Can anything knock China off its mountain?

A great nation at its peak can still make big mistakes.

A few years ago, it looked as if the U.S. and China might battle over global hegemony and preeminence. But this looks less likely now, thanks to America’s own behavior. Under Trump 2.0, the U.S. has alienated many of the key allies it would have needed in order to match China’s market size and manufacturing acumen, leaving America standing alone against a country four times its size. Tariffs have hobbled America’s already tottering manufacturing sector. Just a few months after Trump’s inauguration, the idea of a democratic world led by the United States standing up to challenge China’s rise now seems more than a little far-fetched. Meanwhile, China continues to bully and overpower Trump in trade negotiations.

This basically leaves China as the world’s preeminent power by default. The likeliest outcome is that this will be a “Chinese century” — though it won’t look quite like the “American century” did, because China will use its power and influence very differently than the U.S. did:

On the other hand, nothing is certain. Rising powers have squandered their moment in the sun and cut short their own rise in the past. In fact, this is not such an uncommon outcome. At the beginning of the 20th century, there were four rising powers — the U.S., Germany, Japan, and Russia. Of those four, only the U.S. arguably realized its full potential. Germany and Japan engaged in total wars against coalitions of opponents they couldn’t defeat, while Russia embraced one dysfunctional political-economic system after another until it slowly ground itself down.

So it’s possible that even without being overmatched by a U.S.-led coalition, China will stumble all on its own over the next three decades or so. That would certainly come as a relief to China’s increasingly alarmed neighbors, and it would provide critics of the CCP with the occasion for plenty of gloating. I don’t think it’s likely, but it’s worth thinking about the factors that could make China disappoint its most ardent fans.

Demographics

In general, China’s demographic situation seems to be the threat that its detractors have fixated on the most. I occasionally see headlines like “China Faces Economic Blow From Population Crisis”, or “Will China’s Demographics Constrain Its Foreign Policy?”. Some people even think that China’s rapid aging and shrinking population make it a paper tiger:

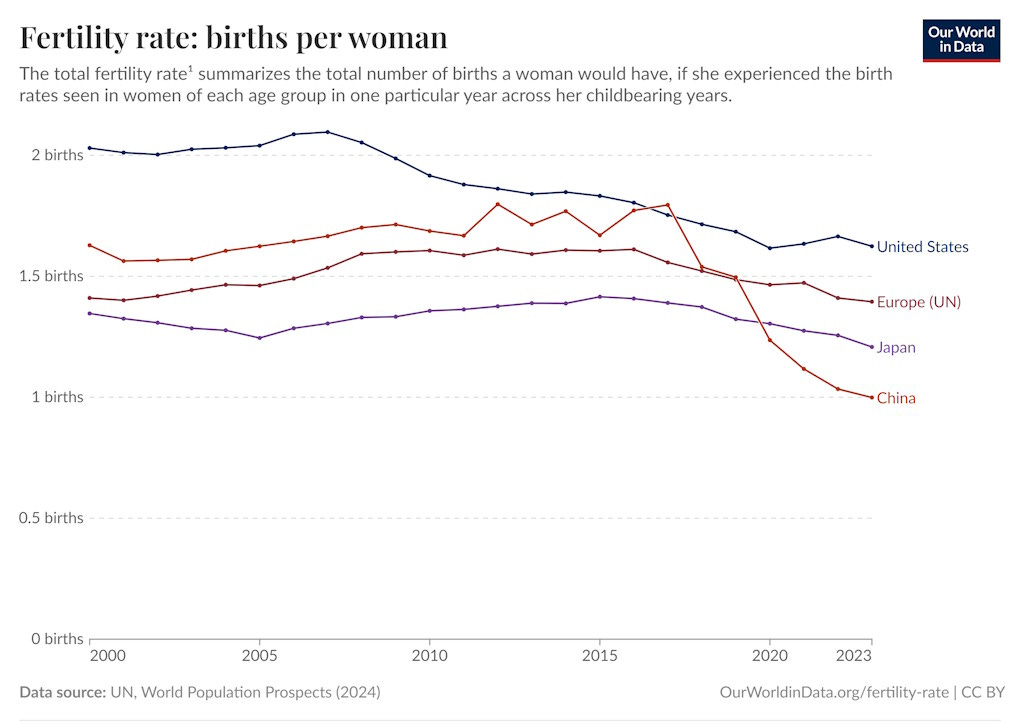

On one hand, there is something to this. Almost all nations are headed for major demographic problems, but China’s will be especially challenging. Its total fertility rate has fallen to 1.0 — one of the lowest in the world, and lower than Japan, Europe, or the U.S.

