At least five interesting things for the middle of your week (#43)

Slop wars; Poland and Ukraine; AI bubble; MMT reversal; Chinese frustration; YIMBY victories

Hope you had a happy Independence Day! I was going to put in nine items like in last week’s roundup, but I decided to spare you and only do six. But we do have three podcasts! The first is me being interviewed by Chris Best, one of the founders of Substack, about AI slop and the degradation of the internet:

In honor of Chris, I decided to make the first item in this week’s roundup, as well as the header image, about slop.

Next we have me appearing in the inaugural edition of Anna Gat’s new podcast, The Hope Axis, where we talk about optimism, culture wars, and stuff like that:

And of course we have an episode of Econ 102. In this episode, I rant about how both Republicans and Democrats often run into unintended consequences:

Anyway, on to this week’s list of interesting things!

1. Begun, the Slop Wars have

In my post about the death of the internet as we know it, two of the factors I cited were 1) AI flooding social media with slop, and 2) foreign governments flooding English-language social media with disinformation. Well, if you take a look at the screenshot at the top of this post, you’ll see the intersection of the two! Apparently someone wrote an X.com AI chatbot that treats replies as normal prompts, so a clever human simply prompted it into revealing that it was an AI.

Who made this chatbot and put it on X.com? It could have been some Trump supporters in the U.S., since the chatbot’s purpose is obviously to convince Democrats not to vote in the upcoming election. But the most likely candidates seem like the governments of Russia and China. The FBI recently found and neutralized a large networks of Russian-run AI chatbots:

The Justice Department today announced the seizure of two domain names and the search of 968 social media accounts used by Russian actors to create an AI-enhanced social media bot farm that spread disinformation in the United States and abroad. The social media bot farm used elements of AI to create fictitious social media profiles — often purporting to belong to individuals in the United States — which the operators then used to promote messages in support of Russian government objectives[.]

John Scott-Railton wrote a good thread explaining the details of how the bots were found and taken down.

This was, of course, inevitable. One of generative AI’s core strengths is generating large amounts of medium-quality text in support of a particular point of view. The technology is perfectly suited to the kind of “information operations” that the Russian government specializes in.

The bot shown above also might have been Chinese. Microsoft and U.S. officials recently released a report about Chinese AI sowing political disinformation on X.com:

Online actors linked to the Chinese government are increasingly leveraging artificial intelligence to target voters in the U.S., Taiwan and elsewhere with disinformation, according to new cybersecurity research and U.S. officials.

The Chinese-linked campaigns laundered false information through fake accounts on social-media platforms, seeking to identify divisive domestic political issues and potentially influence elections. The tactics identified in a new cyber-threat report published Friday by Microsoft are among the first uncovered that directly tie the use of generative AI tools to a covert state-sponsored online influence operation against foreign voters. They also demonstrate more-advanced methods than previously seen.

Accounts on X—some of which were more than a decade old—began posting last year about topics including American drug use, immigration policies, and racial tensions, and in some cases asked followers to share opinions about presidential candidates, potentially to glean insights about U.S. voters’ political opinions. In some cases, these posts relied on relatively rudimentary generative AI for their imagery, Microsoft said.

And just today, the Director of National Intelligence released a statement about Iranian government agents posing as Palestine protesters online in order to stir up unrest in the U.S. This will inevitably be at least partially outsourced to AI.

Much of the focus has been on X.com, but AI art slop can also go mega-viral on Instagram, as demonstrated by the recent mega-viral spread of the “All eyes on Rafah” image, created by some Malaysian hobbyists. Obviously, foreign governments will try to leverage this.

The information war between the great powers of the world has now become an AI slop war. The American public’s sanity, already sorely strained from internal tensions, is now under threat from foreign empires armed with technology straight out of a sci-fi novel.

2. Poland will fight Russia if it has to

As I wrote back in February, you cannot understand the Ukraine war without understanding the importance of Poland. Vladimir Putin views Poland as Russia’s chief rival for influence in the Slavic world that he wants to dominate. And by joining the EU and industrializing to surpass Russia in income, Poland has demonstrated the value of leaving the Russian sphere of influence and joining the West. Putin will definitely attempt to subjugate Poland after Ukraine.

