At least five interesting things for your weekend (#46)

Morning in America; Trump's bad vibes; Japan's chip industry; Biden and abundance; native-born employment; redistribution; transit costs

Wow, I really need to start doing these roundups more frequently! I only put seven items in this time, but I had six more that I wanted to include! There’s just too much interesting stuff in the world of economics.

Anyway, first let’s go with some podcasts. I have two episodes of Econ 102 for you this week. In the first, Erik and I discuss a whole bunch of stuff I’ve written recently, including Venezuela, Tim Walz, China, and the U.S. economy.

In the second episode, we talk about my idea that the VC industry is facing headwinds from the fact that the internet has been mostly built out. Erik has worked in VC himself, so had lots of thoughts of his own to offer.

Anyway, on to this week’s list of interesting things! The general overall theme for today is that the U.S. government and the U.S. economy have been doing pretty well. That’s not a message you often hear, so it’s important to get it out there.

1. Morning in America

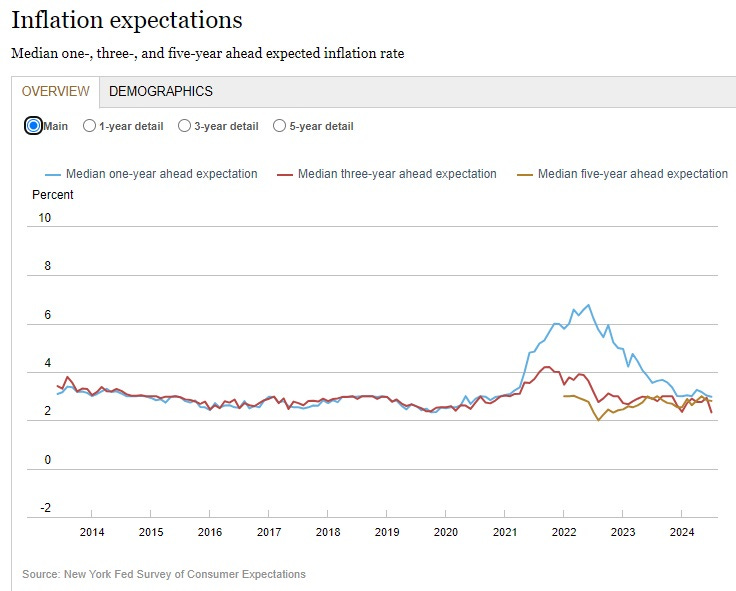

I often compare the 2020s to the 1970s, but there’s at least one big difference. In the 1970s, high inflation, high crime, and a bad economy lingered throughout the entire decade. In the 2020s, these problems started going away much more quickly. For example, inflation is back down to around the 2% target. And people don’t expect inflation to return anytime soon — inflation expectations, as measured by market prices, are back to where they were before the pandemic, or even a bit lower.

Lower inflation expectations mean that people expect the Fed to cut interest rates. And lower interest rate expectations translate to lower mortgage rates:

Mortgage rates fell to the lowest level in more than a year, raising hopes for relief in the battered U.S. housing market…The average rate on the standard 30-year fixed mortgage fell around a quarter percentage point to 6.47%…“Mortgage-rate relief is arriving quicker than many expected,” said Ralph McLaughlin, senior economist at Realtor.com…Investors have…ramped up bets that the Fed will cut interest rates, starting next month.

