Repost: Why I'm so excited about solar and batteries

"Atoms" technologies might bring back fast productivity growth

When I declared Noahpinion to be a “techno-optimist” blog back in late 2020, renewable energy technology was a big part of the reason. Fast forward two years, and my optimism has been borne out; it seems like every day we get another report about how quickly solar power is changing our energy landscape. And of course batteries are driving the EV revolution, and promise to enable a whole lot of other kinds of innovation as well.

Among some other techno-optimists, however, enthusiasm for solar and batteries can sometimes seem strangely muted. Jim Pethokoukis, for example, who writes my favorite techno-optimist blog, pointedly refuses to mention solar at all. There seems to be an impression in some quarters that solar is a sort of inferior backstop technology — a wimpy form of energy that tree-hugging hippies forced on the world with regulation and subsidies, whose only purpose is to stave off climate change. Not real progress, in other words.

Nothing could be further from the truth. Solar power isn’t just about saving us from climate change; it’s about giving us energy cheaper than we’ve ever had before. In a post in late 2020 entitled “Why I’m so excited about solar and batteries”, I predicted that the technological revolution represented by cheap solar and batteries will break the energy stagnation that we’ve suffered since the end of cheap oil — and enable an acceleration of productivity growth.

William Gibson wrote a story in 1981 called “The Gernsback Continuum”, in which a photographer has visions of an alternate America filled with retrofuturist 1920s technology. Many of us have, in the back of our minds, a similar vision — the “Jetsons future”, with flying cars and robot housekeepers.

But for the past few decades, this future vision has seemed like an anachronism. In the 70s, innovation shifted toward information technology. What had seemed like a constant march toward faster transportation and more useful appliances broke down. When technologists grouse about flying cars or writers ask where our hoverboards are, they’re really talking about the stagnation in physical technology, and the shift in innovation from “atoms” to “bits”. Instead of the Jetsons future, we got the cyberpunk future.

The Great Stagnation

Why did that happen? One potential answer is “regulation”. But while building codes undoubtedly kept us from building as many gleaming Jetsons towers as we might have liked, regulation wasn’t powerful enough to stop us from sprawling out into the exurbs or doubling floor space per person. And the productivity slowdown was global; other countries got bullet trains, but they didn’t get flying cars or robot housekeepers.

Instead, I blame the slowdown in energy technology. In 1700, humanity got its energy from human muscle power, from animals, and from burning wood (and occasionally from wind and water). In the 19th century we switched to coal, which was much cheaper, more plentiful, more energy-dense, and easier to extract energy from than those traditional sources. Then in the 20th century we upgraded to oil, which was superior in all of these categories. After World War 2, a global extraction regime and price controls allowed us to keep cheap oil flowing. That ended with the Oil Shocks of the 70s. And though oil became cheaper again in the 80s and 90s, it never attained its former lows, or its low volatility. Then in the 00s it got expensive again:

But what’s even more important is what’s not shown on this graph — the fact that we didn’t get anything better than oil during this time. Nuclear fission provided a bit of a boost to electricity generation (and a big boost in France), but nobody ended up driving fission cars around or flying fission planes through the sky (probably for the best). And even setting safety and security concerns aside, fission plants were always difficult to build because they required massive up-front financing that only government could provide in practice.

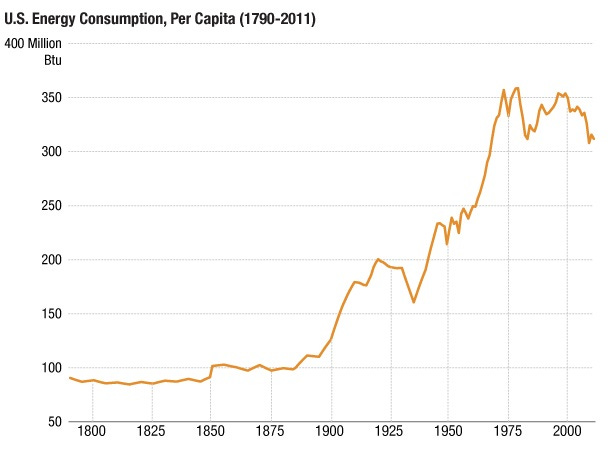

As a result of expensive energy, we started using less. Here, via NPR, is a graph of U.S. energy consumption per capita. Notice when it hits a ceiling.

