Bloomberg Opinion columnist Theresa Ghilarducci made a lot of people on Twitter quite upset the other day, by writing a post giving personal finance advice on how to deal with inflation:

The column was well-meaning, of course — Ghilarducci certainly does not control the rate of inflation, and there’s no crime in trying to help people deal with it. But Americans, to put it mildly, do not like to be told to accept decreases in their standard of living. Here were some of the suggestions:

When it comes to food, don’t be afraid to explore…Meat prices have increased about 14% from February 2021 and will go up even more. Though your palate may not be used to it, tasty meat substitutes include vegetables (where prices are up a little over 4%, or lentils and beans, which are up about 9%)…It's a more efficient, healthier and cheaper way to get calories…

If you’re one of the many Americans who became a new pet owner during the pandemic, you might want to rethink those costly pet medical needs…

A “cheaper way to get calories” sounds like the kind of thing people are asked to endure during a war. Ditto for letting your pet die. This kind of thing was a hard enough sell in the 1970s, when stock markets were also in the tank; now, when the country is awash in cheap capital and the country’s billionaires are increasing their aggregate wealth by a trillion in a year, telling people to live in the proverbial pod and eat the proverbial bugs sounds more than a bit Marie Antoinette-ish.

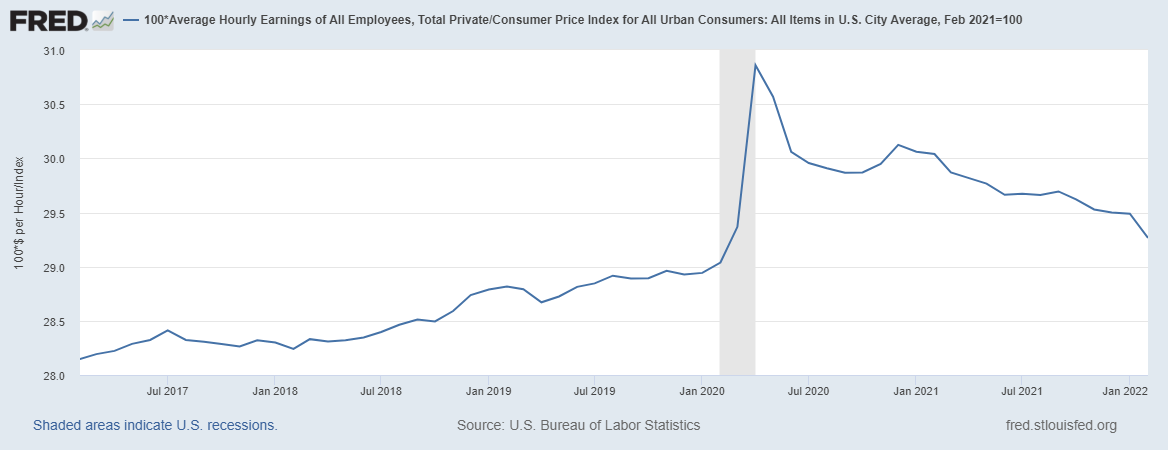

This, in a nutshell, is why people hate inflation. When wages can’t keep up with prices, people get poorer. That’s true even if the inflation is mostly in food and energy (the two things most likely to get more expensive due to the Ukraine war and the sanctions on Russia), rather than the “core” inflation that policymakers use to make their decisions. And here is what has been happening to inflation-adjusted wages in America:

Last year, there was a silver lining to this: While wages went down for the upper and middle classes, workers in the bottom third of the income distribution saw their wages increase faster than prices:

That’s because the economy was booming and adding jobs very rapidly.

But the inflation of 2022 may be a very different animal. Instead of a byproduct of a red-hot economic recovery, inflation going forward is likelier to be driven by supply shocks — expensive energy that raises costs for businesses, and expensive food as well. That’s not likely to be good for the economy, or for low-wage workers.

Anyway, like I said before, Bloomberg Opinion columnists, for better or for worse, are not the ones who control inflation. That task falls to our hard-working and dedicated central bankers at the Federal Reserve. So as inflation grinds on, the question now becomes: When, if ever, will the Fed raise interest rates really high and drive inflation back down? The economic story of the next decade or three could hang on this question.

When does the Fed drop the hammer on inflation?

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.