Pakistan needs a plan

The country can't go on like this. It needs stability, privatization, education, foreign investment, and peace.

Pakistan is a vast country of 231.4 million people. It’s one of only nine countries in the world with nuclear weapons. It’s located in South Asia, which is now one of the world’s most dynamic and fast-growing regions. It has generally favorable relationships with both the United States and China. It has a long coastline in a generally peaceful region of the ocean. It has plenty of talented people, as evidenced by the fact that Pakistani Americans, on average, out-earn almost all other ethnic groups in the U.S.

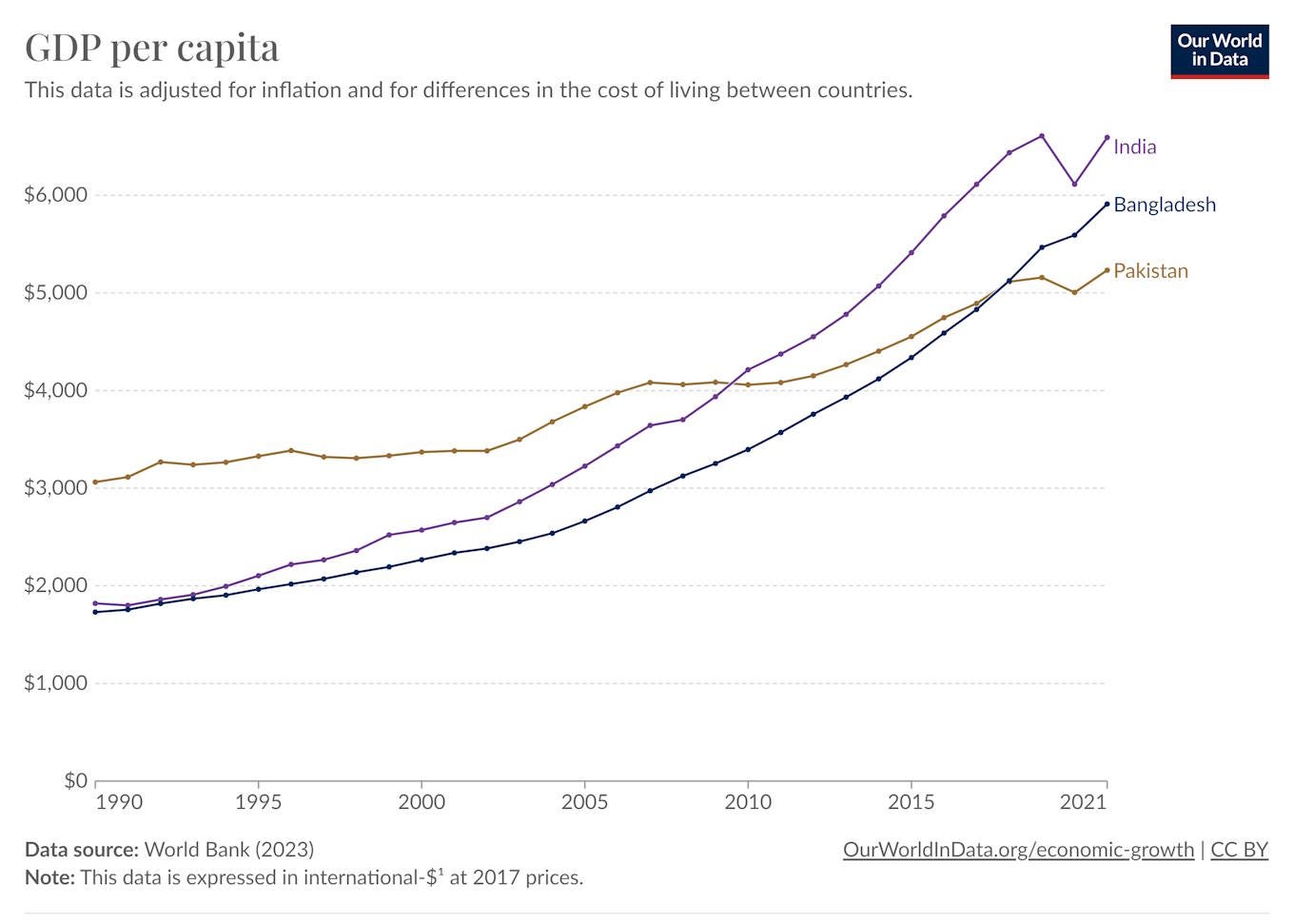

And yet despite these natural advantages, Pakistan is one of the world’s biggest economic basket cases. It’s a poor country, and its income is growing only very slowly; it has now been passed up by India and Bangladesh, despite starting out significantly richer:

If recent growth rates hold, Pakistan is projected to fall far behind its South Asian peers.