More expensive energy makes physical innovation harder in every way. You need electricity to run your washer, your dryer, your heater, your air conditioner, your oven, your stove — and many other newfangled appliances innovators might want to sell to you in the future. And oil is responsible for powering cars, trucks, ships, planes etc., not to mention backhoes, bullzoders, and cranes. And lots of manufacturing is very energy-intensive. Without ever-cheaper sources of energy, physical innovation is certainly still possible, but it just gets harder.

This stagnation in energy technology almost certainly contributed to the productivity slowdown of the 1970s. The economist William Norhaus wrote a paper in 2004 breaking down productivity growth by industry, and looking at the timing relative to the oil shocks of the 70s. He concluded:

The major result of this study is that the productivity slowdown of the 1970s has survived three decades of scrutiny, conceptual refinements, and data revisions. The slowdown was primarily centered in those sectors that were most energy-intensive, were hardest hit by the energy shocks of the 1970s, and therefore had large output declines. In a sense, the energy shocks were the earthquake, and the industries with the largest slowdown were near the epicenter of the tectonic shifts in the economy.

Why didn’t bits fill the gap?

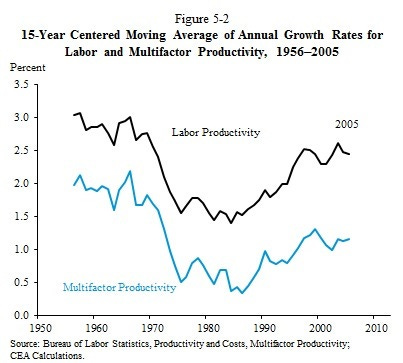

The next big question, then, is why “bits” innovation — computers, software, the internet, etc. — didn’t fully replace cheap energy in terms of driving productivity growth. In fact, it’s widely accepted that IT did drive the re-acceleration of productivity that began in the late 80s and continued through the early 00s.

Economists John Fernald and Shanthi Ramnath find that this surge was basically all IT-driven:

Industry-level data show a broad productivity resurgence that reflects both the production and the use of IT. The most IT-intensive industries experienced significantly larger productivity gains than other industries and a wide variety of econometric tests show a strong correlation between IT capital accumulation and labor productivity….[We] show that virtually all of the aggregate productivity acceleration can be traced to the industries that either produce IT or use IT most intensively, with essentially no contribution from the remaining industries that are less involved in the IT revolution.

And that makes sense. Computerization and online communication allows plenty of production processes, supply chains, and office work to be rationalized and made more efficient. And IT creates lots of new products that people want, like Instagram and iPhones and video games.

But around 2005 — years before the housing bust and the Great Recession — that productivity growth faded. Productivity didn’t fall all the way back to the crawling pace of the 70s and early 80s, but it did slow substantially.

Some have argued that digital services are substantially undervalued in our economic production statistics. Free services generate consumer benefits without showing up in GDP, because GDP doesn’t measure the value of leisure time. This would be similar to what happens in health care, where improvements in health don’t show up in the amount of money people spend on care, and thus tend not to get recorded in productivity. But research by economist Chad Syverson suggests that this omission isn’t nearly big enough to account for the post-2004 productivity slowdown.

Another possibility is that “atoms” innovation, unlike “bits” innovation, unlocks the potential for more extensive growth; instead of simply making us more efficient or more creative at using resources, physical innovation may allow us to gobble up more of the world around us. (As Tyler Cowen and Ben Southwood put it, “many scientific advances work through enabling a greater supply of labor, capital, and land, and those advances will be undervalued by a TFP metric”). A 2013 retrospective on productivity growth by Robert Shackleton of the Congressional Budget Office suggested:

Finally, the sweep of the 20th century underlines the extent to which long-term TFP growth and economic growth in general have been influenced by the development of energy and transportation infrastructure suited to the expansion of suburbs.

A third possibility is that physical technology is less “skill-biased” than IT, meaning that pretty much anyone can be a factory worker but only a few people can use computers productively and effectively. But there’s some evidence against this theory too.

A fourth possibility is that IT simply touches less of our lives than energy does. Sure, lots of appliances run software now, and every business runs using the internet, but every physical object requires energy to make. Electricity and internal combustion might have just been even more general-purpose technologies than computers and software.

And there could be other reasons. It’s well-known that computers and electricity both took a while to show up in the productivity statistics, as businesses learned how to use them effectively. The chain of transmission between technological innovation and productivity just isn’t well-understood.

So it remains a mystery. But for whatever reason, “bits” innovation sometimes drives fast productivity growth, and sometimes doesn’t. Even when it’s changing the way we live and work, or altering the politics of whole societies, IT innovation doesn’t always raise our material standards of living at a rapid clip.

