So why *did* U.S. wages stagnate for 20 years?

There are a few theories, but none of them really satisfies.

A week ago I wrote a post arguing that globalization didn’t hollow out the American middle class (as many people believe):

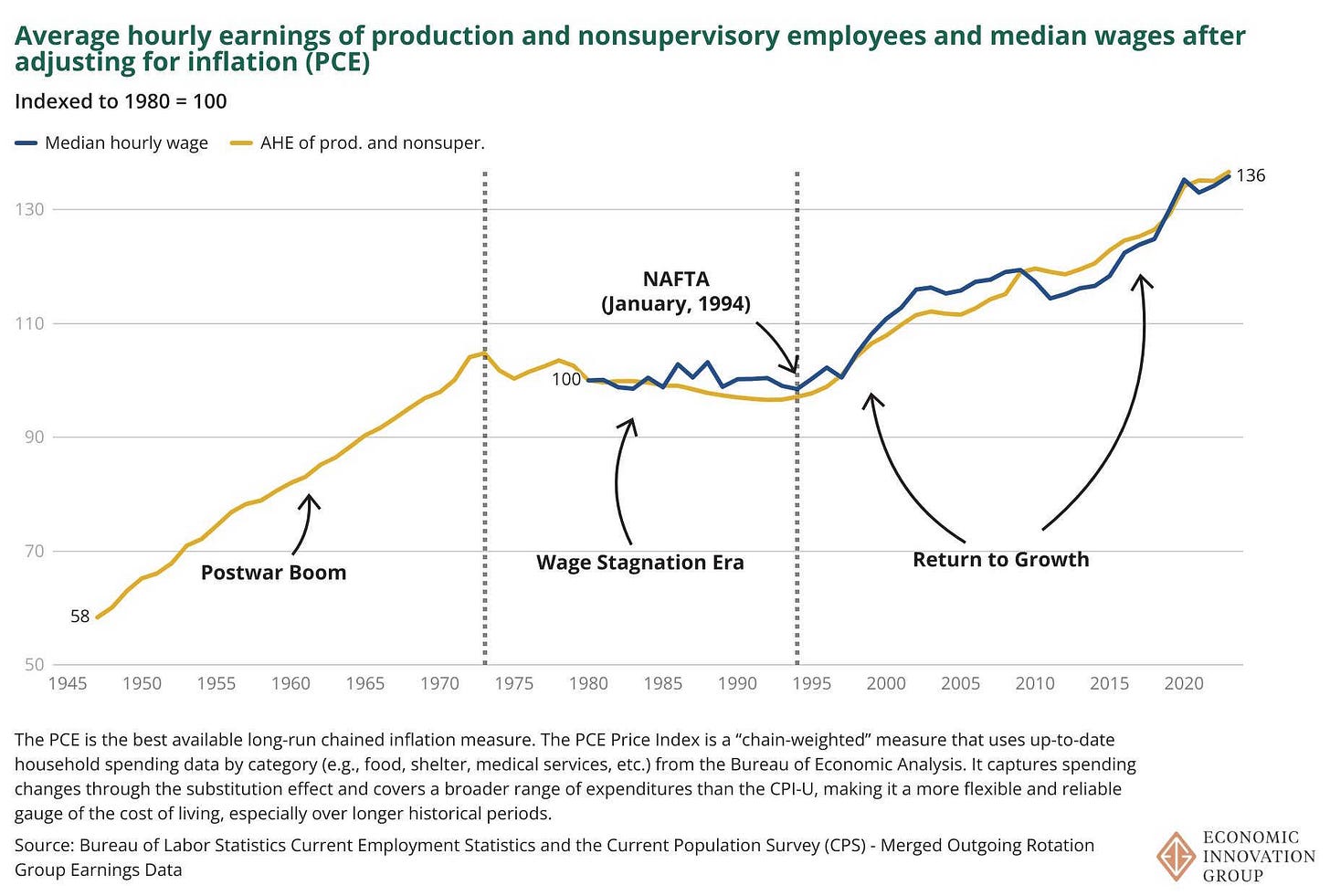

After I wrote the post, John Lettieri of the Economic Innovation Group wrote a great thread that strongly supports my argument. He showed that the timing of America’s wage stagnation — roughly, 1973 through 1994 — just didn’t line up well with the era of globalization that began with NAFTA in 1994. In fact, American wages started growing again right after NAFTA was passed. Check it out!