Poland’s leaders know this very well, and are very anxious to prevent it. They understand that if Ukraine falls, Poland is next in the line of fire, along with the Baltics and Moldova. They also understand that the value of a NATO security guarantee is not what it once was, with Donald Trump probably returning to the presidency of the U.S. next year and showing zero inclination to come to European allies’ defense against Russia.

And Poland understands that if Ukraine falls, Russia’s effective manpower will greatly increase. Russia’s imperial strategy is to use conquered peoples as cannon fodder to conquer yet more subjects. It is doing this in Ukraine right now, conscripting all available manpower from the Ukrainian territories it has conquered, and using these in “meat assaults” to drive back the remaining Ukrainian defenders. If Ukraine falls, another 35 million people will become Russia’s slaves, and these slaves will be flung against Poland and the rest of East Europe in the next war.

Briefly, let’s consider the numbers here. Poland and Ukraine together have over 70 million people — about half of Russia’s population. It’s very hard to conquer an enemy with half of your population. But if Ukraine’s 35 million were flipped and turned into Russian conscripts, Russia would then have over 4.5 times Poland’s effective population. That wouldn’t be nearly as hard of a conquest.

Knowing all this, Poland is rightfully terrified of Ukraine falling. So it’s not very surprising to see the two countries sign a bilateral security agreement this week. Ukraine has signed these agreements with a number of countries, but Poland’s looks more substantial than the others. This part of the agreement got some attention:

In the event of renewed Russian aggression against Ukraine following the cessation of current hostilities, or in the event of significant escalation of the current aggression and at the request of either of them, the Participants will consult within 24 hours to determine measures needed to counter or deter the aggression. Guided by Ukraine’s needs as it exercises its right of self-defence enshrined in Article 51 of the UN Charter, Poland, in accordance with its respective legal and constitutional requirements, will provide swift and sustained assistance, including steps to impose political and economic costs on Russia. (emphasis mine)

This doesn’t explicitly say that Poland will jump into the war on the side of Ukraine. But it’s certainly inching closer. Ukraine is asking Poland to use its military to guard Ukrainian airspace near the Ukrainian-Polish border, and as far as I can tell, Poland hasn’t yet said no.

If Ukraine is in danger of collapse, will Poland jump in and fight the Russians? I think there’s a good chance it will. And that would force every NATO country to choose how much support to provide their treaty ally.

3. Is generative AI in a bubble?

Generative AI has an almost unique ability to draw out overheated rhetoric. I just had to laugh at a particularly lugubrious article in Noema magazine entitled “The Five Stages of Grief of AI”, which argues that humans are collectively grieving over the fact that our intelligence isn’t unique.

That makes for a fun indulgent read, but back here in the real world, people are not grieving — they’re either amused or annoyed by AI slop, and they’re worried that AI will take their jobs, but there doesn’t seem to be any popular outpouring of grief over the fact that statistical models can now remix the works of humanity in order to create text and images.

In fact, a number of analysts are now arguing that generative AI is in a bubble. They note that the technology’s soaring costs — for GPUs and electricity to run them — haven’t yet been matched by soaring revenues. The Economist has an article called “What happened to the artificial-intelligence revolution?”, where they argue that the technology hasn’t been transformative for businesses:

America’s Census Bureau…finds only 5% of businesses have used AI in the past fortnight…Concerns about data security, biased algorithms and hallucinations are slowing the roll-out…

Companies that are going beyond experimentation are using generative ai for a narrow range of tasks…Streamlining customer service…marketing…If you think that such efforts seem faintly unimpressive, you are not alone.

They point out that companies that are expected to benefit from AI have seen their stocks underperform recently. They also note that labor markets look just fine, meaning that workers aren’t feeling any obvious pain, outside of a few very narrow fields.

Sequoia’s David Cahn has a post called “AI’s $600B Question”, where he crunches some numbers:

In September 2023, I published AI’s $200B Question. The goal of the piece was to ask the question: “Where is all the revenue?”…At that time, I noticed a big gap between the revenue expectations implied by the AI infrastructure build-out, and actual revenue growth in the AI ecosystem, which is also a proxy for end-user value. I described this as a “$125B hole that needs to be filled for each year of CapEx at today’s levels.”…If you run this analysis again today, here are the results you get: AI’s $200B question is now AI’s $600B question.

