At least five interesting things: Japan Trip edition (#61)

Trump and Social Security; San Francisco corruption; Phones making us dumb; Ukraine and drones; Abundance stuff; Indian industrial policy; Steve Glinert on CHIPS reform

I’m in Japan for three weeks, promoting my new book! This means I’m away from my main distraction (my pet rabbit), and will have more time to write. Lots of interesting stuff has been piling up in my list, so this roundup is a little longer than usual.

First, I have two episodes of Econ 102 for you. One is about tariffs, and one is about geopolitics:

Anyway, on to the list!

1. Will Trump really mess with Social Security?

In America, one truism of politics is that Social Security is the “third rail” — you mess with it at your peril. When George W. Bush tried to partially privatize the system in 2005, he failed, and his presidency was significantly weakened. Across the years, Donald Trump has consistently promised not to touch Social Security — a significant act of moderation on economic policy compared to previous incarnations of the GOP.

Except now DOGE may break Trump’s promise for him. Musk’s agency almost cut off phone service for people filing Social Security claims, and stopped only after the Washington Post raised a stink:

The Social Security Administration…abandoned plans it was considering to end phone service for millions of Americans filing retirement and disability claims after The Washington Post reported that Elon Musk’s U.S. DOGE Service team was weighing the change to root out alleged fraud…The shift would have directed elderly and disabled people to rely on the internet and in-person field offices to process their claims, curtailing a service that 73 million Americans have relied on for decades to access earned government benefits.

However, Social Security and White House officials said the administration will still move ahead with another far more limited element of the original proposal: Customers will no longer be able to change a direct deposit routing number or other bank information by phone.

The phone service change may not be happening, but Elon still seems to be gunning for Social Security. This is from March 11:

Elon Musk pushed debunked theories about Social Security on Monday while describing federal benefit programs as rife with fraud, suggesting they will be a primary target in his crusade to reduce government spending….“Most of the federal spending is entitlements,” Musk told the Fox Business Network. “That’s the big one to eliminate.”

Musk also called Social Security “the biggest Ponzi scheme of all time”, and has promised to cut the Social Security Administration’s workforce by 12 percent.

Back in February, Trump reassured the nation that ““Social Security will not be touched, it will only be strengthened,” and an unnamed White House official told NBC that “Musk’s personal opinions about Social Security have no impact on Trump’s policies.” But then Trump’s Commerce Secretary Howard Lutnick told Social Security recipients not to complain if their checks are late:

Is Trump really getting ready to mess with Social Security payments? And if not, why is his administration acting like it’s getting ready to do that? What would be the political upside to broadcasting that you’re going to screw with America’s favorite entitlement program, and then not actually doing it? It’s not clear what’s going on here.

What is clear is that the Trump administration doesn’t particularly seem like they’re governing with an eye to future elections. Old people vote in large numbers, and if you stop them from getting the checks they need to live — or even threaten to do so — you’re putting yourself in grave electoral danger. If Trump’s team isn’t worried about future elections…well, that’s deeply concerning.

2. San Francisco corruption is just incredible

San Francisco has always been a pretty corrupt city. Since the 1960s, some of this corruption has involved funneling taxpayer cash to nonprofits who promise to provide public services to poor people and minorities, but who end up pocketing a significant amount of the cash. I recommend the Tom Wolfe essay “Mau-Mauing the Flak Catchers” for a colorful, humorous narration of how this process worked decades ago.

Anyway, it’s still going on today. Here is a story about the nonprofit Urban Ed Academy:

Two investigations converged Tuesday as a nonprofit whose founder is facing bribery charges was given special treatment by the Human Rights Commission, a city department embroiled in scandal over questionable spending practices that surfaced last year…Urban Ed Academy — founded by Dwayne Jones, who was charged in 2023 on felony counts related to misappropriation of public funds and bribery — was awarded grants by HRC despite having “significantly lower evaluation scores” than other organizations competing for funding, the controller’s office said…A similar arrangement occurred with the Office of Economic Workforce and Development, which increased Urban Ed Academy’s grant from $437,000 to $1.2 million even though it had been notified that the nonprofit was not meeting performance metrics.

