Should you give $600 to Scrooge, or to Tiny Tim?

A post of Christmas present.

The other day, Sharif Sourour tweeted the following:

The following day, the Wall Street Journal published an op-ed by Phil Gramm and Mike Solon, entitled “In Defense of Scrooge, Whose Thrift Blessed the World”. The op-ed argued that thrifty businesspeople like the Dickens character of Ebenezer Scrooge were responsible for lifting the world out of poverty.

Both tweets make basically the same argument: Poor people waste money via consumption, while rich people invest money productively. Therefore, concentrating money in the hands of the rich makes the world wealthier, while concentrating it in the hands of the poor makes the world poorer.

Is this true? Suppose you have $600. Will you make the world a better place by giving it to the rich, miserly Ebenezer Scrooge, or to his struggling employee Bob Cratchit and his disabled son Tiny Tim?

Well, you should give it to Tiny Tim. But to see why, it’s time for another ECONOMICS EXPLAINER!

What will they do with the money?

It’s well known that rich people have higher savings rates than poor people. The top 1% save about 30-40% of their money, while the bottom 90% save only a few little bit.

But this doesn’t tell you what people will do with a sudden $600 Christmas present. It only tells you what people do with their regular income. Those things are different. If you give $600 to a poor person, they might use it to pay off payday loans or other debts, which counts as saving. The $600 check might just them a little bit of a reprieve. So giving out checks to the poor might be just as effective at raising national saving as giving them out to the rich.

In fact, stingy rich misers like Scrooge might be more likely to spend the $600! Economists Greg Kaplan, Giovanni Violante, and Justin Weidner found in 2014 that a substantial number of rich people keep all their wealth locked away in assets like stocks and real estate, and change their consumption as their income changes. They hypothesize that this is because these people are basically SO dead-set on earning the maximum return on their savings that they refuse to hold any cash. So they just keep everything in the market, and consume whatever extra bits of money come their way. In fact, this is pretty reminiscent of Scrooge himself, who is so miserly that he goes home and eats gruel every day, so that he can save more money!

In other words, if you want to increase national saving, you might want to give the $600 to Tiny Tim instead of to Scrooge!

But then the next question is: Do we really want to increase national saving? Is that a thing we want to do? And the answer is: Maybe not.

Savings vs. investment

Sourour, Gramm and Solon — the pro-Scrooge people — think we should make the nation richer by encouraging business investment. Business investment is when businesses buy buildings and equipment, train workers, buy software, do research, etc. Ultimately, if we didn’t do any of that, we’d be a very poor country indeed. So business investment is definitely important for making a country rich.

But does someone saving more money — whether they be Scrooge or Tiny Tim — actually increase the amount of business investment? Maybe not.

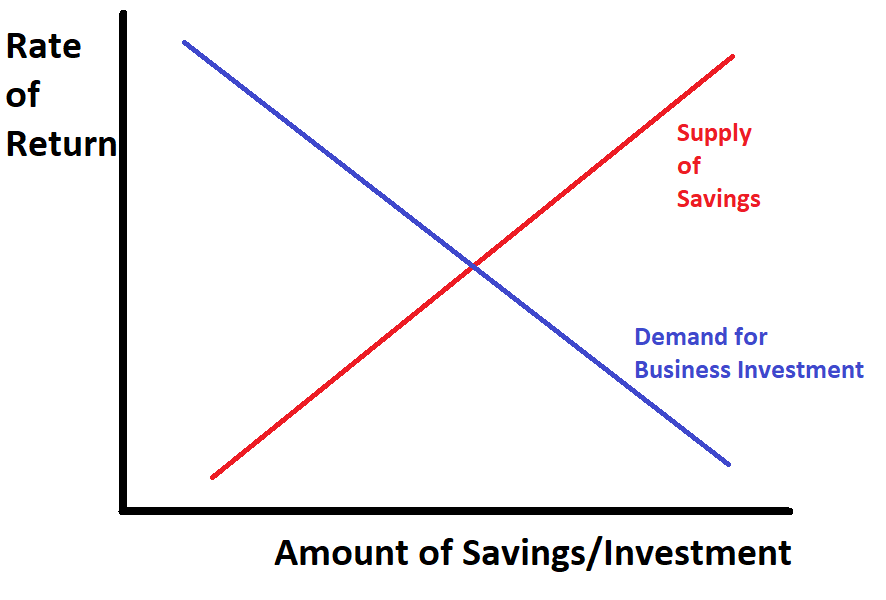

To see, why, let’s think about the supply and demand for savings. The supply of savings is just the amount that people want to save. The higher of a return they can earn on their savings, the more they want to save. Meanwhile, the demand for savings is just the amount that businesses want to do business investment. The more they have to pay to do business investment — in other words, the higher a rate of return they have to offer to the savers — the less they want to do. So it looks like this:

The point where the two lines cross is the amount of savings AND the amount of business investment that actually gets done.

