I think Bitcoin has room for one more bubble (repost)

Some fun speculation about speculation.

Bitcoin is booming again! The world’s oldest and best-known cryptocurrency has been on an absolute tear lately, and its price has more than doubled since the beginning of this year:

In June of 2022, after the big crypto crash, I went out on a limb and predicted that Bitcoin would see at least one more big bubble (and crash). I had a number of reasons for predicting this, and not all of them have come true. But the basic idea — that Bitcoin would be buoyed by the prospect of institutional adoption — seems to be the reason for the current rally. BlackRock has proposed a Bitcoin ETF, which would draw in a bunch of new people who currently don’t own much or any crypto.

So anyway, I don’t have much to add to what I wrote last year, so I thought I’d re-up that post. After explaining some scenarios for how Bitcoin could top its previous highs, I offer some fun but very amateur speculation on how high the price could eventually go, based on back-of-the-envelope math and some (probably silly) assumptions. In any case, speculating on fundamentally speculative assets is all in good fun, as long as you don’t gamble more on them than you can afford to lose. (Financial disclosure: I still own a bit of Bitcoin myself.) So enjoy this post for what it is.

The original was paywalled, so this one is subscribers-only as well.

“Bitcoin is a bubble” is a thing a lot of people say, when they want to claim that Bitcoin is a worthless commodity whose price is sustained only by hype. But in financial economics, a bubble is just a rapid rise in the price of some financial asset followed by a rapid fall. People argue about whether these bubbles are due to speculation, herd behavior, extrapolative expectations, changing information, etc. etc. But really it’s just any time that prices soar and then plunge.

