances would mean a huge loss of face for Trump.

Another possibility is that Trump ideologically hates the idea of trade with other nations, viewing it as an unacceptable form of dependency on foreigners. Perhaps by using ever-shifting uncertainty about who would be hit by tariffs next, he hoped to prod other countries into simply giving up and not selling much to the United States.

A third possibility is that tariffs offer Trump a golden opportunity for corruption and personal enrichment. Trump issues blanket tariffs, and then offers carve-outs and exemptions to various companies and/or their products. This means companies line up to curry favor with Trump and his family, in the hopes that Trump will grant them a reprieve.

But the explanation I find most convincing is power. If all Trump wanted was to kick out against global trade, the Section 122 tariffs and all the other alternatives would surely suffice. Instead, he was very specifically attached to the IEEPA tariffs that SCOTUS struck down. Those tariffs allowed Trump to levy tariffs on specific countries, at rates of his own choosing, as well as to grant specific exemptions. That gave Trump an enormous amount of negotiating leverage with countries that value America’s big market.

This is the kind of personal power that no President had before Trump. It allowed him to conduct foreign policy entirely on his own. It allowed him to enrich himself and his family. It allowed him to gain influence domestically, by holding out the promise of tariff exemptions for businesses that toe his political line. And it allowed him to act as a sort of haphazard economic central planner, using tariffs like a scalpel to discourage the kinds of trade and production that he didn’t personally like.

In other words, I think that although the tariffs had their origin in 1990s-era worries about trade deficits, they ended up as a way to make the Presidency more like a dictatorship. That is almost certainly why the Supreme Court struck the IEEPA tariffs down, citing concerns over presidential overreach instead of more technical considerations.2

For much of the modern GOP, I think, autocracy has become its own justification. To many Republicans, tariffs were good because they made the President powerful, and SCOTUS’ ruling is anathema because it pushes back on the imperial Presidency.

In this case, America’s democratic institutions held the line. But there will be a next case.

The formula, which was probably AI-generated, involved lots of bad assumptions.

For example, SCOTUS could have ruled that IEEPA was fine in general, but that trade deficits don’t constitute the kind of “national emergency” that would justify IEEPA’s use.