This means that China’s population will eventually halve every generation — or worse, if fertility continues to fall. A shrinking population is a big economic problem, since it A) forces young working people to support more and more retirees, B) probably reduces productivity growth, and C) discourages domestic investment.

Nor do I think robots will solve the problem, as China’s boosters often argue. If labor and capital retain significant complementarity, then China will need humans to work alongside the robots, just like everyone else. And if robots replace human beings, China’s main advantage as a country — its colossal educated population — goes out the window anyway. So I think demographics are worth worrying about in the long run.

However, it’ll be a while before this problem becomes severe. I wrote about this last year:

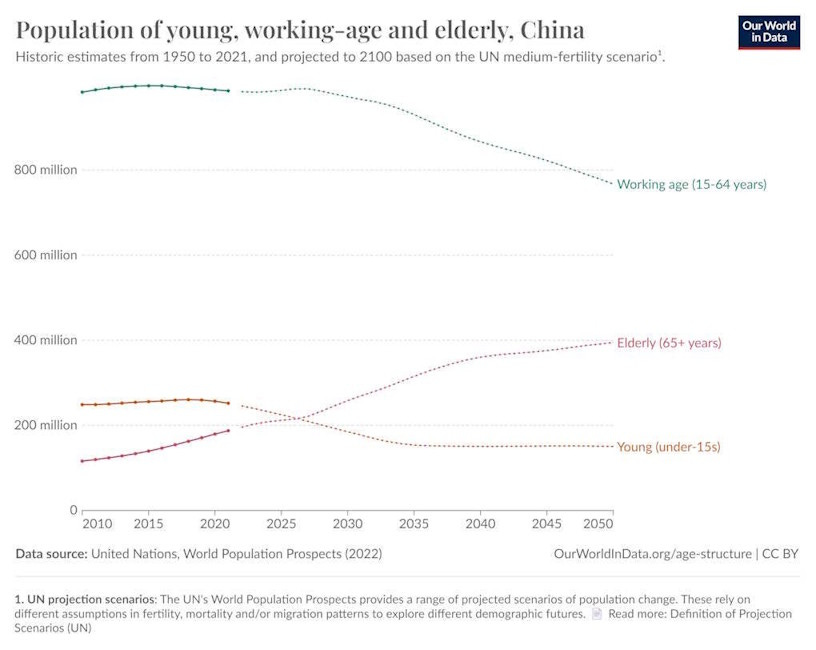

Because China had such an enormous Baby Boom generation, the second “echo” of that big generation — now aged around 7 to 22 — will support the growth of the Chinese workforce for years to come. In fact, China’s working-age population actually grew last year thanks to this baby bulge, and is expected to grow for two more years before it peaks:

