What kind of financial asset is Bitcoin?

Is it money? Digital gold? A tech stock? Recent events shed some light on the question.

A lot of interesting things have been happening in crypto-world recently, mostly bad for crypto investors but interesting from a financial perspective. The whole asset class has fallen a lot recently, so that now all of crypto combined is estimated to be worth about $1.3 trillion, down from maybe $2 trillion a month ago.

I’m going to write about things like stablecoins in a bit, and also about the possible effects of future crypto crashes on the real economy (this one shouldn’t be particularly dangerous, given the modest size of the paper wealth destruction, the lack of connection with the banking system, and the lack of debt backed by crypto assets.) But for today I want to talk about Bitcoin itself — the granddaddy of the cryptocurrencies. Bitcoin hasn’t fared as badly as some others, but it is down by more than half from its peak:

So lots of people will be wondering whether now is a good time to get into Bitcoin, or whether it’s doomed and they should stay away. I can’t answer that question (for my part, I’m just holding on to the same amount of Bitcoin I bought years ago). But I thought it would be interesting to briefly go through the various theories that people have of Bitcoin as a financial asset. Which theory you believe will determine what you think Bitcoin’s price will do in the future.

Theory 1: Bitcoin as the future of money

This is the most common theory of Bitcoin, especially among the cryptocurrency’s supporters (the most avid of whom are called “maximalists”). In fact, this was the original idea of Bitcoin — it was supposed to replace fiat currencies like the U.S. dollar.

Generally, money isn’t a very good investment. Even if money didn’t depreciate via inflation, it still wouldn’t go up in value very fast — even if there was steady deflation, the cash wouldn’t offer the returns of, say, the stock market, or a house. Those things are risky, and thus their returns will always be higher than that of cash.

Instead, the case for really spectacular Bitcoin returns is that Bitcoin is not now money, but will eventually be money. If this is true, then demand for Bitcoin will eventually be much, much, much higher than it is now, since people will need it to buy everything. Higher demand will mean much higher prices.

In other words, the idea is that by buying Bitcoin now, you’re getting in on the ground floor of the future currency of the land. Imagine that you realized that in 20 years, everyone would be using emeralds for money. By getting your hands on some emeralds right now, you could totally get the jump on everyone else, and make a ton of profit. That’s basically the Bitcoin maximalist case. (Vitalik Buterin, creator of the cryptocurrency Ether, plays devil’s advocate and makes a defense of Bitcoin maximalism here).

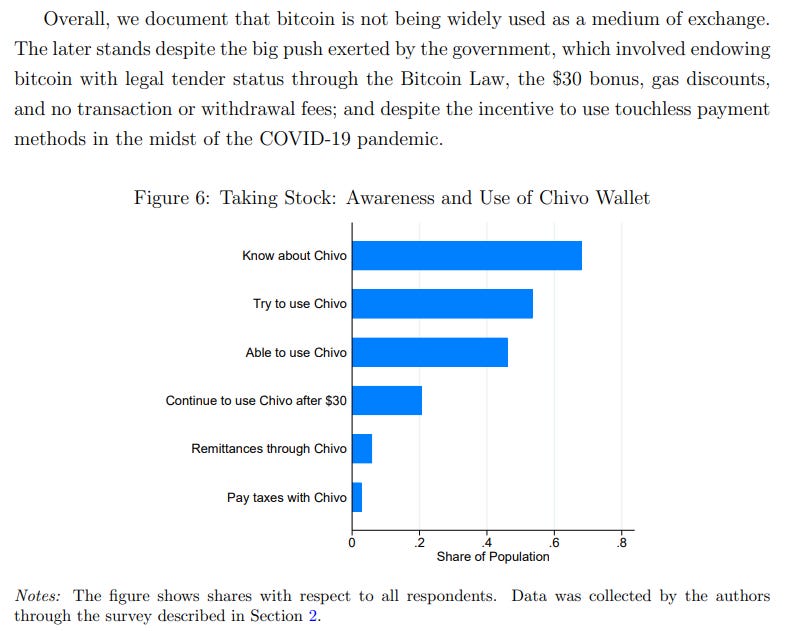

The problem is that so far, there’s very little sign of the Bitcoin maximalist case coming true. In 2021, the country of El Salvador made Bitcoin legal tender (meaning it can be used to pay taxes and debts). It created an app called Chivo Wallet that people could use to make payments in Bitcoin. The government even paid people to download Chivo. And more than half of the country’s citizens did! But as Alvarez, Argente, and Van Patten document in a recent NBER paper, almost no one in the country actually used Bitcoin to pay for anything.

