At least five interesting things to start your week (#1)

Nvidia's triumph, "greedflation", public housing, Atlanta vs. Los Angeles, and what the UK gets right

I’ve been meaning to do more aggregation — lists of short takes on interesting news and research items that don’t necessarily need a full post. The start of the week seems like a good time to do these. As a compromise, I’m going to make the first part of the list free and the second part for subscribers only.

Also, I’d like to add in a little extra feature! If you’re a subscriber, and you have other interesting links from the past week — news, papers, blog posts, Twitter threads, etc. — that you think the other subscribers would be interested in, let me know in the comments! If I see a couple that I think I should comment on, I’ll pull them up and add them to the list. (This is inspired by Marginal Revolution’s “assorted links” and Matt Yglesias’ “mailbags”.)

Anyway, without further ado, here’s this week’s list.

1. Nvidia’s triumph gives America a hint for how to get industrial policy right

A big piece of news from the corporate world this week was Nvidia’s massive stock surge. After the company announced revenue projections that were much better than forecasts, its stock soared by 24% at the end of the week, giving it a market value of around $1 trillion. Tech now has a new Big Five list — Apple, Microsoft, Google, Amazon, and Nvidia. (MANGA, perhaps?) Jensen Huang, Nvidia’s rock-star founder and CEO, saw his net worth rise to $35 billion. Of course, he celebrated by visiting a night market in his native Taiwan (pictured above).

The reason Nvidia is kicking so much butt, of course, is AI. Nvidia makes chips called GPUs, as well as a proprietary language called CUDA that is used to program these chips. Computing power (or “compute”, as they say) is emerging as a key bottleneck in AI — the new models cost hundreds of millions of dollars to train. GPUs are better for AI than traditional CPUs, because they run lots of mathematical operations in parallel, and AI is highly parallelizable. Thus, Nvidia is incredibly valuable to the emerging AI paradigm.

Nvidia’s victory gives us an important insight into how to use industrial policy to shore up America’s dominance in the semiconductor industry. The obvious lesson is “admit more skilled immigrants”; since Huang came over from Taiwan at the age of 9. But the deeper lesson is about disruption.

Nvidia disrupted the now-struggling Intel, in the classic Clay Christensen sense of disruption — it made a product that at first served a niche market (computer graphics), and which later took over much more lucrative and generalized markets. Intel, with its relentless focus on making incremental improvements to CPUs for servers, missed out on the GPU explosion. It also missed out on other disruptive innovations — TSMC’s foundry model for manufacturing, and cell phone chips.

But Intel itself was the product of successful disruption, back in its day! Intel was initially making memory chips, in a market that was increasingly commodified. So it invented the microprocessor, which at first didn’t have many buyers but eventually became a much bigger and more lucrative market than memory. It was Intel’s disruption of the industry, more than U.S. efforts to support our memory makers, that ensured two decades of American dominance in semiconductors. Nvidia is mainly just a replay of that story — and TSMC, which created the foundry business model from scratch with the generous support of the Taiwanese government, is an opportunity the U.S. missed.

So the big lesson from Nvidia is not that U.S. industrial policy should support Nvidia — it’s that U.S. industrial policy should support the scaling up of startups in the chip industry as a whole. Nvidia itself is highly likely to get disrupted at some point, as is TSMC, and we don’t know what will disrupt them. But we do know that whatever does disrupt them, it ought to be an American company that does it. We need to be focusing on helping a bunch of companies that might be the next Nvidia or the next TSMC, instead of just throwing a bunch of government money at big incumbents.

2. Where the UK is beating the U.S.

I am still a bit annoyed at the Financial Times’ John Burn-Murdoch for claiming last year that the United States, along with the UK, was “a poor society with some very rich people”. That was simply false, as I showed in a lengthy post. The UK sort of deserves the epithet, but the U.S. does not — our middle class is richer than that of almost any developed country.