Cahn is a long-term bull — he believes that “a huge amount of economic value is going to be created by AI,” but that “in reality, the road ahead is going to be a long one.” He thinks of the current huge investments in data centers as a speculative frenzy that will create a crash in the short term but deliver long-term dividends.

But not all analysts are so sanguine. Goldman Sachs just put out a research report that’s generally quite bearish on generative AI’s usefulness. Some key excerpts:

We ask industry and economy specialists whether this large spend will ever pay off in terms of AI benefits and returns…

GS Head of Global Equity Research Jim Covello [argues] that to earn an adequate return on the ~$1tn estimated cost of developing and running AI technology, it must be able to solve complex problems, which, he says, it isn’t built to do. He points out that truly life-changing inventions like the internet enabled low-cost solutions to disrupt high-cost solutions even in its infancy, unlike costly AI tech today. And he’s skeptical that AI’s costs will ever decline enough to make automating a large share of tasks affordable given the high starting point as well as the complexity of building critical inputs—like GPU chips—which may prevent competition. He’s also doubtful that AI will boost the valuation of companies that use the tech, as any efficiency gains would likely be competed away, and the path to actually boosting revenues is unclear, in his view…

GS US semiconductor analysts Toshiya Hari, Anmol Makkar, and David Balaban argue that chips will indeed constrain AI growth over the next few years, with demand for chips outstripping supply…

GS US and European utilities analysts Carly Davenport and Alberto Gandolfi, respectively, expect the proliferation of AI technology, and the data centers necessary to feed it, to drive an increase in power demand the likes of which hasn’t been seen in a generation (which GS commodities strategist Hongcen Wei finds early evidence of in Virginia, a hotbed for US data center growth)…Brian Janous, Co-founder of Cloverleaf Infrastructure and former VP of Energy at Microsoft, believes that US utilities— which haven’t experienced electricity consumption growth in nearly two decades and are contending with an already aged US power grid—aren’t prepared for this coming demand surge. He and Davenport agree that the required substantial investments in power infrastructure won’t happen quickly or easily given the highly regulated nature of the utilities industry and supply chain constraints, with Janous warning that a painful power crunch that could constrain AI’s growth likely lies ahead.

I did notice this interesting tidbit from the Cavello interview:

[W]e’ve found that AI can update historical data in our company models more quickly than doing so manually, but at six times the cost.

You remember what I wrote about comparative advantage, right?

Anyway, I think these warnings are worth paying attention to, and will hopefully tamp down a bit of the overheated rhetoric about AGI and human obsolescence and infinite growth1. But I see two big reasons to think that the most ardent pessimists are overstating their case.

First, every new technology tends to create a speculative boom that ends in tears for a lot of investors. It happened with the railroads in the 1800s, and it happened with the telecoms in the 1990s. Yet nowadays, few people would deny that the railroads and the internet were well worth building, even if a bunch of people lost money at the time.

Second, new technologies tend not to improve productivity much at first, because people don’t know how to use them. It takes businesspeople a while to figure out how to restructure their business models to take advantage of the new capabilities. At first they tend to simply try to slot the new technology into their old models — basically what people are doing right now when they use AI to provide customer service or take orders at fast food restaurants. But the gains are typically marginal. Only later, once they find whole new tasks for technology to do, do they really start making money and boosting productivity.

So Cahn’s long-term bullishness seems warranted to me. Generative AI’s capabilities are impressive and novel. Eventually we’ll figure out something to do with those capabilities. The idea that humanity will simply be removed and replaced by humanlike AIs is probably an uncreative, uninspired, dead-end way of thinking about what generative AI can do. The true use cases will be much cooler than that.

4. Suddenly, MMT says government debt is bad

Everyone who reads this blog knows I like to rag on MMT. Despite the “T” in the name, it’s not a true economic theory; it’s a pseudo-theory, whose core precepts can never be written down in a simple usable form, and whose predictions and recommendations must always be dispensed by a core of movement leaders. These recommendations always seem to involve having the U.S. government do more deficit spending.