In fact, wage growth since NAFTA has been almost as strong as in the decades after World War 2!

Now, I think this might be too simple of a story. Although there was a lot of noise and political hand-wringing over NAFTA, most Americans probably don’t think it was competition from Mexico that hollowed out the U.S. middle class — they think it was China. And while economists think NAFTA hurt some specific manufacturing industries in a few specific places, they generally conclude that it helped most Americans; it’s the China Shock, after China’s entry into the WTO in 2001, that many economists think was overall harmful to the working class.

And if you add the China Shock to Lettieri’s timeline, you see that by some measures — but not by others — there’s a second, shorter era of wage stagnation that lines up with it pretty well. I’ve modified Lettieri’s charts to show the China Shock:

You can see that median wages flatten out between 2003 and 2015, while average hourly earnings of production and nonsupervisory workers continue to rise. Obviously the Great Recession is the biggest factor after 2007 (and many economists believe the China Shock only lasted through 2007). But there’s a good argument that Chinese competition did hold American wages down for a few years in the 2000s.

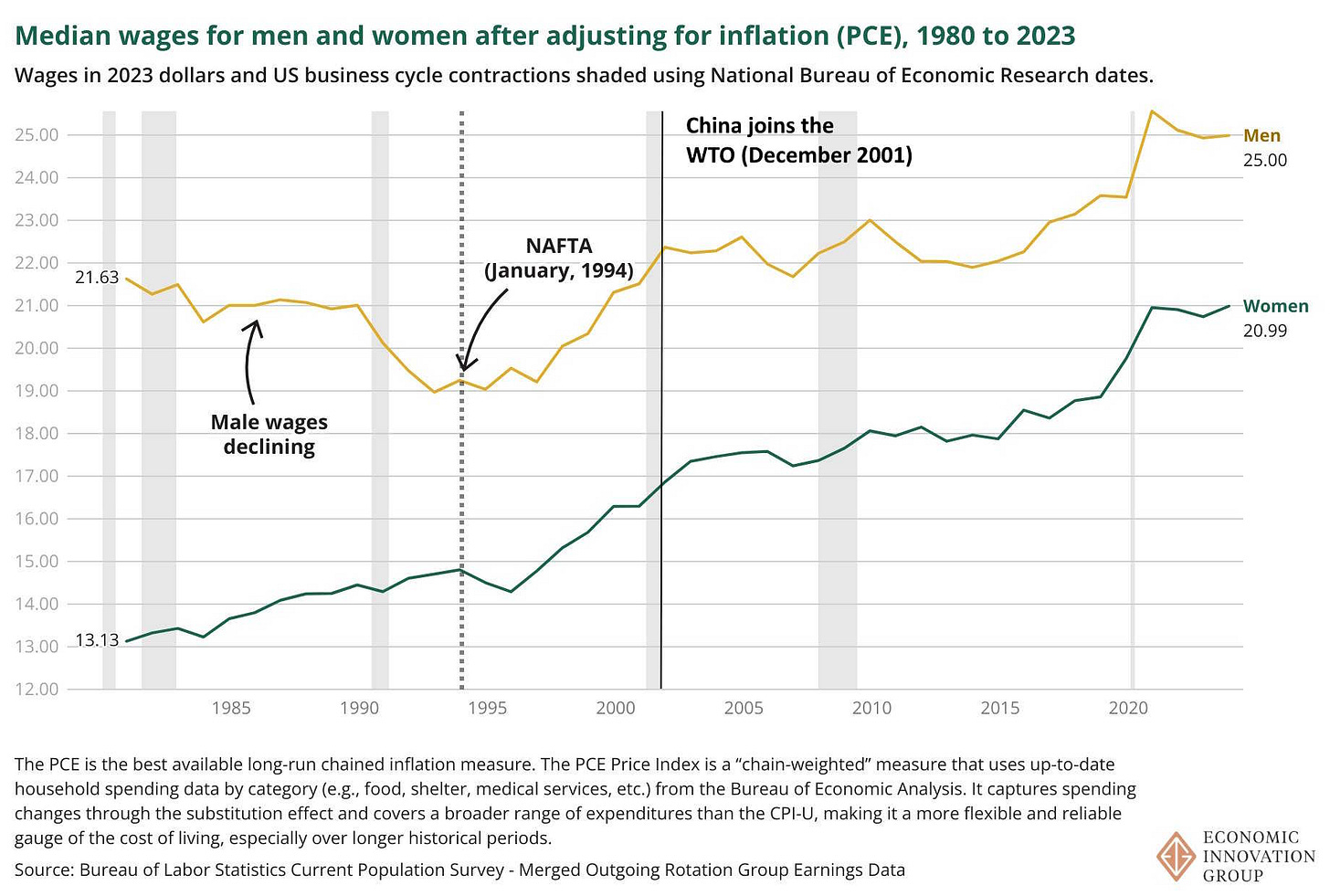

And in case you were wondering, here’s the breakdown for men and women:

And Lettieri has more charts showing that the story looks the same for the working class as it does for the middle class.

So I think the story is more nuanced than Lettieri makes it out to be. The surge in middle-class and working-class wages in the late 1990s might have come in spite of some small headwinds from NAFTA, and the China Shock might have exerted a drag on American wages during the 2000s. But the much bigger story that these charts tell is that the biggest wage stagnation in modern American history came before the era of globalization — roughly from 1973 through 1994.

