Will high oil prices cause a recession?

We're less vulnerable than we used to be.

A couple days ago I talked about high wheat prices, which are a result of Russia’s invasion of Ukraine and the subsequent international sanctions against Russia. Today I’m going to talk about high oil prices. The U.S. has announced a total ban on Russian oil, with the UK to follow suit by the end of this year. Together with the financial sanctions that make it very hard for Russia to do transactions in the West, that’s going to have a big effect on the global oil market. So let’s think about what kind of effect that’s going to have on the U.S. economy.

In normal times, Russia is responsible for about one-eighth of global crude petroleum exports:

Normally, oil is a pretty fungible commodity — it’s relatively cheap to put it in a tanker and ship it to whoever wants to buy. In normal times, that means that there’s more or less one single global oil price, so that a disruption to production anywhere affects all oil consumers equally.

In this situation, however, that’s not necessarily true. Only some countries are going to ban Russian oil, so Russia will probably keep selling to the ones who don’t ban it — especially to China and India, which together buy almost a third of total global oil imports. Because Russia has fewer markets to sell to, the countries that do buy Russia’s oil will be able to get it at a discount. Thus they’ll end up buying more oil from Russia and correspondingly less from other exporters like Saudi Arabia, Nigeria, or Canada. Saudi Arabia, Nigeria, and Canada will then sell more oil to the countries boycotting Russian oil, which will mitigate the rise in prices.

Mitigate, but not cancel out. Because oil importers like the U.S. now have fewer sources they can import from, they’ll pay a premium. That will raise prices on the world market. Indeed, oil has already surged to almost $130 a barrel since the start of the war, with yesterday’s announcements causing a particularly big spike:

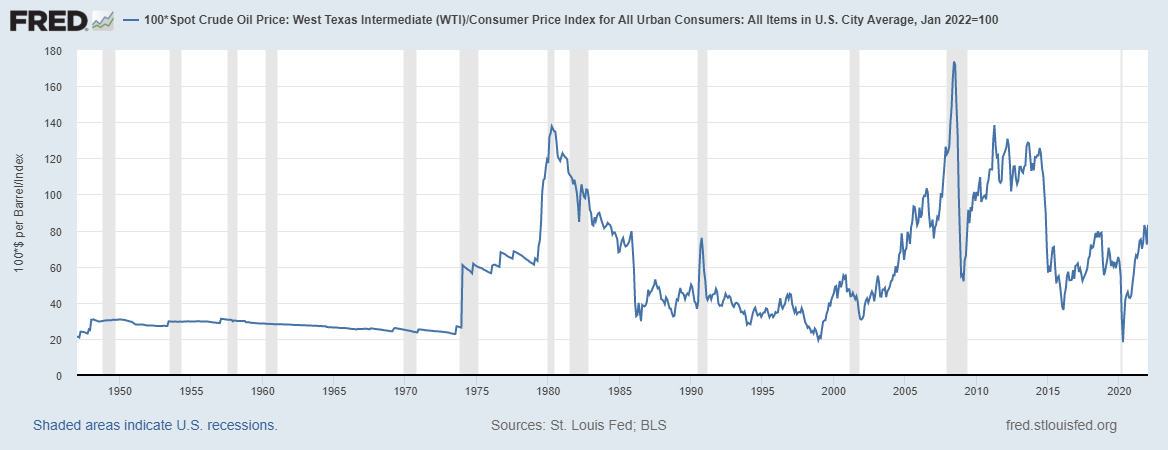

That’s near a historic high, even after adjusting for inflation. Here’s a historic chart of oil prices in 2022 dollars; you can see that only rarely does it approach or exceed the $130 mark (note that this data only goes through January, so it doesn’t include the spike from the war):

A big question now is what effects this will have on the U.S. economy. Whether oil prices cause recessions has been a pretty contentious debate among economists for a long time. And then, of course, there’s the question of what we can do to bring oil prices down.