Despite the government’s large incentives, Salvadorans largely didn’t use Bitcoin; businesses largely didn’t accept it.

Economists are unlikely to be surprised by the result. Bitcoin is a very volatile asset, making it bad for making payments — between the time you get your paycheck and the time you go to buy groceries, the amount of groceries you can buy will probably vary wildly. Nobody wants to deal with that unnecessary uncertainty in their daily lives. Just use regular old fiat money.

In fact, El Salvador as a whole is feeling the sting of Bitcoin’s volatility. The country took so big of a financial loss in the recent crash that it’s now in danger of a sovereign default.

Now, Bitcoin maximalists believe that eventually, as Bitcoin’s adoption as a currency increases, the volatility will calm down. But there’s a bit of a chicken-and-egg problem there. As El Salvador showed, adoption won’t rise if volatility is high. So most people will keep treating Bitcoin as an investment asset instead of as a currency. And this will keep the volatility high, since investment assets get traded up and down a lot. That will hold back adoption.

Fiat currencies get around this by tightly controlling the value of money to force volatility to be low. Inflation targeting prevents the value of the dollar, the euro, the yuan and the yen from bouncing around too much. Bitcoin has no such mechanism.

Of course this is only one problem with Bitcoin as money. There are also technological issues, such as the fact that verifying Bitcoin transactions (“mining”) uses an enormous amount of electric power despite only handling a miniscule fraction of the world’s financial transactions. This is probably the main reason China banned cryptocurrencies, and why Europe is thinking about banning Bitcoin as well. No one wants to have all that energy usage in their back yard.

So the idea that Bitcoin will eventually become a major currency still look slim. The maximalist case hasn’t been falsified — indeed, it can never really be falsified — but things aren’t looking good.

Theory 2: Bitcoin as a worthless fad

At the other end of the spectrum we have the people who believe that Bitcoin is a fad — something inherently valueless that will eventually become worthless.

Of course it’s possible that Bitcoin will go to zero; it might be that eventually nearly every location will ban Bitcoin, making it an effectively useless trinket. But if that doesn’t happen, there are reasons to think that the cryptocurrency will not lose its value.

First of all, Bitcoin is widely used in things like cybercrime and evading capital controls and sanctions. Now, you might not think that those activities have social value, but they obviously have financial value. So as long as Bitcoin can be used for those activities, it will have a fundamental value even if no one ever uses it for anything else.

Also, there is a great precedent for a commodity asset to be valued far above its actual use-value: Gold. The total amount of already-mined gold in the world is estimated to be worth about $12 trillion — about 9 times the current total value of all cryptocurrencies combined. Sure, the yellow metal does have some cosmetic and industrial applications, but not $12 trillion worth. Much of the value of gold simply comes from people thinking that gold has value — a self-fulfilling prophecy.

So this has led some people (including myself) to speculate that Bitcoin might function as digital gold.

Theory 3: Bitcoin as “digital gold”

Why is gold valued so highly, above and beyond its value in jewelry and electronics? The reason is its history. For thousands of years, gold was used as money, and there are lots of people who believe that it might one day be used as money again. This is often presented as a doomsday scenario — the idea that gold is the ultimate hedge against the collapse of modern nations and the return to an anarchic system where carrying sacks of rare metal around will be the best way to pay for things. For this reason, gold is sometimes touted as a hedge against inflation, or against recessions — times when it looks more likely that the modern global economic system might fall.

Looking at gold’s price over the past half century, we see that this story isn’t too implausible — it soared in the inflation of the late 70s and the Great Recession of the late 2000s. It also obviously has some relationship to commodity prices as a whole, which went up in the early 2000s and the late 2010s.

But in general, the correlation of gold with inflation is low, as is the correlation with recessions. Gold’s price sort of appears to move on its own, moved partly by commodity prices but partly simply by people’s belief in the story of a return to a world where gold is money.

Bitcoin might conceivably be like that. The legend of Bitcoin — passed down in a million maximalist blog posts and Twitter accounts and forums — might persist, occasionally flaring up when people decide that a recession or inflation or some other scary event heralds the imminent collapse of fiat currencies.