What was the cause of that epic stagnation? In macroeconomics, it’s very hard to isolate cause and effect, since there are so many things going on at the same time. The decades between 1973 and 1994 featured two oil shocks, major inflation, two big changes in the global monetary regime, multiple major recessions, changes in trade deficits and imports, and plenty more. So much was going on that it’s possible that the wage stagnation was just a series of negative shocks that lasted for a long time — “just one damn thing after another”, as the saying goes.

But as a first pass, we can look at some of the theories of why that stagnation happened, and see if they match up with the timeline.

Productivity stagnation

Part of the stagnation in wages was due to rising inequality. If we look at average versus median hourly compensation (which includes benefits like health insurance and retirement matching contributions), we see that the average stagnated less than the median:

But you can still clearly see that from the early 1970s through the mid 1990s, the average value stagnated as well. This suggests that there was something systemic going on — it wasn’t just the middle class getting hit.

Part of that “something” was a productivity stagnation. If you look at average hourly compensation versus average labor productivity (output per hour worked), you see a modest divergence, but the productivity slowdown from the early 1970s until the mid 1990s is clearly visible, and it exactly lines up with the stagnation in wages :

Nobody knows exactly why productivity slowed down for two decades, but in my opinion the leading candidate explanation is that the oil shock of 1973 inaugurated an era of energy scarcity that forced industrial economies to shift away from energy-intensive growth.

Is it also possible that the same underlying shifts that made productivity slow down during those two decades also caused inequality to rise, and labor’s share of income to fall from 63% to 61% over the exact same period? It seems plausible, because the timing lines up so perfectly. But I don’t know of a good theory as to how a technological shift could cause all of these things at once.