And here’s a story about Sheryl Davis, the former head of the city’s Human Rights Commission:

Investigators revealed new details Thursday about an ex-San Francisco department head who allegedly enriched herself through a corrupt scheme of bribes and illegal gifts that went on for years…The city attorney’s office said Sheryl Davis, who resigned in September as Human Rights Commission director, received tens of thousands of dollars from a city-funded organization that benefitted her personal business ventures, expensive travel, and her son’s tuition to UCLA.

And here’s a story about Kimberly Ellis, the head of San Francisco’s Department on the Status of Women:

Kimberly Ellis, head of San Francisco’s Department on the Status of Women, was placed on administrative leave Thursday morning pending a city probe into the department’s activities…She is a longtime Democratic Party activist who launched two failed bids for state party chair…

Ellis’ department…paid IGNITE, a political organization focused on empowering women, roughly $700,000 to organize the conference…Expenses included a $90,000 catering tab, $120,000 for video production, $25,000 for exhibitions and educational materials, and $70,000 for administrative expenses.

It’s good to see the city investigating and trying to clean up this rampant corruption, but until the practice of shoveling money at unaccountable and politically connected nonprofits is abolished (or at least severely curtailed), these scandals will keep popping up.

3. Are phones are making us dumb?

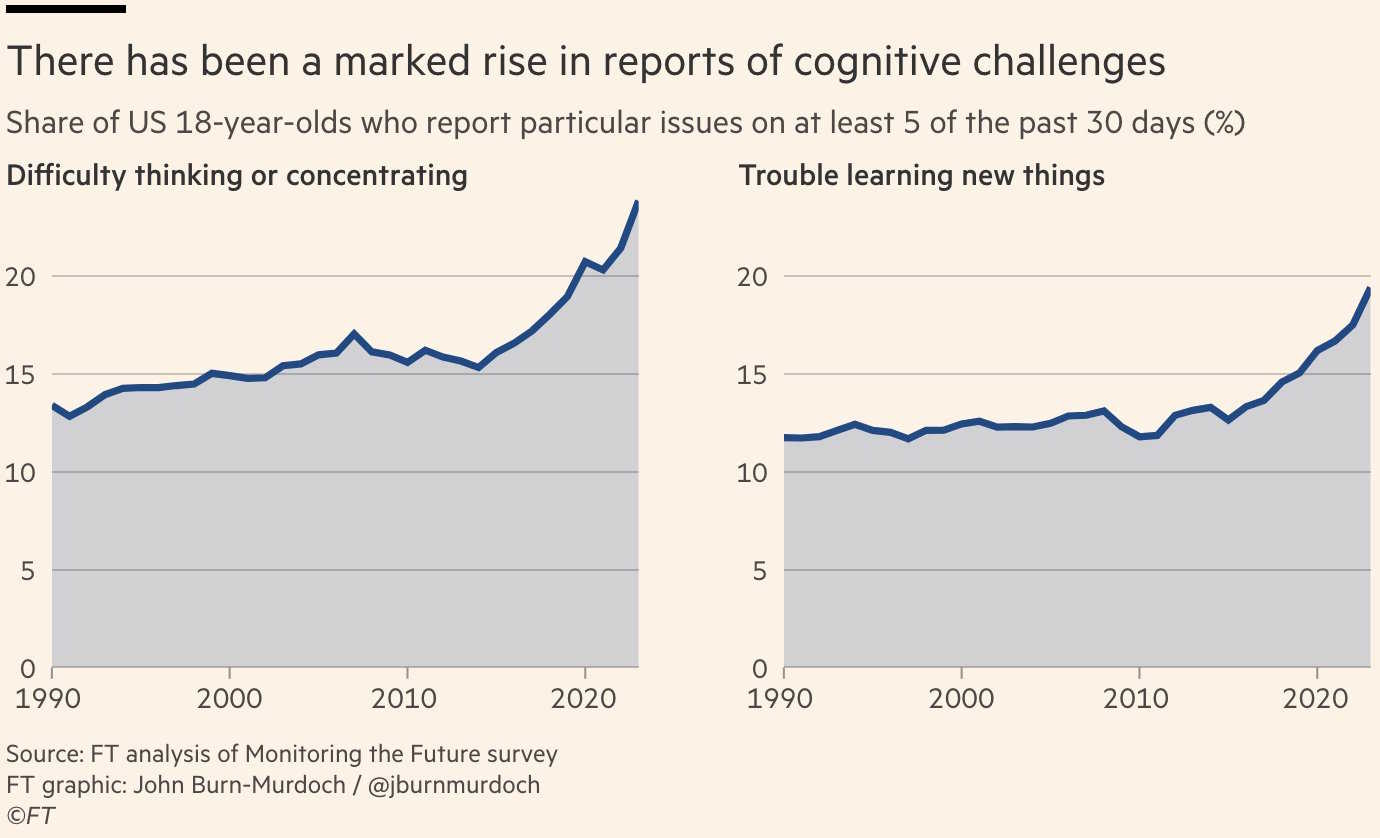

It’s a little ironic that I’m an avowed techno-optimist, and yet I also think that a substantial fraction of the problems of the modern world are being caused by humanity’s failure to adapt to the smartphone. I’ve talked a lot about phones causing depression and political unrest. But now John Burn-Murdoch has pulled together some data showing a decline in cognitive skills in rich countries that coincides uncomfortably with the rise of the smartphone. Here’s a chart that shows a decline in the U.S. that starts around 2012:

And here’s a chart that suggests the decline is a global phenomenon:

The mechanism here isn’t hard to deduce: A social-media-enabled smartphone is a distraction machine that barrages our mind with constant notifications and tiny bits of unrelated information, destroying our ability to focus and think carefully about anything. A third chart lends weight to this hypothesis:

Everyone worries about the changes to human society and cognition that AI will bring, but social-media-enabled smartphones have already crashed into humanity like a meteor, and we’ve barely begun to adapt or even to reckon with the change.

4. Ukraine masters drone war

I’m no military expert, but it has seemed obvious to me for well over a decade that drones would eventually become dominant on the battlefield. That reality is now coming true on the battlefields of Ukraine, where drones are increasingly replacing infantry, artillery, and tanks as front-line weapons of war. This is from a report by Tim Mak:

[T]his one was the first attack of its kind: a successful, all-drone assault on Russian positions. The assault, deserving of a place in the history books, took place near Lyptsi, in the Kharkiv region of northeastern Ukraine…It was a test – initially expected to fail – of whether multiple units could orchestrate a mission with dozens of FPV, recon, turret-mounted, and kamikaze drones all working in tandem on the ground and in the air…The mission succeeded beyond expectations: right after the ground drones finished their mission, infantry rushed into the area and secured the positions…Using more drones for more missions means less blood shed.

Obviously drones are not the only thing on the modern battlefield, but as the war goes on, they keep replacing more and more traditional weapons — and human infantry — with no end in sight.

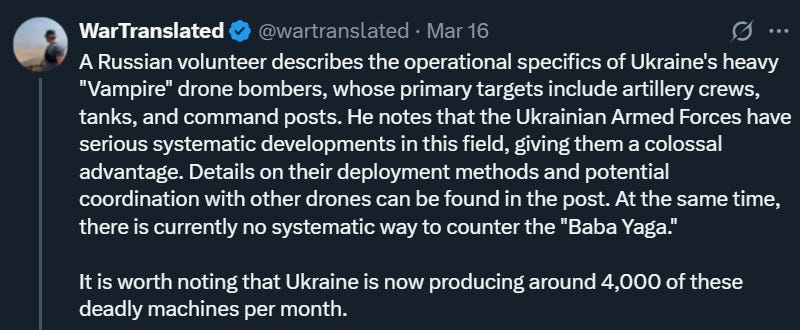

The Ukrainians have emerged as masters of drone warfare. They continually innovate new ways of using drones to take out Russian equipment and soldiers:

Despite the pressures of total war, Ukraine has also emerged as one of the world’s top manufacturers of military drones. Its factories made over 1.3 million drones for its troops in 2024, and the industry keeps expanding. Right now, Ukraine is almost totally self-sufficient in drone production, making 96% of all the drones it uses on the battlefield.

