America's chip export controls are working

Don't be fooled by the people who say we should sell China everything we've got.

“The capitalists will sell us the rope with which we will hang them.”

In December of 2024, before Trump took office, I wrote about the disturbing possibility that the man once known as a consummate China hawk would sell America out to its great rival. I wrote that the key tell would be whether Trump dropped the export controls on chips and chipmaking equipment implemented during Biden’s presidency:

[T]here’s one big important thing Trump could do to sabotage America’s effort to stand up to Chinese power. He could cancel the export controls that the Biden administration placed on the Chinese semiconductor industry. Removing export controls wouldn’t require legislative action — Trump could just do it whenever he wanted. And because the policy is not really in the limelight, there probably wouldn’t be a popular backlash to its cancellation. So export controls are pretty much a pure test of Trump’s China policy — if he keeps them, it’s because he wants to stand up to China, and if he cancels them, it means he doesn’t…

[E]xport controls are doing what they’re designed to do. They’re not killing China’s chip industry, but they’re slowing it down in important ways, and letting the U.S. retain its technological edge…These export controls [are] absolutely crucial if the U.S. is going to maintain any kind of a military-technological edge over China. Chips are the foundation of all modern weaponry, from missiles to drones to satellites to advanced fighter jets. And AI itself, which depends on advanced chips for training and inference, is rapidly becoming an essential weapon of war. When autonomous drone swarms hit the battlefield, AI will become even more crucial to the military balance.

The U.S. probably cannot out-manufacture China, even with all the tariffs and industrial policies in the world. America needs to retain a technological edge to balance out its productive weakness — an advantage in quality to balance out its deficiency in quantity. Semiconductors are that edge. If Trump cancels the export controls, it will mean he’s destroying America’s best chance to keep its weapons ahead of China’s weapons.

In mid-2025 there was a rumor that Trump was going to allow sales of an Nvidia chip called the h20 to China. Ultimately the administration backed off amid a torrent of criticism from hawkish elites. But in December, Trump announced that he would allow the sale of a far more powerful Nvidia chip, the H200. The Institute for Progress had a good post explaining what this means:

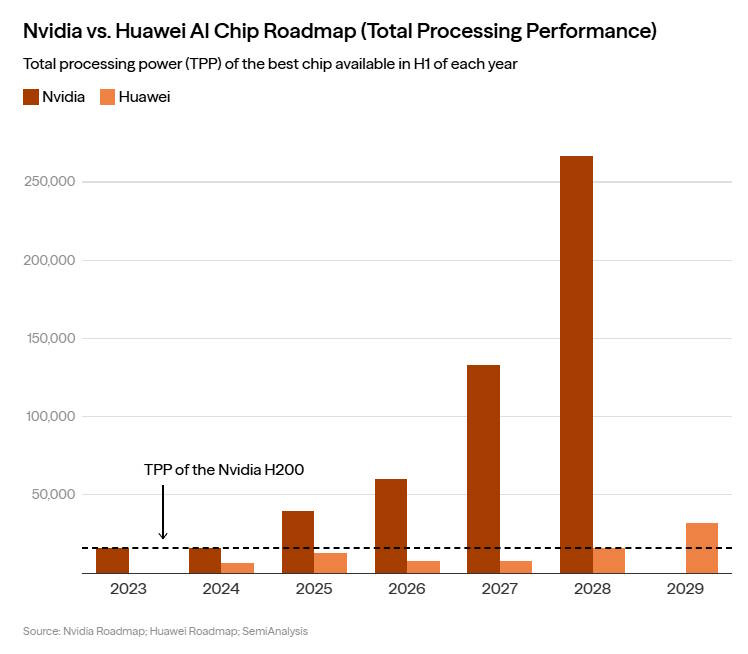

The decision [to sell H200s] would be a substantial departure from the Trump administration’s current export control strategy, which seeks to deny powerful AI compute to strategic rivals. The H200 would be almost 6x as powerful as the H20…China would have access to chips that outperform any chip its companies can domestically produce, and at much higher quantities. Huawei is not planning to produce an AI chip matching the H200 until Q4 2027 at the earliest. Even if this timeline holds, China’s severe chip manufacturing bottlenecks mean that it will not be able to produce these chips at scale, reaching only 1–4% of US production in 2025 and 1–2% in 2026…Chinese AI labs would be able to build AI supercomputers that achieve performance similar to top US AI supercomputers, albeit at a cost premium of roughly 50% for training and 1-5x for inference, depending on workload…

