Suddenly startups are having trouble raising money. Why?

A few reasons for the big VC funding crunch.

About a month and a half ago, I started noticing my friends in the tech startup world getting grumpier. Founders were suddenly saying that they were having trouble raising money, and VCs were grumbling that they couldn’t find good deals.

That got my attention, because for over a year the story had been the exact opposite. If you don’t know a lot of people in startup-world, it’s hard to imagine just how flush with cash the whole sector has been since late 2020. Random people you sort-of know became billionaires overnight. People who used to talk about raising millions of dollars now talked about raising hundreds of millions of dollars. And so on. The word “unicorn” — a startup worth over a billion dollars — was no longer particularly impressive. Instead you heard words like “decacorn”.

Then suddenly the winds shifted, and everyone was talking about a funding crunch. So far the numbers honestly don’t look apocalyptic. Here’s a chart from Carta that’s been making the rounds:

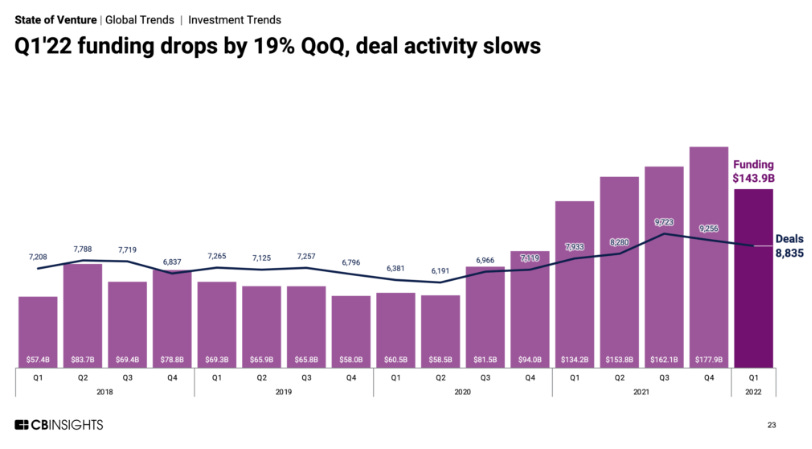

And here’s a graph of overall funding from CB Insights:

(Hat tip to Cat Wu of Index Ventures for some of these references!)

If you want more charts and breakdowns, here’s a good Crunchbase article from a month ago. They all show the same thing — a double-digit decline, but not nearly enough to reverse the huge boom of the last two years. There have been a few high-profile companies that have either died or are in big trouble, but that’s sort of par for the course in a high-risk sector. A couple folks I know are still raising absolutely enormous rounds. Matt Turck of FirstMark has a post in which he argues that it’s just a modest, healthy correction.

But the trend certainly has a lot of people in startup-land worried. April data showed a continued slowdown, so there’s a chance this might only be the beginning of a protracted and severe VC pullback. Nathan Baschez has a widely read Twitter thread in which he forecasts a general decline in the tech sector as a whole:

So to understand where this is going, it probably helps to think about what’s driving the pullback. Here are five possible reasons, in order from the bleedingly obvious to the wildly speculative: