I think Bitcoin has room for one more bubble

Hint: It has to do with SCOTUS and regulation.

“Bitcoin is a bubble” is a thing a lot of people say, when they want to claim that Bitcoin is a worthless commodity whose price is sustained only by hype. But in financial economics, a bubble is just a rapid rise in the price of some financial asset followed by a rapid fall. People argue about whether these bubbles are due to speculation, herd behavior, extrapolative expectations, changing information, etc. etc. But really it’s just any time that prices soar and then plunge.

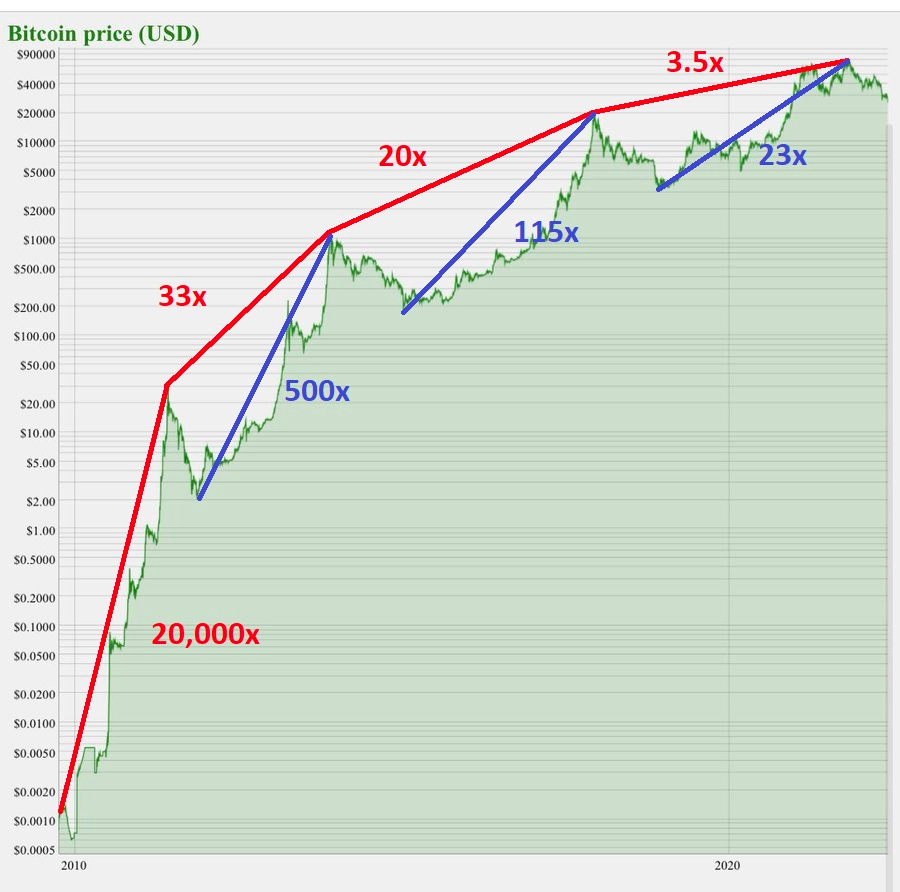

By this definition, Bitcoin has had a number of bubbles since its creation. By my count, the one that just popped is the fourth major Bitcoin bubble. So far, these have roughly coincided with the four-year Bitcoin “halving cycle”, in which the size of the reward given to Bitcoin miners gets cut in half. But that could be a coincidence. Anyway, here is a picture I made of the four major Bitcoin bubbles, with approximate return multiples added in for peak-to-peak and trough-to-peak:

Note that this graph is on a log scale. Although this makes the recent massive crash look smaller, a log scale is the appropriate way to show asset prices if what you’re interested in is showing percentage returns.

And what we can clearly see from the graph is that Bitcoin’s percentage returns are slowing down. If you invested any appreciable amount of money in 2009 and held onto your investment until now, you’re rich; if you bought in in 2015 you still made a killing. If you bought in after the big crash in early 2018, you still made a very good return, but not nearly as spectacular.

The obvious reason for this slowing of returns is adoption saturation. When the world goes from “nobody owns Bitcoin” to “a lot of people own some Bitcoin”, that represents a huge increase in demand that pushes the price up, so that the people who bought in early make a lot of money. There are economic theories where increasing adoption predictably leads to bubbles and crashes. But eventually the world runs out of people who want to buy into Bitcoin, and the increase in demand slows down, and returns fall. That doesn’t mean Bitcoin is destined to go to zero or anything; it just means that the biggest percentage gains from simply buying and holding are in the past.

The question then becomes: Where does this rainbow end? Does Bitcoin have room for one more spectacular bubble-and-crash, or will it stagnate from here on out? And if there is another bubble, how big will it be? Obviously, no one knows the answer to this question, but I think we can make a tiny bit of informed…er…speculation.