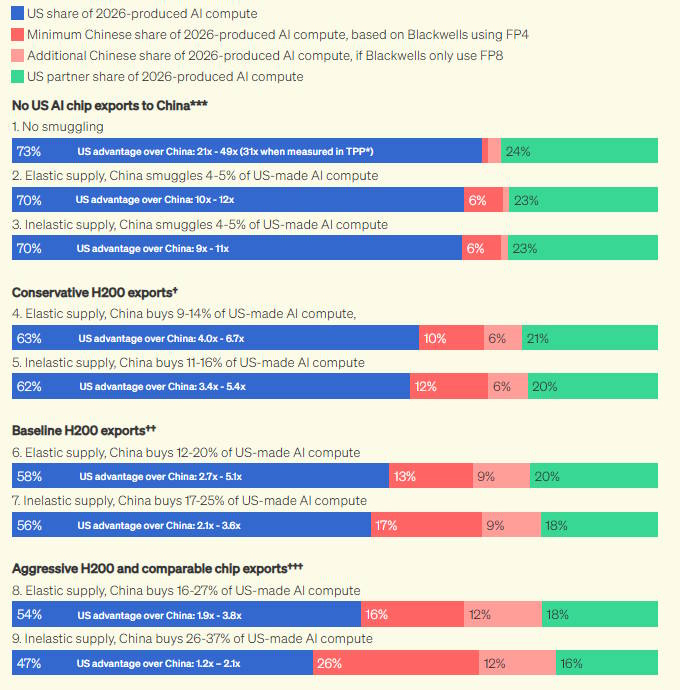

With no AI chip exports to China and no smuggling, we estimate the US would hold a 21–49x advantage in 2026-produced AI compute, depending on whether FP4 or FP8 performance is used for Blackwell chips.7 This advantage would translate into a much greater American capacity to train frontier models, support more and better-resourced AI and cloud companies, and run more powerful inference workloads for more capable AI models and agents. Unrestricted H200 exports would shrink this advantage to between 6.7x and 1.2x, depending on the scale of Chinese demand and the degree of adoption of FP4. [emphasis mine]

IFP has a number of great graphics showing how much H200 sales to China will erode America’s advantage in AI compute:

If the U.S. cared about staying ahead of China in the AI race, why would we sell H200s to China? The obvious answer is that there is no reason we would, and that thus Trump does not care about staying ahead of China in the AI race — that for either personal or political reasons, Trump has decided to facilitate the rise of Chinese power rather than impede it.

Some people actually do argue that selling China H200s will maintain America’s technological advantage. They argue that if Chinese companies are allowed to buy H200s, they will remain dependent on American chip designs (and Taiwanese chip manufacturing), and will thus fail to build their own indigenous rivals to America’s AI chip industry. As Dmitri Alperovitch writes in the Wall Street Journal, this is a dangerous pipe dream:

Rather than grow dependent, China will take Nvidia chips while they are available, use them to train models to compete with American frontier variants and continue to invest heavily in domestic alternatives like Huawei’s Ascend chips. When those are good enough, the firms will drop Nvidia—and quickly.

The notion that restrictions “accelerate Beijing’s move toward alternatives” misses a critical reality: Technological self-sufficiency is a Xi Jinping mandate. He isn’t going to allow China to rely on an American tech stack. The Communist Party is already investing in an alternative supply chain and will limit Nvidia imports if needed to ensure sufficient domestic demand for Huawei. The question isn’t whether China pursues self-sufficiency; it’s whether we hand it advanced capabilities during its years-long catch-up period.

