Thinking about "temporary hardship"

America needs austerity. But is Musk's plan the right kind of austerity?

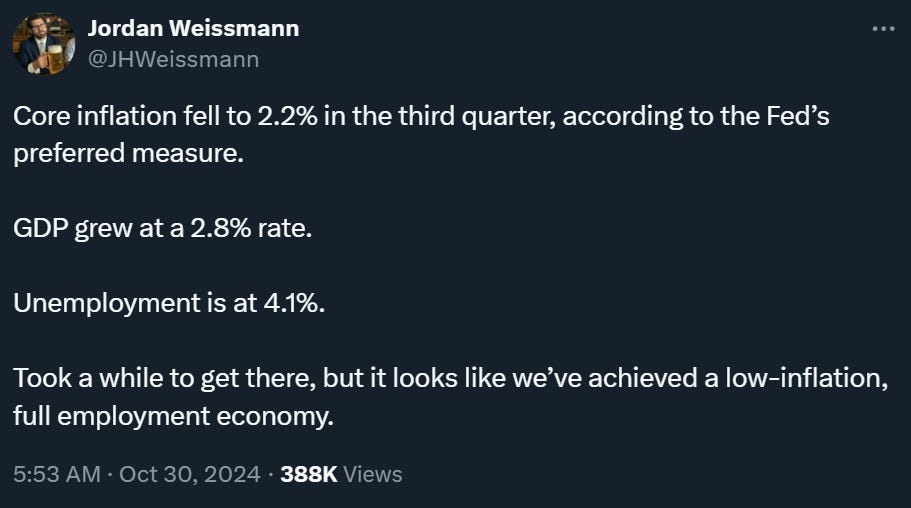

America’s economy is, by any reasonable measure, doing great:

In fact, even as inflation has returned to normal, the U.S. economy has boomed more strongly than forecasters predicted before the pandemic:

This isn’t just due to consumption; in fact, U.S. productivity growth has surged ahead, far outpacing the trend of the Trump and Obama years:

And of course, the U.S. has strongly outperformed all other rich economies since the pandemic (and probably outperformed China as well).

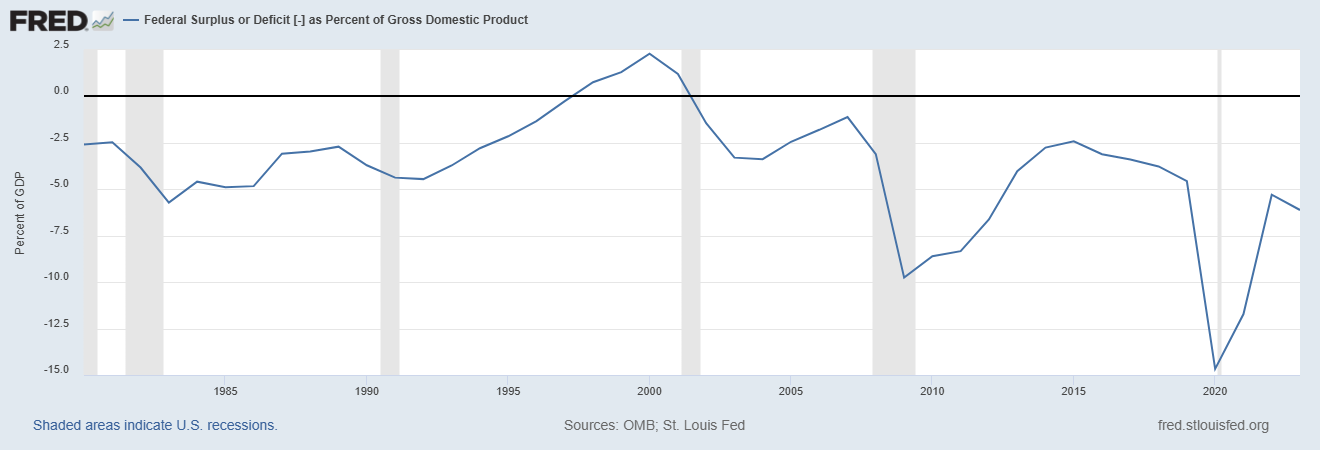

Yay America! Except there is one possible fly in the ointment. This stellar performance has come with high levels of government borrowing. Deficits have come down since the end of pandemic relief spending, but remain far higher than usual, at 6.1% of GDP in 2023:

Unless you believe very strongly in Ricardian Equivalence or some other theory that says deficits don’t boost the economy, you should probably give these high deficits at least a bit of the credit for the economic boom. Just how much credit is hard to say — we know that fiscal multipliers are lower in booms than in busts, so the big deficit is probably not that huge of a factor. But it’s probably doing something.

Anyway, this deficit has to go down. Interest costs are beginning to eat up more and more of the government’s budget every month. Rates are going down, but given underlying inflationary pressures (low debt levels, decoupling, tariffs, high employment, etc.), it’s unlikely that rates will go back to the ~0% of the 2010s. ZIRP was a special era, and barring another major crisis, it probably won’t return anytime soon.

That means interest costs are going to be a persistent problem for the federal government, which means that federal government borrowing has to come down. We are going to need an age of austerity, just as in the early 1990s.

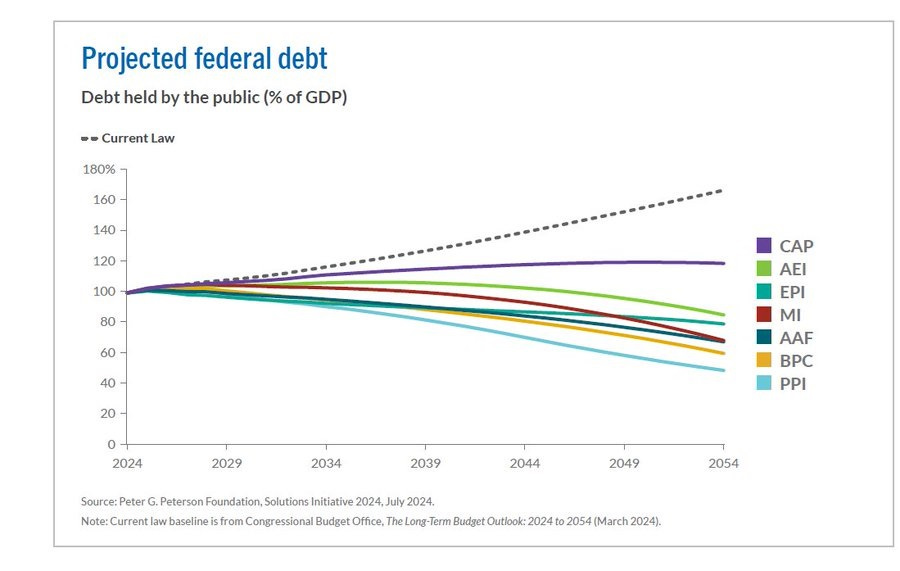

So far, Donald Trump’s policies have looked ready to take us in exactly the opposite direction of austerity. Although Kamala Harris has also promised continued deficit spending, Trump has promised tax cuts that would balloon the deficit to even greater size:

This is in keeping with Trump’s general approach of populism, which typically involves handing out short-term goodies for short-term popularity. It’s also in keeping with his policies during his first term, as well as the GOP party platform — tax cuts without spending cuts.

But now, Trump’s biggest supporter, Elon Musk, has suddenly come out with a big promise of austerity:

Elon Musk appeared to acknowledge Tuesday that his pledge to help former president Donald Trump slash federal spending could unleash severe, short-term economic turmoil…

Musk first outlined his highly aggressive target at a raucous campaign rally in New York last weekend, promising to identify “at least $2 trillion in cuts” as part of a formal review of federal agencies that he would conduct if Trump wins next week’s election…

By Tuesday, Musk appeared to acknowledge the economic risks of his proposal. On X, the social media site he owns, the tech mogul agreed with another user’s post that argued his federal review — and other Trump policies — risked a “severe overreaction in the economy,” causing financial markets to “tumble” before the country’s fiscal standing later improves.

“Sounds about right,” Musk wrote in response.

Trump has endorsed the promise. And at a town hall, Musk declared:

We have to reduce spending to live within our means. And that necessarily involves some temporary hardship, but it will ensure long-term prosperity.

The phrase “temporary hardship” has quickly become notorious. It bears similarity to Xi Jinping’s admonishment to the Chinese people to “eat bitterness”. Americans are not used to their leaders promising economic pain.

But is Musk’s austerity proposal a good one? And would it in fact cause the kind of pain he’s forecasting? Here there’s quite a bit of uncertainty.

For one thing, it’s not clear whether Musk’s proposal means cutting $2 trillion over ten years or $2 trillion every year. Usually, when we’re talking about policy proposals all of these tax and spending and deficit numbers are expressed as ten-year totals. If Musk’s promise is $2 trillion of spending cuts over ten years, it’s pretty marginal — it wouldn’t even cancel out a third of Trump’s deficit-expanding tax cut proposals. But if Musk is proposing cutting $2 trillion annually, it’s a different story — that would mean slashing over a quarter of the federal budget, more than canceling out Trump’s planned tax cuts, and eliminating much of the federal deficit.

The even bigger piece of uncertainty, though, is how much economic pain this would cause. Trump says that “nobody is gonna feel” the spending cuts. But Musk clearly thinks that a lot of people are going to feel it, and that it’s just something they’ll have to endure for a while.

Whether Trump or Musk is right depends on the fiscal multiplier. Estimates of multipliers vary widely, but generally converge around 0.5 for normal (boom) times. For example, this is what Auerbach and Gorodnichenko find when looking at the history of the U.S. economy:

[W]e conclude that a dollar increase in government spending raises output by about $1.50 to $2 in recessions and by only about $0.50 in expansions.

This would mean that a spending cut of $2 trillion would lower output by $1 trillion if there’s no recession happening.

A broad review of the research literature, summarized by Batini et al. (2014), finds a very similar number:

DSGE simulations and SVAR models, developed since the early 1990s, suggest that first-year multipliers generally lie between 0 and 1 in “normal times.” This literature also finds that spending multipliers tend to be larger than revenue multipliers. Based on a survey of 41 such studies, Mineshima and others (2014) show that first-year multipliers amount on average to 0.75 for government spending and 0.25 for government revenues in AEs. Assuming, in line with recent fiscal adjustment plans in AEs, that two thirds of the adjustment falls on expenditure measures, this would yield an overall “normal times” multiplier of about 0.6.

With a fiscal multiplier of 0.6, $2 trillion in annual spending — Musk’s maximum proposal — that means a reduction in GDP of $1.2 trillion per year relative to baseline. U.S. GDP is about $29.3 trillion, so that would be a 4.1% reduction in the size of America’s economy.

Now let’s combine this with Trump’s tax cut proposals. Trump’s promises amount to about $750 billion a year in tax cuts. There’s some theory and some evidence suggesting that tax changes affect GDP less than changes in spending. The rationale there is that taxes mostly affect rich people, who don’t tend to spend much of their income, so that changes in taxes don’t change private spending very much. But some recent evidence finds that tax changes and spending changes are pretty similar.

So if tax multipliers are half as large as spending multipliers, it would mean Trump’s tax cuts would temper Musk’s spending cuts by around 18.75% of the total If tax multipliers and spending multipliers are equal, then Trump’s tax cuts would reduce the effect of Musk’s spending cuts by around 37.5% of the total. Using our earlier estimate for the effect on GDP, the reduction in the size of America’s economy would be anywhere from 3.35% of GDP to 2.56% of GDP.

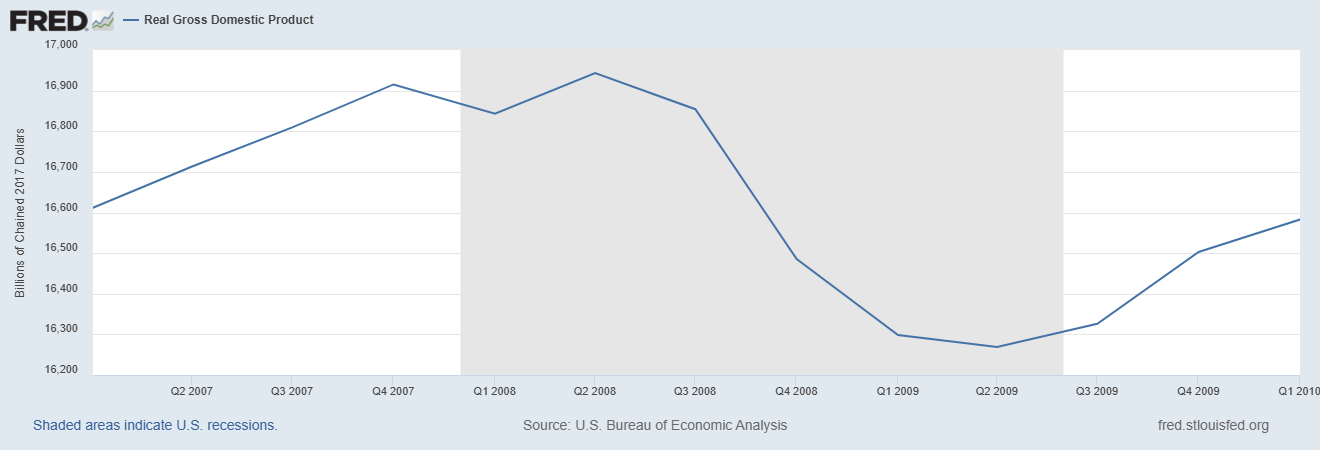

That’s still quite a big drop in GDP. For reference, from the fourth quarter of 2007 to the second quarter of 2009, U.S. GDP dropped by 4.0%:

During that time, the unemployment rate went from 4.8% to 9.3%. That corresponded to about 7 million Americans losing their jobs.

If we take that as a reference point, and use our most optimistic estimate from above, it would mean about 4 million Americans losing their jobs from a Musk/Trump spending cut. That definitely qualifies as temporary hardship! And although I wouldn’t quite call it an economic “collapse”, I don’t think the people using that term are being overly hyperbolic. In any case, Trump’s assertion that “nobody is going to feel” a spending cut of that magnitude is highly dubious.

But with deficits large and interest costs rising, what’s the alternative? For one thing, the size of the cuts Musk suggests could be pared down a bit. To shrink the debt relative to GDP, we don’t need to eliminate the deficit like we did in the late 1990s — we just need to bring it below the growth rate of nominal GDP. To cut the deficit to 2% of GDP would require somewhat smaller cuts.

Second, we could change the mix of tax hikes and spending cuts. Tax multipliers are probably at least a little less than spending multipliers, so hiking taxes will help ease the macroeconomic pain a bit.

Third, we could space out the cuts a little more. The Manhattan Institute recently released a plan to shrink the debt in the long term:

Thirty years is a long time, but even if you accelerated this timetable to 20 or 15 years, the pain would be less noticeable in any given year than under Musk’s shock therapy.

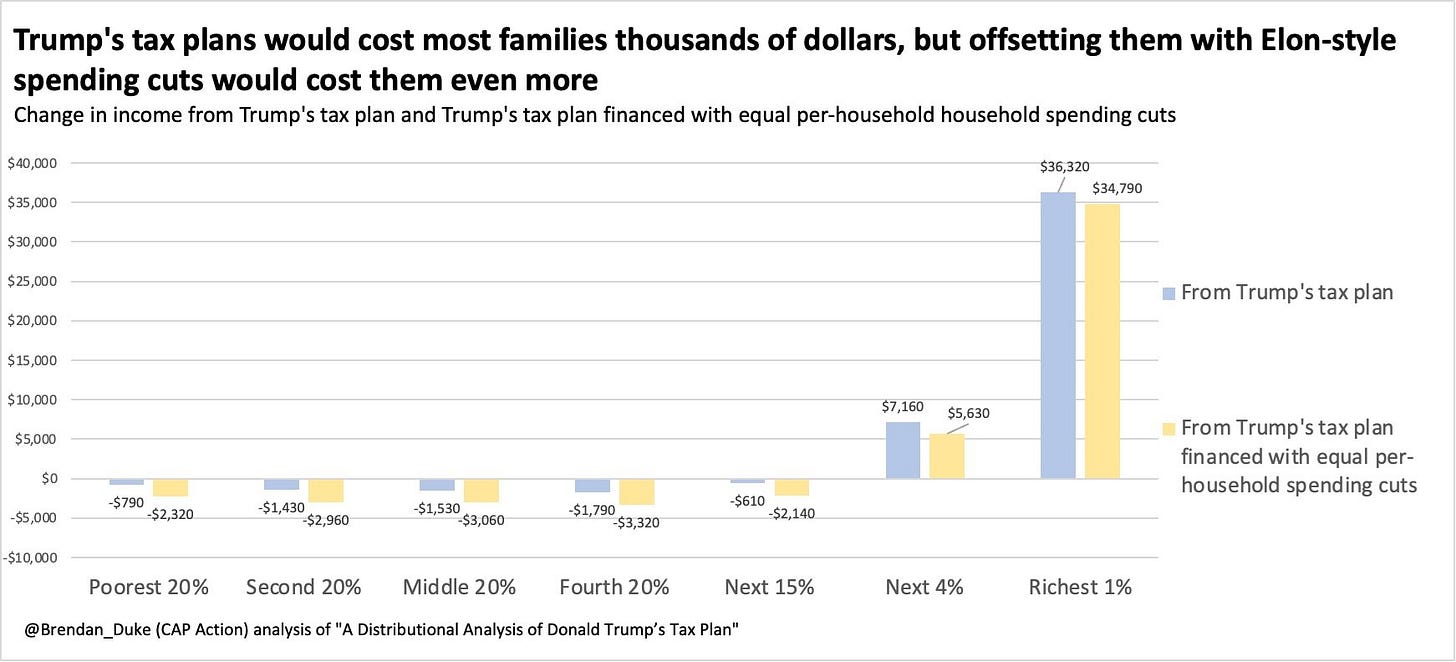

Then there’s the distributional impact to think about. Trump’s tax cuts would mostly benefit the rich (since that’s mostly who pays taxes), while spending cuts would probably be concentrated on health benefits — the GOP has promised to kill Obamacare subsidies and cut Medicaid. That’s on top of Trump’s plan to shift taxes from income taxes to tariffs; tariffs tend to hit the middle class and poor harder. Altogether, this would mean a lot more money for rich people and somewhat less money for the poor and middle class. Here’s one estimate I saw just now:

That estimate may be exaggerating the skew, since it’s done by a former Biden administration employee. But the general contours are probably right — big cuts in corporate and personal income tax, tariff hikes, and deep cuts in government spending on health care would absolutely have this general effect. And unlike the macroeconomic pain, this distributional impact would likely be long-term, rather than temporary.

So on one hand, I think it’s refreshing that Musk is talking about fiscal austerity, and about the hardships that will be necessary to get the government’s finances back on a sustainable footing. On the other hand, I don’t like the way he plans to go about it — giving massive awards to himself and his own lofty social stratum, while inflicting pain on the masses. There are better ways to do austerity.

If Musk was serious about “living within our means” he’d want to pair spending cuts/freezes with a rollback of the Trump tax cuts.

Higher debt, unemployment, or investment are the only choices. I like the Pettis argument that you have to spend to increase human capital to change the composition of the economy and increase consumption/demand to drive productive investment. I think this, along with the Manhattan Institute's review of the debt reduction options, is a more effective explainer than the simplistic Tea Party perspective that I see in Musk.