Will data centers crash the economy?

This time let's think about a financial crisis before it happens.

The U.S. economic data for the last few months is looking decidedly meh. The latest employment numbers were so bad that Trump actually fired the head of the Bureau of Labor Statistics, accusing her of manipulating the numbers to make him look bad. But there’s one huge bright spot amid the gloom: an incredible AI data center building boom.

AI technology is advancing fast, threatening (promising?) to upend many sectors of the economy. Nobody knows yet exactly who will profit from this boom, but one thing that’s certain is that it’s going to take a lot of computing power (or “compute”, as they say). AI models take a lot of compute to train, but nowadays they also take a lot of compute to do inference — i.e., to “think about” and answer each question you ask. Inference compute now represents most of the cost of running advanced AI models, and increases in inference compute are responsible for many of the ongoing performance gains. So compute needs are probably only going to grow as AI keeps getting better.

Whoever provides this compute is going to make a huge amount of revenue. Whether that means they’ll make a lot of profit is another question, but let’s table that for right now; you can’t make profit if you don’t make revenue. So right now, tech companies have the choice to either sit out of the boom entirely, or spend big and hope they can figure out how to make a profit.

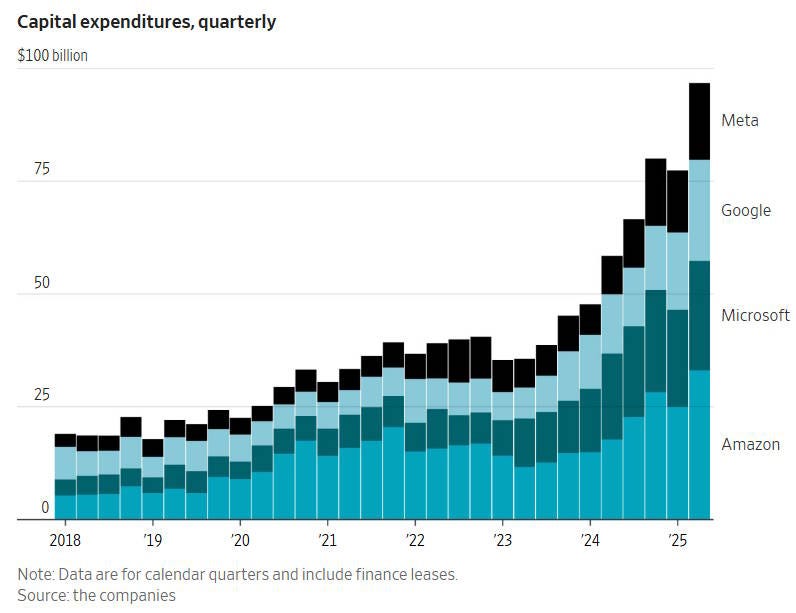

Roughly speaking, Apple is choosing the former, while the big software companies — Google, Meta, Microsoft, and Amazon — are choosing the latter. These spending numbers are pretty incredible:

For Microsoft and Meta, this capital expenditure is now more than a third of their total sales.

Here’s Chris Mims of the WSJ:

The Magnificent 7 tech firms have collectively spent a record $102.5 billion on capex in their most recent quarters, nearly all from Meta, Alphabet (Google), Microsoft and Amazon. (Apple, Nvidia and Tesla together contributed a mere $6.7 billion.)…