In a post back in November, I put it a little more bluntly:

If you want to keep China hooked on American products for strategic reasons, it’s probably a bad idea to scream “HEY CHINA, WE’RE SELLING YOU CHIPS AND EQUIPMENT SO YOU’LL STAY HOOKED ON OUR PRODUCTS, FOR STRATEGIC REASONS!!”. China’s leaders, being smarter than, say, a gerbil, will refuse to take this bait, and will work hard on developing their own indigenous chip supply chain anyway. Which is exactly what they’ve been doing for over a decade now.

In fact, we can already see my argument being proven right in real time. Chinese AI companies are simply buying chips from both Huawei and Nvidia:

This is why selling China H200s won’t actually slow down China’s indigenization efforts. China’s companies will buy as many Chinese-made chips as they can, and simply buy American chips on top of that.

This will give Chinese AI companies a huge advantage. Right now, despite its mighty efforts to catch up, China is proving unable to match America’s chip production capabilities (in large part because of export controls on chipmaking equipment):

Because China can’t match America’s chip production, selling America’s H200s to China will give Chinese AI companies a huge boost in their competition with American AI companies. Currently, China’s compute limitations are the main reason that America’s AI models are better:

Selling China H200s will help alleviate those constraints, and their models will catch up.

Opponents of export controls will doubtless retort by asking: So what? Why should the U.S. try to maintain a lead over China in AI modeling?

It’s a good and important question. The main reason is deterrence. Right now, China is menacing Taiwan and Japan, and threatening to start World War 3. The main thing stopping it from starting a war is the chance that it would lose such a conflict — which would doubtless end in Xi Jinping losing power, and quite possibly his life.

China can out-manufacture the U.S. easily at this point. So the main way China would lose a war is if the U.S. used its technological edge to prevail in a short, limited conflict. Thus, if that technological edge evaporates, China is much more likely to start a war of conquest.

As long as America is way ahead in the AI race, China will therefore be more hesitant to start a world-shattering war. There will always be the lurking possibility that America’s lead in AI tech will somehow allow it to thwart China’s attacks. It’s not clear how LLMs will be used for military applications — perhaps some sort of coordination of drone swarms, or large-scale hacking attacks — but as long as America is clearly better than China in the most versatile and important new technology, it will give China’s leaders one more reason to delay their attacks on Taiwan and Japan.

So it’s in America’s interest to preserve its technological edge in AI for as long as possible. If China can be kept from launching a war for just 5 or 10 more years, something could change that makes World War III far less likely — Xi Jinping could be unseated and replaced with a less bellicose leader, China’s rapidly aging demographics might reduce popular appetite for war, India could develop to the point where China doesn’t enjoy overwhelming primacy in Asia, and so on.

Selling China H200s thus makes World War III a bit more likely in the next decade.

On top of all of that, there’s also the possibility that denying China U.S. chips could cause their domestic tech ecosystem to become isolated from the global ecosystem — a condition known as “Galapagos syndrome”. If Chinese AI companies buy only from Chinese chip companies, then Chinese chips may become optimized for the domestic market rather than the international market. This could ultimately limit the scale of China’s chip industry, preserving an advantage for American and allied chipmakers — an advantage that would also have obvious military benefits.

China’s government knows all of this, of course, which is why it’s always calling for the U.S. to end its export controls. If export controls really helped China indigenize its chip industry, it would welcome the controls — or at least, accept them with minimal grumbling.

China also tries to give ammunition to America’s internal opponents of export controls, by announcing big “breakthroughs” in chip manufacturing. For example, back in 2022, China announced that it had manufactured 7nm chips — something that export controls on advanced chipmaking equipment was supposed to prevent. But as I wrote in 2024, this was a bit of a Potemkin breakthrough:

SMIC, the Chinese foundry company that created the 7nm chip, was rumored to be advancing quickly to 5nm. But the company has reportedly delayed its 5nm release until at least 2026. This has left SMIC’s customer Huawei in the lurch, relying on technology that’s fast becoming obsolete. Even SMIC’s 7nm process, hailed as a catastrophic failure for export controls, is actually not achieving good yields, and is reportedly having reliability issues. This is probably hurting Huawei’s production of leading-edge phones. In the last five years, over 22,000 Chinese semiconductor companies have reportedly shut down….Huawei’s own chip production is probably suffering as well, with very low yields…Meanwhile, Chinese companies are pessimistic about their ability to keep up with leading-edge chipmakers without access to the latest chipmaking tools from the Netherlands, the U.S., and Japan.

