I don’t think we should be panicking about inflation yet. But as the topic starts to reenter mainstream discussion, it’s worth asking: Why do we even care about inflation in the first place?

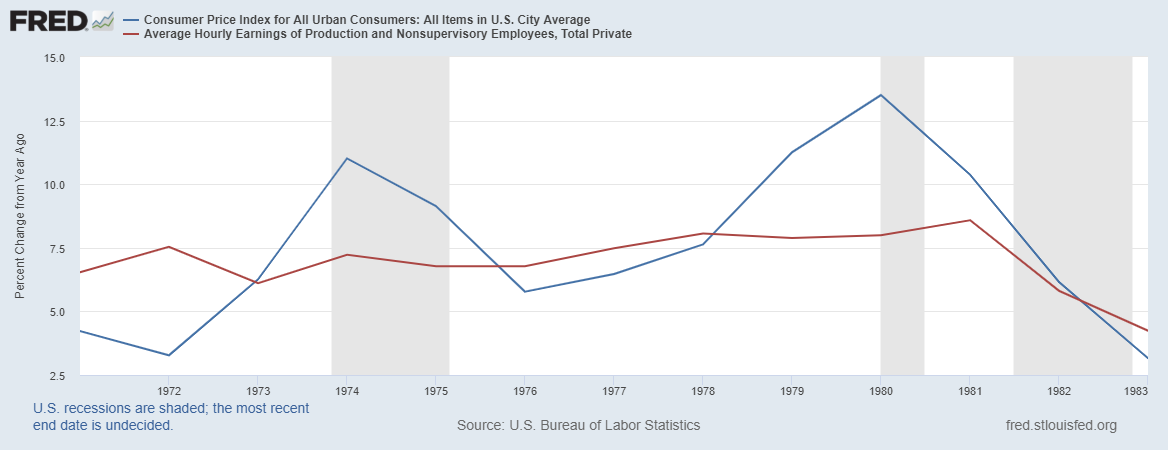

If you look at that poll above (the source is here), you’ll see that inflation really made people very very upset from maybe around 1974 to around 1983. That roughly coincides with when inflation was actually high in America:

But that doesn’t explain why people get so upset about inflation — and why they pressured policymakers to do something about it in the 1970s. At first blush the answer might seem obvious. inflation is a rise in the cost of living, right? Who wouldn’t get upset about that, right?

But in fact, it’s a lot more subtle than that. In theory, inflation could reduce normal people’s debt burdens while leaving their purchasing power unchanged. This is why economists used to think that inflation wasn’t a big deal.

Is money just a “veil”? A review of the basic theory

In an earlier post, I tried to explain what economists were trying to get at when they defined the concept of inflation:

[I]magine the nominal price of everything in the economy doubled, including wages. TVs that cost $500 now cost $1000, people who earned $50,000 now earn $100,000, etc. The relative prices would all be the same; you’d still have to forgo the same number of pizzas, or work the same number of hours, in order to get a TV. Economists typically think that this kind of change isn’t really important in economic terms; our material standard of living is exactly the same, we just assigned different numbers to things.

This kind of change is what the concept of “inflation” tries to get at. We tend to colloquially think of “inflation” as meaning “an increase in the real cost of living”, but to economists it really means something more like “fiddling with the unit of account”.

So suppose this is how inflation really worked. Who would care if all the numbers change, as long as they all keep pace with each other? On Monday you earn $100 and a sandwich costs $5. On Tuesday you earn $200 and a sandwich costs $10. So what?

This is why economists sometimes say “money is a veil”. We think about prices in terms of dollars, but what we should really care about is how many sandwiches we can buy with an hour of work, and so on.

And sometimes it does really work like that! In the late 60s, inflation accelerated, reaching almost 6% in 1970. But wages kept pace!!

In fact, basic economic theory says that this is what should happen. If inflation is higher, workers should simply bargain for cost-of-living increases in their wages. And basic economic theory says that real wages — wages adjusted for inflation — are what reflect a worker’s real fundamental value, and therefore determine how much she gets paid. If that’s true — if you can just bargain for a COLA when inflation goes up — then maybe money is just a veil.

Now, the purchasing power of wages isn’t the only thing that gets affected by inflation. There’s also savings and debt. Inflation expectations are included in interest rates when loans and investments are made — the faster prices are rising, the higher nominal interest rates will be. But a burst of unexpected inflation makes lenders poorer (since they lent at a too-low interest rate) and makes debtors richer (because they borrowed at a too-low interest rate).

So basic theory says that inflation doesn’t do anything to real wages, while unexpected inflation helps borrowers and hurts lenders. If the average U.S. household is a wage-earning family who owes money on net (e.g. for a mortgage), then the average household should actually like inflation, according to the basic theory. In fact, some people use this reasoning even now!

Thinking about things in this manner, economists tried to come up with reasons people would dislike inflation. Maybe it was about the hassle of going to the ATM to get more cash all the time! Maybe it was actually about the variability of inflation! And so on.

But in fact there’s probably a much simpler reason. People didn’t like inflation because their wages weren’t able to keep up.

Inflation, wages, and savings

Remember the graph from above, where wages successfully stayed ahead of inflation in the 60s? In the 70s, that changed, big-time.

This resulted in a loss of real purchasing power for American workers — people actually got poorer.