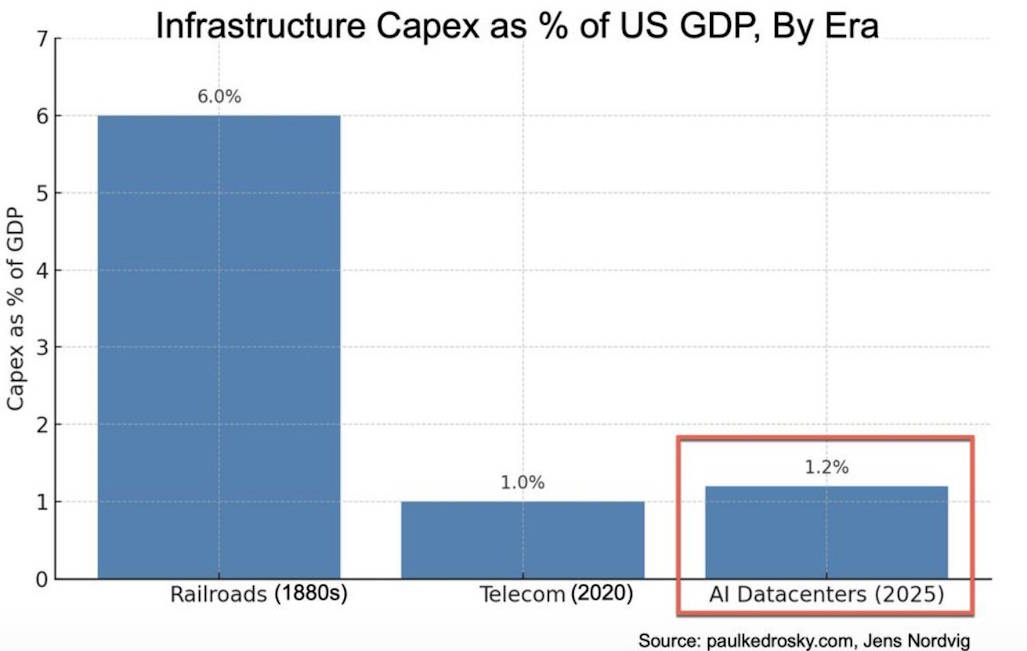

Investor and tech pundit Paul Kedrosky says that, as a percentage of gross domestic product, spending on AI infrastructure has already exceeded spending on telecom and internet infrastructure from the dot-com boom—and it’s still growing. He also argues that one explanation for the U.S. economy’s ongoing strength, despite tariffs, is that spending on IT infrastructure is so big that it’s acting as a sort of private-sector stimulus program…

Capex spending for AI contributed more to growth in the U.S. economy in the past two quarters than all of consumer spending, says Neil Dutta, head of economic research at Renaissance Macro Research, citing data from the Bureau of Economic Analysis. [emphasis mine]

Here’s that chart from Kedrosky, who has been doing an excellent job following this story as it unfolds:

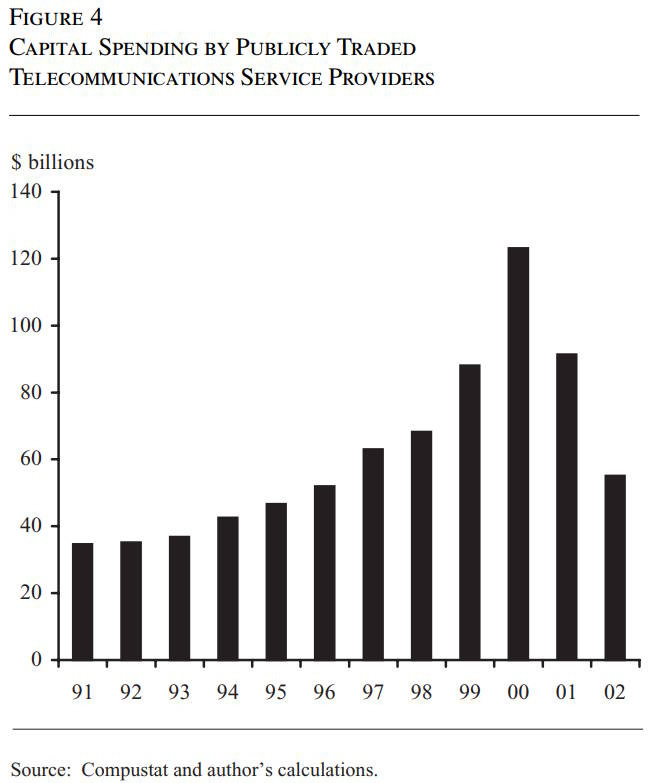

Side note: I’m actually not sure Kedrosky is right about the height of the telecom boom. His chart shows the level of capex for 2020, when 5G and fiber infrastructure was being built out. But Doms (2004) shows U.S. telecom capex reaching $120 billion in 2000:

That would have been around 1.2% of U.S. GDP at the time — about where the data center boom is now. But the data center boom is still ramping up, and there’s no obvious reason to think 2025 is the peak, so Kedrosky’s point still stands.