In an excellent recent thread on the state of the war, Michael Kofman — my favorite military analyst — had this to say:

Domestic drone production has made Ukraine much less dependent on aid from the U.S. There are still some items, like long-range rocket artillery, where U.S. aid cutoffs could really hurt, but if and when Trump stabs Ukraine in the back, it’ll attempt to use even more drones to make up for those lost capabilities. And given recent results, it seems fairly likely that they’ll succeed, and drones will become even more important.

China, interestingly, seems to have noted Ukraine’s prowess in drone manufacturing and tactics. There are reports of Chinese factories flying Ukrainian flags and teaming up with the Ukrainian drone makers. Trump, on the other hand, has chosen to side with Russia instead of with the emerging leader in drone weaponry. That choice is seeming less intelligent by the day.

5. Brian Deese’s policies for abundance

I’ve been having fun covering the abundance debate. Right around the same time as Ezra Klein and Derek Thompson’s book came out, former Biden advisor Brian Deese published an article in Foreign Affairs called “Why America Struggles To Build” that makes very similar arguments. Here are some of his ideas for policy solutions:

States and municipalities that impede reasonable housing construction with restrictive land-use and zoning regulations should lose access to federal resources…The government should also expand the scopes of Fannie Mae and Freddie Mac…so that they encourage more housing construction in places that get zoning right…

Another promising solution could be the creation of a national infrastructure bank to find and finance cost-effective large-scale projects…

In the face of active efforts to tilt the playing field against clean energy…environmentalists should shift their focus away from keeping all fossil fuels in the ground and toward reforms that enable cleaner energy to compete fairly and win…This should include eliminating regulations that impede the development of new energy-generating sources and addressing the backlog of projects waiting to be connected to the grid, almost all of which would generate energy from zero-carbon resources. Those who want a cleaner energy future should abandon ambivalence toward nuclear power and instead embrace a bold goal: building at least ten gigawatts of new nuclear power by 2030…This would involve sweeping reforms of a regulatory framework that currently makes it nearly impossible to build clean nuclear energy because of outdated safety concerns…

Rather than opposing reforms to the National Environmental Policy Act, environmentalists should champion a new approach that replaces outdated bureaucratic barriers with clear, results-driven rules enabling rapid, responsible building.

I hope environmentalists listen to Deese!

6. Josh Barro’s bad critique of abundance

Meanwhile, criticisms of abundance liberalism continue to fall flat. For example, Josh Barro often writes stuff that I like, but his post about Klein and Thompson’s new book feels a bit strained. Barro argues that if Klein and Thompson really cared about giving Americans cheap energy, they wouldn’t even mention the fact that cheap energy is also green energy. The fact that they do mention that, Barro argues, is evidence that deep down, despite what they say, Klein and Thompson actually believe that green energy isn’t really cheap.

That doesn’t sound like a very reasonable argument on Barro’s part, does it? But I don’t think I’m misrepresenting it. Here’s what he writes:

If Klein and Thompson have a plan to offer us energy “so cheap you can scarcely find it on your monthly bill” just 25 years from now, then why does it matter whether or not Republicans care about reducing carbon emissions? If the green transition actually makes energy cheaper, then it should not require political arguments about the climate, nor should it require subsidy and regulation to push its adoption. It might require deregulation (of the sort Klein and Thompson advocate) so that it actually becomes possible to install renewable energy generation and electrical transmission at large volumes. But the prospect of energy “so cheap you can scarcely find it on your monthly bill” should be appealing even to someone who thinks global warming is a total hoax, and also should be a magnet for unsubsidized business investment…

The problem, I think, is that Klein and Thompson don’t quite believe in their own energy vision. The suite of policies they advocate suggests…they still view decarbonization as a cost center. They would take some of the gains from a pro-abundance policy agenda and plow them into the green transition — maybe producing a higher standard of living than if you didn’t change policy at all, but producing a lower one than if you unleashed abundance in the economy while allowing users of energy to seek out the cheapest possible source, whether fossil or renewable.

This line of argument just doesn’t make a lot of sense. First of all, there’s a clear and simple reason for Klein and Thompson to make a climate-related argument for green energy, that doesn’t require any dissembling. They’re speaking to multiple audiences at once. Some portion of their audience only cares about cheap energy, and that’s fine — to these people, simply saying “Solar power is the cheapest, let’s just allow more of it” works fine.