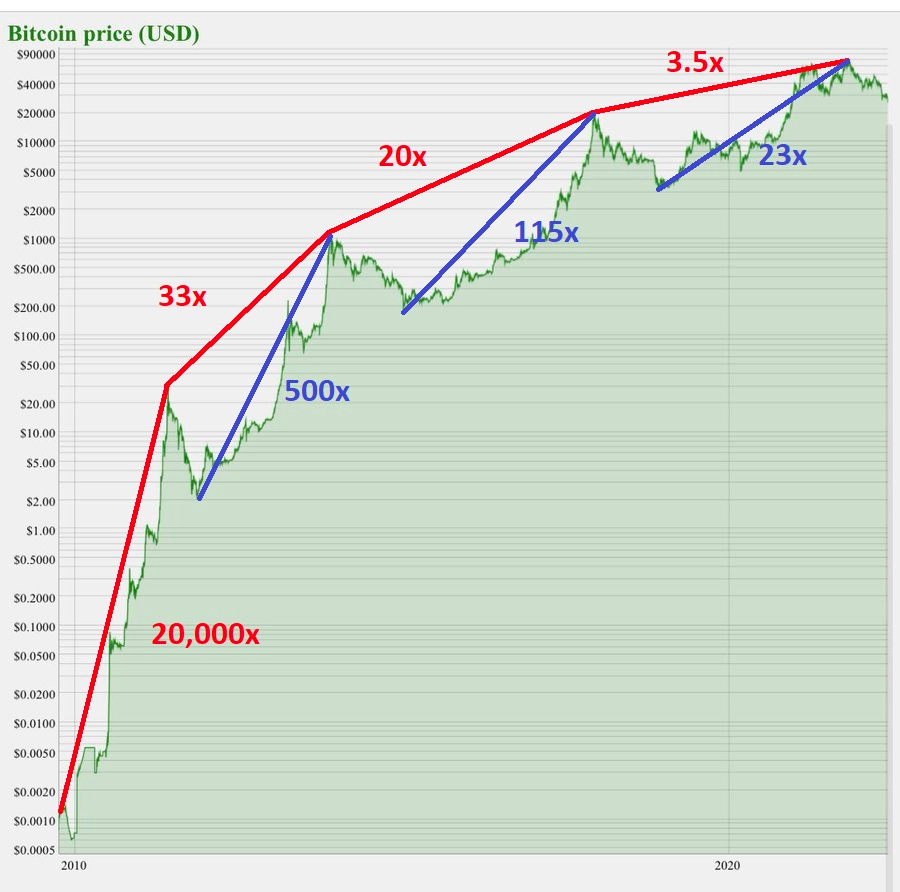

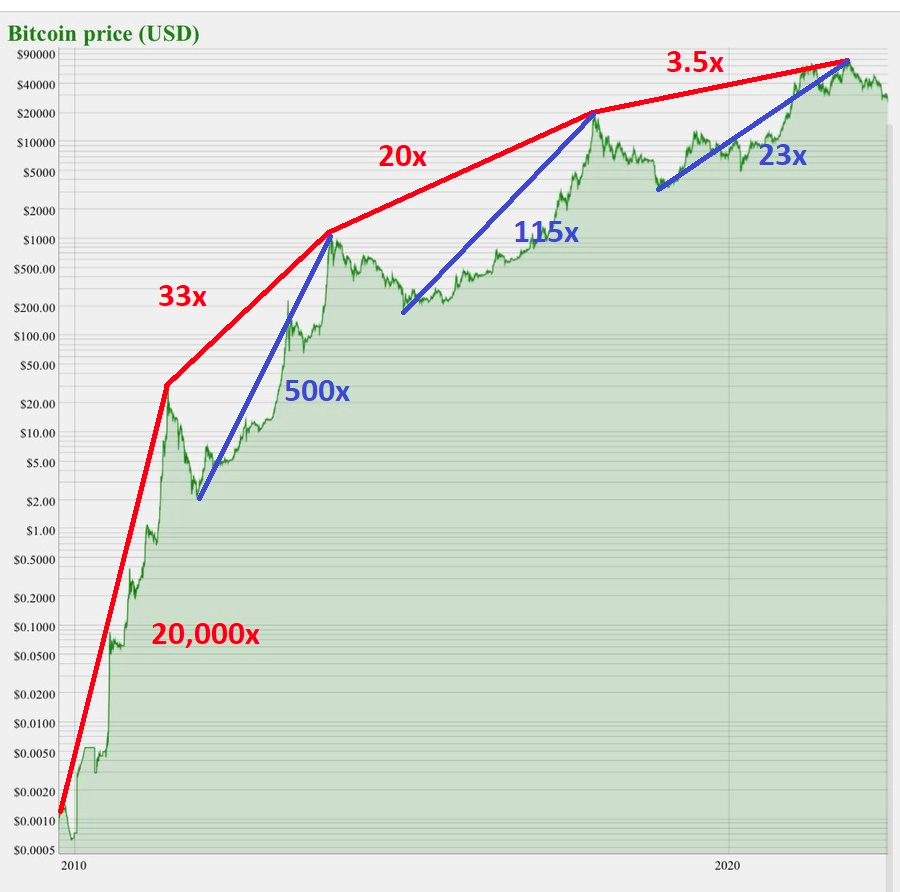

By this definition, Bitcoin has had a number of bubbles since its creation. By my count, the one that just popped is the fourth major Bitcoin bubble. So far, these have roughly coincided with the four-year Bitcoin “halving cycle”, in which the size of the reward given to Bitcoin miners gets cut in half. But that could be a coincidence. Anyway, here is a picture I made of the four major Bitcoin bubbles, with approximate return multiples added in for peak-to-peak and trough-to-peak:

Note that this graph is on a log scale. Although this makes the recent massive crash look smaller, a log scale is the appropriate way to show asset prices if what you’re interested in is showing percentage returns.

And what we can clearly see from the graph is that Bitcoin’s percentage returns are slowing down. If you invested any appreciable amount of money in 2009 and held onto your investment until now, you’re rich; if you bought in in 2015 you still made a killing. If you bought in after the big crash in early 2018, you still made a very good return, but not nearly as spectacular.

The obvious reason for this slowing of returns is adoption saturation. When the world goes from “nobody owns Bitcoin” to “a lot of people own some Bitcoin”, that represents a huge increase in demand that pushes the price up, so that the people who bought in early make a lot of money. There are economic theories where increasing adoption predictably leads to bubbles and crashes. But eventually the world runs out of people who want to buy into Bitcoin, and the increase in demand slows down, and returns fall. That doesn’t mean Bitcoin is destined to go to zero or anything; it just means that the biggest percentage gains from simply buying and holding are in the past.

The question then becomes: Where does this rainbow end? Does Bitcoin have room for one more spectacular bubble-and-crash, or will it stagnate from here on out? And if there is another bubble, how big will it be? Obviously, no one knows the answer to this question, but I think we can make a tiny bit of informed…er…speculation.

The two things Bitcoin needs for another bubble

If adoption is driving abnormal Bitcoin returns (that’s finance-speak for “unsustainable returns”), then what Bitcoin needs in order to reach new heights is new, untapped sources of demand.

