Three threats to the age of energy abundance

Crypto, AI, and the electrical grid.

For the past three years I’ve been talking up a new age of energy abundance. First of all, the U.S. just became energy independent for the first time in many decades, thanks to increased drilling for oil and natural gas. But far more important is the stupendous decline in the cost of solar power and batteries. For the first time in almost a century, we’ve found new energy technologies that work better than the old ones. And so it’s little surprise that the world is installing massive amounts of solar and batteries, at an accelerating pace. Of course China is the pace-setter here, but the U.S. is investing quite a lot as well — building solar plants, buying EVs, and building battery factories.

The reason I’m excited about this — and why you should be excited too — is productivity. Right around the time that U.S. productivity growth slowed down in the early 1970s, the oil shock caused us to start curtailing our energy use:

Correlation isn’t causation, but there’s good reason to think that physical (“atoms”) technologies are more conducive to compounding productivity improvements than digital (“bits”) ones. Even AI will have to build a lot of real physical stuff in order to fulfill its promise as a GDP accelerator. Obviously there are a lot of other things that affect physical goods production — NIMBYism, environmental regulation, trade patterns, and so on — but energy availability is probably a key input. With ultra-cheap and ultra-portable energy from solar power and batteries, who knows what we could achieve — cheap desalination, cheap self-driving cars and e-bikes everywhere, personal air transport, super-powered appliances, robots everywhere, and so on.

But this utopia is under threat, from both increasing demand and limited supply. On the demand side, we’ve invented new digital technologies that could potentially use up arbitrarily large amounts of electricity: Bitcoin and AI. And on the supply side, there are a bunch of bad policies that make it difficult to connect new power sources to the U.S. electrical grid.

Why electricity demand is rising again

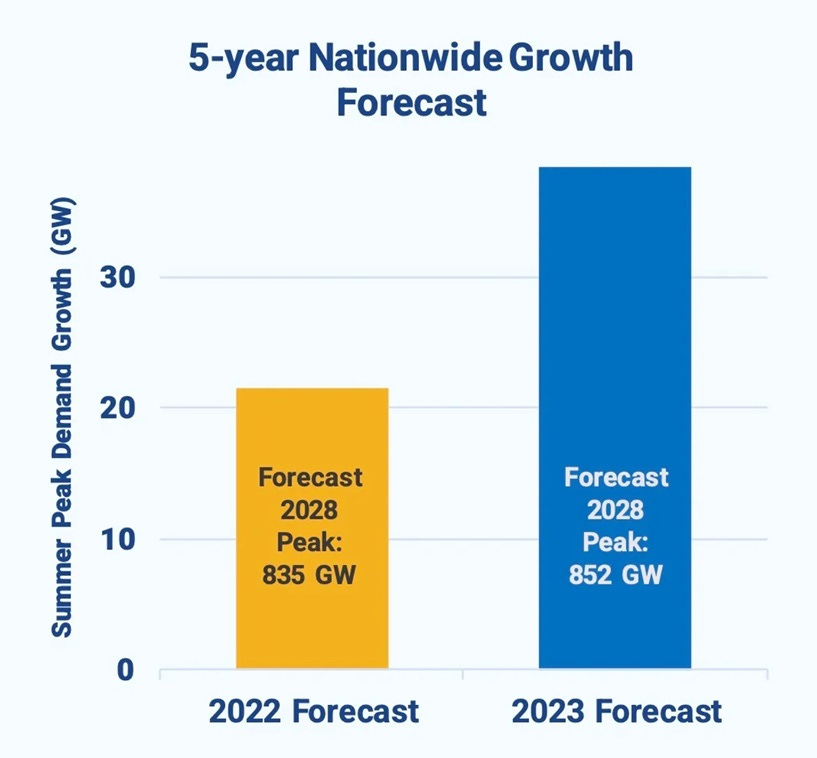

For a long time, U.S. electricity demand was pretty much flat. This led to a lot of optimistic predictions about how fast solar and other renewables would replace existing fossil-fuel-based technologies. But as with so many other economic numbers since the pandemic, we’re finding that a long-standing structural piece of the economy has suddenly changed. Electricity demand is growing again:

For the past two decades, demand for electricity across the United States has hardly increased. But those dynamics appear to have dramatically reversed — and U.S. electric utilities, regulators and power grid planners aren’t prepared to deal with this new paradigm of surging electricity demand.

That’s the key takeaway from a new report by consultancy Grid Strategies called The Era of Flat Power Demand Is Over…In the past year, estimates from U.S. utilities and grid operators of how much electricity demand will grow over the next five years have nearly doubled, jumping from 2.6 percent to 4.7 percent…That’s far higher than the more incremental 0.5 percent annual demand growth estimates of the past decade.