But some other portion of Klein and Thompson’s audience cares about environmental stability in addition to cheap energy. Maybe they live in places prone to wildfires or floods. Or maybe they care a lot about animal habitats. Or maybe they’re simply much more focused on the long term than the average American, and worry about long-term climate-related costs that most Americans discount.

Or maybe the people who care about climate are simply very risk averse, and view climate change mitigation as a form of abundance because it gives them peace of mind. There’s a helpful paper on this from 2013 called “Environmental Protection, Rare Disasters, and Discount Rates”, by Robert Barro.1 From the abstract:

An appropriate model for [environmental] policy analysis requires sufficient risk aversion and fattailed uncertainty to get into the ballpark of explaining the observed equity premium. A satisfactory framework, based on Epstein-Zin/Weil preferences, also separates the coefficient of relative risk aversion (important for results on environmental investment) from the intertemporal elasticity of substitution for consumption (which matters little). Calibrations based on existing models of rare macroeconomic disasters suggest that optimal environmental investment can be a significant share of GDP even with reasonable values for the rate of time preference and the expected rate of return on private capital. [emphasis mine]

Anyway, the point here is that different Americans care about different things, and Klein and Thompson are merely pointing out that green energy satisfies the needs and desires of people who care about the climate as well as people who only care about getting cheap energy.

Is there some slice of Americans who A) only care about cheap energy, B) have high discount rates, and C) have low risk aversion, and so would only want deregulation and not subsidies for green energy? Sure! How big is that slice of the population? We don’t know. Will the size of that slice of the population determine the optimal degree of green energy subsidies? Sure!

Is this something Klein and Thompson should have taken greater pains to point out? Probably not, because it’s just a subtle and difficult point to understand — it’s much easier to just list all the reasons that green energy is good. Abundance liberalism is already wonkish enough without talking about social preferences and optimal subsidy policy.

Is there any reason to think that Klein and Thompson secretly, deep down, believe that green energy is actually more expensive than fossil fuels? No, there is not.

Also, it’s worth noting that Josh Barro doesn’t have to make inferences about Ezra Klein and Derek Thompson’s secret beliefs in order to obtain information about the true cost of green energy. He can just look up the numbers for himself. Or if he doesn’t believe those numbers, he can just look at how Texas is building more solar and wind and batteries than any other state, and ask himself why a low-regulation red state like Texas would be doing that if it wasn’t cheaper than the alternative.

7. India is learning lessons about how to do industrial policy

India’s government is trying hard to boost the country’s manufacturing industry. This is always hard going, and there are typically lots of failures, missteps, and blind alleys even when the ultimate result is successful. So I’m not too pessimistic about the fact that India’s subsidy program for manufacturing didn’t turn out very well:

Prime Minister Narendra Modi’s government has decided to let lapse a $23 billion program to incentivize domestic manufacturing, just four years after it launched the effort to woo firms away from China…Firms were promised cash payouts if they met individual production targets and deadlines. The hope was to raise the share of manufacturing in the economy to 25% by 2025…Instead, many firms that participated in the program failed to kickstart production, while others that met manufacturing targets found India slow to pay out subsidies…As of October 2024, participating firms had produced $151.93 billion worth of goods under the program, or 37% of the target that Delhi had set...India had issued just $1.73 billion in incentives — or under 8% of the allocated funds[.]

And yet India’s electronics industry seems to be roaring ahead despite the failure of the subsidy program, with electronics exports soaring. One big factor behind this trend is Apple’s decision to move large amounts of production to India:

Apple is actively hiring employees across various divisions in India…The Cupertino company has been manufacturing iPhone models in India since 2017, and it is looking to diversify manufacturing of products and strengthen its supply chain resilience, by reducing its dependence on China. Apple is reportedly recruiting for roles in multiple cities in India, ahead of plans to begin producing the iPad and its AirPods truly wireless stereo (TWS) headset in the country.

Economists who study industrial clustering often note the importance of an “anchor firm” in creating a cluster. Apple definitely seems like it’s serving that function for India’s electronics industry, much as it once did for China’s.