But Burn-Murdoch is on much more solid ground when he lambasts the U.S. on its health outcomes. Here is an area where the UK, for all its material shabbiness, is outpacing the United States:

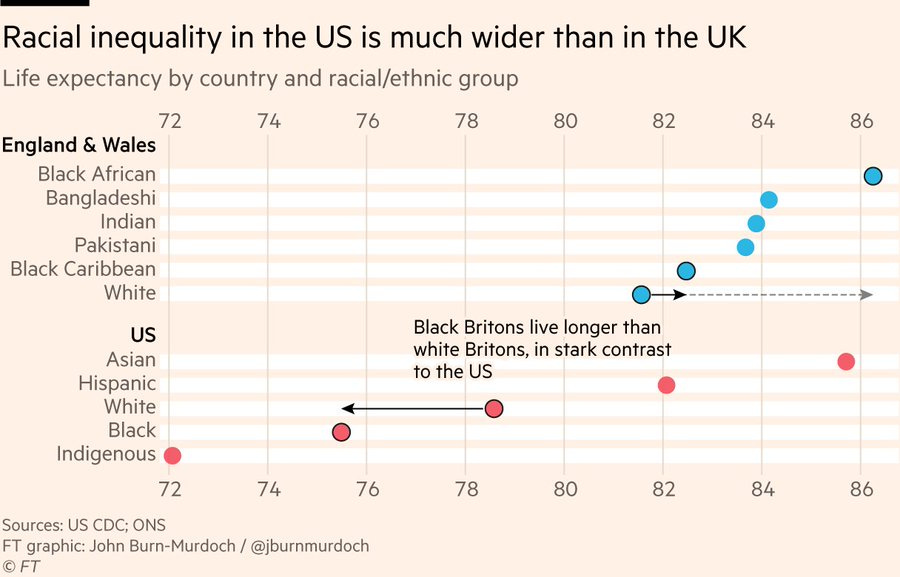

This is also not due to racial demographics. As Burn-Murdoch shows in a follow-up column this week, Asian and Hispanic Americans have life expectancy that compares to the British, but White and Black Americans are both far behind:

This is something that we should be very concerned about. Material goods and services are not the only measure of how well a nation is providing for its populace — public health also matters a lot, even though it doesn’t show up in the GDP numbers. And it’s here that the U.S. is failing its people, while the UK, despite lagging in material welfare, is succeeding. I’ll have more to say in later posts about how we might turn this around (and why our political economy makes it difficult).

3. I disagree with Matt Yglesias on public housing

I relish any opportunity to disagree with Matt, since we agree on a lot, and since our audiences overlap so much. So I’m going to take issue with a recent Bloomberg post in which he argued against public housing. Matt’s basic argument is that public construction costs a lot in America, so public housing won’t make housing any cheaper, and instead we should just allow more private construction:

In a country where every level of government is strapped for cash, and where budgets for even the most plausible and necessary projects seem to be exploding, how does it make sense for the government to build things that the private sector is willing to do? Both Singapore and Vienna launched their investments in public housing at times when the private market lacked confidence that investing in construction would pay off. Both cities built publicly financed apartment buildings as a way of investing in themselves at a time when private markets didn’t want to.

The United States, whatever its problems, does not lack for developers, contractors and entrepreneurs who are willing to finance home construction when they are allowed to do so…Until the US can figure out a way to build the things it needs the government to build, and at a reasonable price, why not simply allow the private sector to build more housing?

I disagree with this for a number of reasons.

First, one of the attractions of public housing is that the government already owns a lot of land that it can build on. That reduces the transaction cost of acquiring the land.

Second, we shouldn’t worry that building public housing will be fiscally irresponsible. The government should build the housing and then sell it off to the private sector, as Singapore basically does. That will defray or even eliminate the cost of building the housing. And if the government also sells the land that it builds the houses on, that’s land privatization, which would swell government coffers even more.

Third, I don’t see any tradeoff between allowing more private construction and doing more government construction. This is a clear-cut case of “Why not both?”.

Fourth, there are clear macroeconomic benefits to public housing. Private housing construction is procyclical — it rises in booms and collapses in busts. Government housing construction can be countercyclical — it can be done as a form of fiscal stimulus, while sustaining construction rates through good times and bad.

And finally, I think public housing construction could have considerable political-economic benefits. There’s a school of thought that if government currently isn’t efficient at doing something, we should just not have government do it at all. The problem is that if the government doesn’t even try to do anything new, it can never get better at doing anything it doesn’t already do. We’re clearly seeing the downsides of that approach right now in the cases of industrial policy and electricity transmission.

If we want the U.S. to get as good at public housing as Singapore, it has to start somewhere. Let the government try to build public housing, get mad at the cost overruns, and figure out how to reduce costs! Also, it’s worth noting that if the government is actually making money off of the construction of public housing, that creates one more powerful anti-NIMBY constituency.

So I think Matt is wrong, and the California YIMBYs pushing public housing are right, and Matt should listen to the YIMBYs on this one.