Of course, that might change soon. Syverson, Erik Brynjolfsson, and Daniel Rock predict that artificial intelligence will supercharge another bump in productivity in the years to come. That will be awesome if it happens.

But in the meantime, I’m even more optimistic about the productivity benefits of an entirely different technological revolution: New rapid progress in energy technology.

Solar and storage to the rescue

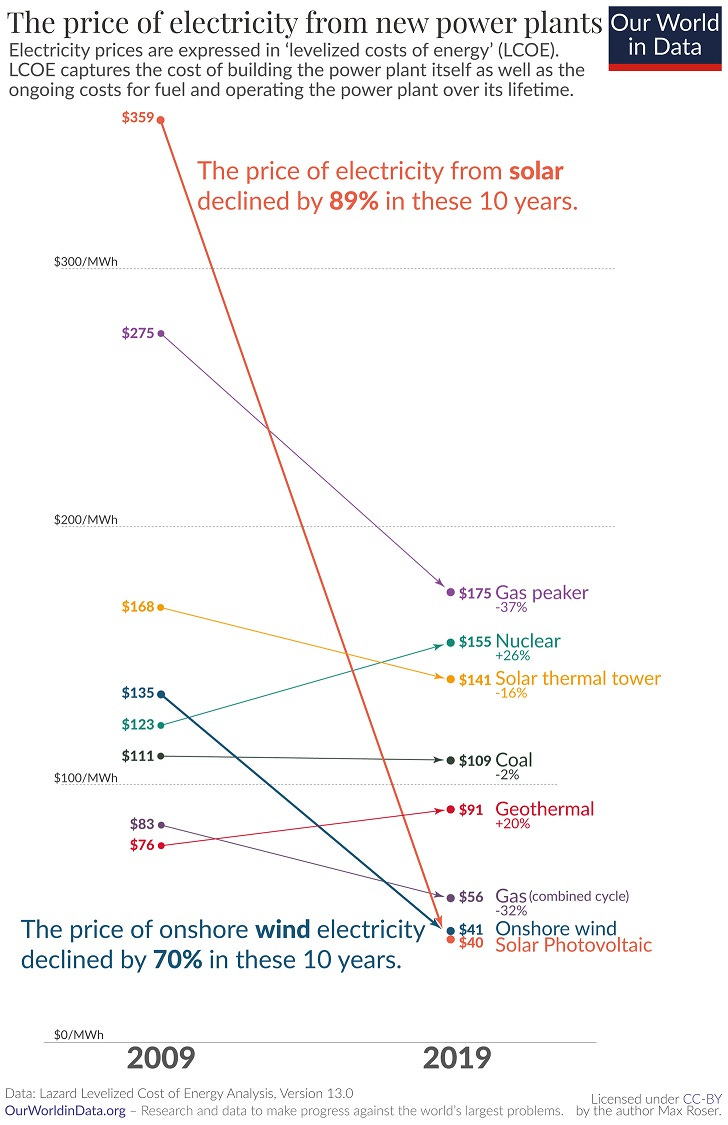

The cost declines in solar and batteries — and to a lesser extent, in wind and other storage technologies — comprise a true technological revolution. Once again, I shall post the amazing graphs:

And there’s no end in sight to this revolution. New fundamental advances like solid state lithium-ion batteries and next-generation solar cells seem within reach, which will kick off another virtuous cycle of deployment, learning curves, and cost decreases.

These technologies will, of course, make it far easier to fight climate change. And that itself is a form of future productivity, since climate change will probably cause big productivity losses if we don’t stop it. Also, the fact that solar and batteries are a far less finite resource than fossil fuels mean that they will allow industrial society to be sustained for much longer — another form of future productivity growth.

But in addition to these future benefits, renewables and storage will do something else — something big. For the first time since the advent of oil, humanity might get a new source of cheaper, more plentiful energy. And that has the potential to drive productivity growth of the kind we’ve only rarely seen since the 1960s.

The magic of cheap energy

With solar and wind now cheaper than fossil fuels in many areas, and still plunging in price, electricity is going to get cheaper. That’s going to enable a lot of cool things. For example, cheap, clean large-scale desalination. This would avert the fresh water shortages that loom over much of the world, and allow improvements in agriculture as well.