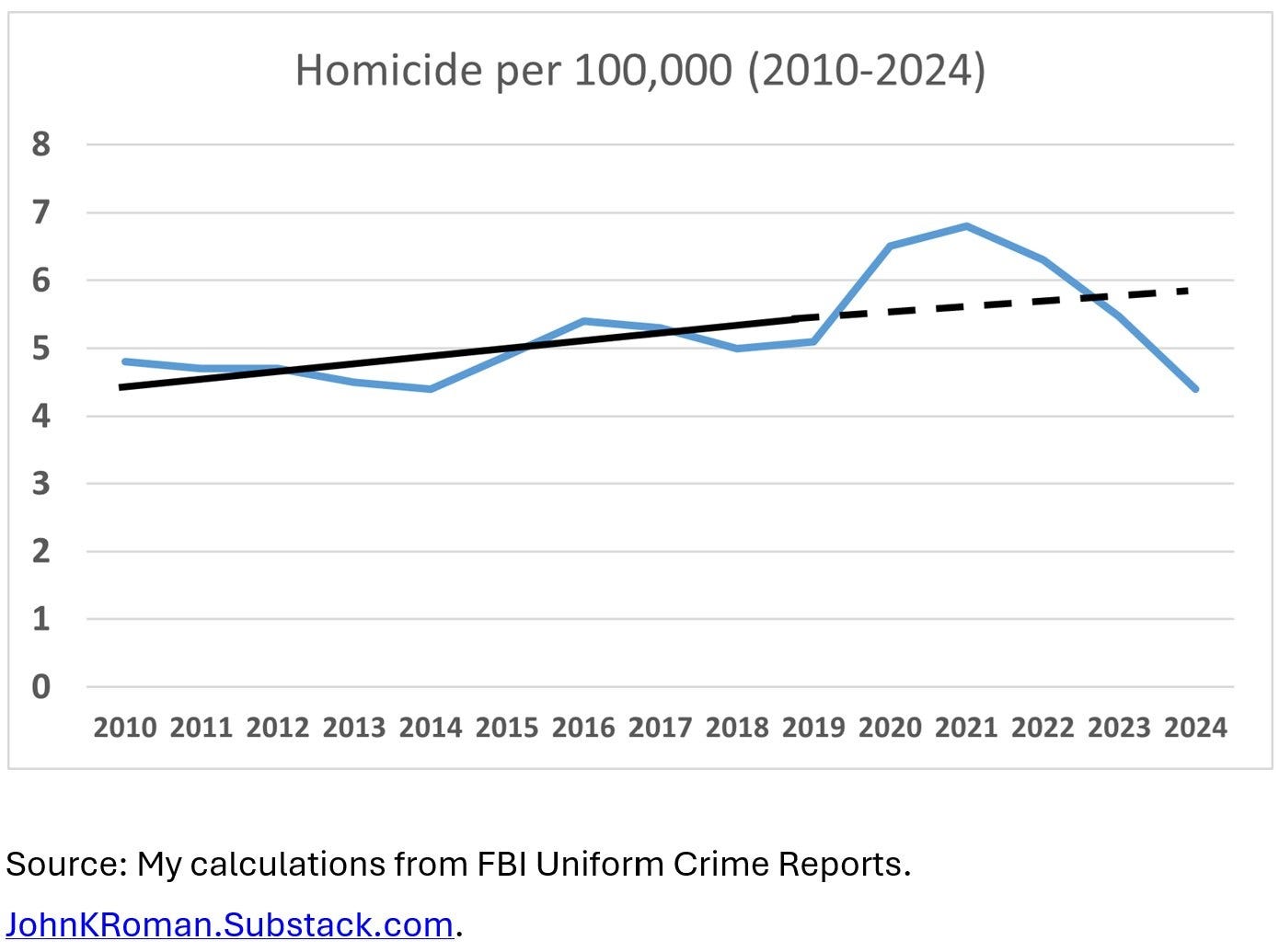

As for crime, a number of different data sources show that the big drops of 2022 and 2023 are continuing this year. For example, FBI data show homicide rates falling almost to record lows:

Some people have decided that they don’t like FBI data, because some cities didn’t report their data back in 2021. That problem got fixed by 2022, so this FBI data should be good. But in any case, it’s not the only data we have. For example, the Major Cities Chiefs Association collects data on violent crime in big cities, and they also find huge drops in 2024:

New preliminary data from major U.S. cities shows a sharp drop in violent crime in the first half of the year — more than 25% in some communities — as the COVID-era crime wave recedes…An Axios analysis of data from the Major Cities Chiefs Association found an overall 6% decline in violent crime among 69 cities during the first six months of 2024 compared to the same period last year…54 of the 69 major cities in the report saw drops in violent crime — defined as homicide, rape, robbery and aggravated assault — in the first half of 2024…[T]he number of homicides in the 69 reported cities fell by more than 17% during the first half of 2024 compared to the last period last year.

Unlike in the 1970s, when violent crime stayed at very high levels, America is already reverting to the relative levels of safety it enjoyed in the 1950s or the early 2010s.

As for economic growth and employment, these continue to do much better than in the 1970s.

So we’re not getting a full replay of the 70s. There are certainly some similarities, but things are just improving much faster now compared to then. 2024 feels more like “Morning in America” than Carter’s “crisis of confidence”.

2. Trump continues to have bad vibes

Policy is important, but I wouldn’t dismiss the power of vibes. Ronald Reagan is one of the most fondly remembered presidents, and yet he was mostly about vibes — his stories were mostly made up, he did very little deregulation or inflation-fighting compared to Carter, he reversed half of his tax cuts, and so on. Yet he’s remembered as an important president because he generated an attitude of sunny optimism that helped America psychically heal from the traumatic years of the 70s and late 60s. Vibes are a crucial input into political economy — countries can’t get as much done if everyone is always screaming apocalyptic anger and doom and threats at each other.