The movement leader you hear about the most is Stephanie Kelton, but the true overlord of MMT is its creator Warren Mosler, a 75-year-old retired hedge fund manager living in the Virgin Islands. And in an recent interview with Joe Weisenthal and Tracy Alloway, Mosler makes a truly stunning declaration. The U.S., he now declares, is doing way too much deficit spending:

In the latest episode of the Odd Lots podcast, Warren Mosler, whose work helped spawn the MMT movement, says he sees a toxic mix of high debt levels and historically large deficits…A 7% deficit as a share of gross domestic product, at a time when the US economy is not in recession, Mosler says, “is like a drunken-sailor level of government spending.”

Mosler’s concern is that because government debt levels are high, raising interest rates raises inflation. This is also the logic of a famous 1981 paper by Sargent and Wallace — two orthodox economists that MMT people typically spend a lot of time bashing — called “Some Unpleasant Monetarist Arithmetic”.

It’s funny to see the godfather of MMT suddenly decry government deficits and start echoing Sargent and Wallace. But note that high interest costs aren’t a function of current deficits — they’re a function of the total size of the accumulated U.S. national debt. That debt was built up over decades, during which the MMT people continually called for the U.S. government borrow more and more and more. The interest payments that Mosler is worried about are a result of the very policies that he and his gang encouraged for so many years. (Not that anyone was listening to them, of course; the borrowing happened for other reasons.)

In other words, the “deficits don’t matter” idea wasn’t ever based on any deep theory of how the economy works — it was just a one-way macro bet that inflation would never return and interest rates would never go up. That bet worked out until it didn’t.

5. Chinese people are feeling more frustrated

These days when I talk about the Chinese economy, I usually talk about the wave of exports that’s threatening to swamp the manufacturing industries of other countries, and prompting a tariff backlash in response. But it’s useful to remember that to people actually living in China, all that stuff is very far away. The continuing real estate bust and economic slowdown is still the big economic story for most regular Chinese people.

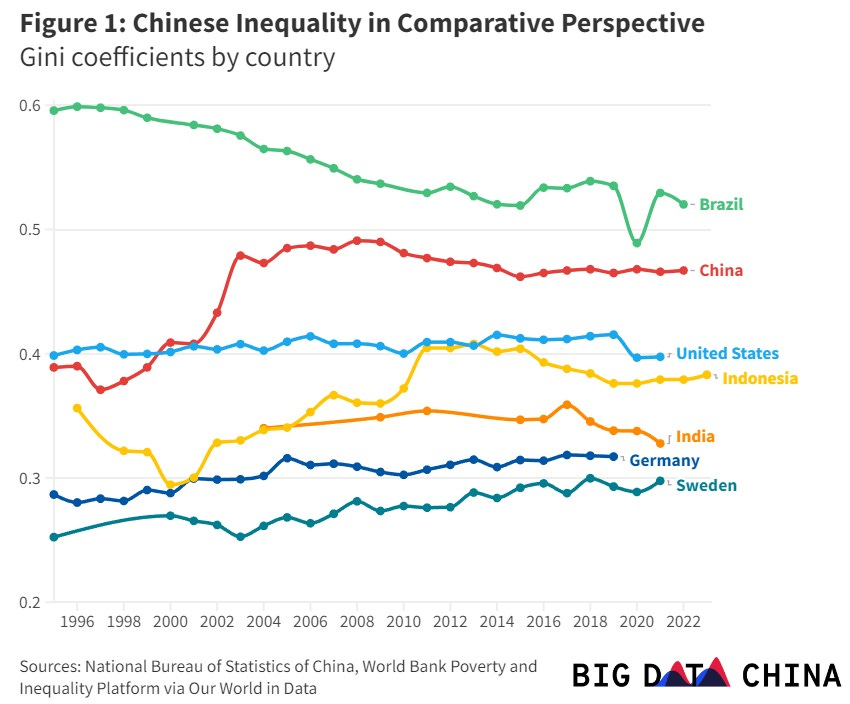

That bust could affect the Chinese social contract. For four decades, the bargain that the Communist Party made with the Chinese people was growth in exchange for political quiescence. But during that time, inequality rose to very high levels:

When growth was fast, Chinese people who were falling behind could tell themselves that they’d catch up someday — that the big inequalities being generated in the system were just the result of some people, in Deng Xiaoping’s famous words, “get[ting] rich first”. The assumption was that everyone else would get rich later.

