The U.S. economy is not crashing

But even so, it's probably time for the Fed to start cutting rates.

Here are Noah Smith’s Three Rules for Writing About the Stock Market:

Nobody really knows why stocks go up or down, even though everyone pretends to know.

By the time you write about a stock price movement, whatever happened is already fully priced in. So stocks are just as likely to bounce back as they are to keep moving in the same direction.

Stocks go up and down a lot, so you should zoom out to get perspective on how important a stock price movement really is.

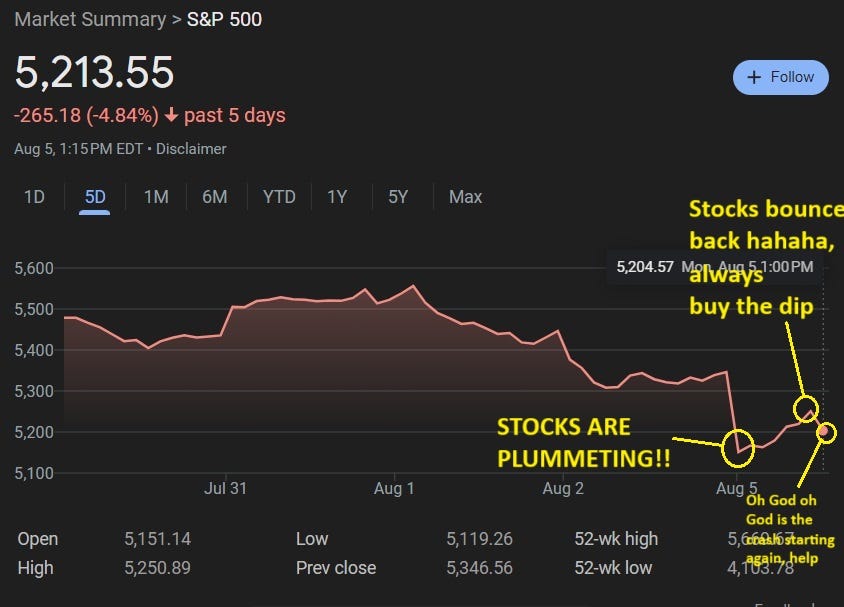

So let’s apply these rules to the big drop in stock prices that happened over the past couple of days. Let’s actually start with Rule #2. Stocks had a big drop over the weekend, but then rebounded partway this morning:

If I had written about this last night, my post could be entitled “HERE’S WHY STOCKS ARE PLUMMETING”. Now that they’ve bounced back a bit, I can still write about declines in stock prices — there’s been a longer, slower decline over the past week — but it doesn’t feel like an abrupt crash. Certainly, comparisons to 1987 — when stocks lost a fifth of their value in a single day — seem a bit overblown.

So how panicked should people be over this drop? Let’s apply Rule #3. Zooming out, we see that as of this writing, even after this week’s decline, stocks are still up almost 10% for this year so far:

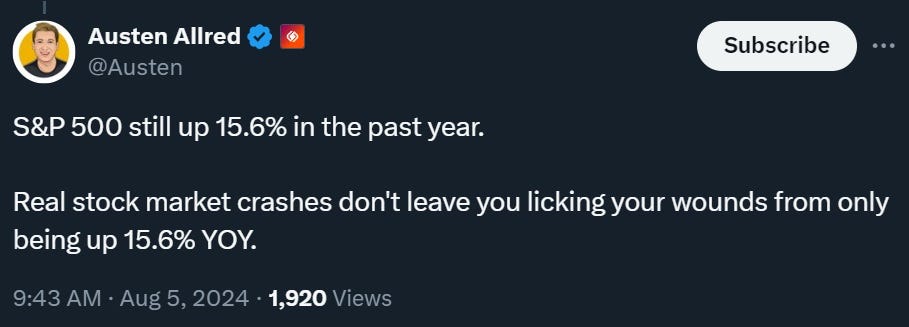

That’s actually a really good performance — the S&P 500’s annual average return is about 10.5%, historically speaking, so 9.9% in just 7 months is better than usual. And over the past year, even after this week, the market is still up by 15.5% — an unusually good performance! Here’s a pertinent piece of wisdom:

OK so, on to Rule #1. Why did stocks decline? We don’t really know. Stocks don’t really need a reason to go down — U.S. stocks are pretty expensive right now, historically speaking, so maybe investors just got jittery about that. On the other hand, the selloff was global, so that probably isn’t the whole story.

In Japan, where the price drop was the biggest — heading into genuine “crash” territory — the story is actually pretty clear. The Bank of Japan raised interest rates, as part of its (so far successful) attempt to stop the yen from weakening too much. Higher rates make stock prices go down. In fact, this might have caused at least part of the global selloff, via general panic, or via over-leveraged global investors being forced to sell U.S. and European stocks to pay back their loans when their Japanese stocks went down in price (or their yen went up). Who knows.

But anyway, let’s get to the reason that most financial journalists are citing for the drop in the U.S. — and the actual reason I’m writing this post. Almost everyone is attributing the stock drop to a slowing U.S. economy.

Here’s the FT:

[R]ecent economic data has punctured the widely held view that global policymakers, led by the US Federal Reserve, will be able to cool inflation without too much collateral damage…Friday’s US jobs report, which showed a much sharper slowdown in hiring than Wall Street anticipated, added to simmering fears that the world’s largest economy is coming under growing strains from high borrowing costs. Corporate executives signalled during the recent earnings season that consumers, who play a central role in the US economy, are beginning to cut back on spending…“Entering this year, investor expectations were for a ‘Goldilocks’ outcome,” JPMorgan equities strategists said on Monday, adding that this narrative was now being “severely tested”…Goldman Sachs said at the weekend that it now believed there was a one-in-four chance of the US falling into recession in the next year, compared with its previous forecast of 15 per cent odds.

And here is CBS News:

Stocks began losing ground on Thursday after weak reports on manufacturing and construction, which stoked fears the U.S. economy may finally be buckling under the pressure of high interest rates…Then on Friday, government data showed that hiring last month was far weaker than expected, adding to Wall Street's fears that a "soft landing," in which the U.S. economy could avoid a recession despite the highest interest rates in 23 years, could instead become a hard landing…"The main factor that has staying power is the economy's slowdown," wrote Wells Fargo head of global investment strategy Paul Christopher in a report. "Investors have been watching household financial stress build for the past two years, but during that time, job growth remained above its December 2009-December 2019 average of 180,000 new jobs per month."…But Friday's jobs report showed that employers added only 114,000 new jobs last month, far fewer than the 175,000 jobs expected by economists, he noted.

This is a perfectly plausible story. High interest rates are supposed to make the economy slow down. And when the economy slows down, so do corporate profits, which makes stocks worth less.

But what’s interesting here is that the economic data coming out doesn’t actually look particularly bad — and yes, that includes the dreaded Sahm Rule. And the economy certainly doesn’t sees to have gotten abruptly worse in a way that should make stocks crash.

Economic indicators still look pretty good

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.