It’s possible to see this simply as a case of real wages going down due to the kind of normal things that economists think make pay go down. For example, maybe the oil shocks reduced worker productivity and forced companies to cut real wages.

But it’s also possible that the kind of inflation that happened in the 70s made it hard for wages to keep up. In the late 60s, inflation might have been driven by high aggregate demand (as evidenced by the unusually low unemployment rate in those years), which tends to raise both wages and prices at the same time. But in the 70s inflation was driven by a combination of the oil shocks and the popular belief that the Fed wouldn’t act to restrain prices.

Now, theoretically, workers in that environment could still bargain for higher wages to offset the rising prices. But…what if they actually couldn’t? There’s plenty of evidence that nominal wages are “sticky” in the downward direction — it’s hard for employers to actually cut pay. But what if there are also reasons why it’s hard for workers to get employers to raise pay at an unusually fast clip? Some economists have claimed that this kind of “upward nominal wage ridigity” is a real thing.

And if something constrains the growth of nominal wages, it means that inflation really can make people poorer. In fact, when he did a survey in the 1990s to find out why people dislike inflation, Robert Shiller found that this was exactly why they disliked it:

To summarize the main perceived costs of inflation briefly, the concerns people mention first regarding inflation are that it hurts their standard of living and a popular model they have that makes such an effect plausible apparently has some badly behaving or greedy people causing prices to increase, increases that are not met with wage increases. This might be called a bad-actor-sticky-wage model. That people think wages are sticky is particularly supported by the results for [several] questions[.]

So this is what people think is happening. And you have to admit, when you look at a graph of nominal wages, it sure looks like inflation doesn’t affect it very much:

Look how smooth that looks! (The annual data looks even smoother.) Inflation was bouncing around like crazy in the 70s, and yet nominal wages — the actual number of U.S. dollars that workers got paid — just glided steadily upward.

Now look at a graph of real wages! It’s all over the place! As soon as inflation goes up, real wages crash:

It’s possible that workers’ true market value bounced around all over the place during these decades, and that somehow nominal wages just happened to stay on a smooth unbroken glide path that whole time…but it seems like one hell of a coincidence, does it not?

Just from looking at these graphs, it sure looks like nominal wages are sticky, meaning that inflation — if it happens for the wrong reasons — can reduce workers’ wages and real purchasing power.

But what about debt? Doesn’t unexpected inflation bail people out of debt? Well, only if their wages go up. Wages are the way normal people pay down debt; if wages are sticky, inflation doesn’t actually erode the value of their debts.

But it does erode the value of their savings. Suppose that on Monday you earn $100, you have $100 in savings and $200 in debt, and a sandwich costs $10. Then on Tuesday, thanks to sticky wages, you still earn $100 (and you still have $100 in savings and $200 in debt), but thanks to inflation, a sandwich now costs $20. Your savings, which could buy you 10 sandwiches before, can now only buy you 5 sandwiches! But your debt is still 2 times your income, just like before. In other words, thanks to sticky wages, inflation eroded your savings while leaving your debt the same.

In other words, people probably hate inflation because of upward nominal wage rigidity. That means economists should study upward nominal wage ridigity more. Why is it so hard for workers to negotiate cost-of-living raises? Why was this so hard even in the late 60s and 70s, when unions were much stronger than they are today? What is broken in our wage-setting process?

If we can answer that question, we might have a chance of fixing it. And if we can fix that — if we can figure out how to let workers get paid more when prices go up — then we can make inflation a much less scary thing than it is now.

As Kit said above, "Your analysis gives too much credit to the average guy’s understanding of economics."

A simple reason ordinary people hate inflation is that they don't know much about it and expect that more knowledgeable people will take advantage of them. What was a clear, stable and straightforward earning/investing/buying institution how is changing, forcing them to devote attention to risky strategies: to battle for salary increases, to learn the new rules (if they exist, more likely there is a confusing welter of proposed rules to choose from), to change financial plans, etc.

Other things to consider:

1) inflation greatly bifurcates the range of outcomes for labor. Those with bargaining power will see wages adjust. Those without won’t. The latter falls behind at a quicker pace in a high inflation world. Its may be hard to know in advance which group you’re in.

2) Less wealthy people rationally hold a larger portion of their savings in low-volatility and cash-like investments since they cannot withstand drawdowns. These assets suffer real declines with higher inflation.

3) Consumption represents a higher % of income for the poor. Thus they face a higher burden from the “inflation tax.”

4) 35% of Americans don’t own a home. Higher inflation puts this further out of reach.

5) Inflation seems to be the enemy of productivity. Compare productivity and real wages in the 70s (weak) to the disinflationary 90s (strong).

6) Many older people are on a fixed income. Plus there is a legitimate fear that inflation-adjustments would fail to fully capture actual changes in the cost of living.

7) Taxation increases since tax-bracket cutoff-points are fixed.

8) inflation messes with our sense of fairness. We all know people who save and invest cautiously and people who maximize risk-taking and leverage. We accept that over time the former will achieve lower returns...but to purposely accelerate that process seems a bit unfair.

9) it’s unclear how much (if at all) inflation would help the US fiscal position. A significant portion of our future liabilities are quasi-inflation-indexed (TIPS, healthcare, social security, military spending).