Who might buy into Bitcoin who doesn’t own it yet? There are basically three categories:

Retail investors (i.e., regular shlubbs like you and me)

Institutional investors

Central banks

I went over the case for institutional investors and central banks buying into Bitcoin in this previous post:

So let me just quickly recap. For many institutional investors, the key reason to invest in Bitcoin is familiarity; once an asset class has been around for a while and a lot of people seem to have it, asset managers create a “bucket” for that asset class, and make sure some nonzero percentage of their assets under management goes into that bucket. I don’t know of much research on this, but anecdotally, these buckets are very persistent — once the asset management world has decided that crypto is A Thing To Invest In, it sort of has it made. Many institutional investors haven’t made crypto one of their buckets yet, so this is a potential big new source of demand.

As for central banks, the big driver here is geopolitics. With the world potentially splitting up into two (or more) military-economic blocs, and the U.S. looking shaky in terms of political stability, there’s the possibility that the U.S.-led global financial system that we’ve known since WW2 will give way to a new era of financial anarchy. In that environment, Bitcoin and other cryptos may provide central banks with a store of value that they feel isn’t as closely tied to the shifting winds of politics. Additionally, lots of countries will be looking for ways to make themselves less vulnerable to the type of financial sanctions that Europe and the U.S. are currently using to strangle Russia’s economy; Bitcoin and other cryptos may provide them with some way to do that, at least to a small extent.

Then there are retail investors. An NBC News poll from March found that about 21% of Americans have invested in or used cryptocurrency. Other sources give lower numbers. That’s considerably less than the 58% who own stocks. So there’s some room for growth there, especially if 401(k) plans start offering crypto to savers.

But a far bigger retail market might be overseas. The U.S. is actually pretty average in terms of crypto ownership, so countries where relatively few people own crypto have much more room for growth. On my recent trip to Japan I saw tons of advertisements hawking Bitcoin on trains and billboards, and bookstore shelves were strewn with books about how to sell NFTs. Obviously the recent crash will dampen some of this mania, but there are still probably some substantial fraction of normal folks out there who can probably be persuaded to plunk some money into crypto.

But in order to onboard all these new adopters, the crypto ecosystem will probably need more than a bunch of fancy expensive ads with big gold letter Bs on them. There will probably have to be a compelling story about why crypto is more important now than before. This could be geopolitical instability, but my bet is on financial innovation. Each of the last two big crypto booms involved some potentially compelling new use case for cryptocurrency. In the 2017 bubble it was ICOs, which people thought might be a new way to finance startup companies In the 2020-21 bubble it was DeFi and NFTs.

Disappointingly, these things didn’t really work out. Most ICOs ended up being scams, and the non-scam ones were just crypto infrastructure companies whose ultimate success depends on increased Bitcoin demand. DeFi was overwhelmingly just Ponzi schemes — DeFi schemes financing other DeFi schemes instead of anything real. But ICOs and DeFi were not obviously useless ideas, so they managed to convince people they had a lot of potential. As for NFTs, the market for collectibles is not that big, but at least it’s something.

The next big crypto use case might be something in web3 — for example, unique digital identities that you can port to a bunch of different apps. But if I had to guess, I’d say that the next use case will be something a little less like a financial ouroboros (crypto investing in crypto investing in crypto). I think that DeFi is going to be used to finance real assets, especially real estate.

I had this idea when watching a video of Packy McCormick struggling to explain how a house could be put on the blockchain:

This is being widely touted as a “gotcha” video, because McCormick can’t explain how property rights to real assets could be self-enforcing with smart contracts. And yes, the idea of “a house on the blockchain” is silly. But watching this, it occurred to me that it doesn’t really matter; what matters is whether the mortgage lenders are on the blockchain.

It has become a cliché by now to say that DeFi is just recapitulating all the mistakes of traditional finance in an environment of low or nonexistent regulation. So now think about that for real estate lending. There is a massive thicket of government regulation and corporate caution around real estate lending (and that thicket grew far more massive after the housing bubble and crash of the 2000s). But suppose the bank won’t give you a low-interest-teaser-rate exploding subprime mortgage or whatever. Just go to the blockchain and borrow from people there, and buy the house! Voila — regulation and caution circumvented, shady financing secured.

OK, but won’t the SEC crack down on that so fast it’ll make the Winklevoss Brothers’ heads spin in tandem? Maybe. But there’s a force in American law more powerful than the SEC, and it’s called the Supreme Court.

As you may have noticed, this new SCOTUS is changing a lot of big things about American law and government, and it’s changing them rapidly and with seeming abandon. It’s not just social issues like abortion rights or affirmative action, either — the Court is deeply involved in the structure of the regulatory state. This week SCOTUS will decide whether the EPA will regulate greenhouse gases (Update: The Court ruled that it cannot do so). But why will it stop there? Most of the legal authority for the U.S. regulatory state depends on the court’s interpretation of the Constitution’s Commerce Clause. If this SCOTUS decides that the federal government has massively overstepped its constitutional authority in areas like financial regulation, we could see the SEC effectively neutered.