America needs good vibes after the 2010s. Biden, for all his strengths on policy, was not able to provide those vibes. Harris is trying to, and that’s good.

But Trump’s vibes continue to be very, very bad. Recently, he disparaged Medal of Honor winners, drawing a condemnation from veterans:

Former President Donald Trump received an immediate backlash Thursday when he said the Presidential Medal of Freedom he awarded to Dr. Miriam Adelson, the widow of Republican mega-donor Sheldon Adelson, was "equivalent" and "much better" than the Medal of Honor, the nation's highest military award for bravery in combat…

[Trump] added, "It's actually much better because everyone gets the Congressional Medal of Honor, they're soldiers. They're either in very bad shape because they've been hit so many times by bullets or they are dead.”

The Veterans of Foreign Wars called Trump’s comments “asinine”, and they are correct.

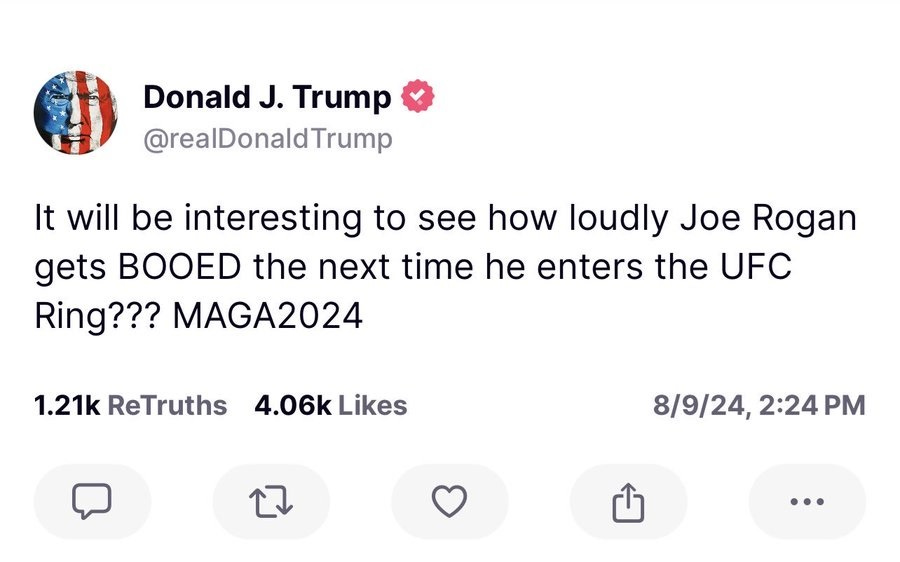

Trump’s interactions with the rest of the world continue to be defined by petty feuds. As just one of many, many examples, he recently blasted Joe Rogan after Rogan said RFK Jr. was his favorite candidate:

Meanwhile, a number of people in Trump’s own party are speaking out against him. A group of Arizona Republicans just endorsed Kamala Harris:

Not every Arizona Republican is voting red in the 2024 presidential election…"One of the biggest reasons I’m voting for Kamala Harris, and I would’ve voted for Joe Biden is that they’re not Donald Trump," Mesa Mayor John Giles said…"We are here to send a clear message," Robin Shaw, co-chair of Republicans for Harris said, "Arizonans are rejecting Donald Trump and his failed leadership.”…Notable Grand Canyon state Republicans like Mayor Giles, former Arizona state representative Robin Shaw, and former Scottsdale Mayor Sam Campana all gave their endorsements to Harris rather than the former president.

Arizona, notably, is the home of John McCain, whom Trump unfairly attacked. It’s also a state that Trump tried very hard to steal when he attempted to overturn the 2020 election. Meanwhile, small smatterings of “Republicans for Harris” are popping up elsewhere all over the country.

Trump is still an almost even-money bet to win the election. But the vibes are very off. There’s every reason to believe that a second Trump presidency would plunge an exhausted nation back into the bitterness and instability of 2014-2020. Personally, I’d rather not.

