As bargaining over Biden’s big “Build Back Better” bill builds…

…Sorry, just couldn’t resist doing that. My editors at Bloomberg would always take out long strings of alliteration, but now I’m free to write as many “b” words in a row as I want! The power is all mine!! Buahahahahaha

…Anyway. As I was saying. As the negotiations over Biden’s $3.5 trillion reconciliation bill continue, Americans are once again starting to worry about budget deficits. This happens whenever there’s a substantial spending outlay or tax cut being mooted, but when the administration proposing it is a Democratic one, the cries for fiscal probity are always especially shrill. Twitter, for example, is now veritably filled with stuff like this:

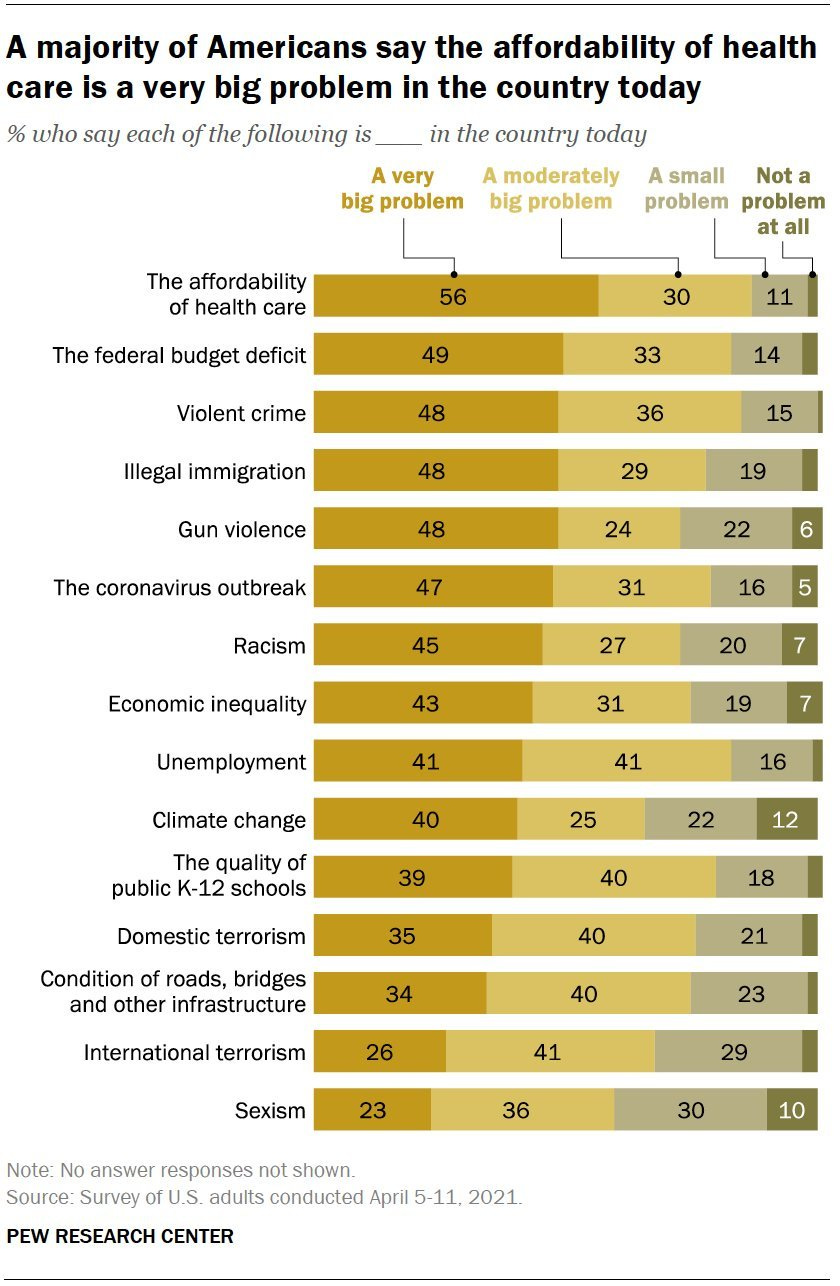

Nor are these isolated voices shouting in the wilderness. A number of polls have found that a significant percentage of Americans rate government debt and deficits as among their top concerns. Most striking was an April Pew survey in which federal budget deficits came in second in importance only to health care costs:

Gallup’s long-range survey suggests that the percent of Americans worried about deficits is a bit smaller than during Obama’s presidency, but still much larger than the percentage who aren’t worried.