And it gets worse. Pakistan isn’t just poor and stagnant; it’s also in a huge amount of debt. In order to make its citizens feel just a little less poor, Pakistan has borrowed quite a lot of money over the past few decades. Mostly, this money was borrowed from the International Monetary Fund.

But because its economy is poor and stagnant and it’s not very good at collecting taxes, Pakistan generally hasn’t been able to pay the money back. Its solution has been to borrow even more money from the IMF in order to cover the debt that it already owes. As you might expect, this strategy led to Pakistan’s foreign debt to increase relentlessly over the years.

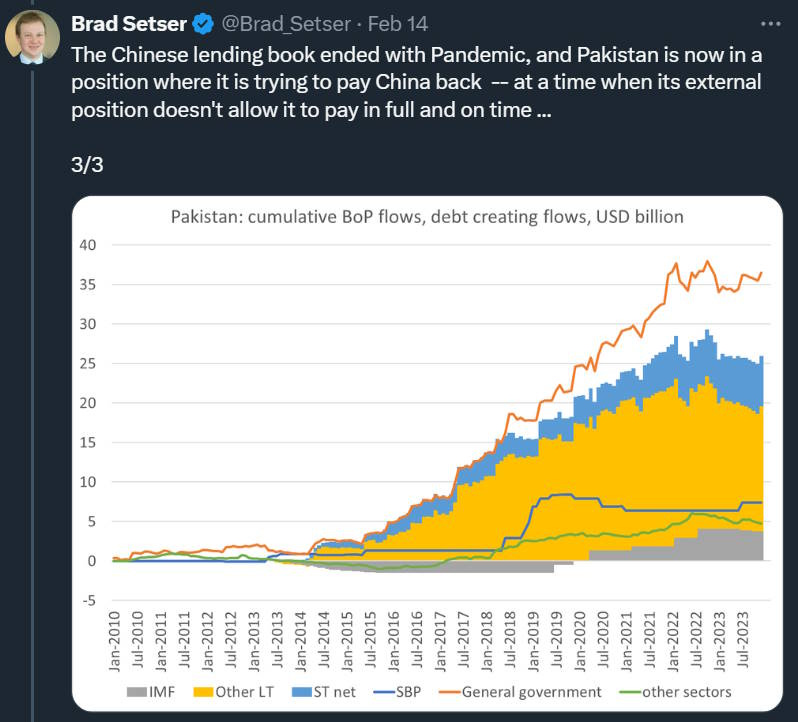

More recently, though, Pakistan started borrowing a lot of money from other countries as well — from Saudi Arabia and UAE, but especially from China. Much of the debt from China was related to the Belt and Road project, which was supposed to build new high-quality infrastructure in Pakistan, but…didn’t.

Now Pakistan, like many of the Belt and Road borrowers, is discovering that all those Chinese loans weren’t contingent on whether the projects actually worked out. Shehad Qazi, managing director at China Beige Book, explains:

And Brad Setser provides some additional context, declaring that “Pakistan’s leaders should panic a bit more.”

The IMF has bailed out Pakistan many, many times, but that was when it was the IMF itself that Pakistan mainly owed money to. The organization will probably be less willing to lend Pakistan money to cover its Chinese debt, as this would make the Chinese government whole while leaving the IMF holding the bag. And China is unlikely to extend Pakistan a neverending string of bailouts, as the IMF has done.

As the Pakistani American economist Atif Mian puts it, “the country is bankrupt.”

