The economics of "Rich Men North of Richmond"

It made some good points, and some not-so-good points.

I was going to blog about the economics of industrial policy today, but I guess I’ll postpone that slightly. Instead, today I’m going to write about the song that’s taking the nation by storm: “Rich Men North of Richmond”, a viral hit by independent country singer Oliver Anthony. Here’s a video:

And here are the lyrics:

I've been sellin' my soul, workin' all day

Overtime hours for bullshit pay

So I can sit out here and waste my life away

Drag back home and drown my troubles away

It's a damn shame what the world's gotten to

For people like me and people like you

Wish I could just wake up and it not be true

But it is, oh, it is

Livin' in the new world

With an old soul

These rich men north of Richmond

Lord knows they all just wanna have total control

Wanna know what you think, wanna know what you do

And they don't think you know, but I know that you do

'Cause your dollar ain't shit and it's taxed to no end

'Cause of rich men north of Richmond

I wish politicians would look out for miners

And not just minors on an island somewhere

Lord, we got folks in the street, ain't got nothin' to eat

And the obese milkin' welfare

Well, God, if you're 5-foot-3 and you're 300 pounds

Taxes ought not to pay for your bags of fudge rounds

Young men are puttin' themselves six feet in the ground

'Cause all this damn country does is keep on kickin' them down

Lord, it's a damn shame what the world's gotten to

For people like me and people like you

Wish I could just wake up and it not be true

But it is, oh, it is

Livin' in the new world

With an old soul

These rich men north of Richmond

Lord knows they all just wanna have total control

Wanna know what you think, wanna know what you do

And they don't think you know, but I know that you do

'Cause your dollar ain't shit and it's taxed to no end

'Cause of rich men north of Richmond

I've been sellin' my soul, workin' all day

Overtime hours for bullshit pay

This is basically a right-populist anthem, containing a swipe at Yankees and references to standard conservative hobbyhorses like taxes, welfare, inflation, and cancel culture. I highly doubt that anything I write about it could change the opinions of the song’s fans, if they even read this blog, which they probably don’t. But it’s still interesting to think about how many of these complaints about the modern world hold water.

The short answer is that about half of them do. Anthony is right to complain about low wages for factory work, and obesity and suicide are huge problems in America right now. But low-paid workers actually aren’t getting taxed much, and food stamps help fight hunger a lot more than they encourage obesity.

Factory work really doesn’t pay all that much, but at least it doesn’t get taxed highly (and miners are doing OK)

First, let’s talk about “working all day/ Overtime hours for bullshit pay”. Anthony isn’t making this up; he actually was a factory worker. Factory workers in general have seen their pay lag the national average in recent years. And factory workers in Anthony’s home state of Virginia earn earn even less, and have been falling behind even more:

In inflation-adjusted terms, manufacturing wages have been pretty flat over the last two decades, but Virginia production workers earn less than they did in 2010. When Anthony sings “your dollar ain’t shit”, he's presumably not making some goldbug/Bitcoin reference — he’s talking about the real erosion in purchasing power that people in his social class have experienced in recent years.

And in absolute terms, an hourly wage of $24.62, multiplied by a 40-hour workweek and a 50-week work year, equals a pretax income of $49,240. That’s above the median personal income (which includes people who don’t work), but it’s lower than the 2022 median wage of $54,132. And that’s for a job that’s almost certainly more tiring, boring, dirty and dangerous than the average occupation. Also, keep in mind that $24.62/hr. is the average wage for Virginia factory workers, meaning that more than half of workers make less than that.

As a side note, miners — which Anthony says he wishes politicians would look out for — are doing a bit better than factory workers. Their wages are about 20% higher than the national average.

Anyway, back to the manufacturing worker we discussed above, who makes $49,240 a year. Does their paycheck really get “taxed to no end”? Here we use SmartAsset’s Virginia Paycheck Calculator, which includes federal, state, and local taxes. Putting in the zip code for Anthony’s hometown, I found that someone who makes $49,240 in Virginia will take home $36,960, or $3,080 a month. That’s…not a lot. It’s important for the professional-managerial class types who read blogs like this one to remember that that’s the kind of income the average American lives on.