But in fact, although I’ve suggested this story in the past, there are reasons to doubt it as well. Analysts have noted that Bitcoin is increasingly correlated with technology stocks — the correlation with the NASDAQ recently reached 0.82 (for those who don’t know, correlations max out at 1). Bitcoin has fallen substantially during the recent inflation. It did not soar to new heights when Covid struck. And as recession fears have increasingly weighed on the economy, it has fallen even more.

In other words, Bitcoin is not yet being treated as a doomsday hedge. It has idiosyncratic swings, but they look like they’re increasingly correlated with tech stocks. This has led some people to the conclusion that in financial terms, Bitcoin basically is a tech stock.

Theory 4: Bitcoin as a tech stock

There are some good reasons to think of Bitcoin as a tech stock. For one thing, it is literally a technology. For another thing, venture capitalists invest a whole lot of money in crypto applications related to Bitcoin — $33 billion in 2021. Also, lots of the people most interested in buying Bitcoin seem to be people in the tech industry, and tech workers get paid based in part on their own company’s stock value — thus, a fall in tech stock values will tend to reduce demand for Bitcoin.

In fact, it’s pretty easy to see other ways in which Bitcoin’s function as a technology drives its price. The two biggest runups in Bitcoin’s price were in 2017 and late 2020. Those corresponded to two big innovations in crypto-world: the ICO (initial coin offering) boom in 2017 and the DeFi (decentralized finance) boom of late 2020. These bursts of financial and technological innovation involved moving sums of cryptocurrency around, and the most popular cryptocurrency was Bitcoin. Therefore, Bitcoin’s use in technological applications drove its demand, and its price.

But if Bitcoin is a tech stock, then we have to think about if and when the technology becomes obsolete. As mentioned before, Bitcoin is enormously expensive to transact in, due to the vast electricity usage of the proof-of-work algorithm on which it relies. Some alternative cryptocurrencies, like Solana, use a “proof-of-stake” algorithm that uses much less energy. (The Ethereum network, which supports the Ether cryptocurrency, is also planning a switch to proof-of-stake). That could prove a decisive technological advantage.

Also, you can’t really do much with Bitcoin besides trade it back and forth. Whereas the Ethereum and Solana blockchains are optimized for creating smart contracts and decentralized autonomous organizations (DAOs), Bitcoin just mostly sits there like a rock. Packy McCormick puts it thus:

But Bitcoin is limited. It’s kind of dumb. It doesn’t really know much, can’t really change itself, and doesn’t really do anything; “it simply exists, and leaves it up to the world to recognize it.” It really is like gold in that it sits there as people do stuff to it and assign value to it…

Bitcoin does the thing that it was programmed to do really well, but DAOs can theoretically do anything really well…Bitcoin is digital money. Ethereum is a platform on top of which builders can create anything, from apps to entire organizations.

Between that and the energy problem, Bitcoin sounds like a technology that’s in serious danger of going obsolete. In fact, although Vitalik praised the Bitcoin maximalists, the truth is that Bitcoin’s dominance of the cryptocurrency ecosystem is on the wane:

And like a legacy tech company tending faithfully to its aging corporate customers, Bitcoin will probably keep serving its existing pool of adopters — staying pure to the proof-of-work algorithm and to the idea that the purpose of cryptocurrency is simply to be a form of money.

So the “tech stock” theory is a mixed one for Bitcoin’s future. As people develop new stuff to do with crypto, Bitcoin will be used in that new stuff. But as other cryptos get technologically better and better and Bitcoin doesn’t, it will become a diminishing part of the ecosystem.

Tying the theories together

Note that there’s one other feature of Bitcoin that might slow its decline and increase its relevance to the fancy crypto applications of the future — its value as a marketing device for the crypto ecosystem in general.

Ethereum and Solana are weird and complicated and intimidating for normies. Most people probably think a DAO is some kind of ancient philosophy, and haven’t the foggiest notion about proof-of-work vs. proof-of-stake. But most people do understand what it means to spend money. So Bitcoin’s basic pitch — “Here is money that you can spend and which goes up in value over time” — has an intuitive appeal to many people, even if it’s wrong.

As I see it, the useful purpose of this appeal isn’t to make Bitcoin the future of money. That will not happen. Instead, the purpose of all the massive apparatus of Bitcoin-related guff and mythology and gobbledegook is to onboard people into the crypto world. Once they’re onboarded, they can then take the next step of learning about cryptocurrencies that are cooler and more advanced than Bitcoin. (Perhaps it’s no wonder Vitalik is sanguine about the maximalists; in a way, they’re part of his customer acquisition team!)

