This is called "capital flight"

It usually only happens to poor countries, and it never ends well.

Today’s post is about something that’s nerdy and technical, but also incredibly dangerous and terrifying. Usually, Americans can get by perfectly well without ever thinking about the intricacies of international finance and the bond market. But these things actually have the power to devastate America’s economy like nothing else. Our fabled prosperity is like a town built on the back of a giant sleeping dragon, and the dragon’s name is “international finance and the bond market”. Normally, we go about our business in peace, not even thinking about the dragon slumbering beneath our feet. But if one day it wakes up, we could all burn.

It may be waking up right now.

The chart you see above is the U.S. dollar to euro exchange rate. When Trump took office, one dollar could buy you about 0.97 euros. Today, it can buy you only 0.88 euros. The dollar is absolutely plunging, at least as of this writing.

It’s important to realize that this is not typical for a trade war. Usually, when you put up tariff barriers, your currency gets stronger, not weaker.1 That’s how it went when Trump put up tariffs against China in his first term.

That’s not what’s happening now, though. What’s happening now is that a bunch of investors are selling large amounts of U.S. bonds and other assets:

The dumping of these assets weakens demand for the dollar, because people are taking the dollars they get from selling the U.S. assets and swapping them for other currencies or commodities — euros, yen, gold, etc. — so that they can invest elsewhere. Thus, the dollar is going down. This effect is so strong that it’s overpowering the normal effect of tariffs — by a lot.

When people sell a lot of U.S. bonds, as they’re doing now, the interest rate on those bonds — called the “yield” — goes up.2 Yields on 10-year U.S. Treasury bonds from 4% to about 4.5% since April 4:

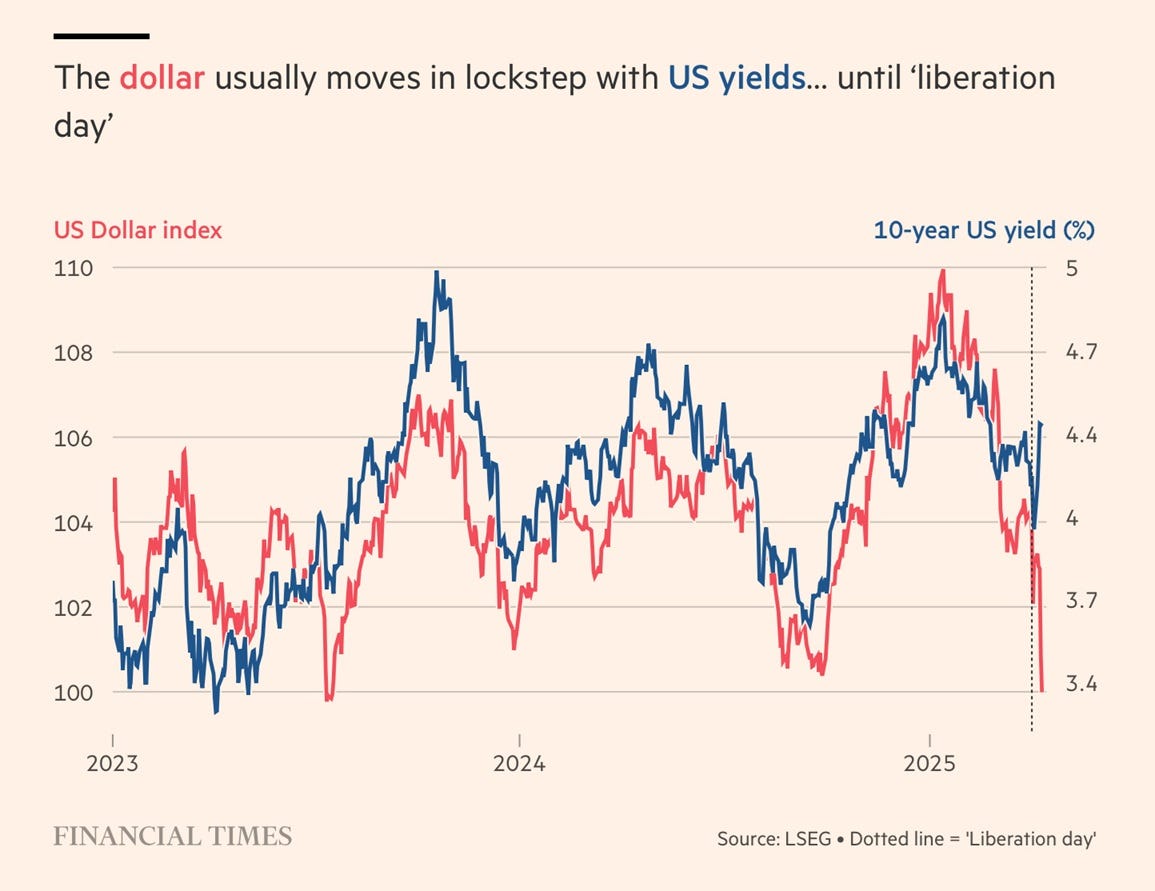

Now, it’s helpful to understand that U.S. bond yields going up while the dollar goes down is actually a highly unusual and scary situation.

Usually, Treasury yields and the dollar move together, because usually, when investors look at U.S. government bonds, they don’t ask “How risky is this bond?” — instead, they only ask “How much money will this bond pay me?” When yields rise (because of Fed policy or economic conditions), investors buy more Treasuries in order to get those higher returns, and this buying drives up the dollar. When yields fall, investors sell, and the dollar goes down. So yields and the dollar move in the same direction.

But ever since Trump announced his “liberation day” tariffs, that long-standing correlation has suddenly and dramatically reversed:

What’s going on? Why are investors dumping America’s bonds? One reason has to do with the intricacies of financial trading. The Economist has a good explainer on this, and Allie Canal has a good thread about it as well. Basically, Trump’s tariff announcements — and his later partial walk-back — caused a lot of volatility in markets, which caused a lot of Wall Street traders’ bets to blow up. That meant the traders had to raise cash in order to pay back loans they had taken out in order to make those bets. And the easiest way to raise cash quickly is to sell Treasury bonds. So this was probably part of what was going on.

But this doesn’t explain the fall in the dollar. Normally, when Treasuries get sold off, people park their money in cash, instead of moving it overseas. This time, a bunch of investors actually pulled their money out of America entirely.

In other words, for the first time in many decades, the U.S. has experienced capital flight. And if it continues, the consequences for the U.S. economy could be absolutely dire.