The conquest of the post-pandemic inflation

The Fed, with an assist from oil prices, is steering us toward a soft landing. But it's not a done deal yet.

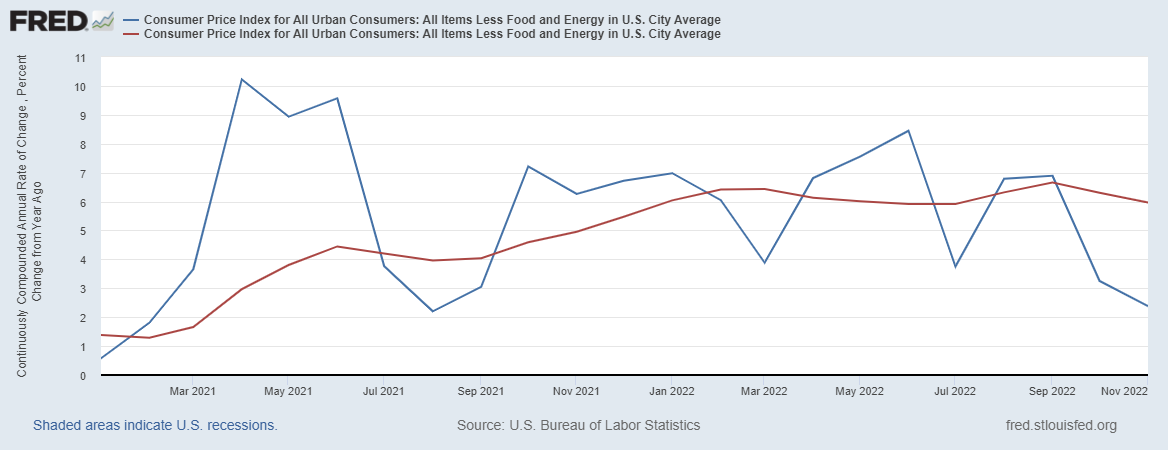

So, two big pieces of news on the monetary policy front today. The first is that core inflation is down:

In month-over-month terms (the blue line), it’s down almost to the 2% target! That doesn’t mean inflation is almost beaten, of course. Remember that month-to-month is more volatile and can bounce back up; just look at what happened after August 2021. But it’s a good sign. And when we look at other measures — for example, substituting private data on new rental contracts for the CPI’s standard rent measure (which includes leases signed back when inflation was higher) — we see an even better picture:

There are two basic reasons inflation is falling — interest rate hikes and fading supply shocks. As I’ll explain in a bit, it’s not clear how much credit to allocated to each of those factors. But both are bullish for the economy (and, probably, the stock market) over the next year or two.

The second big piece of news is that the Federal Reserve raised interest rates yet again, by 50bp (0.5%), to 4.25-4.5%. In most cases hike of that size would be considered major, but given that the Fed had been doing 75bp hikes in recent months, this represents a bit of a deceleration.

So when does the Fed stop raising rates and start cutting them? There have been increasing calls from progressive politicians and commentators for an end to the tightening cycle. Some have also suggested that the Fed should raise the inflation target to 3%, which would mean loosening earlier. Personally, I doubt the Fed will do either of those things, and I’ll explain why shortly.

But the overall message here is that the surge of inflation in the post-pandemic world looks less and less like the new normal. One way or another, the inflation of the early 2020s is being conquered. And that’s a good sign for economic, social, and geopolitical stability.