This raises the obvious question: Why? Why are so many Americans worried about government borrowing? An easy answer is “because the media told them to worry about it”, which would fit with the fact that respondents say they’re worried about pretty much every item on Pew’s list of issues, and most of the items in the other polls. But it still doesn’t explain why people are more worried about deficits than other problems they hear about. What makes this issue loom especially large in Americans’ minds?

I don’t know the answer. Unlike for inflation, I can’t find good surveys delving deep into the question of why Americans don’t like deficits. Nor is the answer obvious from history — the inflation of the 70s corresponded with drops in real wages, but periods of high deficit spending have often (though not always) tended to be fairly good economic times, as in the 80s, the early 00s, and the late 10s. Deficits haven’t obviously gotten us into trouble heretofore, so why should people be so worried about them now?

Here are four possible explanations, in order of most charitable to least charitable.

Theory 1: People are afraid of default and/or hyperinflation

One possibility is that people are worried about deficits for good reason. Lots of people like to heap scorn on anyone who thinks government debt is a problem, but there’s really a chance it might be a problem!

In fact, no one really knows what that chance is. In January, I wrote a post explaining why this is. If the government just keeps borrowing exponentially more and more, at some point private markets may stop buying the government debt. That will force the government to either A) default, or B) get the Fed to finance future government borrowing. If the Fed finances borrowing, there could be the possibility of a hyperinflation — an economic catastrophe so devastating that default would probably be a safer bet.

The problem is, no one actually knows how much government borrowing the Fed can finance before hyperinflation hits. It could be just another trillion, or it could be $100 trillion more. As I wrote in my earlier post:

For hyperinflation to happen, companies have to start raising prices really rapidly. And we don’t know when they’ll do that, because we really understand very little about how companies behave in this regard (more on that later). At some point, presumably, the companies look at government spending and go “Oh shit, the dollar is going to be worth NOTHING”, and then they just start raising their prices like crazy because they think the dollars they’re getting are about to be worth much less. But “at some point, presumably” is a polite term for “we have no idea when”…

So when the government borrows more and more from the Fed and spends the money, it’s like our country is walking down an infinite corridor towards an invisible pit. We know the pit is out there somewhere in front of us, but we just have no idea how far we have to walk before we fall in.

But if we ever do fall in…whew. It’s quite a pit.