3. Japan’s strength in semiconductors runs deeper than people realize

At the end of last year, there was a flurry of interest in Japan’s semiconductor industry. Japan was traditionally very strong, but lost most of its chipmaking business to Taiwan and South Korea. Yet the country still has deep reservoirs of talent, and a lot of companies that still make very good chipmaking tools and components. Combine that with the weak yen (which makes it easier to build fabs in Japan and to sell Japanese-made chips overseas), relatively few regulatory barriers to construction, low wages, and generous government support, and Japan seems like the perfect place to build the future of the chip industry:

As if to underscore Japan’s deep strength in the sector, a Japanese university just made what might be a major breakthrough in chipmaking technology. Recall that currently, fabrication of leading-edge chips requires Extreme Ultraviolet Lithography (EUV) machines, manufactured exclusively by the Dutch company ASML. These machines are incredibly expensive — each one costs $380 millio. They require some of the most complex, highest-precision components ever created, in addition to a huge amount of electric power and expensive maintenance. But Okinawa Institute of Science and Technology professor Shintake Tsumoru may have found a much simpler and cheaper way to do EUV:

The Okinawa Institute of Science and Technology (OIST) has designed a new type of extreme ultraviolet (EUV) lithography equipment that could significantly reduce the cost to produce 7nm and smaller semiconductors…According to reports, the EUV equipment’s optical system is greatly simplified while power consumption is reduced by a factor of ten, raising the prospect of much cheaper advanced chip-making machines…

Professor Shintake aligned two axis-symmetric mirrors in a straight line and used a total of only four mirrors instead of ten…Because highly absorbent EUV light weakens by 40% with each reflection, only about 1% of the energy from the light source reaches the wafer when bounced off ten mirrors while more than 10% does when only four mirrors are used…This makes it possible to use a smaller EUV light source with only one-tenth the power…

“This configuration is unimaginably simple,” Shintake says, “given that conventional projectors require at least six reflective mirrors. This was made possible by carefully rethinking the aberration correction theory of optics.”…Furthermore, “the performance has been verified using optical simulation software and it is guaranteed to be sufficient for the production of advanced semiconductors.”…

OIST has filed a patent application for the technology, which it first plans to demonstrate with a half-scale model. After proving the concept, it will be used to build a working EUV lithography system in cooperation with one or more Japanese corporate partners in 2026…If that all goes to plan, Japan’s global position in the geopolitically important semiconductor industry will be greatly enhanced…The most likely partner would be Nikon[.]

Not only is this good news for Japan’s lithography industry, but it also demonstrates the country’s deep reserves of scientific expertise and research capabilities, which bodes well for the future.

One other underrated advantage Japan has is its ability to work closely with Taiwan and South Korea. TSMC has recently made a major investment in Japan. And South Korea and Japan are cooperating on semiconductor supply chains, along with the U.S.

All in all, the story of Japan’s semiconductor renaissance still seems important.

4. The Biden administration is quietly promoting abundance

The press and social media seem to have forgotten about Joe Biden, absorbed as they are in the presidential contest between Trump and Harris. But out of the limelight, the now lame-duck President and his administration have been doing a lot of things to make life easier for regular Americans.

For example, Biden is taking action to cut regulatory red tape and make it easier to build housing in America. Some specifics from the policy announcement:

The Department of Housing and Urban Development (HUD) is announcing the availability of $100 million…to communities to identify and remove barriers to affordable housing production and preservation…

The Department of the Treasury and HUD are announcing a major improvement to the Federal Financing Bank (FFB) Multifamily Risk Sharing Program that would provide greater interest rate predictability for state and local housing finance agencies that finance housing projects through the FFB…

New guidance FAQs , issued by the Build America Bureau, clarify that Transportation Infrastructure Finance and Innovation Act (TIFIA) and Railroad Rehabilitation and Improvement Financing (RRIF) loans used for conversion projects may be eligible for a categorical exclusion under the National Environmental Policy Act (NEPA)…

The Advisory Council on Historic Preservation (ACHP) proposed a new tool that would accelerate historic preservation reviews for millions of federally-funded, licensed, or owned housing units across the country…

HUD anticipates finalizing a rule to update its Manufactured Home Construction and Safety Standards. Manufactured housing provides an essential path to increasing overall housing supply and offers significant savings over site-built housing…[T]he new rule, if finalized, would enable duplexes, triplexes, and fourplexes to be built under the HUD Code for the first time…

The Council of Economic Advisers analyzed the importance of state and local government actions to permit and approve new developments more quickly, including examples from HUD’s PRO Housing grants. Permitting requirements contribute to the nationwide housing shortage…Reforms to streamline permitting processes can lead to more housing being built more quickly, which will lower housing costs.

These are all great moves. Yes, they’re deregulation, which might make some dyed-in-the-wool progressives unhappy. But that’s exactly what we need in America in order to create abundant housing.

Meanwhile, the Biden administration has successfully used the Medicare system to negotiate some drug prices lower:

As I have written in the past, monopsony power is one of the great strengths of national health insurance systems like Japan’s and Korea’s. Many medical suppliers and providers have monopoly power, which raises health care costs; a national insurer can use its countervailing power as a dominant buyer to negotiate these costs down. Using monopsony power to cancel out monopoly power improves economic efficiency, resulting in greater abundance.1

Moves like these cement Biden’s legacy as the Abundance President. Of course, future Presidents will have to greatly expand Biden’s efforts, and add more of their own, in order for the U.S. economy to undergo the kind of deep transformation we need. But Biden has gotten the ball rolling. I just wish he’d get more attention and credit for doing so.