Financialization

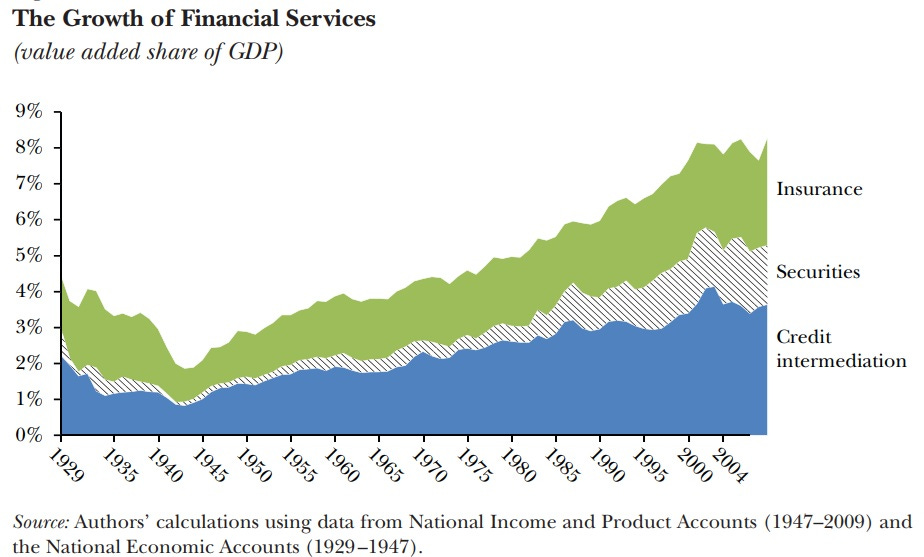

One common theory is that in the 1970s and 1980s, American industrial policy — including trade policy — stopped favoring manufacturing and started favoring the financial sector. This is, for example, the thesis of Judith Stein’s Pivotal Decade: How the United States Traded Factories for Finance in the Seventies. But if you look at the growth of the finance industry as a share of the U.S. economy, it’s a more or less unbroken rise from the end of WW2 through the turn of the century:

And if you look at financial profits, these actually fell as a share of the total in the 1970s before surging in the 1980s and again in the late 90s and early 00s:

The timing here doesn’t really line up. There’s no clear measure of financialization that coincides specifically with the early 1970s through the mid 1990s. The explosion of finance profits in the 1980s might explain part of the wage stagnation, if it came via financiers putting pressure on companies to suppress wages. But that can’t explain the wage stagnation in the 1970s, nor the re-acceleration in the late 90s and early 00s (when financial profits exploded but wages did well).

The decline of unions

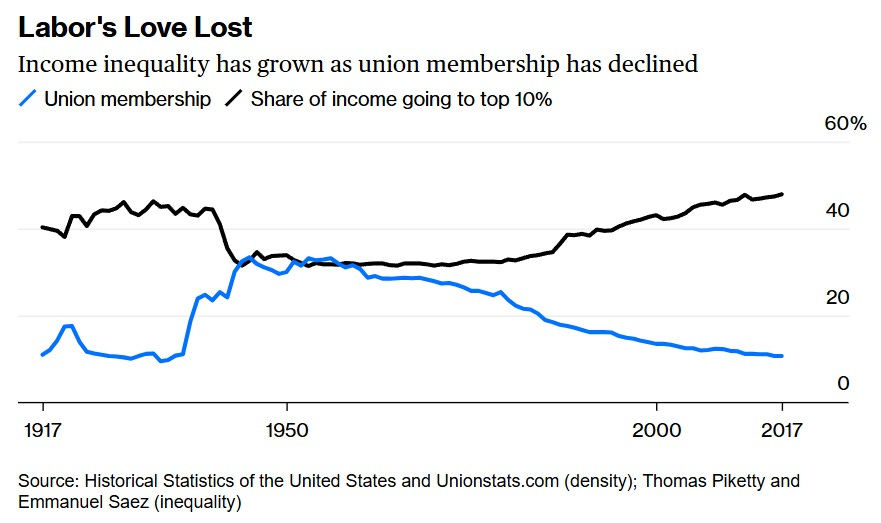

A lot of research suggests that unions drive down economic inequality (though researchers disagree on exactly how big the effect is). Farber et al. (2021) write:

U.S. income inequality has varied inversely with union density over the past hundred years…We develop a new source of microdata on union membership dating back to 1936, survey data primarily from Gallup (N ≈ 980,000), to examine the long-run relationship between unions and inequality…Using distributional decompositions, time-series regressions, state-year regressions, as well as a new instrumental-variable strategy based on the 1935 legalization of unions and the World-War- II era War Labor Board, we find consistent evidence that unions reduce inequality, explaining a significant share of the dramatic fall in inequality between the mid-1930s and late 1940s.

Here’s a picture of that relationship:

As we saw above, wage inequality — the divergence between average and median compensation — was responsible for part of the stagnation in middle-class wages, though not all of it.

But the timing doesn’t seem to fit here either. As you can see from that chart, unions have been in decline since the mid-1950s. The decline was a bit faster in the 1980s, which might slightly help explain wage stagnation in that decade. But overall it’s been pretty smooth. That doesn’t match up with the 20-year wage stagnation that started in the early 70s and ended in the mid 90s.

Inflation

The chart of real wages for production and nonsupervisory workers shows a dramatic slowdown from around 1973-1994. But a chart of nominal wages for those same workers — i.e. the actual number of dollars they earned per hour — shows no such slowdown, except maybe a very gentle flattening in the 1980s:

The difference, of course, is inflation. From around 1973 to 1983, prices increased at rapid rates:

The smoothness of nominal wage growth raises the possibility that nominal wage growth is very sticky — that workers are able to negotiate about the same number of additional dollars from year to year, despite big changes in the purchasing power of a dollar.

Again, the timing here doesn’t line up with the era of wage stagnation. But I suppose it might explain the first half of it.