But now, with the whole system slowing down, many Chinese people are rightfully starting to wonder whether that will actually ever happen. An interesting new report from CSIS’ Big Data China project highlights polling data showing rising economic frustration among the Chinese populace:

The report argues that these frustrations aren’t yet near a boiling point; instead, they’re festering slowly and producing general disillusionment. Instead of a revolution, China will probably get a slacker generation. I hope they make some great music and art.

6. YIMBYs continue to win modest but important victories

One long-term story I like to follow is the progress of the YIMBY movement. I love YIMBYism because it’s oriented around concrete goals rather than methods — YIMBYs are perfectly happy deregulating and building public housing, as long as the housing gets built.

YIMBYs have been slowly winning a series of modest but important victories at the state level. One of these was Minneapolis’ 2040 Comprehensive Plan, which upzoned many parts of the city. In a recent post, Zak Yudhishthu wrote about why this plan succeeded in increasing housing supply. Basically, the much-talked-about allowance of duplexes and triplexes throughout the city did absolutely nothing, because in most places this upzoning was canceled out by other regulatory requirements. But along big roads, a decent amount of new housing was built, mostly in the form of small apartment buildings. This shows how lots of upzoning success stories actually involve compromises — the NIMBYest neighborhoods get to avoid new construction, while other neighborhoods get a bunch of new apartment buildings. This is the same pattern we’ve seen in Arlington, VA and in Houston.