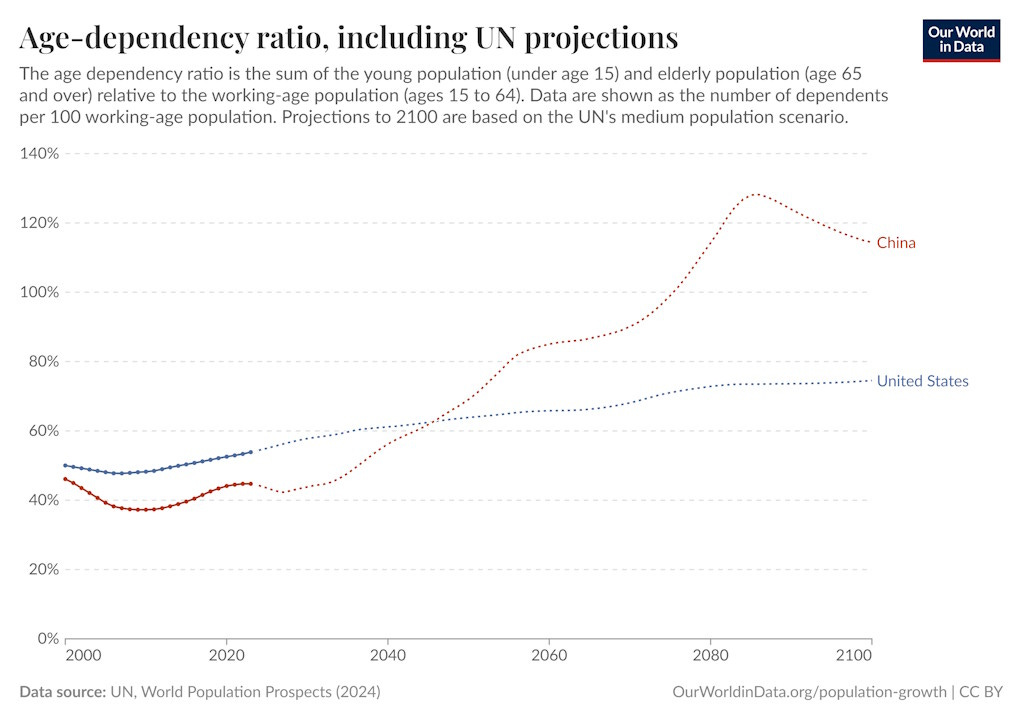

Only in the mid-2040s or so will China’s dependency ratio rise higher than America’s:

In the short term, China’s median age is rising a bit, but this will be more than compensated for by rising education levels and old people working longer.

In other words, I don’t think there’s much chance that demographics will spoil China’s moment in the sun, though they may end up cutting it short several decades from now.

Macroeconomics

The other big Chinese problem that everyone is talking about is the macroeconomic situation. China’s epic real estate boom went bust three years ago, and the country is still dealing with the fallout — a mountain of bad debts, a depressed property sector, persistent deflation, and local governments that are unable to fund themselves1.

Eventually, this sort of problem generally gets solved with government bailouts. The government simply borrows or prints money, buys the bad debts, and takes a fiscal hit. This cleans up bank balance sheets and corporate balance sheets, and makes everyone feel safe about borrowing and lending again. In China, this effort has begun — the central government is beginning to bail out banks and local governments, and is considering bailing out big property developers too. If that were the only thing going on, it would probably turn a “lost decade” into a four-year slump like the one America experienced after the crisis of 2008.

But that isn’t the only thing that happened. China’s government also tried to sustain growth through this difficult period by ordering banks to make a new giant wave of loans — this time to manufacturers. A lot of those loans ended up going to property-related stuff, which probably didn’t help. But a lot went to manufacturing — along with truly massive amounts of government subsidies, as part of the government’s push for China to be the world’s dominant high-tech manufacturer. If you count both subsidies and the benefits of ultra-cheap loans, China’s industrial policy push might total 4.4% of GDP.

The problem was that — as Japan’s MITI bureaucrats from the 1970s could have told you — when you pay a ton of different companies to manufacture the same stuff, they end up competing each other’s profits out of existence:

This is called “involution”, or 内卷 in China.2 It’s a problem for several reasons. First, it’s a case of capital misallocation on a grand scale. No one in China really needs that many EVs and humanoid robots and whatnot, and the world market is getting saturated (where it’s not actively blocked by tariffs). So China’s total factor productivity — its ability to make stuff that people actually want — is being held back. Also, despite China’s much-publicized push into academic science, most of China’s R&D is still done at the corporate level — and if corporations have no profits, they have no way to invest in new technology, even if doing so would be useful in the long run.

Those are the microeconomic problems of involution. But there are also two big macroeconomic problems. First, if you force your economy to over-produce, you get deflation. China continues to experience falling prices. Falling prices mean companies and banks and local governments have reduced ability to pay back their debts. This is called debt-deflation, and it’s exacerbating China’s attempts to bail out its real estate debt.

On top of that, China’s huge burst of hastily made industrial loans is piling up more bad debts in the system. Even though industrial loan growth has slowed sharply (as everyone in China realized that many of those investments were going to get competed out of existence), China’s total debt-to-GDP ratio has kept on rising relentlessly.

Eventually, many of the car companies and solar companies and robot companies that China’s government told its banks to lend to will go bust, and this will leave another mountain of bad loans on the books, on top of the leftover mountain from the real estate crash. And this time, there’s no obvious sector that the government can pump up lending to in order to keep the party going.

So unsurprisingly, China’s government is trying to rein in overcompetition, much as Japan’s government did in the 1970s. Basically, the solution is going to look like price fixing — telling companies not to compete by cutting prices3:

China’s top economic planning agency and market regulator have unveiled new measures aimed at curbing disorderly price competition…To address the issue, the regulators will step up cost investigations, price supervision and enforcement actions against rule breakers, according to the notice. Companies which are found to persist in illegal pricing after formal warnings could face further scrutiny or penalties.