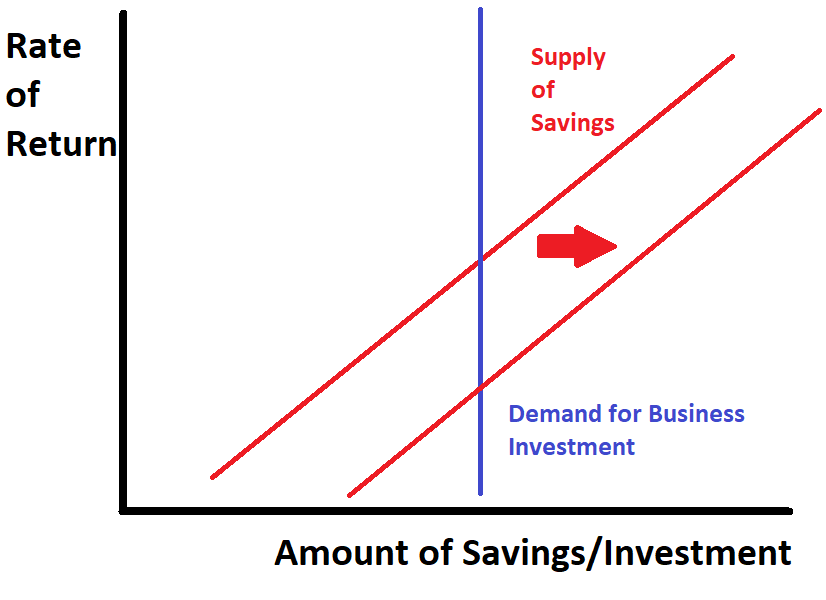

But OK, suppose that the amount of business investment just doesn’t depend much on the rate of return. Then you get a graph that looks like this:

OK, now suppose that in this sort of world, you give someone $600 and they stick it in the bank. That increases the supply of savings. But it doesn’t do anything to the demand for business investment. Businesses invest the same amount. And the rate of return just goes down.

The country doesn’t actually have any more material wealth, but interest rates and future stock returns go down. And in fact, total saving doesn’t even go up! You give the $600 to one person, they stick it in the bank or in the markets, that lowers interest rates or stock returns or whatever, and then other people save $600 less as a result. No change.

In fact, this outcome looks pretty close to what we’ve seen in America over the last few decades. Investment as a percent of GDP has remained roughly constant or even decreased slightly, even as interest rates have fallen.

Expected stock returns are much harder to measure, but those also look lower now than before.

This is in spite of stuff that we did to try to make saving money more attractive, like cutting the tax rates on capital gains and dividends. The actual amount that was saved and invested didn’t go up; all that changed was the rate of return, which is the price of investment.

What this strongly suggests is that the world has a glut of savings. What’s limiting business investment isn’t a lack of financial capital; we’ve got plenty of that. What’s limiting business investment is a lack of actual profitable business opportunities.

(Also, on top of this, there’s the question of whether our society would even get richer if businesses invested more. At a certain point, accumulating more capital doesn’t make society richer, since it depreciates too fast. Some economists think we’ve actually reached this point.)

So people like Sourour, Gramm, and Solon are probably wrong — giving $600 to rich people, in the hopes that they’ll save it, and that this saving will increase business investment, and that more business investment will make society richer, is probably wrong. Maybe it was true in Scrooge’s day — maybe 177 years ago businesses were mainly being held back by financial constraints. But today, with the world awash in savings, things have changed, and what’s holding businesses back is something else.

Growth vs. welfare

But even if giving $600 to Ebenezer Scrooge DID increase business investment a little bit, and even if that DID grow the economy a little bit, would that be worth taking $600 away from a poor little kid like Tiny Tim?

That’s a moral judgment, obviously. Most people would probably say: “Hell no, you ghoul!” And in the rich modern world, that is — in my opinion, and hopefully in your opinion too — the morally correct response. A little bit of added capital accumulation is not worth seeing poor kids go hungry.

Now, maybe 177 years ago, this was different. Maybe in the world businesses were SO in dire need of financing, and their growth opportunities were SO juicy, that letting some poor kids go hungry in order to concentrate enough money in a pool of savings, in order to build mechanized harvesters so that the poor kids of tomorrow wouldn’t go hungry made grim economic sense. When the whole world is poor, you have to make some dire, grim decisions. 1843 sucked.

But in 2020, we are very far from that world. In 1843 it might have been a choice between starvation today and even more starvation tomorrow. Maybe. But in no way is that true today. It is unconscionable that Americans are going hungry in this day and age.

So there are a whole bunch of reasons to give the $600 to Tiny Tim, and not to Scrooge. Maybe that was obvious to you from the first moment you heard the question, but it’s still useful to think through why it’s true.

Anyway, have a very merry Christmas.

Noah, you're a genius:

Perhaps the model where there's plenty of savings available but inelastic business opportunities/investment demand might also explain something quite different, the pitfalls of pension privatization.

El Salvador on the 90's privatized pensions following the Chilean model where the savings of the workers were meant to dynamize the capital markets (and generate growth).

However, the equity market hasn't been a source of finance for Salvadoran companies.

The pensions have been invested mainly on bonds with returns of around 5%, inferior to the US stock market benchmark.

In less than a decade, the initially 5 private pension funds became a duopoly, perhaps because of the small size of the market (Country of 6 million people with only half of the workers on the "formal" economy).

Real growth of the economy never really picked up above 2% on average, and wages have remained largely stagnant.

Even back on 2005, Rodrik & Hausmann published a paper arguing that the real bottleneck of the economy was the incapacity of discovering profitable business opportunities.

So, when I saw that graph, a light turned on inside me: Privatizing pension, at least in my small country, was basically taking the money away from the little Timmys and into the Scrooges, with low returns to Tim.

The idea that poor people waste money given to them has been disproven by numerous studies showing the efficacy of cash transfers. It's also classism, pure and simple.