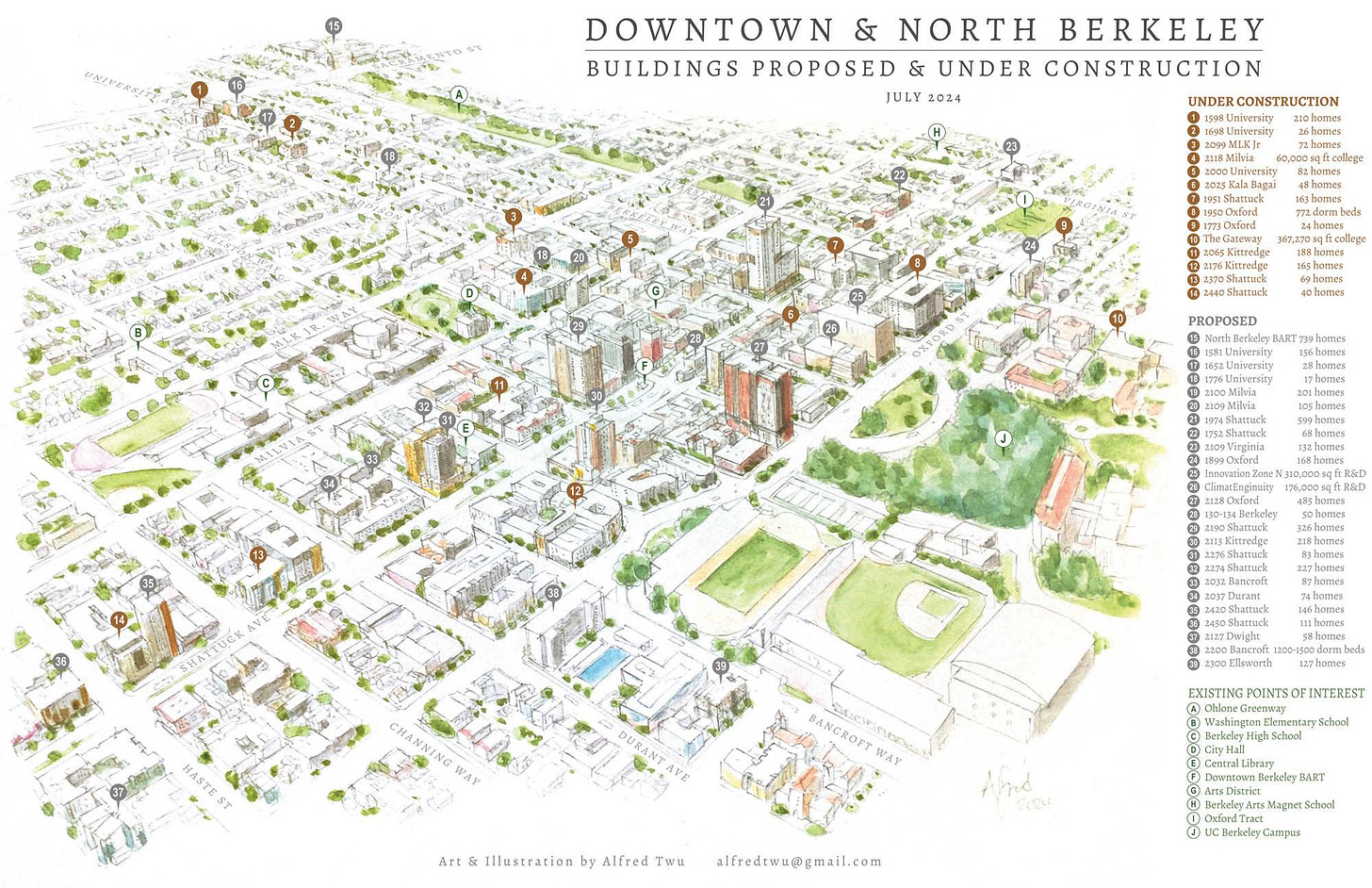

Another unlikely YIMBY success story appears to be Berkeley, California. The excellent Alfred Twu reports:

Downtown & North #Berkeley, buildings proposed & under construction. About 1,000 homes & 700+ dorm beds being built, another 5,000 homes & 1200-1500 beds planned.

And here is Alfred’s illustration:

This is especially encouraging because college towns, along with big metros, are the most economically thriving and dynamic places in America, and have seen some of the steepest cost increases as a result.

Even San Francisco might be getting some new housing, thanks to a new state law sponsored by the YIMBYs:

San Francisco could soon see 200 new homes in Duboce Triangle enabled by a…state law aimed at spurring faster housing development across California.

Developer representatives filed a notice of intent with the city to build a 23-story apartment building at 1965 Market St. that takes advantage of Senate Bill 423, a state law that kicked in at the end of June to fast-track new housing. The apartment tower—slated to include 200 residential units—could be the city’s inaugural project to take advantage of SB 423 benefits like bypassing discretionary hearings and waiving environmental reviews…

San Francisco was the first city subjected to SB 423’s new rules because it failed to meet its housing goals and holds the dubious distinction of having the longest housing approval timelines in the state.

That’s really great to see.

All across the U.S., the basic pattern repeats itself. Cities that allow more housing construction see falling rents:

The prevalence of year-over-year rent declines in Sun Belt markets can be clearly seen in the metro-level map below. The Austin metro has seen the nation’s sharpest decline among large metros, with prices there down 7.4 percent in the last 12 months. The Austin metro is also significant for permitting new homes at the fastest pace of any large metro in the country, signaling the important role new supply plays in managing long-term affordability. Austin is not alone in exhibiting this trend. Among the ten metros with sharpest year-over-year rent declines, seven also rank in the top ten for the highest rates of multifamily permitting activity from 2021 to 2023 (Austin, Nashville, Raleigh, Jacksonville, Orlando, Phoenix, and San Antonio).

This is just correlation; there may be other factors involved. But when the pattern repeats itself so many times, over and over, it’s hard not to think there’s causation involved.

Build more housing.

Haha who am I kidding. No it won’t.

There is too AI grief.

Arcade Fire's "Deep Blue" is about AI grief

Problem with these sort of AI tweet stories is that there's no way to tell if the people reporting them are being honest. This guy has tweeted that he'd rather vote for a dead body than Trump so he's not exactly an unbiased source, the left just demonstrated a willingness to engage in a massive conspiracy in which they lied to each other/the public to create support for Biden, and they have a looooong history of crying wolf about bots on Twitter. For example he makes the assertion in his TikTok video that any username that ends in numbers is a bot, which is absolute nonsense. That's been the default username pattern Twitter gives people for years:

https://tinysubversions.com/notes/twitter-usernames/

As there's no way to prove attribution it could easily be the guy himself. "Nobody real has any doubts about Biden, everyone who does is secretly a bot, look I proved it!"

On AI potential, I am still bullish. Profitable use cases are everywhere I look and even getting just one right can consume a lot of GPU capacity. Right now there's still a lot of work needed to get even the basic cases like support, summarization etc really reliable, but that's getting easier.

Good to see the MMT people get their comeuppance! About time!