We can't afford to keep cutting taxes for the rich

Trump's "Big Beautiful Bill" is an advanced stage of a disease that took hold long ago.

“I wanted the money.” — Edward Pierce

Donald Trump has done away with much of the Reaganite conservative ideology that defined the Republican party of my youth. But one Reagan tradition remains in place: Every time the GOP finds itself in control of both Congress and the Presidency, they pass a giant tax cut. Bush did this in 2001, Trump did this in 2017, and now Trump is about to do it once again in 2025. Trump’s rather ludicrously titled One Big Beautiful Bill Act is, first and foremost, a tax cut bill. The Economist tallied up the numbers on the version of the OBBBA that just passed the Senate, and found that tax cuts dominated everything else in terms of their impact on the government’s finances:

A more detailed breakdown is available from the Committee for a Responsible Federal Budget. The New York Times has found similar numbers for the House version of the bill.

A lot of people are mad about the OBBBA, for many reasons — the health insurance cutoffs, the huge cuts to scientific research, the crazy energy policy, and so on. But really, this bill is first and foremost about tax cuts for the rich.

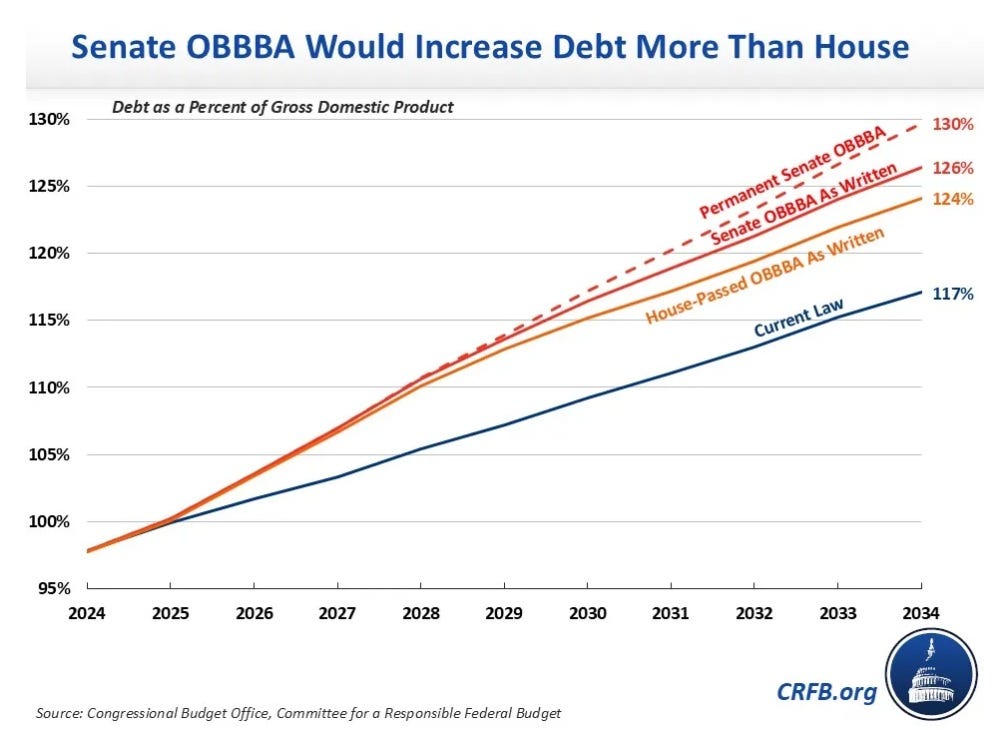

Those new tax cuts will require a staggering amount of government debt. Even with all the money that the OBBBA will cut from Medicaid, energy, and so on, the Senate version will add an estimated $3.9 trillion to the federal debt over the next decade. Federal debt is already on an unsustainable path, but this will get much worse after Trump’s big tax cut:

In fact, that’s a low estimate; the truth is probably much worse. As the CRFB points out, Trump’s bill pretends that some of its tax cuts will expire in the future, when in fact they will probably be made permanent. That would raise the debt cost of the bill by an additional trillion dollars or more.

What is the point of borrowing money to cut taxes? Every time they do this, Republicans claim that their tax cuts will supercharge economic growth so much that they’ll pay for themselves, and actually reduce the deficit. And if you go on the White House website, you can still find them making this claim:

MYTH: The One Big Beautiful Bill “increases the deficit.”

FACT: The One Big Beautiful Bill reduces deficits by over $2 trillion by increasing economic growth and cutting waste, fraud, and abuse across government programs at an unprecedented rate….President Trump’s pro-growth economic formula will reduce the deficit…MYTH: “But the CBO says….”

FACT: The Crooked Budget Office has a terrible record with its predictions and hasn’t earned the attention the media gives it. The CBO misreads the economic consequences of not extending the Trump Tax Cuts. The One Big Beautiful Bill delivers real savings that will unleash our economy and prevent the largest tax hike in history, resulting in historic prosperity, while lowering the debt burden.

In the 1980s, you could probably find a few economists who actually believed that tax cuts would pay for themselves. Nowadays, no one really thinks this is true; every big tax cut since the Reagan days has increased the federal debt.

In fact, Trump’s 2017 tax cuts were better in this regard than most. Economists generally agree that corporate taxes are more harmful to the economy than personal income taxes, so when Trump cut the corporate tax rate, some were optimistic. But while Trump’s first tax cut did spur a bit of growth, Chodorow-Reich and Zidar (2024) find that this only offset a tiny amount of the deficit that the tax cut created:

Domestic investment of firms with the mean tax change increases 20% versus a no-change baseline. Due to novel foreign incentives, foreign capital of U.S. multinationals rises substantially. These incentives also boost domestic investment, indicating complementarity between domestic and foreign capital. In the model, the long-run effect on domestic capital in general equilibrium is 7% and the tax revenue feedback from growth offsets only 2p.p. of the direct cost of 41% of pre-TCJA corporate revenue.

This time around, things are likely to be even worse, because of long-term interest rates.

In the late 2010s, for reasons we still don’t entirely understand, America was still in a disinflationary regime, where the Fed could and did keep interest rates at zero without causing inflation. ZIRP meant that big deficits didn’t push up interest rates. Since the pandemic, however, America has been in an inflationary regime, where the Fed has had to keep interest rates around 4-5% in order to prevent inflation from rising. In other words, it looks like interest rates have normalized, and that means there are probably no more free lunches.

There are basically three ways that increased debt can make long-term interest rates rise.

First, more government borrowing can increase inflation. People may assume the government will print money in order to help pay off the debt in the future. This can become a self-fulfilling prophecy, where businesses raise prices in order to get ahead of the inflation — thus causing the very inflation they feared. In this case, the Fed will have to hike short-term rates in order to squash inflation, and raising short-term rates causes long-term rates to rise as well.

Second, higher deficits can crowd out private investment. If banks and bond investors have only a limited amount to invest, then higher government debt can starve the private sector of capital, forcing everyone to pay higher interest rates in order to borrow.

Finally, higher deficits can introduce a default risk premium into long-term interest rates. Investors may assume that the government’s reckless borrowing is a sign that it doesn’t take its own future solvency seriously. At that point, they may start charging the U.S. government a premium to borrow money. If that happens, private businesses have to pay higher rates too.

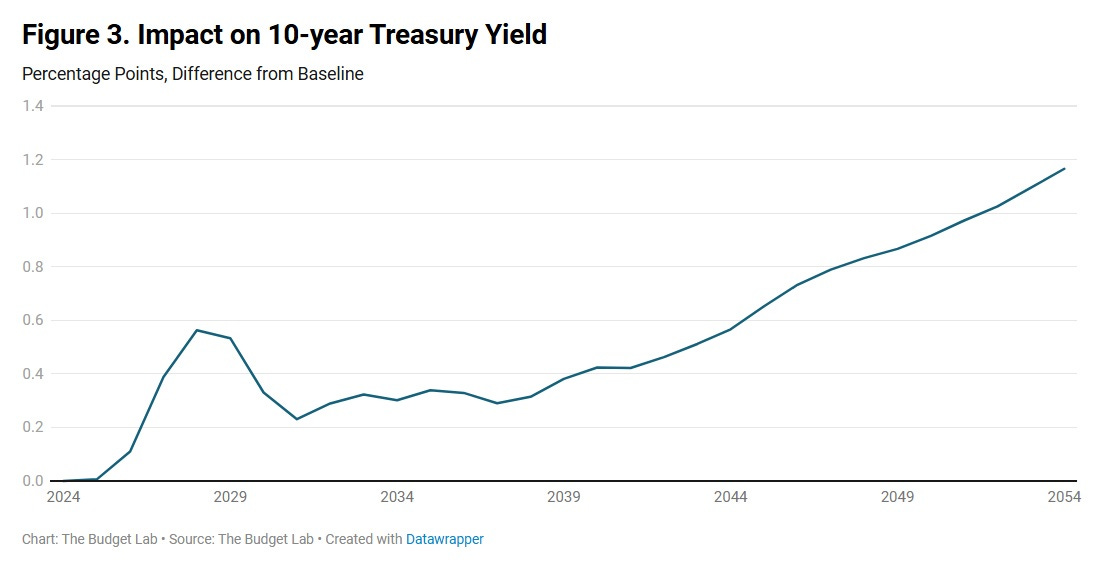

The Yale Budget Lab thus predicts that Trump’s OBBBA will cause long-term rates to rise:

This would hurt U.S. economic growth, since higher interest rates make it harder for companies to borrow and invest and grow:

A 3% lower GDP is only a small hit to growth, but it’s in the wrong direction — instead of Trump’s new tax cuts paying for themselves, they’ll actually make themselves slightly harder to pay for. And increased rates will also put the U.S. government in a more perilous fiscal position, forcing it to borrow more and more just to service its debt in the future. This line is only going to go higher:

So I doubt that anyone in the administration or the GOP still believes the old line that tax cuts pay for themselves.

If juicing economic growth isn’t actually the point, why is the GOP running up government deficits in order to cut taxes by trillions of dollars? Essentially, they’re promising to tax tomorrow’s taxpayers — whether via higher taxes, inflation, or a sovereign default — in order to give today’s taxpayers a rebate. Why would they do that?

I can think of a number of reasons, none of them very encouraging about the state of our nation. The GOP might simply have an eye on the electoral cycle, hoping to hand out goodies in order to secure a donor base and shore up support among the wealthy voters who have been defecting to the Democrats in recent elections. They might think that a short-term Keynesian stimulus from tax cuts might outweigh the long-term economic drag for a couple of years, allowing them to do better in the 2026 midterms or the 2028 presidential election.

The darkest possibility is that some Republican leaders think that America is effectively a walking corpse of a nation — that its future is nonwhite and non-Christian, and therefore Republicans might as well simply raid and scavenge as much as they can before America turns into South Africa.

But that’s probably too dark. I think the most likely explanation is that Republicans and their existing donor base simply want the money. The U.S. electorate’s obsession with culture wars gives elites an opening to simply raid the U.S. Treasury without suffering major consequences. Few people really like the OBBBA, and the public probably realizes that the bill is an engine of upward redistribution. But maybe the GOP thinks that when the next election comes around, they’ll grumblingly ignore bread-and-butter issues and vote based on immigration, DEI, trans issues, or whatever the current culture war happens to be.

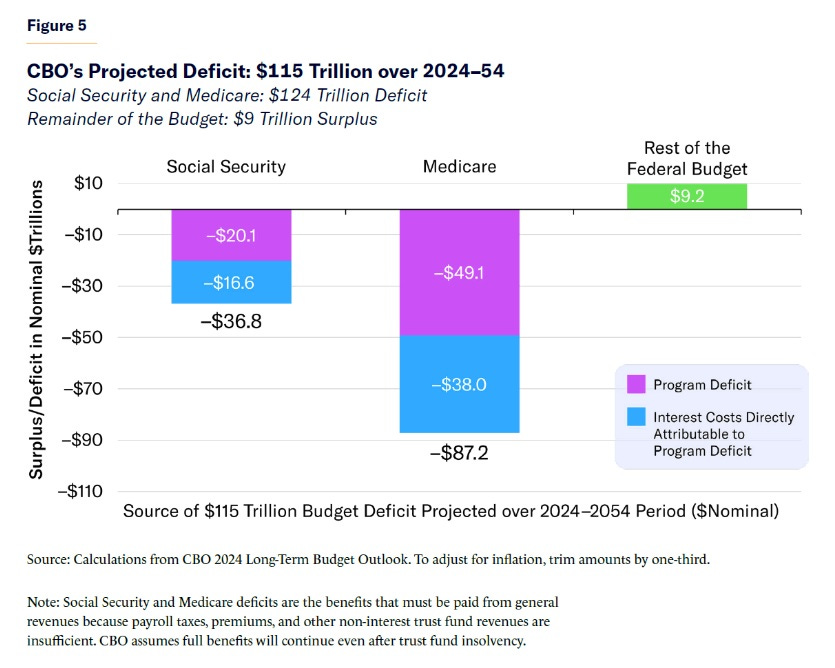

In any case, America simply can’t afford to keep giving big tax cuts to rich people. The government was already running massive deficits, and paying an increasing interest bill on its existing stock of debt. On top of that, the aging of the U.S. population means that Medicare (and to a lesser extent, Social Security) is going to end up costing a lot more over the next three decades:

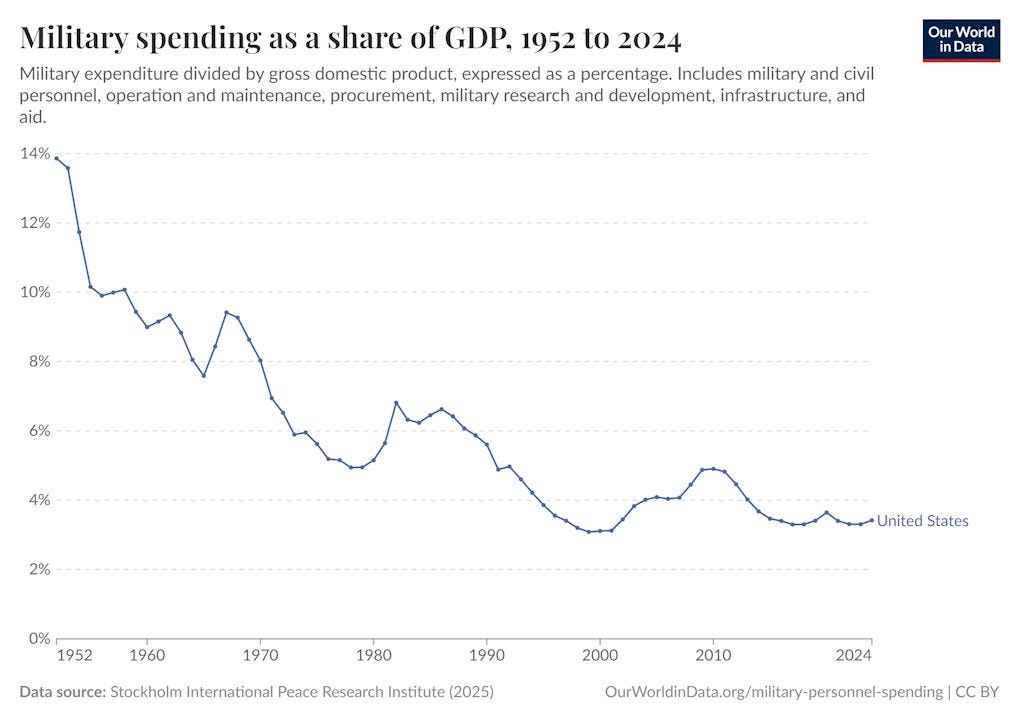

All of this means that the U.S. has to both raise taxes and cut spending in order to maintain solvency and keep interest costs down.1 The Medicaid cuts that the Republicans are enacting are cruel, but unless our government comes up with some way to control health costs much more effectively than ever before, something along those general lines will eventually be necessary. There just isn’t much else that the government spends a lot of money on; defense spending has been cut to the bone, even as foreign threats proliferate:

So health spending was always going to have to be cut, and even if the poor could have been spared the brunt of those cuts, it was always going to hurt the middle class. That’s bad.

The way to make that bargain seem fair was always to tax the rich. In the 1990s, Bill Clinton hiked taxes on the rich, and managed to raise federal revenue from 16.7% of GDP in 1992 to 19% of GDP by 1998. 2.3% of GDP might not sound like a lot, but today that would be $690 billion a year, or $6.9 trillion over a decade. The rich didn’t even get particularly mad about this. And it ended up making Clinton’s fiscal austerity a lot more palatable to the masses, because people knew the rich were paying their fair share to help bring the deficit down.