Anyway, this worker’s total tax rate is 24.3%. A 24.3% tax rate isn’t high, but it isn’t low either. Some economists estimate that rich Americans (whether north of Richmond or not) pay only 23% of their income in taxes. That doesn’t seem fair, since a quarter of a rich person’s income won’t make a huge difference to their quality of life, while a quarter of a working-class person’s income makes a huge difference. We should tax rich people more.

BUT, it’s also true that the working-class taxpayer is getting substantial benefits. Almost a third of the Virginia worker’s taxes are FICA taxes, which will come back in the form of old-age Social Security benefits (which are roughly proportional to income at low income levels), and Medicare (if they need health care in old age, which they will). And as for the remaining 2/3 of the tax burden, some of that goes to public goods that will directly, immediately benefit the working class too — better roads, public health, and so on — as well as to income security and programs like Medicaid that will be very useful if they get laid off or have some other economic crisis.

There is still some redistribution from the working class to the poor — housing assistance, food stamps, and so on — as well as to veterans. But overall it’s not taking a big bite out of Virginia manufacturing workers’ paychecks — maybe 2% for the hypothetical worker described above.

What can be done to help factory workers in the U.S., and especially in states like Virginia? Well, on an individual level, production employees can try to unionize, and they can vote for (usually Democratic) politicians who support labor unions. Virginia has one of the lowest union affiliation rates in the country — just 3.7%. Increasing that number wouldn’t vault factory workers into the upper middle class, but it would definitely help with that “bullshit pay”.

At the government level, besides supporting unions, the government could make the tax system even more progressive than it is — tax rich people more and hand the proceeds to everyone else in the form of cash or tax cuts. Of course, doing that will require overcoming the objections of conservatives, who will denounce universal programs for directing money toward people they consider undeserving.

One problem with right-populism is that when it comes down to the actual economic policies that would move the needle for working-class people, they end up looking a lot like left-populism.

Food stamps fight hunger, may slightly increase obesity, and don’t cost taxpayers much

Anthony’s song spends several lines complaining about obesity, arguing that government programs are promoting overeating while failing to combat hunger:

Lord, we got folks in the street, ain't got nothin' to eat

And the obese milkin' welfare

Well, God, if you're 5-foot-3 and you're 300 pounds

Taxes ought not to pay for your bags of fudge rounds

Obesity is certainly a huge public health problem in the United States. And though the goals of the fat acceptance movement are noble, I think conservatives are right to criticize this movement for downplaying the public health aspect of the issue. Estimates for the annual excess health costs related to America’s obesity epidemic range from the hundreds of billions to $1.72 trillion. That upper estimate is 9.3% of our entire GDP. Obesity is absolutely making us poorer as a country, and we need to do something about it.

That “something” is almost certainly not cutting food stamps. There is a lot — and I mean a lot — of research on the question of whether food stamps promote obesity. People have thought long and hard about this question, and attacked it from multiple angles, and the general consensus seems to lie somewhere between “no it doesn’t promote obesity” and “it promotes obesity a little bit”, depending on your assumptions about who selects into the program. Yes, there is a chance that taxes are paying for some obese people’s fudge rounds (which I just now learned are actually a real dessert!). But the effect, if it exists, is quite small, and it can probably be canceled out just by tweaking the food stamp program to incentivize people to buy healthy foods.

