What happens if the world pulls its money out of America?

The more Trump makes it clear that America is not what it used to be, the more likely capital flight becomes.

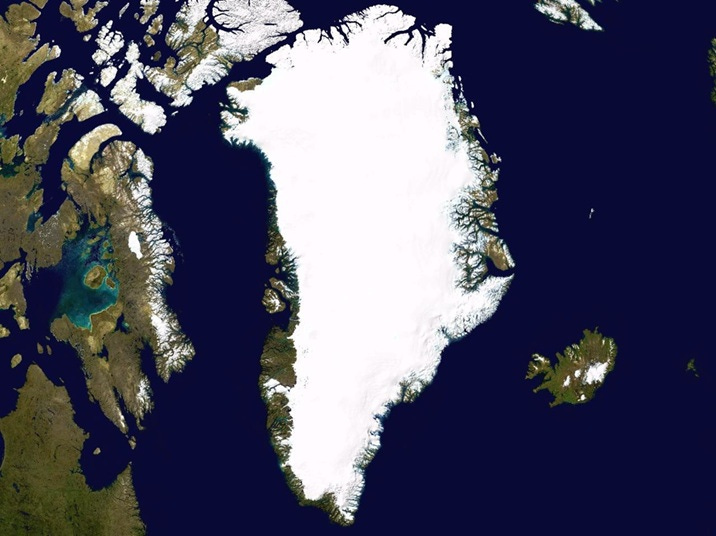

This past week, the world was treated to another fun and exciting episode of “Donald Trump almost wrecks the U.S. economy”. Trump escalated his threats to invade Greenland, causing the Danish territory to actually begin preparing for war. The U.S. President seemed to signal his seriousness by threatening to impose 10% tariffs on any European country that opposed his seizure of the island. That tariff rate by itself isn’t very high, but the fact that Trump was making the threat seemed to indicate that this time, his aggression was more than just bluster.

Financial markets reacted sharply to the seeming seriousness of the latest threat. U.S. stock markets dropped sharply, the U.S. dollar fell in value, and U.S. Treasury yields rose. As CNBC reported, this was basically a “sell America” trade:

The “sell America” trade is in full swing Tuesday morning after President Donald Trump and European leaders escalated tensions over Greenland…U.S. bond prices tumbled, sending yields spiking. The U.S. Dollar Index, which weighs the greenback against a basket of six foreign currencies, fell nearly 1%. The euro jumped 0.6% against the dollar…“This is ‘sell America’ again within a much broader global risk off,” Krishna Guha, head of global policy and central banking strategy at Evercore ISI, wrote in a note to clients.

Trump responded by backing off, declaring that he wouldn’t use military force to seize Greenland:

After a meeting with [NATO Secretary General Mark] Rutte on Wednesday, Trump called off promised tariffs on European nations, contending that he had “formed the framework of a future deal”…It was a stark shift in tone for Trump, who just days earlier had declined to rule out using the military to secure ownership of Greenland and posted an image online of the territory with an American flag plastered across it…Trump…sought to de-escalate, calling for immediate negotiations to discuss the U.S. bid to acquire Greenland. “I don’t have to use force,” he said. “I don’t want to use force. I won’t use force.”

Trump also dropped his tariff threats against Europe. He instead announced a “deal” that would give the U.S. full military access to Greenland (which it already had) and give the U.S. the right to mine minerals in Greenland. Stock markets rose and Treasury yields fell, though the dollar didn’t rebound against the euro.

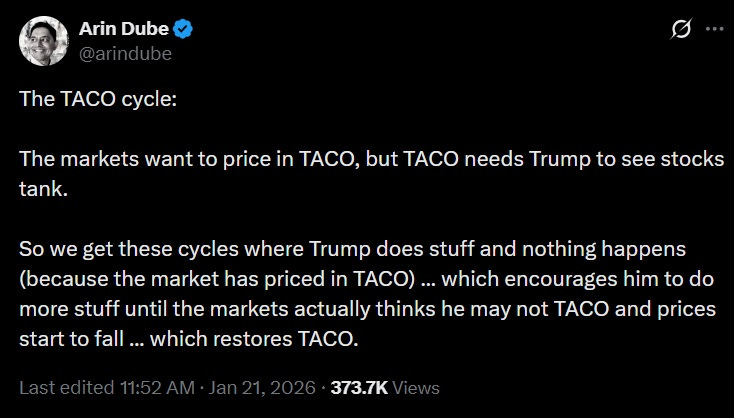

In terms of the immediate economic outcome, this is fine for Trump. Stock and bond markets are back to normal, and the weaker U.S. dollar will help American exporters, which is probably a good thing. It looks like another case of “TACO” saving the day. But as Arin Dube notes, the long-term implications are still worrying, because investors’ expectation that Trump will always chicken out means that he has to do crazier and crazier things each time in order to cause the kind of financial market reaction that will make him pull back:

The more interesting story here is why Trump pulled back, and why markets reacted the way they did.

The stock market drop wasn’t very surprising, and it also doesn’t tell us much — stocks tend to drop on basically any kind of worry or negative news. Similarly, the fall in the dollar could just be an indicator of general pessimism. But the fact that bond yields rose is important, because it tells us something about why investors were “selling America”.

When Treasury yields rise, it means that people are selling U.S. bonds. Higher yields happen when investor demand for bonds goes down; you have to issue bonds that pay higher interest rates in order to entice investors to buy them.

Often, when there’s an economic crisis, demand for U.S. bonds goes up and yields go down. This happened in 2008-9, for instance, during the financial crisis; even though the crisis originated in the U.S., people still thought U.S. government bonds were the safest asset out there, because they made a bet on long-term American economic strength.