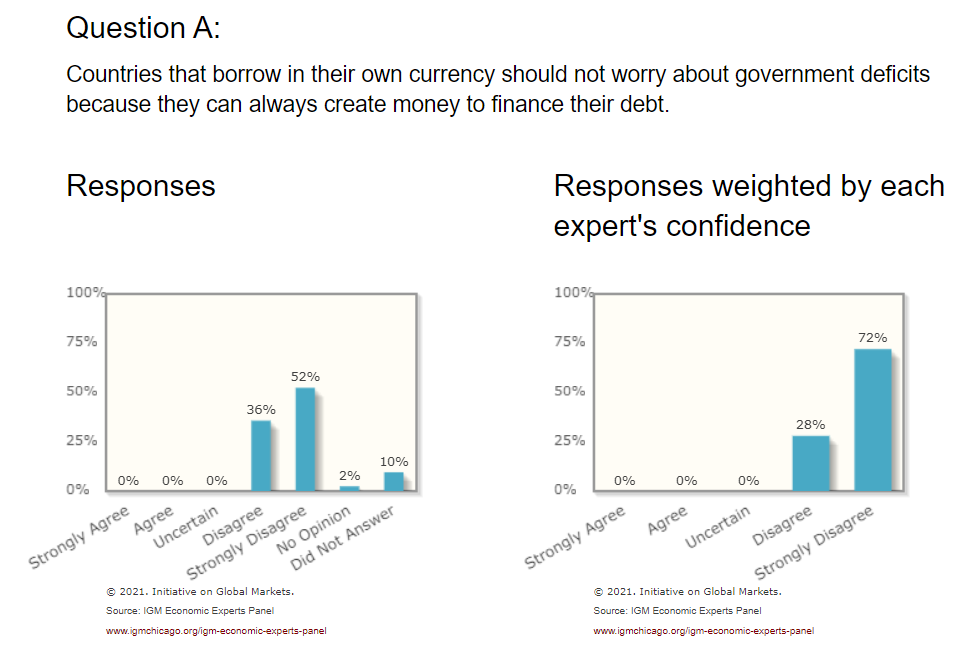

In other words, the American populace might be smarter than the pro-deficit pundits, and realize — somehow — that the pit of hyperinflation isn’t actually that far away. Economists, for their part, generally think that the pit is really out there:

So I think we have to give people enough credit to allow for the possibility that they might know something about how much the government can safely borrow.

Theory 2: People misunderstand government finances

If the populace understands how much debt is too much, it must be in some sort of wisdom-of-crowds sort of way, because when you see how people actually talk about federal borrowing — as in the tweets above — they definitely don’t seem to understand it. Declarations of “we’re out of money” or “we’re broke” are common. That, of course, is not how federal debt actually works

Some people are probably making simple, absurd errors, like believing that the debt ceiling — a legal rule about how much debt the federal government is allowed to have — represents some kind of physical limit on borrowing. Obviously we could repeal the debt ceiling tomorrow. But many people probably make a more natural, reasonable error — they instinctively view the federal government as similar to a household or a business, both of which can indeed run out of money.

There are actually two very deep and important reasons why this isn’t true. A household or business can’t just create money to pay off its debts. If I create a new cryptocurrency called NoahCoin and offer to pay my hospital bills with NoahCoin, the hospital can just laugh in my face and demand dollars instead. But if the federal government decides to eliminate its debt by telling bondholders “You now have $20 trillion more dollars in your bank account”, it can just do that. Any time it wants. And then poof, the debt is gone, and there’s absolutely nothing any of the bondholders can do to stop that (short of, say, armed rebellion).

Of course, the federal government has rules — rules that it made for itself — that prevent it from doing this. Instead, the government forces itself to act sort of like a household or business — when it spends money, it forces itself to either tax or borrow, instead of just creating the money out of thin air. But here’s where the Fed comes in. If the Fed finances government borrowing, then the government is effectively paying its debts by creating money — getting around its own rules that it made for itself. Of course that could still risk hyperinflation, as mentioned above. But that risk isn’t the same as a household or business’ risk of running out of money.

I don’t have a Fed. You don’t have a Fed. Google and Apple don’t have a Fed. But the federal government does have a Fed.

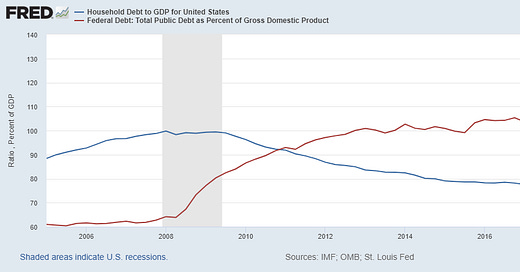

The second difference between government and a household is that some percent of government debt is owed to Americans. Currently, only about 25% of the public debt is held by foreigners:

When a household or company borrows, it borrows from an outside entity. But most federal government debt (in America) is just money that some Americans owe to other Americans, with the federal government as an intermediary.

So when a household or business borrows money from an outside entity like a bank, they’re choosing to spend more today, meaning they’ll be able to spend less tomorrow (since they’ll have to pay back the loan). But when the federal government borrows from American lenders, it doesn’t mean that America as a whole is spending any more today, and it doesn’t mean that it’ll have to spend any less when the debt gets paid back. (Yes, it’s more complicated than this, because there are Keynesian demand effects from deficit spending, but this isn’t the same.)