4. Is “greedflation” something we should think about?

The problem with the “greedflation” idea is that no one ever understood what it really meant. It was always easy to make fun of the idea that prices go up because companies got greedier, since this would imply that price crashes are due to companies getting less greedy. But of course, the proponents of “greedflation” don’t actually think this is what’s happening.

The problem is that it’s difficult to assess what exactly they do think is happening. For example, a recent article in Jacobin claims that corporate “price gouging” and “profiteering” are driving inflation, but the only “evidence” it shows for this is that both profits and prices have risen. To a Jacobin writer, this correlation is evidence enough. Post hoc, ergo propter hoc. Case closed — it’s time to enact price controls and start nationalizing industries and blah blah blah.

But this make no sense, because there’s an obvious story here about why price increases and profits should be correlated that has nothing at all to do with “greed” — it’s just all about demand shocks. When demand increases from a booming economy and fiscal/monetary stimulus, people are willing to pay more for stuff. And some of that increased payment will go to the company that sells the stuff, which will raise the company’s profits. Products that see greater demand shocks will see both greater price rises and greater profits, but the profits didn’t “cause” the price increases in any meaningful sense.

In an excellent post, the socialist writer Matt Bruenig goes over three recent papers that have claimed to support the “greedflation” idea — or which various other writers have claimed provide support for it. He shows that one of these papers, from the ECB, supports the demand explanation I gave above. A second one, from the Kansas City Fed, claims that companies are jacking up prices in anticipation of future cost increases, noting that price markups haven’t been correlated with price increases at the industry level in the recent inflation. The third paper, a note from the bank UBS, does claim that greed is causing inflation, but doesn’t attribute this to market power — instead it tells a sort of hand-wavy behavioral story about how long-term customers allow companies to bilk them.

Another recent paper, by Conlon et al., confirms that price growth hasn’t been correlated with markup growth in recent years:

What this shows is that the advocates of “greedflation” need to be more specific about what they mean by “price gouging” and “profiteering”. They need to give an explanation that isn’t just a garden-variety demand shock or supply shock, and which accounts for the lack of correlation between price growth and markup growth. Otherwise, it’s just hand-waving and populist wordplay.

5. Some evidence on affordability in U.S. cities

Kevin Erdmann has been writing a bunch of really interesting papers about housing affordability in U.S. cities, and writing the papers up on his Substack. Here’s the latest one:

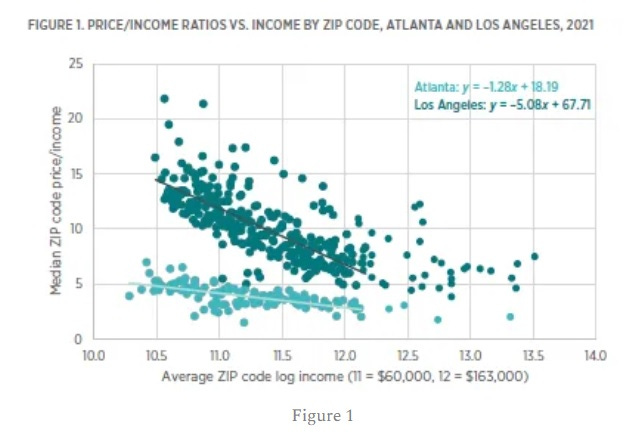

Here’s a good graph that shows how Erdmann approaches the issue. On the x-axis is income by ZIP code (richer ZIP codes on the right). On the y-axis is affordability, measured by the housing price-to-income ratio in that ZIP code. What Erdmann shows is that in some cities like Atlanta, affordability is about the same for rich areas and poor areas, while for other cities like Los Angeles, affordability is MUCH worse in the poor areas.

Erdmann argues that this difference is because Atlanta builds lots of housing and Los Angeles doesn’t. He shows that the houses with the steeper (i.e. worse) affordability curves tend to see population outflows, while those with the shallower (i.e. better) curves tend to see more inflows. That makes sense, since eventually people will move away from places they can’t afford.

I don’t think Erdmann’s theoretical framework is complete yet, because it doesn’t account for production. There’s a reason so many people, especially so many high earners, move to Los Angeles — money. That’s where the jobs are. So it’s possible that a ton of American cities like Atlanta are affordable not because they actually allow more housing construction, but because they haven’t yet benefitted from clustering effects, so there aren’t as many good high-paying jobs there yet.

In fact, Erdmann’s most recent paper suggests that this might be the case. He shows that most American cities are starting to look more like L.A. in recent years, in terms of lack of affordability for low-income residents. This suggests that maybe most American cities were about equally NIMBY all along, and that some are just now finding that out as job opportunities diffuse throughout the country. Which would suggest that NIMBYism is a more pervasive and less localized problem than many would hope.