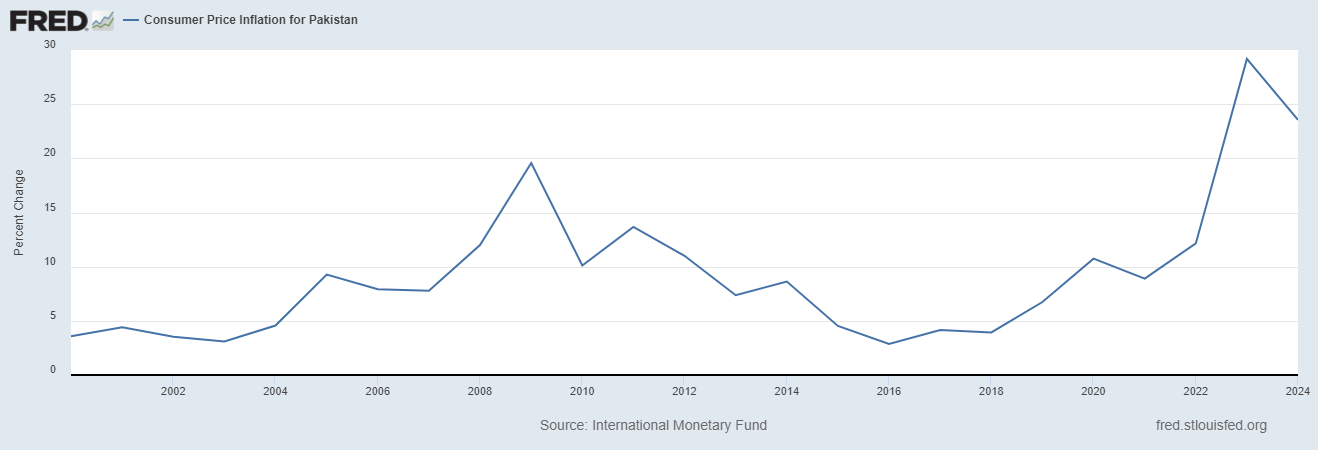

What this means is that Pakistan is in ever greater danger of a classic emerging-market currency crisis, in which a country’s currency gets so cheap that the only ways to pay off foreign debt is either by default or by high inflation — either of which hurts the real economy a lot. Already, the Pakistani rupee has lost a lot of its value:

And inflation is pretty high:

Already, some are talking about the possibility of a Pakistani default.

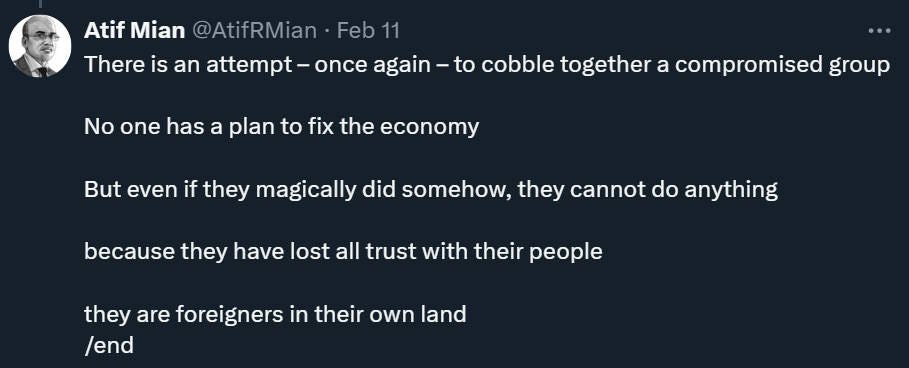

Pakistan had elections earlier this month. Although the party of the recently ousted Imran Khan won a plurality, Khan’s opponents made a parliamentary coalition and thus managed to take control. The government is negotiating with the IMF for yet another bailout, which probably won’t alleviate the Chinese debt problem much, but would at least provide some breathing space. Mian, however, is not optimistic that the new government is really serious about solving the country’s long-term problems:

If Mian is right, and Pakistan’s elites have little or no interest in solving the country’s problems, then that’s the whole ball game — Pakistan is doomed, and only a revolution will replace those elites with someone who actually cares enough to take decisive action. But a revolution would be very likely to either break up the country or burden it with an ideological, totalitarian regime, which would also spell doom. So Pakistan’s leaders have a very large incentive to prove Mian wrong, and to make a concerted effort to fix their country’s economy.

Escaping the debt trap is obviously job #1. An IMF bailout will replace old debt with new debt, so it’s just a delaying tactic. A better idea, as Samir Tata writes, is a privatization program — selling off government assets to pay down debt:

The key to escape Pakistan’s sovereign debt trap is hiding in plain sight – deleveraging…[P]rivate holders (e.g., portfolio investment funds, sovereign wealth funds, and corporate investors) of existing Pakistani sovereign debt denominated in foreign currencies would swap such debt for shares of state-owned enterprises that are to be privatized…

Privatization would have two objectives: raising cash via the sale of state-owned assets and reducing the budgetary burden of supporting poorly performing loss-making state-owned enterprises…An example of an individual transaction to transfer control of an SOE to a foreign company could be the sale of Pakistan International Airlines (PIA) to a foreign airline company.

