The Biden Boom

We kept ourselves out of debt, so now we're enjoying a speedy recovery.

The official numbers aren’t in yet, but In the 4th quarter of 2021, the United States economy is believed to have grown by about 5.5% or 6% (annualized rate). That’s a pretty incredible number, when you consider that the consensus forecast for China is only 3.5% in the same quarter. But things get even more impressive when you look at the employment numbers. The unemployment rate probably fell to 4.1% in December — a number below what we used to think to think of as the “natural rate” of unemployment.

If you told me in April 2020 that unemployment would be 4.1% by December 2021, I’d have laughed in your face. And yet here we are.

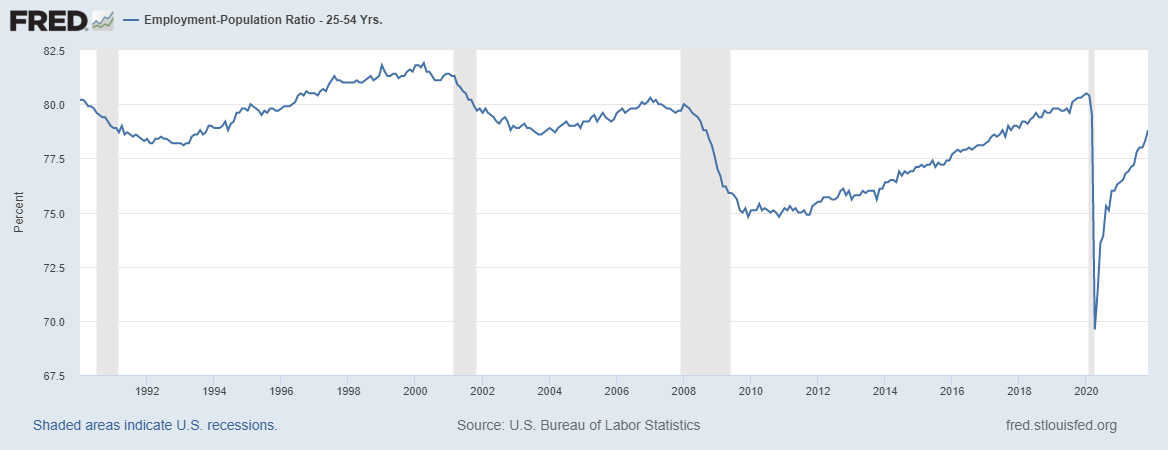

Of course, after the Great Recession, we all got very used to looking past headline unemployment numbers, to see who is actually working. But now when we do that, we see that all the other numbers tell the same story. U6, the broadest measure of unemployment plus underemployment, is down to the level of 2018 or 2006. And my personal favorite labor market indicator, the prime-age employment-to-population ratio, is back to the level of late 2017:

Other indicators also show an extremely healthy labor market. While some have interpreted rising quits as a sign of a “Great Resignation”, the truth is that this mostly just reflects job churn; people are quitting in order to get better jobs, because the opportunities are so good. To see that, check out this graph from the Economic Policy Institute, showing that hires are greater than quits pretty much everywhere:

And the most amazing thing is that this labor market still has more room to run. The Beveridge Curve — which plots unemployment versus the vacancy rate — shows that even though unemployment is low and falling, the number of job vacancies remains historically high:

And for workers at the bottom of the distribution, this red-hot labor market has been raising real wages, even as inflation erodes the pay of the people higher up.

This looks like an economy that’s close to topping out — but growth is still over 5%! Any way you slice it, that’s an economic boom.

Now, there will be two main objections that people raise to this simple, optimistic story. The first, of course, is inflation; consumer prices have been rising at an annualized rate of somewhere around 6-10%, the fastest since the early 1980s. And of course I’m not going to deny that this is a problem, particularly for the people in the middle and upper classes who are seeing their salaries eroded.

But remember that some degree of inflation is just what we’d expect to see in an economic boom. The old classic theory was that high growth comes with high inflation — like in the late 1960s. That theory has plenty of problems with it, of course. And we all know that the current high inflation isn’t purely a function of a hot economy — it’s also due to supply chain snarls. But some of our inflation is simply due to the fact that people have a lot of money to spend right now.

The second objection will be that Omicron is likely to quash this boom. I don’t think so. First of all, the Delta wave didn’t put much of a dent in the boom, nor did the incredibly deadly winter wave of original Covid a year ago. And for vaccinated people Omicron is considerably less dangerous than Delta, while the unvaccinated who are in real danger don’t tend to be the kind of people to stay inside out of fear of the virus anyway. So while there might be a mild slowdown in the first one or two quarters of this year, I heavily doubt that Omicron will stop the boom in any meaningful way.

The economy is doing startlingly well, and we need to recognize that. So now let’s think a little bit about how we managed this, and who gets the credit.