The fiscal arsonists

Please stop playing weird political games with the U.S. fiscal system.

I regret to inform you that once again, people are playing weird political games with the U.S. fiscal system.

For those of you who don’t know, the United States has a law stipulating a maximum amount of debt that the federal government can issue. Currently, this limit is set at about $31.4 trillion. If we want the government to borrow more than that, Congress needs to periodically pass laws to raise the ceiling, over and over.

The debt ceiling is a very silly law, for two reasons. First, it’s not adjusted for inflation. But second, and far more importantly, it gives irresponsible politicians the ability to hold the functioning of the U.S. government hostage over and over and over. And for the last 12 years, this is exactly what they’ve been doing.

Before 2011, Congress would just raise the debt ceiling whenever necessary. But in 2011, the Republican-controlled Congress — often referred to as the Tea Party Congress — got the brilliant idea that if they refused to raise the ceiling, they could force the President to agree to whatever they wanted. In this case, what Congress wanted was to cut government spending. They could simply pass a budget with a bunch of spending cuts, but President Obama likely would have vetoed that, just as President Clinton did in 1996. The GOP got the worst of that exchange. So this time, they decided to get around the President’s veto power with debt ceiling brinksmanship.

This was a very dangerous thing to do, because it put the U.S. in danger of a sovereign default. The danger wasn’t as immediate as some claimed — there were plenty of desperate, last-ditch fiscal tricks the U.S. could do to keep making payments even after the debt ceiling had been reached. And in this case, a “default” wouldn’t initially mean a failure to make payments to holders of Treasury bonds — at first, it would simply mean that the U.S. government would be unable to make payments that it’s legally required to make, such as Social Security payments, salaries for the military, etc.

But even that sort of technical default could easily shake creditors’ faith that the U.S. would make payments on its bonds. As it was, even though the Tea Party Congress and President Obama eventually agreed on a package of spending cuts and tax hikes to end the 2011 standoff, a lot of people were freaked out. Debt ratings agencies, whose ratings typically reflect conventional wisdom, downgraded U.S. sovereign debt for the first time ever.

At this point it’s worth mentioning that a U.S. sovereign default would be really, really bad. Defaults hit a country’s financial system hard, since a country’s banks tend to hold a lot of that country’s government bonds, so if those bonds suddenly aren’t worth as much, the banks become insolvent. The government also suddenly finds it much more difficult to borrow (for obvious reasons!), which causes deep and immediate spending cuts. All of this invariably causes a deep recession.

But a U.S. sovereign default would be far more apocalyptic than the typical default. This is because U.S. government debt is held not just by U.S. banks, but by banks all over the world, because Treasuries are considered such a safe asset. This is what people mean when they say that the U.S. dollar is the “reserve currency”.

A U.S. sovereign default wouldn’t just bring down the U.S. financial system, but the global financial system as well. There would be economic chaos, disruption of trade, widespread recessions, and a rapid reordering of the entire global order — which would most likely involve wars. So to quote Peter Venkman of the Ghostbusters, “Yeah, that’s bad.”

Fortunately, we didn’t go very far down the slippery slope to this sort of disaster in 2011. If investors had believed that the probability of default was imminent, they would have started charging the U.S. government a default premium, meaning that interest rates would have risen. They didn’t. It seems investors took the ratings agencies’ downgrade as a warning rather than a full-fledged alarm, and the 2011 debt ceiling crisis was resolved.

But that doesn’t mean that what the Tea Party Congress did was OK. It took us one step down the slippery slope toward catastrophe, and that’s one step too many. Americans were not happy about this — Congress’ approval ratings fell to all-time lows after the episode, and though Obama’s approval rating fell too, the GOP’s debt ceiling brinksmanship might have been a factor in Mitt Romney’s defeat in 2012.

The worst result of 2011, though, was that debt ceiling brinksmanship became a regular part of the GOP’s political toolkit. Right now, we’re in the middle of the biggest debt ceiling fight since 2011, with Congressional Republicans holding the process hostage and demanding spending cuts.

Now, I should take a moment and point out that spending cuts would be just fine right now. Inflation is still above target, and fiscal austerity probably does reduce inflation a bit (which is why tax hikes were part of the Inflation Reduction Act). And real interest rates aren’t high yet, but they’re higher than they’ve been in a while, so government borrowing is getting a bit more expensive.

Furthermore, except for support to Ukraine (which is not costing us very much at all) there’s no obvious emergency that the government needs to be spending extra amounts of money on. The pandemic is as over as it’s ever going to be. With employment levels near historic highs, there’s no aggregate demand shortage that needs to be countered with fiscal stimulus. And yet despite the fact that there’s no emergency, deficits are still very high in historic terms:

In other words, we could afford to do some austerity right now, and a combination of spending cuts and tax hikes is a reasonable way to do it.

But if you want austerity, the correct way to do it is to pass spending cuts in Congress, and iron out a budget deal with Biden through the normal process that we successfully used in the centuries before 2011. Using debt ceiling brinksmanship to try to force this austerity is an absolute clown show. It makes the U.S. look like a banana republic — once again, the Treasury is being forced to resort to scrambling, desperate measures to make its payments. That’s hardly the image we want to be projecting to the world at a time when Russia and China are challenging our global leadership. And a spike in policy uncertainty decreases the chance that the Fed will pull off a soft landing, and increases the risk of recession.