5. No, immigrants did not take American jobs

Political partisans need talking points. The job market has been incredibly strong under Biden, so right-wing types need some reason to tell themselves that no, actually, things are going badly. And one of their talking points was the idea that all of the jobs are going to foreigners, and that Americans are being replaced by immigrants:

This is one of those terribly misleading charts I keep warning everyone about, and I already debunked it in a previous post. The dual y-axis disguises the fact that the fall in native-born employment on this graph is much much tinier than the increase in foreign-born employment. In fact, the tiny fall in native-born employment is entirely due to the mass retirement of the Baby Boomers — the actual employment rate for native-born Americans has gone up, and is near its all-time high.

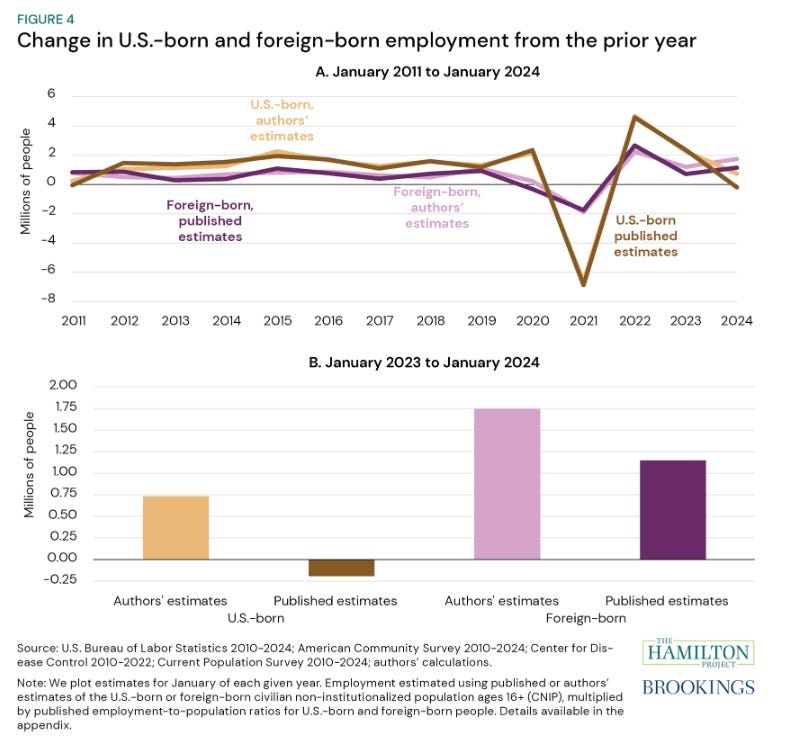

But as it turns out, even this is too pessimistic. As Wendy Edelberg and Tara Watson of the Hamilton Project have found, the official data probably understate native-born employment growth by a significant amount:

We estimate that U.S.-born employment increased by about 740,000 over the course of 2023. In contrast, the published data in the Current Population Survey (CPS) show a decline of 190,000…We find that the published data in the CPS significantly underestimate population growth from January 2023 to January 2024 and, thus, employment growth over the year for both groups.

And here is their chart:

Basically, what happened is that the government calculates employment rates first, then multiplies by population to get total employment estimates. But the government underestimated native-born population growth in 2023, meaning that it incorrectly concluded that the number of employed native-born people had gone down as well. When you fix the population estimate, it turns out that native-born employment increased substantially in 2023.

So the talking point that all of the employment growth in the U.S. economy is flowing to immigrants is just plain wrong. Native-born Americans are doing great in the job market.

6. America actually redistributes a lot

Among progressives — and thus among much of the media — there is a deep belief that free-market policies triumphed in America in the late 20th century. This is typically called the “neoliberal” age, and progressives are still very, very mad that this happened.