This theory of Bitcoin as the “gateway drug” of the crypto-verse sort of ties all of the previous theories together. The ideas of Bitcoin as the future of money and Bitcoin as digital gold get people interested. Those people then get introduced to crypto applications like ICOs and DeFi and whatever web3 ends up being. And because the newbies just joining the party come in owning a bunch of Bitcoin, that ends up being one of the main currencies that gets used in the new applications — which slows Bitcoin’s slide into technological obsolescence.

So if this is right, the main thing determining Bitcoin’s future as a valuable financial asset is probably the degree to which innovators can come up with desirable new things to do with blockchains.

I'm a huge fan of Noah. However, this newsletter contains unwarranted hope for cryptocurrency, especially for what can be built on the Blockchain. Noah has always maintained he's an optimist and is a huge fan of technology. Sometimes, optimists are right. This, in my considered opinion, is not one of those times.

My experiences with the quality of the content and discussion on this newsletter convinces me that I would be wasting my and others' time by making the case for why cryptocurrency ironically cannot function as currency.

However, there's something more insidious going on. People untethered to the crypto ideology can already see that they can't work as currencies. Instead, they hold that the Blockchain is the thing with real utility here. Or, in other words, the tokens are worthless but the game board is valuable.

Part of this is due to how many people dismissed the internet and had to eat their words. But the Blockchain and the dot-com boom of the nineties are as far away as Timbuktu and Tarawa.

The internet enabled anyone to send any kind of information at scale within seconds. People just failed to see how that would be useful. It was the same with the car. The mobile car was faster and more efficient than the horse with the advantage of no possibility of fatigue. People just failed to see how that would be useful. They were failures of conservatism for conservatism's sake.

On the other hand, we've had the Blockchain now for thirteen years. The crucial question is not what can it do( people get blindsided here). It is what can it do better than non-blockchain alter natives. The answer is nothing unless you are a criminal, a speculator, or someone in a financial system so broken that anything at all is an improvement.

This is because the Blockchain is a clever solution to a problem that introduces a hundred more. It's like burning the mansion to save the shed. The reason the electricity consumption is so wasteful is because the Blockchain is not secured by cryptography. Some of the only meaningful contributions of cryptography to the Blockchain are the public keys and private keys which we've had since 1976. Marlinspike grasped this in January.

It's so wasteful because the Blockchain is secured by electricity consumption. You can't take control of the system because you would bankrupt yourself doing so. They are mostly financial barriers, not technological.

The reason its transaction rate is so pathetic is because it can't scale. The mining process is not based on knowledge. Making things is based on knowledge and knowledge improves, so efficiency scales. A fancy name for this is Wright's law. But randomness can't scale. You can't get better at guessing lottery numbers. You can only buy more and more lottery tickets. So mining has predictably consolidated in a few hands. The centralization they sought to avoid re-entered through the backdoor.

Of course, miners can't waste expensive electricity and equipment for nothing unless they know someone is on the other side making these transactions. And so, you can't have these blockchains without the speculation. You can't slice the thorn away from the 'rose'.

And then we have smart contracts. My area of specialization is law and the level of meaningful adoption here is around zero.

A smart contract is based on the conceit that the most important things are what goes into the contract. But the most important things are what's outside the contract- the trust and identities of the parties, the regulatory framework, a legal system available for retribution.

No code is perfect. Unlike normal code in which you can just fix your bugs in peace, smart contracts must be perfect from scratch. If a bug is found and exploited, it's over. This happened to the Ethereum founders who then all forgot about their lovely ideals of decentralization. The point is if it can happen to them, why can't it happen to the average programmer.

And it doesn't remove trust. You still have to trust the programmers writing the code, the oracles feeding the data, the stability of the overall platform. Trust is inevitable so why not just start with building more trustworthy systems rather than creating long, dangerous, and unnecessary hoops that will still require trust anyway.

The Blockchain is also irreversible. People complain constantly that Twitter has no edit button so unless you delete the tweet, your mistake is permanent. Well, how about putting your medical records, financial transactions, on a permanently irreversible Blockchain. Your entire life is like one long twitter thread that you can never edit or delete.

Everything the Blockchain sought to eliminate - audits, central banks, centralization - has simply returned. Only this time, far more inefficiently.

If this is what now passes for innovation, we might as well begin an innovation award in the honour of Charles Ponzi. After all, he did start the whole damn thing

Cryptocurrencies are to the real economy what fantasy sports are to the real sports.

And NFTs are like penny stocks.