In other words, for a household or business, borrowing today can be a short-sighted action — living large today and being forced to pay the piper tomorrow. But when the government borrows from Americans, then the “piper” it’ll have to pay is just…Americans.

I think a lot of people don’t really understand either of these differences.

Theory 3: People just don’t want more social spending

The two theories above are reasons why people might not want deficits for their own sake. But it’s also possible that people say they worry about deficits when really they’re worried about different stuff.

One other thing they might be worried about is government social spending itself. I’ve written that I think Americans are in a “scarcity mindset”, where everyone is afraid that some other Americans are getting an unfair leg up on them, or cutting line, or getting a free handout, etc. One piece of supporting evidence is a recent poll finding that Americans don’t want to make Biden’s child tax allowance a permanent program.

One way for people to oppose new social spending without looking cruel, stingy, or heartless is to worry about deficits. Saying “I’d love to help you but I just don’t have the money” is a lot easier on the conscience than saying “I wouldn’t actually love to help you because you don’t deserve more money”. So expressing antipathy for social spending by saying they’re worried about deficits could simply be a way people salve their consciences — or try to look virtuous in front of pollsters, friends, relatives, Twitter followers, or whoever. A substantial fraction of Americans say they want more social spending…but maybe not all of them really do.

Theory 4: People just don’t like social change

One of my favorite authors is Rick Perlstein, a historian who wrote a series of epic books about the rise of the modern conservative movement. In a recent essay, he argued that the concern over inflation in the 1970s was actually a stand-in for unease about the pace of (liberal) social change:

[S]o, you have to ask: What were these people really talking about when they talked about inflation?

The conclusion I’ve drawn is that this was a form of moral panic. The 1970s was when the social transformations of the 1960s worked their way into the mainstream. “Inflation spiraling out of control” was a way of talking about how more permissiveness, more profligacy, more individual freedom, more sexual freedom had sent society spiraling out of control. “Discipline” from the top down was a fantasy about how to make all the madness stop.

Now, I disagree with Perlstein that this is the main reason people didn’t like inflation; I think many people could see that their wages weren’t keeping up. But I think he’s probably on to a real phenomenon here, especially as regards deficits and debt. Unlike inflation, deficits and debt are an abstract, far-away thing that doesn’t personally affect people’s pocketbooks on a day-to-day basis. So I think it’s more plausible that people are expressing cultural conservatism by professing economic conservatism on deficits. After all, polls tend to find that Americans usually care more about social and cultural issues than about economic ones.

Now, one can easily imagine Americans who are “fiscally conservative but socially liberal”, as people sometimes claim to be. But in actuality, there probably aren’t many such people. In general, surveys find that economic and social liberalism and conservatism tend to line up pretty clearly — and for people who are split, “economically liberal but socially conservative” is actually more common. at least in this day and age:

So it seems fairly likely that some people just want change to stop in general, and pointing to the debt as a reason to stop change is just easy and convenient.

…So which is it?

So why do Americans worry so much about federal deficits? Which of the above theories is right? The answer is:

I don’t know, I’d need more data.

It’s probably different reasons for different people.

Some people probably have a mix of these reasons.

There might be more reasons I haven’t thought of yet.

But in any case, this is a question that deserves detailed and rigorous investigation, because a popular desire for fiscal austerity has a big and important impact on the country’s economic future.

Of all matters of public, policy, the debt is the easiest to demagogue. The very word "debt" is already a piece of demagogy, since it immediately confuses government finance with household finance. Using instead terms like "Treasury bills, notes, and bonds" removes much demagogic distortion, if it also puts before us the challenge of actually understanding these financial instruments and their functioning as parts of US government operations and the global (including US) economy. Talking about "the debt" amounts to a pointless exercise insofar as "the debt" has no content except as a big scary number.

Here in the UK, during the post credit-crunch austerity period, the narrative coming from government was entirely aimed at Theory #2 - for example, ministers would make comparisons between government debt and household credit card bills. This was a very effective way of justifying spending cuts that voters (who generally like our welfare state, NHS etc) pretty much waved through, because they believed that there was no other choice. So if you are a politician who dislikes social spending but doesn't want to admit it, pandering to Theory #2 seems quite effective!