That historical narrative is true in some important ways, but our collective memory has greatly exaggerated the degree to which America deregulated, cut taxes, and shrank the welfare state. I wrote about this back in 2022:

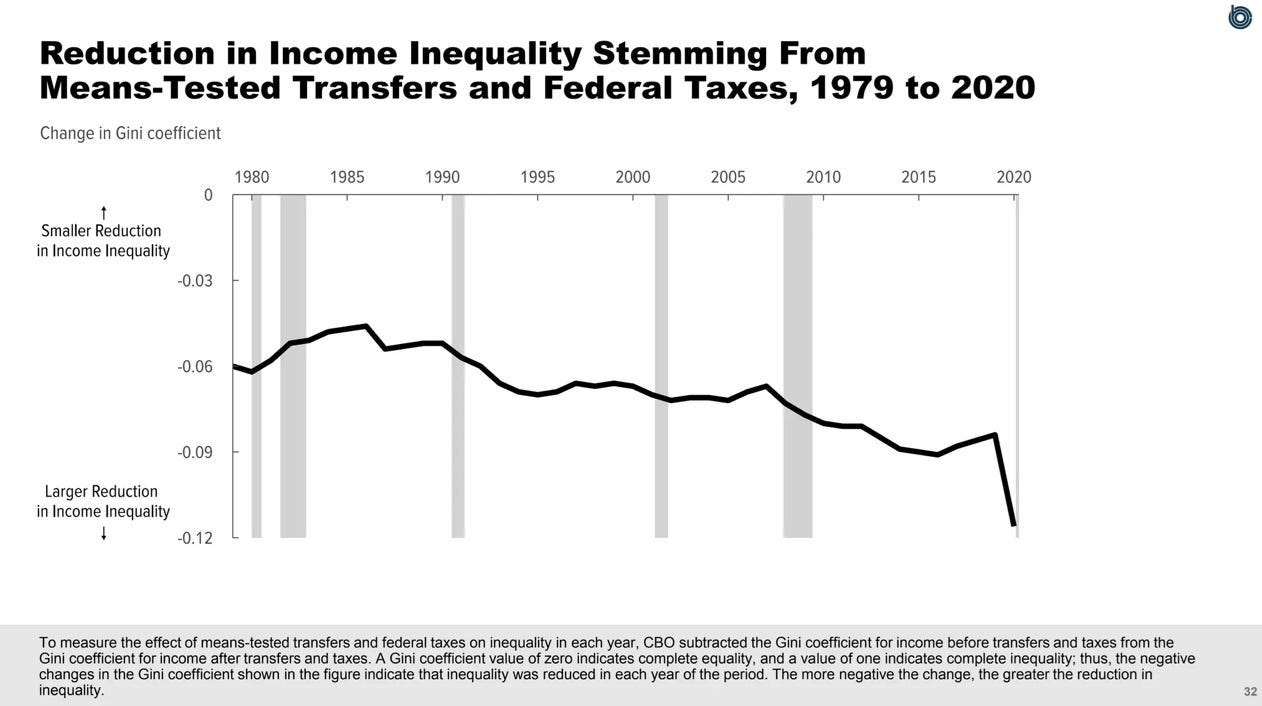

Matt Yglesias has a recent series of posts that makes broadly similar points. In his latest installment, he points out that America has actually become a much more redistributive country over the past few decades — exactly the opposite of what the typical potted history of “neoliberalism” would have us believe:

[T]he “neoliberals” think you should try to address individual issues on the merits and deal with distributional concerns separately through tax policy and the welfare state. The anti-neoliberals think this is misguided, and a big part of how they’ve persuaded more people to join their team is by convincing them that the “address distributional concerns separately through tax policy and the welfare state” is impossible to execute on.

But it is not impossible to execute on. In fact…The overall tax-and-transfer system of the United States has become meaningfully more progressive over time…[T]he GOP [often] lowers taxes on the rich and the middle class, but then Democrats raise taxes on the rich and spending on the poor. In the aggregate, the poor get more and the middle class get more and the rich end up ping-ponging back and forth. The result, according to the CBO, is that even if you ignore the plague year of 2020 (as you should), the see-saw tilts toward more redistribution over time.

And he posts this helpful chart:

