Why is the U.S. doing so much deficit spending?

And is this going to hurt us down the line?

When I was a kid, the nation was in a collective freakout about the national debt — and the deficit, which is the amount the federal government adds to the national debt each year, although people tend to get “deficit” and “debt” mixed up. Either way, people were upset about it. We had that National Debt Clock, which was installed on the side of a building in New York City in 1989. In the 1992 election, the three candidates competed to portray themselves as deficit cutters — and to be honest, all of them were being pretty honest. Bill Clinton won, and the nation celebrated as his combination of spending cuts and tax hikes brought the nation back to a surplus by the end of the 1990s.

Why was the U.S. so austerity-minded in the early 1990s? The country had begun to run persistent budget deficits in the 70s, which had grown in the 80s as a result of Reagan’s tax cuts and defense buildup:

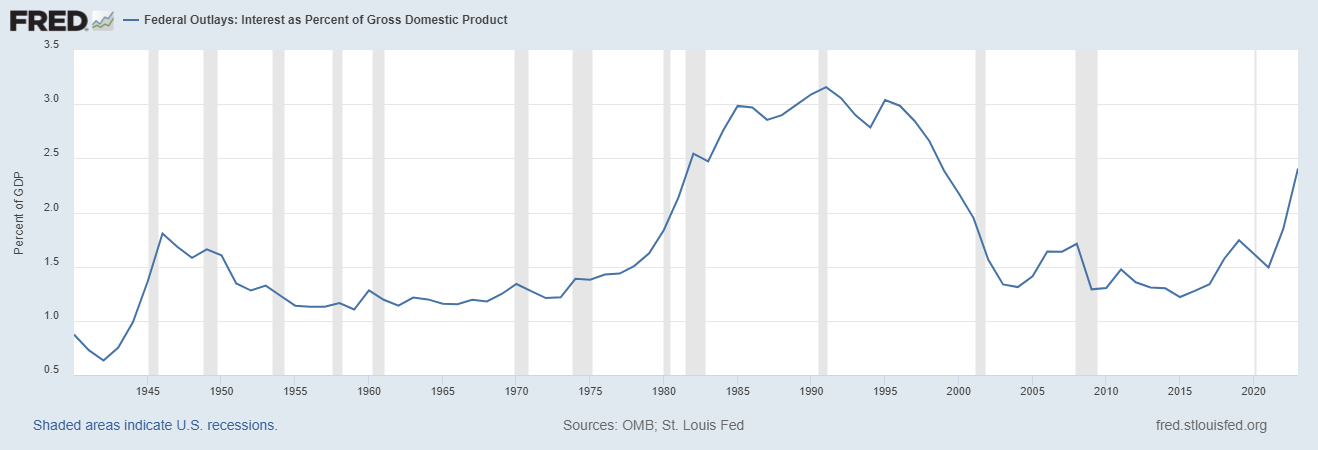

But that wasn’t the only reason. The government was also paying a fortune in interest on the national debt every year. The Fed had raised interest rates in the late 70s and early 80s to fight the inflation of the previous decade, and these higher rates meant that the U.S. national debt was suddenly more of an annual burden:

In the years after Clinton’s victory over deficits, the U.S. reversed course again. The federal government went into the red during the Bush years, mainly because of tax cuts. Obama then unleashed a massive stimulus to fight the Great Recession. With some pressure from the Tea Party Congress, Obama cut the deficit somewhat in his second term, but Trump started raising it again. The Covid hit, and the U.S. did a massive amount of deficit spending to make sure it didn’t wipe out Americans’ finances.

Why was the U.S. so blasé about big deficits in 2002-2020, when we had freaked out so much over comparatively modest deficits in the early 90s? Part of it was that there were a bunch of emergencies that seemed to justify a temporary burst of deficit spending — 9/11, the financial crisis and Great Recession, and Covid. But a lot of it was simply due to the fact that interest rates were really low, so it was a lot easier for the government to carry a larger amount of debt. As you can see from the graph above, even though debt rose steadily in the 2000s and 2010s, interest payments stayed pretty low.

But over the last two years, something ominous has happened. Although the pandemic is long over, the economy is doing great, and interest rates have risen sharply, the U.S. federal government is still borrowing a ton of money. The deficit was over 5% of GDP in 2022, and increased to over 6% of GDP in 2023 — levels not seen since the Great Recession. Part of the increase from 2022 to 2023 appears to have been a one-off, driven by a stock bust and some strange timing of tax collections. But the 2022 deficit is still historically very large as a percent of GDP.

And it’s starting to cost us. As the graph above shows, interest costs on the debt are spiking — they’re not yet back to early 1990s levels, but they’re rising very fast.

So there are two questions here. First, why are we doing this? And second, when will this become a problem for our country? Unfortunately, there’s a huge amount of uncertainty around both of those questions, but it’s not too hard to come up with some scary theories.