India is thus learning valuable lessons about how to build manufacturing industries from scratch. “Throw a bunch of money at companies” doesn’t seem like a winning strategy, while “Get big leading multinational companies to set up shop in your country” seems like a more successful approach.

8. Steven Glinert’s ideas for CHIPS Act reform

Personally, I’m pretty pessimistic about Donald Trump’s desire to actually reindustrialize America. I think he doesn’t really want to do industrial policy or rebuild manufacturing, or any of that stuff; I think he probably only wants to cut off America’s economy from the world.

But my friend Steve Glinert, a defense contractor, is more conservative than I am, and also more hawkish, and he believes that the Republicans truly want to make American manufacturing great again, and that they want to stand up to China. So he wrote a post about how Trump and the GOP can change the CHIPS Act into a more conservative policy, which he also thinks will be a more effective policy. It’s very much worth a read:

Here are a few of his suggestions:

The [CHIPS] Act relies heavily on subsidies, and subsidy-like instruments, for driving investment and results. While subsidies are a necessary component of any serious industrial policy they cannot succeed alone. The Act needs additional mechanisms which can complement subsidies: tariffs, to protect these investments and ensure long-term commitment from firms, and a strategic chip reserve, to give firms a guaranteed income stream.

Additionally, the Act actually often counteracts the subsidies it relies on by forcing firms to comply with an extensive array of “everything bagel” regulatory requirements, from environmental to reporting to labor (and DEI for good measure). This slows down the distribution of funds and undercuts the subsidies through compliance costs…

A corollary of the regulatory burden is the slowness of fund distribution. Bureaucratic delays are killing the Act's momentum…

Trump’s strategic tariffs from the first term did achieve some measure of success for narrow industries…The washing machine tariffs are an example of getting foreign firms to behave well…The tariffs triggered significant “tariff-jumping investment,” with both Samsung and LG establishing major U.S. manufacturing plants to avoid import duties…Contrary to concerns, washing machine prices quickly stabilized as these new plants began production…

Trump can use lighter tariffs on all foreign produced chips (in the 10-20% range) as a protective measure to augment subsidies…Trump can ensure TSMC and Samsung complete their investments through the potential threat of punitive tariffs if they do not…

A strategic chip reserve was considered during Trump's first administration but never implemented…A strategic reserve would provide a buffer against both short-term disruptions and potential geopolitical crises, particularly any involving Taiwan…By tying access to reserve contracts to specific domestic production targets, the government could provide semiconductor manufacturers with guaranteed demand — effectively creating a stable revenue floor for new facilities (one could even imagine that a revenue stream might be better for some firms than a subsidy)…

The CHIPS Act's implementation has become unnecessarily complex…The regulatory burden functions as an implicit tax…The first major obstacle comes from excessive financial and technical disclosure requirements…Environmental compliance represents another significant barrier to rapid implementation…The Davis Bacon Act wage requirements create a third layer of regulatory burden…Perhaps most problematic are the NOFO (Notice of Funding Opportunity) provisions. The Act's "upside sharing" requirement forces companies receiving over $150 million to share an undefined portion of profits that exceed their projections…The provision effectively penalizes successful execution and innovation.

The whole thing is worth reading in full. Even though I don’t agree with all of it (the case for steel tariffs is very weak, for example), I think Glinert is someone the GOP should probably be listening to.

It’s often a good idea to listen to your dad.

You identified one thing that Ukraine is getting from the US : long range missiles. Two other extremely important parts of US aid are maintenance and ammunition for Patriot anti-missile systems and intelligence. Ukraine's ability to defend itself was greatly diminished when we stopped sharing intelligence with Ukraine briefly.

The news about China inviting Ukrainian drone makers was news to me, but not surprising. Far more important to XI is China's future than Russia's future. China is following its old playbook of inviting innovators into their country so they can be the absolute first to steal it and then manufacture it on a great scale. For the sake of US future security, Trump needs to get those Ukrainians out of China right away. It would be so ironic if Taiwan was conquered using Ukrainian designed drones.

I also happen to be in Japan at the moment! Would be neat to be able to meet you in person at one of your book-promoting events.