In fact, this may already be in the pipeline. In a case called Jarkesy v. SEC that’s now making its way to SCOTUS, the plaintiffs argue that Congress’ delegation of certain regulatory powers to the SEC is unconstitutional. If the Court rules in Jarkesy’s favor — and with this new conservative Court, that has to be the likeliest possibility — it could open the door to all kinds of challenges to the SEC.

In that environment, it’s conceivable that blockchain lenders might have a far freer hand than many now assume. We could very rapidly return to a Wild West of real estate lending (and perhaps corporate lending as well). DeFi would then stand not just for “decentralized finance”, but for “deregulated finance” too. Ether is used for DeFi, of course (since it’s programmable), but Bitcoin serves as an on-ramp to the crypto ecosystem, and loans could conceivably be taken out in Bitcoin too.

Of course, it almost goes without saying that this would eventually crash the U.S. economy. Real estate bubbles and busts are pretty much the most reliable way to get a long deep recession, and deregulated finance will always produce a bust. In the wake of that crash, a combination of new Congressional legislation and the general chastening of another generation of financiers might put an end to the final Bitcoin bubble. But before that happened, we’d see a new top.

I think crypto financing things other than crypto itself is the logical next step for the ecosystem. And thus it’s the likeliest scenario for the next Bitcoin bubble, though certainly not the only one.

How big might the final bubble be?

So how big would this bubble be? Obviously I have no real predictive power here — if it were so easy to predict bubbles, they wouldn’t occur nearly so often! But I can make some fun guesses, using the time-honored method of “eyeballing a chart and then making some ad-hoc assumptions”.

From the graph above, we can see that Bitcoin’s returns in each bubble-and-bust cycle have been attenuating. Let me repost that graph:

If the pattern holds, the next bubble peak will see an even more modest increment over the last peak. The peak-to-peak return multiple went down by a factor of about 600 between the first bubble and the second, a factor of 1.65 between the second bubble and the third, and a factor of 5.7 between the third bubble and the fourth. Let’s take the most optimistic of those scenarios — another decrease by a factor of 1.65.

That would mean the peak-to-peak multiple for the fifth Bitcoin bubble would be about 2.1 — meaning a peak price of about $146,000. Over 4 years — another “halving cycle” — that translates to about a 20% annualized return. Not too shabby, and better than what the stock market is likely to serve up. But also not in the get-rich-quick range either.

Update: Via @frankmuci, here is a similar chart showing annualized returns instead of multiples. A 20% annualized return for the next cycle would not seem out of place on this chart at all.

Anyway, a multiple of 2.1 is a reasonably optimistic scenario, given the rate at which Bitcoin’s returns have been shrinking over time. Any faster decline in returns, and the next bubble might not even attain the height of the 2022 peak.

So does this mean you should buy Bitcoin? I guess I see a case there, but a weaker one than in the past. A 20% annual return is nothing to sneer at, but it’s also not going to be the kind of thing that suddenly vaults you into a new category of wealth. And remember, that prospective 20% comes with very big risks as well — not least of which is the risk that an econ blogger drawing lines in Microsoft Paint for fun is not exactly Warren Buffett. (Personally, I am still just HODLing on to the modest amount of BTC and ETH that I bought in 2017.)

And remember, whatever else you do, never bet more money on these sorts of speculative assets than you can afford to lose — you do NOT want to be one of these people telling Wall Street Journal reporters about how you lost all your life’s savings betting on crypto.

Crypto is just branded serial numbers. You can start up Buttcoin today using the exact same (energy sucking) algorithms as Bitcoin. (In fact there are thousands of cryptocurrencies now.) The product would be identical--a record (serial numbers) kept on a blockchain. So it’s the name brand that has value--i.e. the perception in people’s heads. Think Beanie Babies without the trade dress protection.

Interesting point of view. However, one point you don't mention is that after each bubble, the floor price of Bitcoin has always been higher than the previous floor, which shows that each bubble brings more private and corporate people who *really* believe in the future of Bitcoin and invest in it for the long term.

So what's your point of view when you say "Bitcoin would see at least one more big bubble (and crash)" : do you think that after the last bubble, 1) Bitcoin will collapse, or 2) that it will remain on a more stable price floor than before, perhaps further encouraging its use as a currency?