By 2025, it was clear that China’s chipmaking technology had actually stalled, with rumored further breakthroughs to 5nm failing to materialize, and with Huawei downplaying the importance of making 7nm chips at all.

But the Potemkin breakthrough of 7nm chips probably helped opponents of export controls make their case to the Trump administration, allowing them to claim that China’s indigenization drive was succeeding. With the lifting of export controls on the H200, China won on the battlefield of information warfare what it had been unable to win in the laboratory.

And as if on queue, I’m now reading that China has made a stunning breakthrough in Extreme Ultraviolet Lithography (EUV), the most powerful and important chipmaking technology in the world:

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence, smartphones and weapons central to Western military dominance…Completed in early 2025 and now undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML.

It seems only a matter of time before opponents of U.S. export controls are using this stunning “breakthrough” to argue that the U.S. should allow ASML to sell EUV machines to China in order to keep China “hooked” on Western technology — the same terrible argument that resulted in the sale of H200s.

But read the fine print, and it turns out that China’s supposed breakthrough is less than it appears:

China's machine is operational and successfully generating extreme ultraviolet light, but has not yet produced working chips…China still faces major technical challenges, particularly in replicating the precision optical systems that Western suppliers produce…The availability of parts from older ASML machines on secondary markets has allowed China to build a domestic prototype, with the government setting a goal of producing working chips on the prototype by 2028…But those close to the project say a more realistic target is 2030.

So it’s not even clear that China’s supposed EUV prototype even works yet — or that it will ever work. Nor is it clear how China plants to source high-end components such as the ultra-smooth mirrors that only the German company Zeiss can make, and which are an essential input to EUV. There is every possibility that this is another Potemkin breakthrough.

Except it seems inevitable that before too long, ASML executives will be pointing to stories like this, and whispering to Trump that unless he lets them sell EUV machines, the Chinese will just invent their own. And it seems likely that as with H200s, the administration will fall for it, sacrificing one of the key technological edges that could have deterred WW3 — or helped America win it. Whichever communist said that “capitalists will sell us the rope with which we will hang them” appears to have been right on the money.

This is a good piece on the hardware war. But there’s a layer beneath chips that’s missing from the analysis.

Noah’s right that China can’t match US chip production. The IFP data on compute advantage is solid. But compute is the foundation, not the building.

What runs on those chips matters more than who makes them.

I’ve spent the last month reading Chinese IPO filings and securities disclosures. Documents with legal liability. Here’s what they say:

Moore Threads (China’s most advanced GPU company) admits in their filing that NVIDIA’s CUDA ecosystem is “not easily surpassable” (不易逾越). So they stopped trying to beat it. They built a migration tool instead. They conceded the codebase.

But Huawei isn’t trying to win the chip war. They’re building a world where CUDA doesn’t reach. 50,000 engineers trained in Malaysia. 27,000 in Egypt. 79 Huawei ICT academies across Africa and Southeast Asia. Zero NVIDIA equivalents.

Noah mentions “Galapagos syndrome” as a risk for China. But what if that’s the strategy? Not isolation. Bifurcation. A parallel ecosystem serving three billion people who will never use American software.

The hardware controls are working on hardware. But we’re not watching the software layer. And software is what locks in advantage for decades.

I wrote about this today: https://open.substack.com/pub/russwilcoxdata/p/warren-thinks-shes-winning-the-chip?r=2o1c82&utm_medium=ios&shareImageVariant=overlay

Ah yes, the old “give them our best stuff to disincentivize them from developing their own better stuff” argument.

The same logic that led us to sell our best military kit to the USSR during the height of the Cold War.

Remember back in Reagan’s first term, the deal he signed to sell Moscow a dozen SR-71s, ten squadrons of F-15s, three divisions of Abrams tanks, and ICBM inertial guidance systems? Because this would slow Soviet weapons development?

You don’t remember that? Because it never happened? Because it would be very foolish? Silly me. I must have my timelines mixed up.