Home appliances will also be easier to power; lots of people will be able to afford clothes dryers, air conditioning, and so on. Plenty of manufacturing industries use a lot of electricity; these will be able to produce more with the same amount of labor, so workers' wages will go up. Construction will become more efficient, allowing the cheap creation of denser suburbs (or more Jetsons towers, if we want them). Recycling, renovating buildings, cleaning up pollution, and all kinds of environmental work will get more affordable. Even the IT industry will benefit, since server farms will be able to do the world’s computing cheaply and cleanly. They can even mine more cryptocurrency.

Coupled with cheap, energy-dense batteries, even more possibilities open up. No one wants to run a gasoline-powered robot housekeeper inside their home, but a battery-powered one would be fine. Better batteries would make electric cars quick and easy to charge and give them long range. Electric flight and electric shipping might make global trade and travel not just more environmentally friendly but actually cheaper. Drones will get much better too (though you can bet these will be used for military purposes as well as civilian ones). Even flying cars might become electric at some point.

And nearly every one of these benefits is complementary to human brain power — it’s just as easy to drive an electric truck as a gas-powered one. That means energy tech won’t make workers worried about being replaced, like A.I. does. In fact, with the right institutions in place to make sure the productivity gains are shared equally, energy tech could reduce inequality.

Of course, just as in the industrial revolution, the human world will have to make reforms and compromises and bold changes in order to take advantage of the revolution in energy technology. Building the suburbs was easy; allowing them to be rebuilt in a denser fashion will be politically harder. Faster transportation, new appliances, and improved industrial processes will always require their share of regulation, while increased resource use will have to be managed with care. Cheap energy doesn’t free the rest of society from the burden of smart rule-making.

But it does grease the wheels of prosperity. One of the scariest scenarios for the 21st century is that of a zero-sum world, where low productivity growth convinces people that the only way to get rich is at someone else’s expense. That sort of dog-eat-dog world would see intensified conflict and political instability. But cheap energy, even more than other kinds of innovation, offers the potential for the world to return to the sort of positive, future-oriented, growth-oriented, win-win culture that we sometimes managed to achieve, in some places, during the 20th century.

It’s the future we thought we had lost, but which we might finally get after all.

Update: I have successfully cyberbullied my friend Jim Pethokoukis into writing about solar! Here is his post:

And here are some excerpts:

What is the energy source of America’s future?…the answer is … wind and solar energy…I’m talking photovoltaic panels based right here on terra firma…Defining the timescale here as, say, ten years hence, makes my prediction a low-risk one…Also making this a safe forecast: the recently passed Inflation Reduction Act…Solar and wind double, coal falls by two-thirds. That’s a significant change!

[W]hat we have is a classic “a bird in the hand is better than two in the bush” situation, where the two in the bush are the future energy sources I often write about: nuclear fission from small reactors, nuclear fusion, advanced geothermal, and even space-based solar. Solar and wind are being installed, while those others are still being developed and demonstrated rather than being plugged into the grid. That’s just the reality.

As always, I heavily recommend reading and subscribing to Jim’s blog.

Solar and wind are low density power systems and work 20-35% of the time. The rest of the time you need backup. You can't replace a coal/gas/nuclear plant (say 1 Gwatt plant) with 1 Gw of solar (or wind) you need to build 3-4 Gw, and then at least 12 hours of battery or some sort of backup. A review of California, UK or Canadian minute by minute power inflow and demands show that every now and then, 2-6x/year there will be days when no wind blows and essentially no sun shines. If you plan for these you will need more than 12 hours of backup. So even at $1/watt for utility solar build costs your built out system capex, ignoring the transmission lines will result in a much higher capex for the system than exists for the present coal/gas/nuclear/hydro system, which means the $ cost per kw-hr is not going to be anywhere near "so cheap it will cause an economic boom" scenario. Ask Californians what price fluctuations they see, and ask UK and German rate payers what there kw-hr costs are now versus 20 yrs ago. And you ignore the nimby factor and the environmental impact and regulatory regime that will greatly hinder any major solar/wind/transmission line build out unless we have a political revolution.

Naive question..how "competitive" would solar be if the panels weren't being build by Uyghur slave labor and other CCP subsidies?

I'm less enthusiastic about solar also because even if you ignore the above issue, there are unanswered questions regarding massive disposal of degraded solar panels, the enormous amount of land usage needs of industry and the environmental impact on 3rd world countries from the mining for the rare earth minerals needed for a solar economy.

Can we just do Gen III or Gen IV nuclear power? We know that fission can deliver on demand power to industrial society. Solar is still a question mark to me