And yet somewhere in the years since Clinton, the Democrats lost their appetite for taxing the rich. Obama taxed the rich a little bit, and Biden only by a token amount. The U.S. went from having one fiscally responsible party in the 1990s to having zero fiscally responsible parties. Debt soared under Obama, soared again in Trump’s first term, and then soared again under Biden:

If politicians keep getting rewarded for blowout deficits, massive health care spending increases, and tax cuts for the rich, the U.S. government’s solvency is eventually going to be called into question. We don’t know exactly when that will happen, but the amount of fiscal irresponsibility that bond market investors will be willing to tolerate is not infinite.

There are lots of things America’s government can no longer afford. One of those things is tax cuts for the rich.

Update: Why am I only saying “raise taxes on the rich” instead of “raise taxes on the middle class”? Commenter Dan writes:

The unpleasant reality that neither party wants to contemplate is that we don't just need to raise taxes and cut spending: we need to raise taxes _on the middle class_ and significantly cut spending. America already has one of the most steeply progressive tax systems in the world. There are lots of loopholes we can and should close to prevent the ultra-rich from paying less than their fair share -- I favor eliminating preferential capital gains tax, eliminating step-up in basis, taxing unrealized gains used as collateral to secure loans, and significantly reducing inheritance tax exemptions, myself -- but there just aren't enough ultra-rich to tax to plug the budget gaps, and they're already paying a significantly outsized share of taxes relative to their percentage of total national income.

People often idolize the welfare states of Northern Europe while neglecting to notice that those welfare states are not paid for with punitive taxes on the rich, but rather by tax rates on the middle class that are close to double what Americans pay. We've been living beyond our means as a nation for some time now, and that bill is coming due. And both parties are simply hoping the other one is forced to answer the door when the debt collectors come knocking.

Dan is absolutely right that if America wanted to have a welfare state like a European country, then we would have to raise taxes on the middle class — ideally through a VAT.

But America does not have a European-style welfare state. We have a welfare state, but it’s focused mostly on the poor, with highly targeted benefits. European countries, in contrast, provide broad, less-targeted services toward their middle classes and poor. This is why Europe’s government spending tends to be higher than America’s by about 8 to 12 percent of GDP (a really big gap):

Yes, if we want to be like Europe, we’re going to need big middle-class tax hikes. Progressives like Bernie Sanders don’t seem to understand this yet, but it’s true.

BUT, what America needs now is austerity. Before we decide whether we want a European-style welfare state, we need to get our fiscal house in order. That will involve painful spending cuts, especially to health care. Those cuts will fall heaviest on the middle class. To ask middle-class Americans to pay higher taxes on top of those benefit cuts would be both unfair and politically impossible.

Hence, for the sake of austerity, what we need are higher taxes on the rich. I’m absolutely looking forward to paying my fair share of that.

MMT people and some progressives will tell you that we don’t have to raise taxes or cut spending, because a sovereign country without much external debt can never be forced to default. This is technically true — with a few legal changes, the Fed could just print money to cover U.S. debts — but that would cause spiraling inflation, which is even more painful than austerity.

The unpleasant reality that neither party wants to contemplate is that we don't just need to raise taxes and cut spending: we need to raise taxes _on the middle class_ and significantly cut spending. America already has one of the most steeply progressive tax systems in the world. There are lots of loopholes we can and should close to prevent the ultra-rich from paying less than their fair share -- I favor eliminating preferential capital gains tax, eliminating step-up in basis, taxing unrealized gains used as collateral to secure loans, and significantly reducing inheritance tax exemptions, myself -- but there just aren't enough ultra-rich to tax to plug the budget gaps, and they're already paying a significantly outsized share of taxes relative to their percentage of total national income.

People often idolize the welfare states of Northern Europe while neglecting to notice that those welfare states are not paid for with punitive taxes on the rich, but rather by tax rates on the middle class that are close to double what Americans pay. We've been living beyond our means as a nation for some time now, and that bill is coming due. And both parties are simply hoping the other one is forced to answer the door when the debt collectors come knocking.

Seems like the decision makers and donors of the Republican party have always been motivated by one thing, tax cuts for the rich, and the social issues are just a way to fool the masses into voting for them.