Anyway, there are your five interesting things to start your short Memorial Day week. If you have any more, feel free leave the links in the comments, and I may pull one or two up to the main list and add some thoughts!

From the comments:

6. Property taxes are good for development

Via Braised Pilchard, here’s a very interesting OECD paper from 2008, on which type of taxes are best for promoting growth. Here’s the relevant table:

Now, this paper is a bit out of date, and it’s also true that cross-country regressions are always pretty suspect. In reality, nation-states aren’t statistically independent observations; there’s all kinds of correlation and heterogeneity, so just plugging them into a standard regression will give you standard errors that are basically nonsense and point estimates that are likely to be biased. Therefore these results should be taken with a big grain of salt, as always with this type of research. But it’s really interesting to see that property taxes come out so far ahead of income taxes in terms of being associated with economic growth. The easiest interpretation here is the simple Georgist one — property taxes are more efficient, since no one is making any more land. But my bet is that there’s also some reverse causation here on the institutional side — a country that is able to implement property taxes has to have good property rights in the first place, as well as the state capacity to override the parochial interests of local landowners. Those institutions probably tend to promote long-term growth.

7. We found an education policy that really works!

Via Kathleen Weber, it seems that Mississippi has had a big breakthrough in teaching poor kids to read! The core of the approach is an old technique called “phonics” that’s coming back into vogue. But it’s also about identifying students who are struggling and giving them extra resources, while also not simply giving them a rubber stamp and letting them pass to a higher grade.

Mississippi went from being ranked the second-worst state in 2013 for fourth-grade reading to 21st in 2022. Louisiana and Alabama, meanwhile, were among only three states to see modest gains in fourth-grade reading during the pandemic, which saw massive learning setbacks in most other states…

The turnaround in these three states has grabbed the attention of educators nationally, showing rapid progress is possible anywhere, even in areas that have struggled for decades with poverty and dismal literacy rates. The states have passed laws adopting similar reforms that emphasize phonics and early screenings for struggling kids…

[T]he country has taken notice of what some have called the Mississippi miracle. Tennessee, North Carolina, Georgia, Kentucky and Virginia are among the states that have recently adopted some of the same policies…

[Mississippi aims] to catch [reading] problems early. That means screening for signs of reading deficiencies or dyslexia as early as kindergarten, informing parents if a problem is found and giving those kids extra support.

The states have consequences in place if schools don’t teach kids how to read, but also offer help to keep kids on track.

Mississippi, for one, holds students back in third grade if they cannot pass a reading test but also gives them multiple chances to pass after intensive tutoring and summer literacy camps. Alabama will adopt a similar retention policy next school year. It also sent over 30,000 struggling readers to summer literacy camps last year. Half of those students tested at grade level by the end of the summer.

I think there are basically two lessons we can learn here. First, older education techniques are sometimes better than newer ones, and deserve to be brought back (here is another example). Second, the progressive idea of giving struggling students more resources and the conservative idea of holding students back until they’re proficient at testable skills end up working very well together.

Noah, I think you're wrong about PHIMBY. I'd LOVE for it to be a "Why not do both?" thing, and to whatever extent that it is, I *do* agree with you.

But the plain fact is -- as Matt pointed out -- that the PHIMBYs themselves are NOT selling this as a "Why not do both?". Rather, it's a lot of tankies and other crypto-socialists engaging in blatant checkism -- just get government to write a big enough check, and the problem will go away, right? They're explicitly saying that NO regulatory reform is needed, because they're just going to fix everything with [definitely NOT Soviet] housing blocks.

Public housing keeps running into the same roadblocks as private housing. The problem isn't whether it's public or private, it's the roadblocks. And happily, we will GET both by destroying the roadblocks! But public housing has such a politically toxic reputation in the US that it doesn't have a snowball's chance of destroying the roadblocks for us. No, WE need to destroy the roadblocks for IT.

I have a maybe coherent theory of greedflation. It goes like this:

All companies are always trying to raise prices. However, they usually raise prices at different times. This means that all their competitors are not raising prices, and they are forced to lower them again.

However, when inflation strikes, it causes an indirect synchronization effect. The news of high inflation gives all companies in a market a signal to raise prices at the same time. Because all the companies in a market raised prices at once, the usual competitive forces that would push the price back down are not as quick to respond.

So while companies are not uniquely greedy in times of inflation, the inflation signal creates a temporary coordination effect.