Trade with Europe and Japan

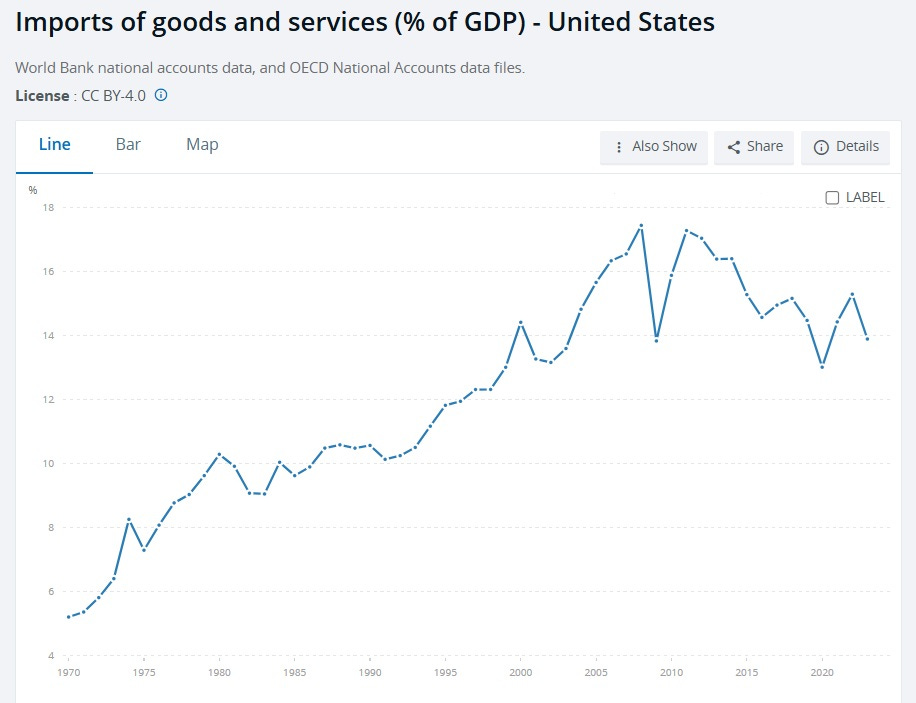

Finally, we’re back to trade and globalization. Certainly, Americans worried a lot about competition from European and Japanese companies, especially in the early 1980s. The Japanese and European auto and machine tool industries really did put American companies under intense competitive pressure starting in the 1970s. But it’s very hard to see this effect in the aggregate statistics. Import penetration rose in the 1970s, but flatlined in the 1980s and early 1990s:

As for the trade deficit, that was zero in the 1970s and then had a brief but temporary surge in the 1980s:

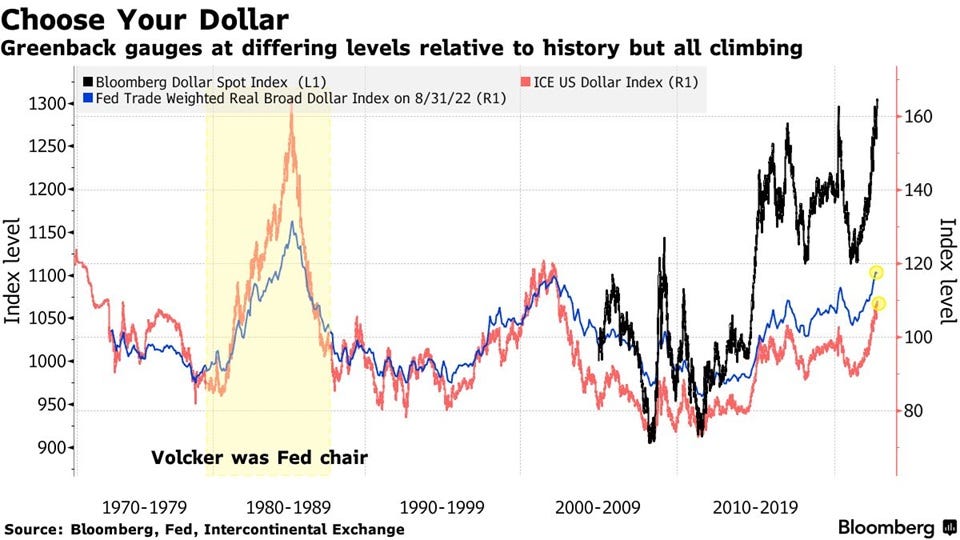

Some people I talk to seem to think that wage stagnation began as a result of the abolition of the Bretton Woods currency system in 1971-73. But that change, which ended the U.S. dollar’s role as the world’s official reserve currency, caused the U.S. dollar to depreciate, which made U.S. exports more competitive and actually discouraged imports. The dollar then surged again in the early 80s and collapsed in the late 80s after the Plaza Accord (an agreement to weaken the dollar):

And the Japanese yen strengthened more or less steadily against the dollar during the entire period of wage stagnation.

So trade with Europe and Japan just doesn’t line up with the wage stagnation in terms of timing, either. If you think overall import penetration is the key measure of globalization, then maybe trade had an effect in the 1970s; if you think trade deficits are a better measure, then maybe trade had an effect in the 1990s. But then the trade deficit and imports both surged in the late 1990s, which is when the wage stagnation ended.

In any case, we’re left with a bit of a mystery. The only macro trend that lines up very neatly with the great wage stagnation of 1973-1994 is the productivity slowdown, but there’s no good theory explaining how that could explain all of the wage stagnation, since productivity rose more than wages. Meanwhile, de-unionization, financialization, inflation, and trade with Europe and Japan can at best explain only some sub-periods of the wage stagnation — not the whole thing.