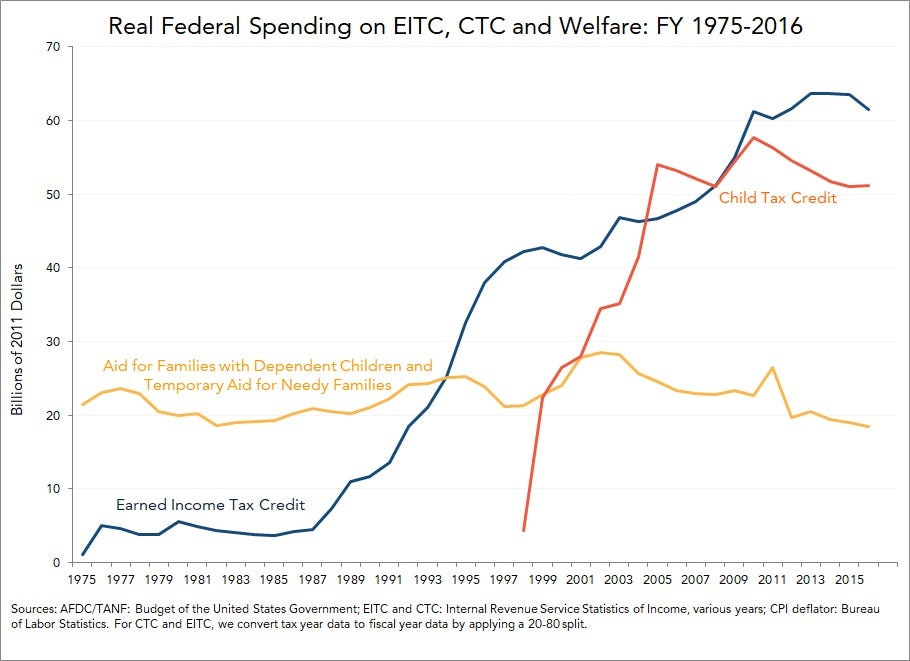

Here are a couple of other helpful charts I’d like to add. First, what was this redistribution, exactly? The two most important policies were the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). These vastly outweighed Clinton’s cuts to the old welfare system:

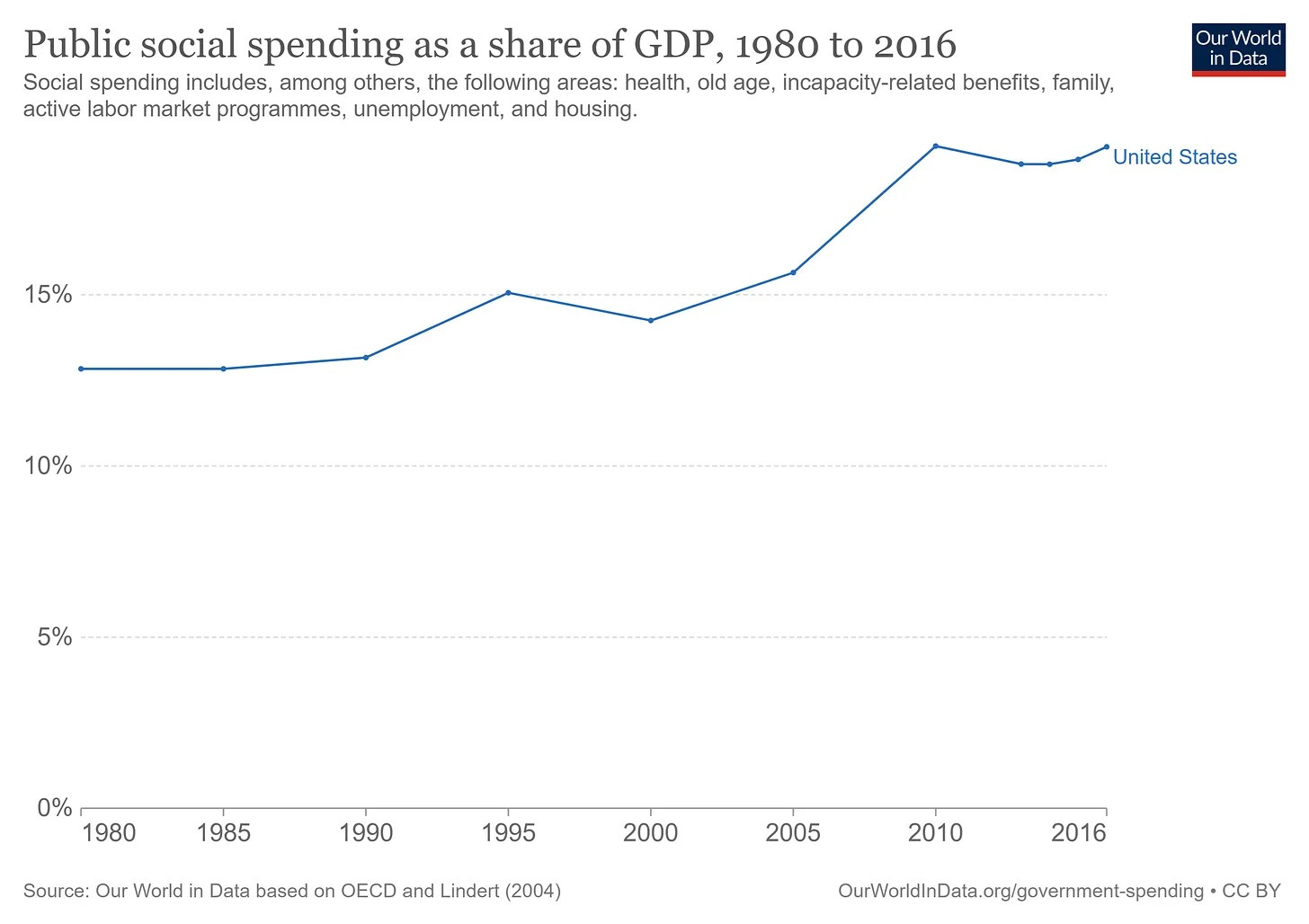

And when we look at public social spending overall, we see that it went up as a fraction of the U.S. economy during the “neoliberal” era:

And all this spending had the effect of significantly reducing poverty in America. Redistribution works!