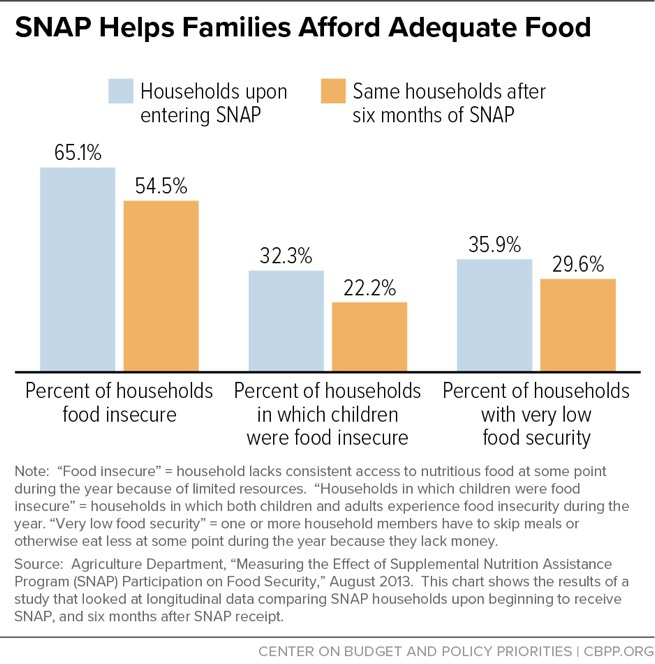

And if you’re worried about “folks in the street [that] ain’t got nothin’ to eat”, well, food stamps are a decent tool for fixing that. There’s very little doubt that food stamps reduce hunger. For example, here’s a 2014 study by the Department of Agriculture that compares people who just started the program with people who have been in the program for 6 months. It finds that food security improves when people get food stamps. Here’s a graph:

So, on one hand, this is…not amazing? You’d think a program that just gives people all the food they need would manage to reduce food insecurity by lots more than one-fifth. That modest effect speaks to the complexity of poverty in America, and the difficulty of solving it with simple interventions.

But even if food stamps don’t solve hunger, they certainly cut down on it. And at $119.4 billion in 2022, the cost is not tremendous. If you’re worried about people starving in the street, this is a program you should definitely want to keep, even if we do need to tweak it to encourage healthier eating.

Suicide and cancel culture

That leaves two other social problems that Anthony complains about: suicide and cancel culture.

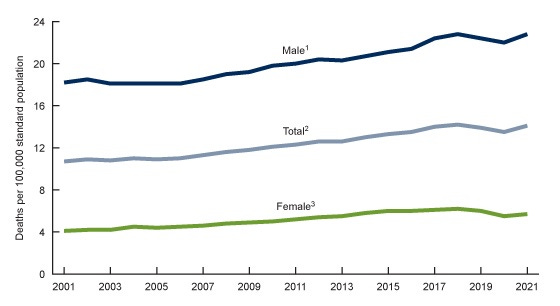

The first of these is certainly a major problem. Anthony sings that “Young men are puttin' themselves six feet in the ground/ 'Cause all this damn country does is keep on kickin' them down”. I don’t know if he’s right about the reason, but he’s certainly right about the fact. Suicide rates are at all-time highs, male suicide rates are much higher than female rates, and the gap has increased:

He’s also right about the “young” part. Suicide among the old has actually declined recently, while suicide among the young continues to rise relentlessly:

I don’t know what the country needs to do in order to stop the suicide epidemic, but trying to not kick young people down seems like a good general principle.

Finally, there’s cancel culture. Anthony sings:

Lord knows they all just wanna have total control

Wanna know what you think, wanna know what you do

This is certainly true; people are busybodies who want to control your life. But I doubt the rich men north of Richmond themselves are more interested in this than the average bored middle-class teenager. And really the problem here is just the internet — it used to be that everyone’s actions and thoughts were controlled by their busybody neighbors in small towns, and then we had a few glorious decades where cars and urban life let you live on your own, away from prying eyes, and then social media came along and turned the world into a bunch of small towns again. Sigh.

But it’s not a conspiracy. It’s just something we have to adjust to, given the march of technology. More people will leave centralized social media networks like Twitter and go back to small-group forums and discussions, and “mind your own business” will make a comeback as a moral nostrum in America.

Anyway, overall I sympathize with most of the problems that Oliver Anthony sings about. We do live in a country with long hours and wages that are often low and stagnant. Obesity and suicide have become increasingly dire social ills. To reject these complaints simply become they come from a right-populist would be a big mistake. But to focus on welfare programs or undeserving welfare recipients as the root of these ills, as right-populism does, is deeply misguided. Tax cuts just aren’t the solution to what ails America.

A frustrating thing about the discourse in with this specific song is that the gripe appalachian populists have with welfare programs is generally not with food stamps, but with social security disability payments. Upwards of 25% of some Appalachian counties are on SSDI getting ~600/month. High school kids have 2 paths “get a job” or “get checks”, and there is a lot of legitimate derision of the abuse of disability income in Appalachia.

"That’s…not a lot. It’s important for the professional-managerial class types who read blogs like this one to remember that that’s the kind of income the average American lives on."

/me makes about the same amount, looks around, wonders how many other readers are evidently not in my shoes.