In fact, the great wage stagnation might have been from a patchwork of causes — first inflation and a surge of imports in the 70s, then accelerated de-unionization and financialization and the collapse of exports in the 1980s, with the productivity stagnation playing a corrosive role the whole time. But we should always be suspicious of complex, multi-factorial explanations for trend breaks on a chart. That wage stagnation started and ended suddenly enough that it cries out for a simple story. We just don’t have one yet.

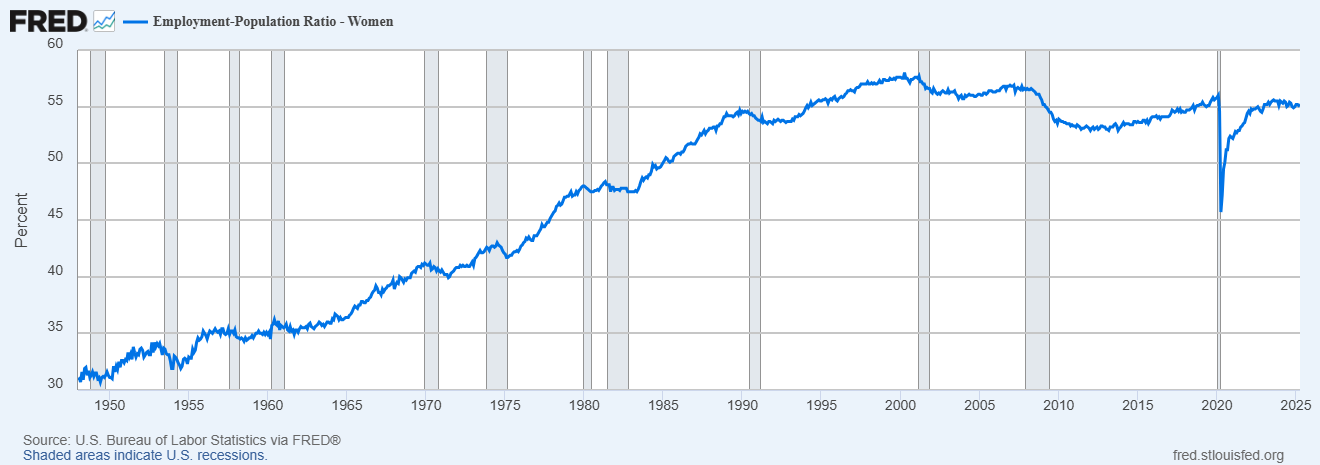

Update: Some people have been asking me if the wage stagnation of 1973-1994 might have been caused by the mass entry of women into the U.S. workforce. Here’s the employment rate (also called the “employment-population ratio”) for American women:

You can see that the first part of the timing doesn’t line up here. When the wage stagnation began, American women had already been entering the workforce at a steady clip for 25 years. (The labor force participation rate for women looks much the same). Also, empirical evidence suggests at most a small effect of female labor supply on male wages — and if you look at the breakdown for men and women, you see that the stagnation for men was worse than for women over 1973-1994.

And theoretically speaking, women’s mass entry into the workforce shouldn’t produce an overall decline in wages. Just like immigration or a baby boom, women’s entry into the workforce is both a positive labor supply shock and also a positive labor demand shock at the same time — when women earn more, they spend most of what they earn, on things that require labor to produce.1 So we shouldn’t expect the addition of women to the workforce to hold down wages.

Thus, this theory also doesn’t line up with the timing of the stagnation, and it’s not clear why we would expect it to be a major factor in the first place.

And they save the rest, which in normal times should drive down interest rates and make it cheaper for companies to invest.

Could the rise of women entering the workforce play a role? Trying to think of major shifts that start in the late 70s and then normalize in the 1990s, and that's one:

https://equitablegrowth.org/womens-history-month-u-s-womens-labor-force-participation/

Figure 2

I’m sorry. That was all my fault.

The period of stagnation closely corresponds to the period between my birth and my graduation from college. The obvious explanation is that the cost of raising me was a huge drag on the economy, but once I became a giver rather than a taker, things turned around.