On top of all that, this debt ceiling fight looks like less like a serious policy battle and more like the GOP going through the motions. Mitch McConnell, who helped spearhead the confrontational approach in 2011, recently declared that the debt ceiling would eventually be raised and that the U.S. will never default. On the investor side, nobody seems to actually believe the Republicans will force a default this time either.

So if that’s the case, why engage in any of these theatrics in the first place? It’s conceivable that the whole thing is just Congressional Republicans trying to signal toughness and partisanship to their riled-up voter base, in order to create cover for furtive but substantive bipartisan action — to pretend that they’re still the fire-breathing Tea Party Congress of 2011, while secretly getting a bunch of pragmatic stuff done.

But if so, the debt ceiling is an absolutely boneheaded way of creating political cover. The business world is getting mad at the supposed “party of business” over this tomfoolery, and rightly so. If Republicans want to signal toughness to their base, surely they can find some low-stakes symbolic culture war fight, instead of pretending to threaten the full faith and credit of the global reserve currency.

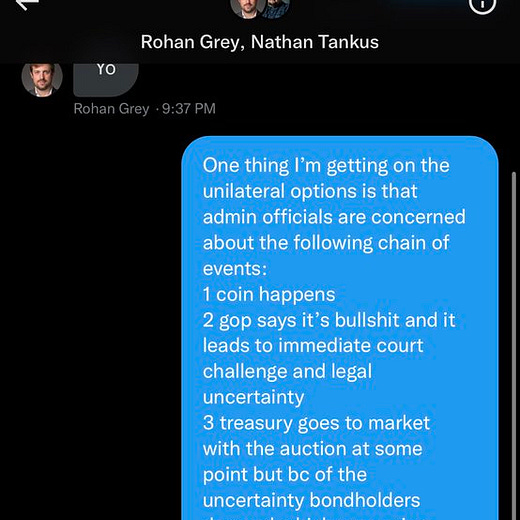

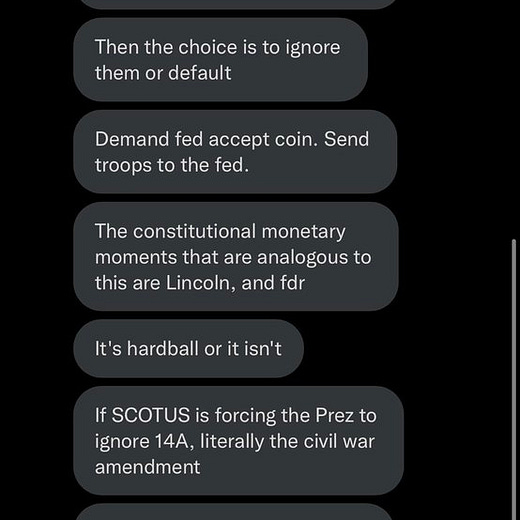

On top of that, debt ceiling brinksmanship just encourages even worse fiscal arsonists who are lurking out there in the margins of the political-economic discourse. The idea of minting a trillion-dollar platinum coin as a way to get around the debt ceiling is cute and fun, but some of the people pushing this idea are absolute maniacs. In a discussion with economics reporter Jeff Stein, two supporters of the idea proposed ignoring orders from the Supreme Court and sending troops to the Federal Reserve:

Nathan Tankus and Rohan Grey are two of the most aggressive purveyors of MMT, the infamous pseudo-theory that advocates relentlessly for more deficit spending. It’s not entirely clear whether they think they could use a constitutional crisis to further their wacky fiscal ideas, or whether they want to use their wacky ideas to create a constitutional crisis, but at this point I think that question is a bit academic. What is clear is that people like this should never, ever, ever be allowed within intercontinental ballistic missile range of the actual levers of power. If you think a U.S. technical default would throw our country’s credit into disrepute, just imagine what defying the Supreme Court and sending troops to storm the central bank would do.

But I didn’t come here to rant against the fringe. It’s crucial to realize that if the Congressional Republicans weren’t playing pointless games with the debt ceiling, economics reporters at major national newspapers wouldn’t have any reason to be listening to the MMT people in the first place. Fiscal arsonism on Twitter is sadly to be expected, but fiscal arsonism in the halls of the legislature of the world’s most financially important superpower is absolutely inexcusable. The rising chorus of voices demanding a permanent bipartisan reform of the debt ceiling law is absolutely correct — the madness that began in 2011 has gone on long enough.

Just sick and tired of ‘business’ leaking their frustration about Republicans but continuing to give them money

If they think this is a danger and the danger is only coming from one place then turn off the taps FFS

"But if you want austerity, the correct way to do it is to pass spending cuts in Congress, and iron out a budget deal with Biden through the normal process that we successfully used in the centuries before 2011."

And if you want to avoid these perpetual crises, then offer a reasonable budget to moderates (including this Democrat) who find the extraordinary explosion in federal spending and deficits objectionable. Medicaid should be a matter for the States; the social security eligibility age needs to be pushed out; drunken-sailor-spending like student-loan bailouts needs to be eliminated and excoriated as growth-reducing redistribution to people who made bad but free choices; negative income tax should be used for 70-80% of the population; an income taxes can go up for the top 20-30% without objection here.