Even if Trump chickens out, you should still be worried about the economy

Tariff pauses are keeping us afloat for now. But debt and interest rates are a big threat.

In general, people don’t like to think about the economy. When the economy is running well, they can ignore it and think about their own personal situation — their business, their job, etc. It’s only when there’s a recession, or a surge in inflation, or a stock market crash, or some other calamity that regular people have to sit up and pay attention to the broader economy.

Back in April, everyone was paying attention. Trump’s “Liberation Day” tariffs, by far the highest in the country’s history, threatened to upend the American economy and way of life. Stock markets plunged. Consumer confidence dove. Interest rates spiked and the dollar fell, as investors moved money out of the country.

Two months later, the specter of looming economic catastrophe has all but vanished from the headlines. Stocks have bounced back, almost to where they were before Trump came to power:

Long-term interest rates are still elevated, but they’re no higher than they were at the beginning of the year:

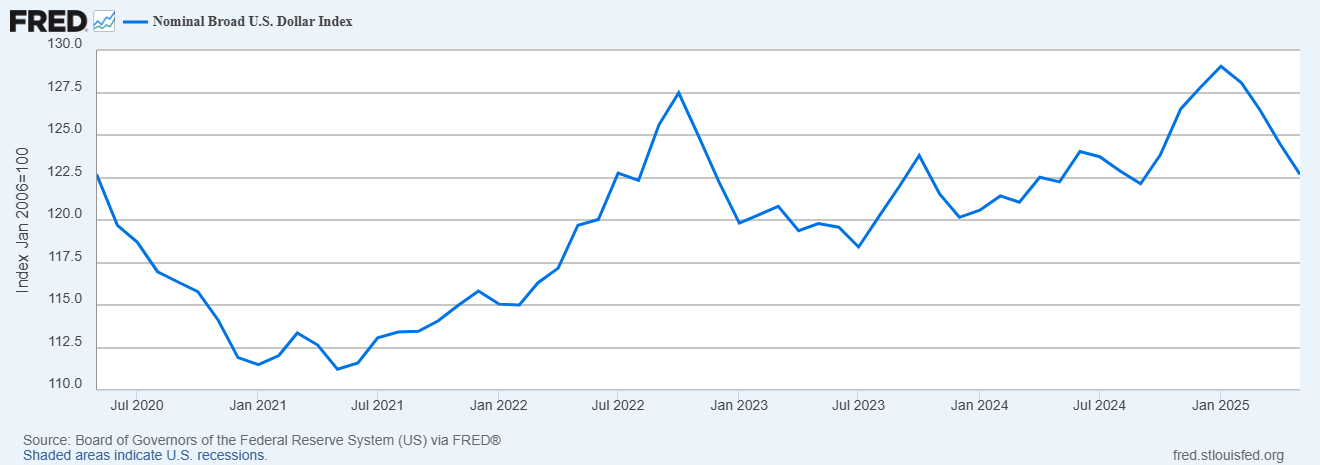

The dollar is a bit down from where it was before the tariffs, but overall it’s about where it was in previous years:

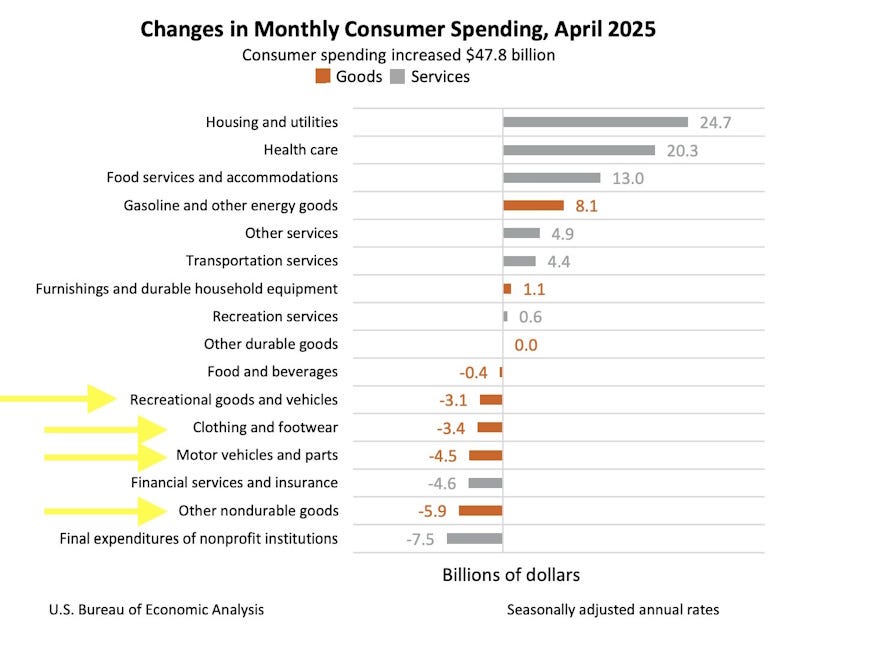

Meanwhile, real economic data is a bit weak, but doesn’t look too catastrophic yet. Americans are cutting back on consumption of the kinds of goods that got hit hardest by Trump’s tariffs:

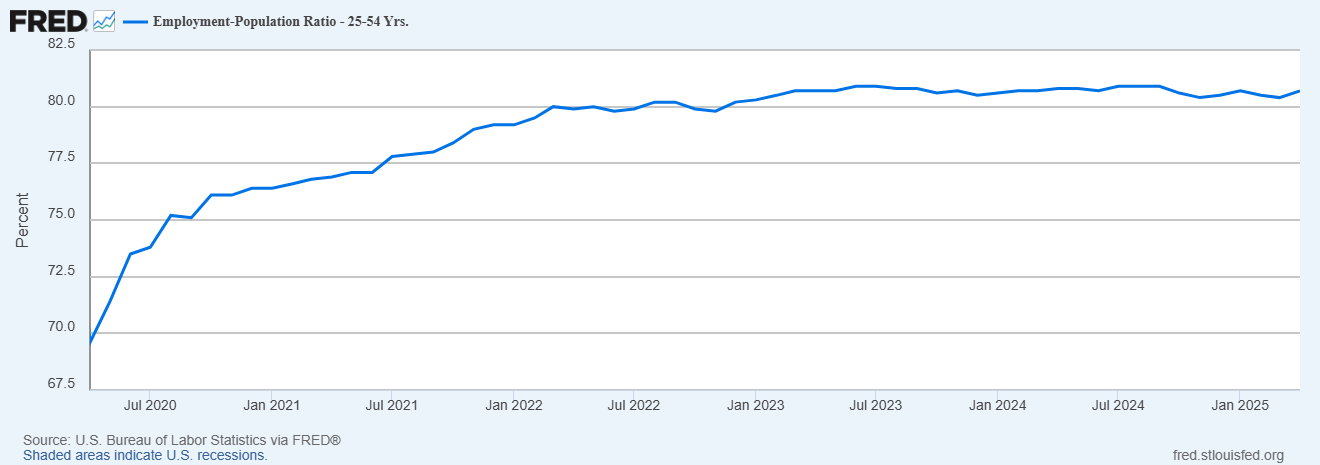

But remember that because imports don’t count in GDP one way or the other, this won’t show up as much in American production numbers — or employment, which is closely tied to production. The drop in motor vehicle parts purchases will eventually show up as decreased U.S. auto manufacturing, but that localized (and totally unnecessary) pain will probably be masked by whatever is going on in the broader economy. Meanwhile, despite some chaos in the logistics and trucking industries, employment rates were still near record highs as of April:

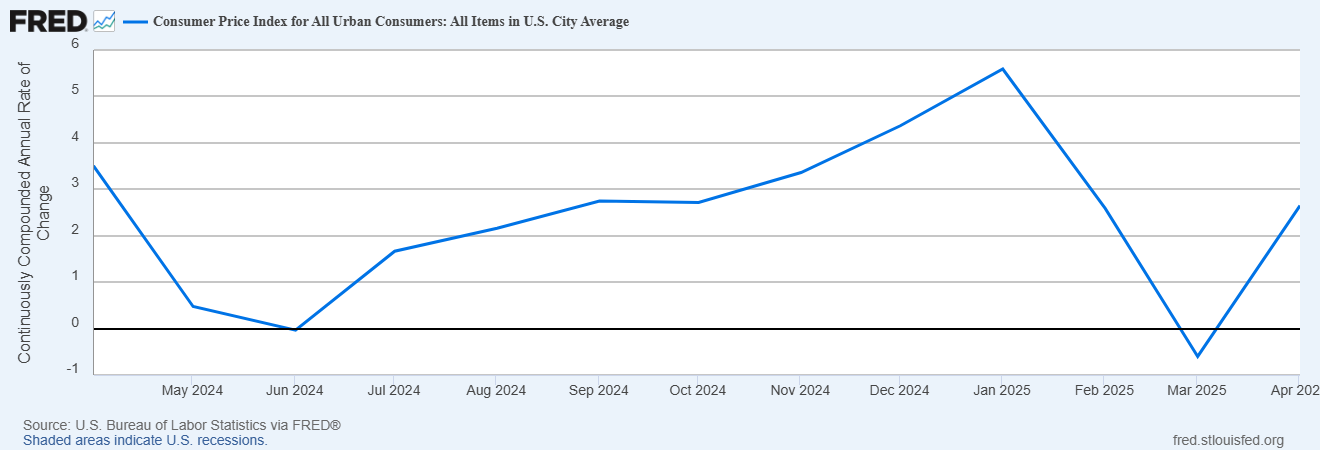

Nor does inflation look like it’s much above the 2% target:

Market expectations of future inflation over the next 5 years, meanwhile, are just a little over 2%.

What happened? Just a little over a month ago, I was warning that serious negative economic consequences were in the pipeline, scheduled to arrive in the next few months. That could still happen, but markets don’t look particularly perturbed anymore, and there’s no sign of major disruptions yet.

What happened was TACO. This is an acronym that a bunch of corny Wall Street traders invented for “Trump Always Chickens Out” — i.e., a bet that as soon as it looks like tariffs are hurting the markets, Trump will put them on pause. Indeed, most of Trump’s gargantuan “Liberation Day” tariffs are already on pause until next month, while the tariffs on China have been paused for even longer.

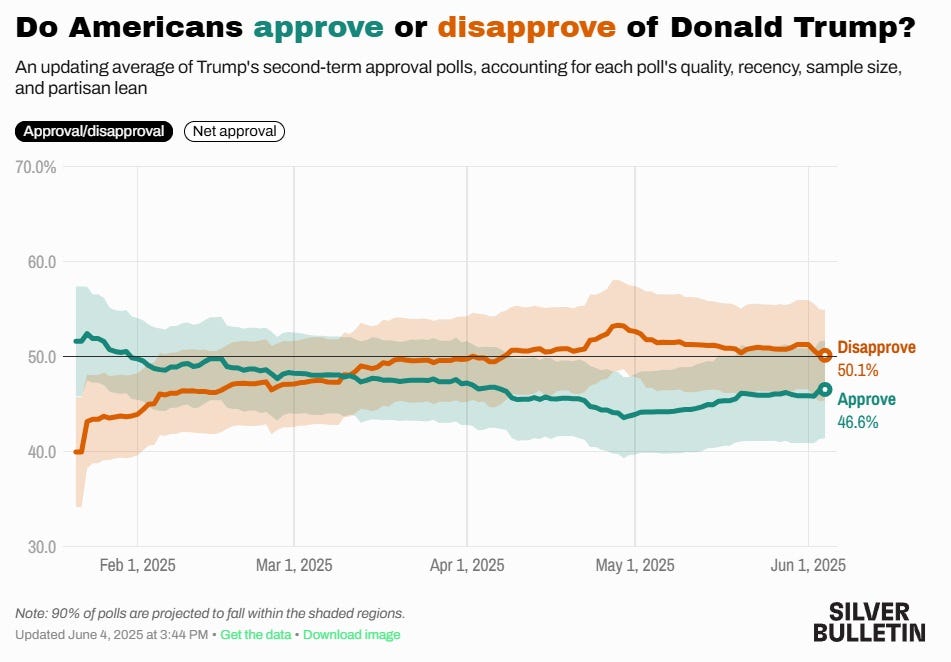

Wall Street is betting that the pauses will continue, or that the courts will end up blocking most of the tariffs (there have been several court rulings against tariffs in the past week; the administration is appealing these). That’s probably why the stock market has gone up. And the nation, perhaps sensing that Trump is just a bag of hot air rather than a madman, has become a little less unhappy about his presidency in recent weeks:

Trump obviously doesn’t like being told he’s a chicken. But broad tariffs of the Liberation Day variety are simply a terrible policy, and terrible policies hurt the markets. Trump doesn’t want to crash the markets or cause a big recession, because then he’ll be remembered as a disastrous failure of a President. So he’s in a bit of a bind here — either go through with his stupid, self-destructive plans, or get called a chicken.1

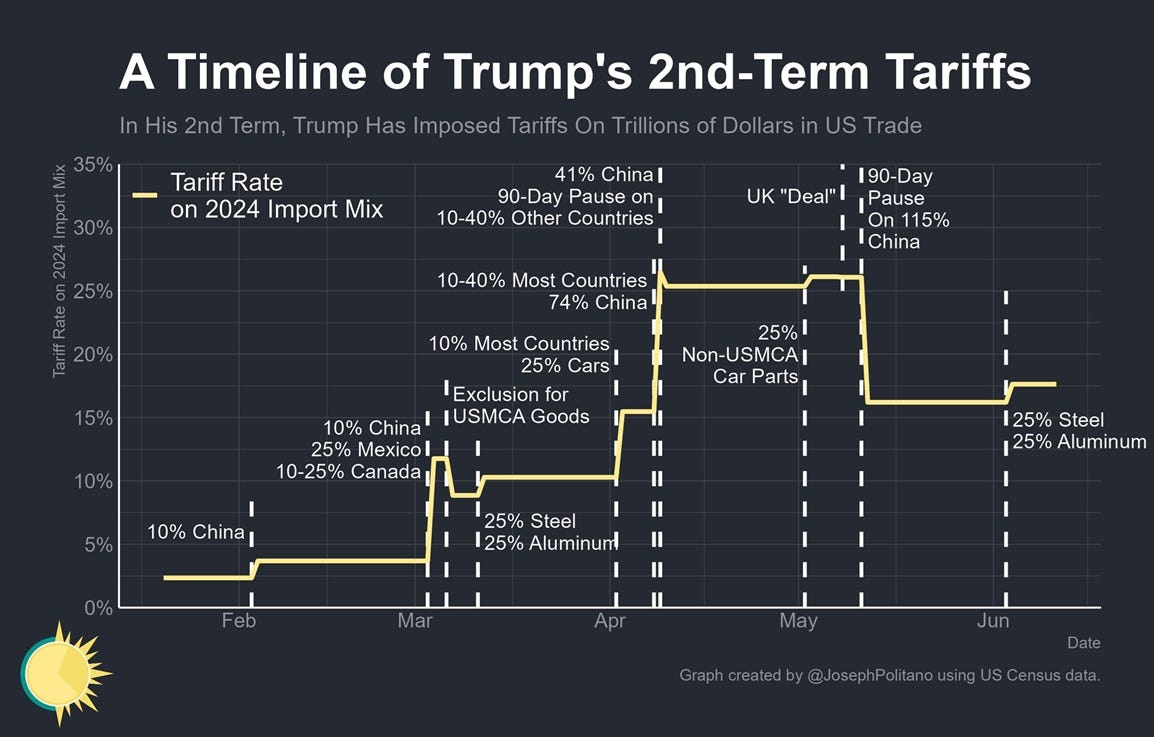

In any case, as a result of the blizzard of new tariff announcements and tariff pauses, the overall U.S. tariff rate keeps swinging wildly back and forth, but generally staying in the 10-20% range. Joey Politano has done a great job of tracking this:

(This overall rate is calculated by weighting the various tariff rates by the percent of U.S. imports that this rate would have applied to in 2024.)

So does TACO mean we’re saved? Are we destined to simply endure an endless series of tariff announcements followed by predictable pauses and pause extensions, all the way up until Trump leaves office? That’s a ridiculous way to run a country, but it’s better than actually making American businesses pay all those crazy tariffs. Is it time to breathe a sigh of relief and go back to our daily lives?

Well…maybe. But as I see it, there are still several reasons to worry. These are:

The return of big tariffs

Negative effects of the tariffs and tariff uncertainty that we already have

The GOP’s huge debt bonanza, and the rise in long-term interest rates that it might cause

Of these, the first is the biggest short-term worry, but the third is the biggest long-term worry. The U.S. government is showing that it does not have the political will to stop itself from borrowing at unsustainable rates.