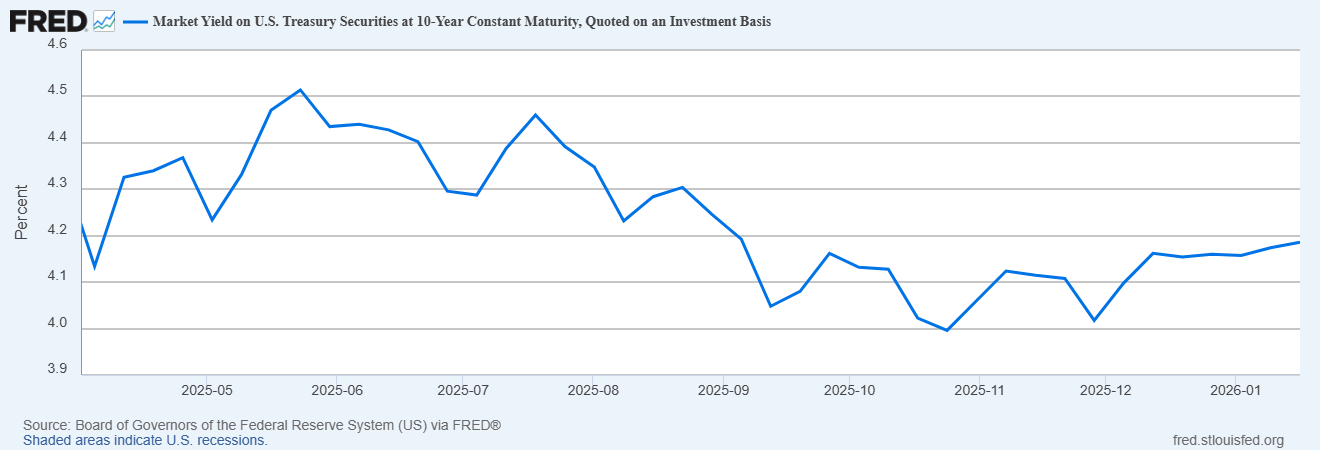

But ever since Trump returned to power, the opposite has been happening. When Trump announced his massive “Liberation Day” tariffs in April 2025, Treasury yields went up. It was only after Trump started backing off of many threats, and the TACO trade set in, that yields began drifting back down:

Basically, Trump’s reckless tariff threats temporarily convinced a lot of people that the U.S. was going to start intentionally hurting its own economy. They reacted to this news the reasonable way — by pulling their money out of America, and putting it in European bonds and elsewhere. The term for this is “capital flight”. I wrote a post explaining it, back in April:

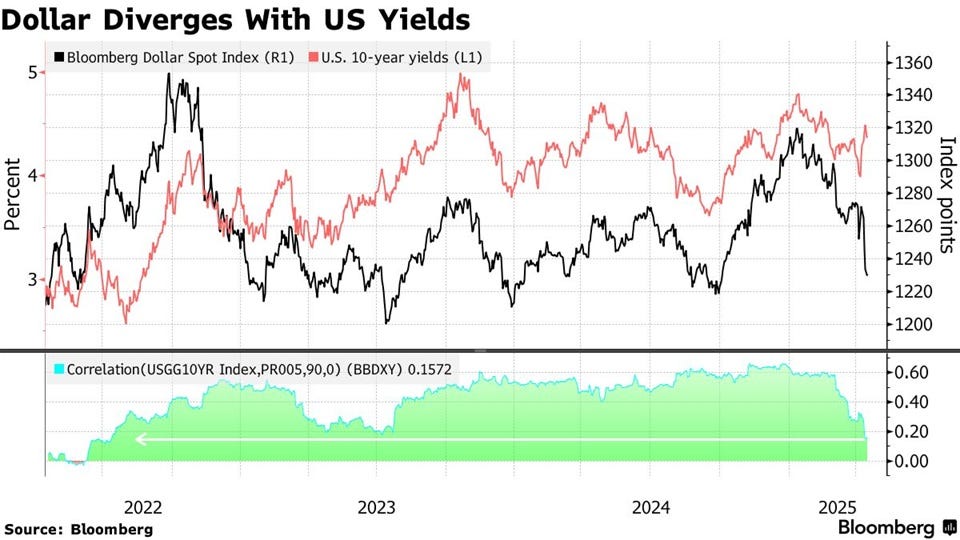

We know capital flight was underway because at the same time that investors were dumping Treasuries, they were also moving their money out of the U.S. entirely. Usually, when investors sell Treasuries, they put the money elsewhere in the U.S. - stocks, real estate, etc. But last April, the dollar went down even as yields went up:

This means that people were pulling their money out of the country entirely. When investors sell U.S. bonds and stocks, and buy assets in Europe or elsewhere, they have to swap dollars for foreign currencies in order to do it. Selling dollars pushes down the value of the dollar. So because Treasury yields went up and the dollar went down, we know people were moving their money out of America.

That’s probably why Trump backed down on tariffs back in 2025. And it’s probably why he backed down on Greenland this time — the sudden rise in Treasury yields and drop in the dollar were an uncomfortable echo of what happened back in April and May. There’s a popular idea that Trump cares mainly about the stock market, but the bond market is probably a bigger deal.

Why? As I’ll explain, capital flight is scary in a way that simple stock market declines aren’t. And the U.S. is primed for a ruinously damaging run of capital flight — we’ve benefited for years from the reputation that we’re still the country that won World War 2 and the Cold War. If investors around the world decide that the era of American exceptionalism is over, the economic consequences for American living standards could be harsh — and Trump could take the blame.