The macro arsonists

Governments have borrowing constraints. Pretending otherwise is very dangerous.

The economic pseudo-theory known as MMT has not been doing well in the court of public opinion in recent years. One of MMT’s basic precepts is that the government doesn’t have a budget constraint — that the only thing stopping the government from borrowing and spending infinite amounts of money is the risk of inflation. Before 2020, when inflation was stubbornly low despite rising deficits and low interest rates, the MMT people were able to wave that danger away without much pushback. But ever since inflation exploded back into the national consciousness in 2021, the notion that fiscal deficits can allow a nation to live without limits has seemed dangerous and even kooky.

The MMT people have responded to this setback by doing what they do best — launching PR efforts to make an end run around their critics and appeal to whomever has not yet learned, through bitter experience, to avoid them. Two years ago they got the New York Times to give them a fawning, hagiographic write-up. The pushback was so ferocious that the paper changed the headline to something more neutral-sounding, but they’ve continued to make a few inroads at the Times. Now they’ve produced a documentary, Finding the Money, advocating for their vaguely defined ideas and calling — as they always do — for more deficit spending.

At one point in Finding the Money, the MMT people interview Jared Bernstein, the chair of Biden’s Council of Economic Advisers. When they ask him why the U.S. borrows money in a currency that we print ourselves, he stumbles over himself trying to give a tactful answer. The MMT people have been presenting this as a tremendous “gotcha” moment.

Progressives are justifiably angry at the MMT people, but conservatives are pouncing. Fox Business thought it was newsworthy, and the Washington Free Beacon even put the clip up on its YouTube account:

This shows that MMT is willing to whisper their pro-deficit message into the ears of conservatives if progressives are unwilling to listen. That certainly fits with their history — Stephanie Kelton, the current face of the movement, has written that fiscal deficits are a way for rich people to pay lower taxes, and the hedge fund manager Warren Mosler, MMT’s founder, got some of his ideas from Art Laffer.

Ultimately, MMT as a movement doesn’t really matter — the econ journalism world will eventually shun them, just as Bernie Sanders and AOC both did after some initial flirtations. But the idea that they promulgate and represent — that deficit spending doesn’t really cost the taxpayer anything — has taken on a life of its own. I see this idea used to justify things like student loan cancellation, on the grounds that nobody is really footing the bill:

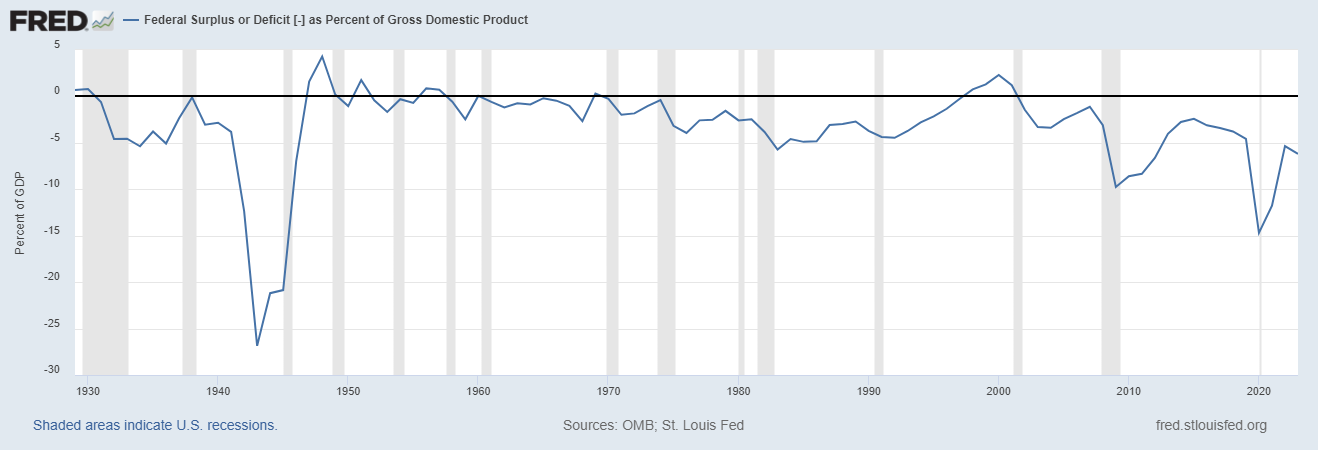

Ideas like this matter, because the U.S. government is currently borrowing money at a rate that’s unprecedented outside of war, recession, or natural disaster:

Is this fine? Of course everyone wants to think we can get something for nothing, which is why tweets like the one above are popular. But it’s just not correct — the government does have constraints on how much it can borrow. The MMT people, to the degree that they even have concrete ideas as opposed to poorly defined memetic verbiage, are wrong. And yes, there’s a good reason the government borrows in a currency that it can also print.

Yes, the government has borrowing constraints

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.