This could help with the deflation problem a bit. But it will tend to exacerbate the capital misallocation problem. Essentially, instead of simply cutting off the subsidy tap to the failing companies and letting the successful companies acquire them and fire half of their workers (which is what the typical theory of industrial policy says you should do), China may simply end up allowing a bunch of inefficient companies to stay in business. That could hurt long-term productivity, as it probably did in Japan.

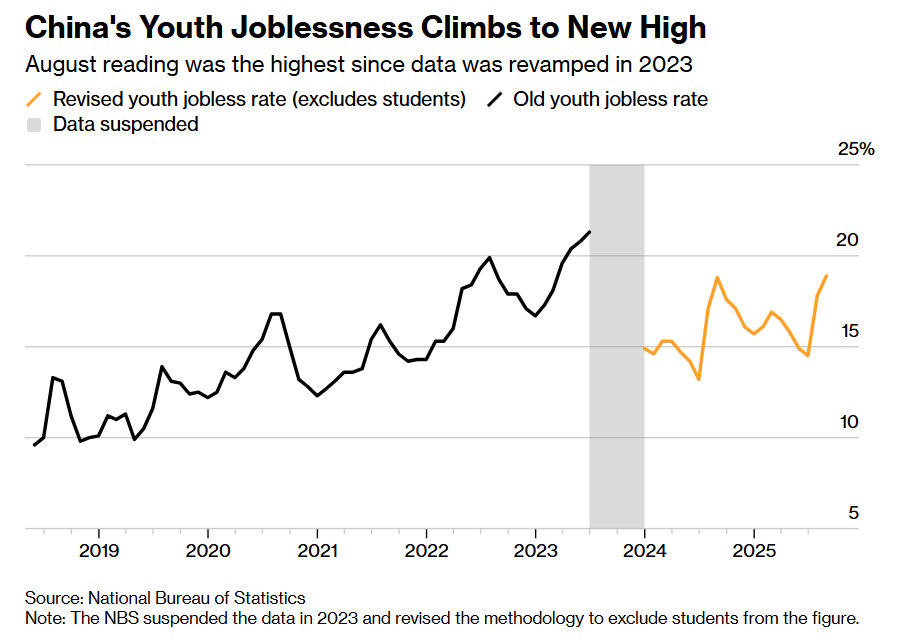

The problem is that if China does allow its bad companies to fail, a lot of Chinese people are going to be out of a job, which could increase unrest. China’s labor market is already hurting, so the government is very sensitive to this.

An added wrinkle is that unlike Japan or Korea, China is a very large country with a highly federalized governmental system. This means each province has its own local champion companies, meaning that if Beijing lets a bunch of inefficient companies die, it’ll hurt some provinces a lot more than others. This could increase political instability, meaning China has even more incentive to let “zombie” companies stick around than Japan did in its day.

So China is in a bit of a macroeconomic bind. It can’t easily stop its industrial policy, but continuing it means mounting costs — exacerbated by the legacy of the real estate bust. This could end up causing a multi-decade drag on China’s productivity, like similar problems did for Japan.

But this wouldn’t represent a collapse for China, or even a fall from its peak. When Japan went from 95% of U.S. living standards to 61%, it meant becoming an economic also-ran. But China is four times the size of the U.S., so a similar slowdown in its economic trajectory would still leave it with much more economic heft than its biggest rival. Recall that the USSR — that famous economic basket case — had 30% of America’s per capita GDP. If the Soviet Union had been four times America’s size, its economy would have been 1.2 times as large, and the Cold War might have gone very differently.

In other words, China’s economic problems are a reason to think its peak might underwhelm, but that’s worlds away from causing it to fall off its perch.

War and internal dissent

If the slow, peaceful processes of demographics and economics aren’t going to stop Chinese dominance anytime soon, that leaves the more violent threats of war and internal dissent. In fact, these are the things that normally cut short a great power’s moment in the sun — Germany and Japan are only the most recent examples. France bit off more than it could chew militarily in the 1700s and early 1800s, as did Spain in the 1600s. The Tang Dynasty and the Mongol Empire were torn apart by internal dissent, and so on. Even America’s current decline is due mainly to internal divisions, as Abraham Lincoln predicted.

So what about China? Until Trump’s election, the notion that China would run into a military coalition it was unable to overcome was at least somewhat plausible. China’s main allies, Russia and North Korea, are militarily fierce but not economically strong; together, an alliance of the U.S., Europe, India, Japan, and Korea might have been able to take down China’s New Axis, especially if the U.S. had implemented policies to rapidly reindustrialize itself and build up India’s technological and manufacturing capabilities.