That trick would really only work once — you pretty quickly run out of SOEs to privatize — but it would give Pakistan a single golden opportunity to escape from the crushing cycle of foreign debt that has characterized the last forty years.

So how can Pakistan take advantage of that one-time opportunity? The answer, in broad strokes, is that it needs to invest more.

Right now, Pakistan builds very, very little new capital. Whereas Bangladesh and India are reinvesting 32 and 29 percent of their GDP each year, respectively, Pakistan is reinvesting only 14 percent:

As I put it in a post back in 2021, this means Pakistan is a low-income consumption society:

Pakistan is eating its proverbial seed corn instead of planting it in the ground. Bangladesh and India, in contrast, are planting their seed corn — foregoing current consumption in order to build productive capital and be richer tomorrow…Pakistan is behaving like a lot of natural resource exporters behave — but without the natural resources. Instead of a middle-income or high-income consumption society, it’s a low-income consumption society — keeping its people barely treading water, with lots of help from external largesse.

How can Pakistan increase investment? Obviously when the government is so strapped for cash, it can’t do much. A privatization program, coupled with bailouts, might get it out from under the debt burden, but it would still have to figure out how to tax the economy more effectively. That’s a worthy goal, but one that will probably take a lot of time and effort.

In lieu of government investment, Pakistan will have to rely on the private sector. Pakistani businesses will invest more if the country is both politically stable and macroeconomically stable. The former is something that Pakistan’s elites have to work out for themselves, while the latter mainly requires reducing the foreign debt burden and curbing inflation.

But that leaves one important actor: foreign investors. FDI is a tried-and-true strategy that has lifted countries like Malaysia to near-developed status, and which helped Bangladesh grow quickly in the 2000s and 2010s. The most important type of FDI for Pakistan, by far, will be greenfield investment in export manufacturing. This is when companies come set up factories in Pakistan to make stuff to sell elsewhere. This kind of export-oriented investment can help narrow a country’s trade deficit, even as it also provides employment, raises productivity, and pumps money into the country’s financial system.

Pakistan has low wages, but by itself that’s not typically enough to attract a bunch of FDI. Foreign companies need more than just low wages — they need water and electricity and transport infrastructure, they need government assistance in setting up their business, they need cheap financing, and they need low regulatory and tax burdens. But most of all, they need security. They need to know they aren’t going to lose their business.

There are basically three kinds of people who can destroy or appropriate your business assets — the government, rebels/terrorists, and criminals.

If Pakistan’s government is serious about attracting FDI, it’ll avoid expropriating foreign businesses’ assets; instead, it’ll roll out the red carpet and give them what they need. Rebels and terrorists are a bigger threat, as Pakistan has both. Baloch separatists have attacked Chinese workers and projects. And various Islamist terrorists, including the Taliban, have attacked Pakistani cities. They might conceivably try to blow up foreign factories.

Crime is also a problem. Karachi, the country’s biggest port, is beset by chronic gang warfare, and for a while was considered one of the world’s most dangerous cities. There has been a big effort to clean it up, but high violence rates persist. Yet Pakistan has shown that it’s capable of creating pockets of public safety, if it really wants to. The capital, Islamabad, is generally viewed as an extremely safe city.

So the best approach for Pakistan is to make heavy use of special economic zones. SEZs are places where foreign businesses can cluster and find qualified workers easily. But they’re much more than that — they’re places where governments in poor countries can create pockets of stability and good infrastructure. Within a designated factory zone on the coast, Pakistan’s government can use the army and police to provide security from terrorists and criminal gangs. And even its meager resources are probably enough to provide those small areas with electricity, water, roads, port infrastructure, and so on.

Pakistan already has a few SEZs, many of them created as part of Pakistan’s economic partnership with China. These should be upgraded and expanded, if possible. But more importantly, these existing SEZs and some new SEZs should be opened up to countries other than China. Companies in the U.S., France, South Korea, and other developed democracies are eager to de-risk their operations by moving them out of China; right now they’re moving to India, Vietnam, and Mexico, but Pakistan could make itself another contender. All it has to do is to encourage developed democracies to come set up shop in its special economic zones, right alongside their Chinese rivals.

Pakistan has been playing the developed democracies off against China for a while now, using its possession of nuclear weapons and its strategic importance in fighting terrorism to pressure both sides of Cold War 2 into letting it borrow cheaply and in large volumes. Now it’s time to use that same strategic importance to encourage FDI instead of loans.