Whether more redistribution is the way to go to continue tackling poverty and inequality in America, or whether we should focus more on “predistribution”, is a topic for another day. But people need to realize that the U.S. actually redistributes a whole lot, and that a significant amount of redistribution was inaugurated during the “neoliberal” era of 1980-2016.

7. Americans play politics while the rest of the world builds

Why does it cost so much more to build stuff in America than in the rest of the world? The answer to this question will be somewhat different for different industries. But Eric Goldwyn of the Transit Costs Project has an interesting thesis: Americans use construction projects as fights over distribution. In a new short paper, he explains this thesis in the case of transit costs.

Here’s how expensive it is for America to build a kilometer of train, compared to other rich countries:

Singapore and Hong Kong do worse than us, but that’s at least partly because all of their land is densely urbanized. The hapless UK and New Zealand also do worse. But overall, America does very badly here.

Why? After doing a huge number of case studies and interviews, Goldwyn believes he can explain:

In this paper, I argue that these mounting costs and delays are the product of prioritizing politics ahead of transit projects…Nuno Gil…argues…that impacted stakeholders, often “nonmarket actors” such as municipal agencies, require tangible value from megaprojects in order to allow them to proceed. In practice this “value distribution” is negotiated and renegotiated…This ongoing uncertainty leads to larger project scopes, schedule slippage, and higher costs over time. For transit projects, this do no harm principle or expansive value distribution framework adds costs and diminishes project benefits, when viewed through the lens of faster travel times and greater ridership, when agencies site a transit project in a less convenient freight railroad right-of-way rather than condemning private land, use federal grants to pay for elements beyond the needs of a transit project to gain needed permits, adopt more expensive designs to limit third party interfaces, and placate different powerbrokers, including elected officials, utility companies, transit agency operating entities, and others while undercutting traditional planning, design, cost estimating, and project management.

In other words, Americans view transit projects primarily through the lens of who gets the benefits and who pays the costs, rather than through the lens of whether the train actually gets built. Fights over distribution shrink the pie for everyone.

To me, this seems like a potential explanation for many, if not all, of America’s excess cost problems. The richer a nation gets, the more important distribution becomes, simply because there’s more “pie” to go around. Growth of the whole “pie” becomes proportionally less important, since the pie is already so big. In other words, there’s just so much money sloshing around America that everyone is laser-focused on grabbing a larger share from their neighbors, even if that ends up costing a lot in terms of overall efficiency.

This is a pessimistic conclusion, because it means that any nation that reaches a certain level of wealth will have to contend with sclerosis resulting from distributional fights. The U.S. isn’t quite the richest country in the world in terms of GDP, but we have the highest consumption per capita, by far. America’s sclerosis may thus be the destiny of every other country, as they catch up to us.

But this principle isn’t a law written in stone. Switzerland has consumption that’s three-quarters as high as America’s — among the very highest in the world — but transit costs that are far, far lower. It is possible even for rich countries to build things cheaply, with the right institutions. So there’s hope for America yet.

Of course, it’s possible to do this too much, to a degree that hurts innovation in the pharmaceutical space. So that has to be carefully monitored. But pharma innovation is alive and well in Europe and Asia, so it’s possible to get consumer savings while preserving a robust innovation ecosystem.

I have no idea what the merits of the Japanese lithograph breakthrough are, but form a geopolitical standpoint, isn’t it bad to simplify chipmaking?

Currently the West is ahead of China in only two areas of manufacturing - chips and commercial aircraft. This is *because* these two are so incredibly complex that catching up is really hard.

If ASMLs tech dominance ceases to be a bottleneck, that seems primarily like a win for China. Especially if it’s slowed by a Japanese patent, which western companies will abide but Chinese certainly won’t.

"Meanwhile, the Biden administration has successfully used the Medicare system to negotiate some drug prices lower."

No, they didn't negotiate using monopsony power (which would be bad enough). They just applied price controls. Why are you pretending this is good for pharmaceuticals when you acknowledge how terrible it is for food?