Now, this is looking a lot less likely. The Trump administration seems dead-set on alienating Europe, India, and Korea. There are strong signs that Trump wants to abandon involvement in the Eastern Hemisphere in order to focus on domestic conflicts (immigration and suppression of political dissent). On top of that, Trump has sacrificed industrial policy in favor of tariffs that simply hurt American manufacturing.

This doesn’t mean China is going to be able to conquer the world. But it does mean the world will no longer be able to conquer China.

Which leaves internal dissent as the main threat to China’s moment in the sun. In a post a few months ago, I speculate that as Xi Jinping ages, dissatisfaction with his lack of policy competence may cause him to crack down harshly:

I wrote:

Xi Jinping is 72 years old…72 is old enough where everyone starts thinking about who the successor is going to be…Xi hasn’t yet chosen a successor…Xi changed China’s rules to remove term limits, so as long as his health holds up, he could rule for another two decades; perhaps he doesn’t think he needs to start thinking about a successor yet. But other people in China will definitely be thinking about this all-important question; they’d have to be fools not to be plotting and planning and sharpening their knives right now. Xi, being a consummate master of backroom politicking, undoubtedly knows this. And he also certainly knows that whoever wants to rule China after his passing has an incentive to undermine his power before he’s dead or out of office.

Like other aging dictators, Xi will have to spend an increasing amount of time fending off such challenges to his power. If leaders become more physically infirm or mentally slow, this only heightens their vulnerability, and requires them to be even more ruthlessly paranoid in order to stay on top…[T]here are some signs that Xi might be starting to enter his “lion in winter” phase…Meanwhile, Xi has stepped up his purges, especially of the military. Some of the generals he has purged were his own appointees…And The Economist has data showing that investigations of senior officials have tripled since the pandemic.

It would be incredibly stupid and self-destructive for China to fall into destructive political infighting right at the very peak of its relative power and wealth. But it wouldn’t be the first time, as the aforementioned examples of the Tang Dynasty and the Mongol Empire show. In a way, Europe cut short its peak as well, with World War 1, when cooperating to manage the global system of European empires would have extended their dominance.

Unfortunately — as Americans have found out to their dismay over the past decade — simply warning everyone of the harms of internal dissent doesn’t do much to dampen the problems, because when people are fighting for control of a country, their overriding priority is to win that struggle instead of to limit the collateral damage. In China’s case it’s a little different, because in theory, Xi Jinping could see reason and be persuaded to let China return to something approximating the bureaucratic, oligarchic consensus-based succession mechanism that prevailed before he took over. But what are the chances Xi would limit himself in this way?

So if anything does knock China off its perch as the world’s premier nation over the next two or three decades, it would probably be an internal power struggle. It seems pretty unlikely, but it could happen. And if it doesn’t, expect to live out several more decades of “Chinese century”.

Local governments in China had funded much of their spending via land sales; now, land isn’t selling, and when it does, the price is much lower than before, putting a big hole in local government revenue.

in Japan it was called “excessive competition”, or “過当競争”

This is similar to what Japan did, which was to allow or even force companies to form cartels to prop up prices.

What if Late Trumpism is also peaking right now? And the same fate that may beset Xi's "Lion in Winter" phase is reflected in Washington in 2026: internal dissent among the MAGA coalition as it's clear they've overstepped and lost the center? Even outright fascism aspires to popular mandate and to grassroots fervor.

I can't bring myself to be too optimistic: even if Democrats can claw back some partial Congressional power and even if Republicans start to think about their own, individual post-Trump political interests and defect (a la Marjorie Taylor Greene), we'll still have another two years after that of lame duck Trump thrashing about with scary executive overreach covered by lawfare and a loyal Supreme Court. That's a long time with the eye off the ball in countering Chinese global influence. A lot can happen in geopolitics and relative superpower power within the span of a single administration.

But could we dare to hope that the West (maybe even with a more robust Europe that constructively frames the alliance) can right the ship after 2028? Maybe something a little more balanced and even better than "The American Century?"

You state that Japan went from 95% to 61% of US in living standards, I think it more correct to say GDP. As someone who recently visited Japan and have a cousin married to a Japanese my impression is that Americans outside the top 20% have a lower living standard than the Japanese. As someone living out in Maga Land I understand the anger and frustration that pushed voters to Trump. Their standard of living has been in decline for forty years and know that (sadly) GDP growth does not translate into a higher living standard for most Americans.