There are a couple of other ingredients Pakistan will need in order to take advantage of FDI. One is education. No country is an attractive base of operations without a large base of workers who can read, write, and do basic math. Pakistan scores notoriously poorly on international measures of education, with much lower literacy rates than Bangladesh. Indices of human capital place Pakistan more on a level with the very poor countries of Sub-Saharan Africa.

This obviously needs to change, and quickly. Simply spending more on public education is clearly the solution here. The government is strapped for cash, but if foreign debt can be reduced and tax collection improved, then there will be some money to invest in quality public schooling for the mass of Pakistanis.

The final thing Pakistan needs is peace with India. This idea will doubtless ruffle some feathers in the Pakistani military and the more nationalistic elements of Pakistani society, who view resistance to India as their country’s national purpose. But it’s time to face facts — Pakistan has gone to war against India four times, in 1947, 1965, 1971, and 1999, and it lost every time. India is just way too big for Pakistan to ever beat.

The old adage goes: “If you can’t beat em, join em.” Pakistan has failed to defeat India in more than 70 years of trying, and it’s time to stop. Pakistan should recognize that it controls part of Kashmir, and India controls the other part, and that’s how it’s going to stay. A lasting rapprochement between these two countries may sound like an unrealistic pipe dream, but it happened to Germany and France, and it’s now happening to Japan and Korea, so maybe it could happen to Pakistan and India as well.

Instead, the focus should be on opening up trade links and economic cooperation between the two countries. This will improve Pakistan’s security, because it’ll free up military resources to provide security for special economic zones and foreign investors. It could also improve Pakistan’s fiscal position, since it would allow decreased spending on the military. And most importantly, trade with India would give Pakistan’s economy a direct boost.

This is South Asia’s moment to shine in the global economy. Pakistan needs to take advantage of that moment before it’s too late. If it misses the window, it’ll end up being a poor, dysfunctional backwater, while India and Bangladesh advance confidently to middle-income status and beyond. Success will require determination, pragmatism, compromise, dogged purposefulness, and some smart planning on the part of Pakistan’s elites. But the alternatives are just too awful to contemplate.

Noah, thanks for putting this together. As a Pakistani-American with family still in Lahore, I think you hit the nail on the head.

A few observations:

1. Completely agree with privatization. Regardless of the impact on debt, the truth is most Pakistani state institutions are hopelessly inefficient and corrupt. Most of my friends will never fly PIA to Pakistan ( look up PIA flight 8303), and everyone with the means has switched from the national power grid to privately provided solar energy.

2. The real tragedy of Pakistan is elite capture by the army, bureaucracy and landlords. The army itself is the biggest landowner and business empire in the country. The only analogous system I see is Egypt.

3. As such, the elites have no incentive to change anything. And even if a leader emerged promising change, the vested interests in these institutions would bring this person down (as has happened several times in Pakistan’s history).

4. I completely agree that peace with neighbors is essential for Pakistani stability. Once again, the army has undermined all such efforts to justify continued investment in its infrastructure.

In the end, it’s just a tragic story. The Pakistani people are smart, industrious and entrepreneurial. They deserve better.

Weirdly little emphasis on Pakistan effectively being ruled by its military in Noah's article. For instance, the word "army" appears just once in a suggestion that it provide "security from terrorists and criminal gangs" (which would be nice, but seems a starry-eyed hope given the army's own striking resemblance to a pro-terrorist, criminal gang). Prime ministers, to a crude approximation, either bend the knee to the army (and nationalists and landlords), or they get ousted (https://news.sky.com/story/in-pakistan-it-seems-there-are-only-two-ways-prime-ministers-leave-office-military-coups-or-assassinations-12737632).

With Pakistan's crooked, army-dominated political establishment, there's little reason to expect privatization to help, and multiple reasons to expect it to fail:

‣ Pakistan's SOEs aren't valuable enough to clear its foreign debt (https://www.noahpinion.blog/p/pakistan-needs-a-plan/comment/49760299);

‣ the privatization process itself is one more opportunity for corruption and digging Pakistan's hole deeper; and

‣ indeed Pakistan already engaged in significant privatization since 1991, and has ended up where it is.

Education would probably help (but takes time to kick in). FDI might help (though given how flighty and unstable it is, there's no guarantee). Peace would help (but is only very partially in Pakistan's gift; it's not like Modi's smiled benignly on Kashmir). Stability would help, but that's Noah being the economist assuming the can opener like in the old joke.