Repost: Much of what you've heard about Carter and Reagan is wrong

Debunking our narratives of the late 70s and early 80s

Former President Jimmy Carter has gone into hospice care and is expected to pass away soon. So instead of the post I had planned to publish today, I thought I’d re-up this post I wrote about Carter (and Reagan) back in 2021. Carter was before my time, but I grew up hearing a very clear narrative about how his presidency was a disaster and how Reagan corrected the nation’s course. Then I grew up and found that this narrative bore little resemblance to reality. In fact, the eventual solutions to many of the challenges of the 1970s — inflation, over-regulation, and a resurgent USSR — were initiated by Carter, while Reagan’s approaches represented more continuity than U-turn. A number of people have told me that this post changed their perspective on the history of the 70s and 80s.

If you, like me, grew up in the United States of America, you’ve probably heard a story of the late 1970s and early 1980s that goes something like this: “In the 70s, Carter’s liberal big-government policies resulted in runaway inflation. Reagan came in and defeated inflation, and produced an economic boom with deregulation and tax cuts. Reagan also embarked on a massive defense spending binge which, although it increased the deficit a lot, forced the USSR to bankrupt itself trying to keep up, and thus won the Cold War.”

That might sound like a straw man, but the narratives we tell each other about the past often consist of exactly such straw men. And debunking those narratives might feel like shooting at easy targets, but it’s helpful for taking a closer look at history.

Anyway, the above narrative is almost entirely wrong. Carter was a deregulator who didn’t increase deficits much, and appointed the Fed chair who beat inflation. Reagan didn’t do much deregulating, nor did he increase defense spending much as a share of GDP — and the USSR didn’t fall because of the arms race. Let’s go through these points one by one.

1) Carter was the one who beat inflation.

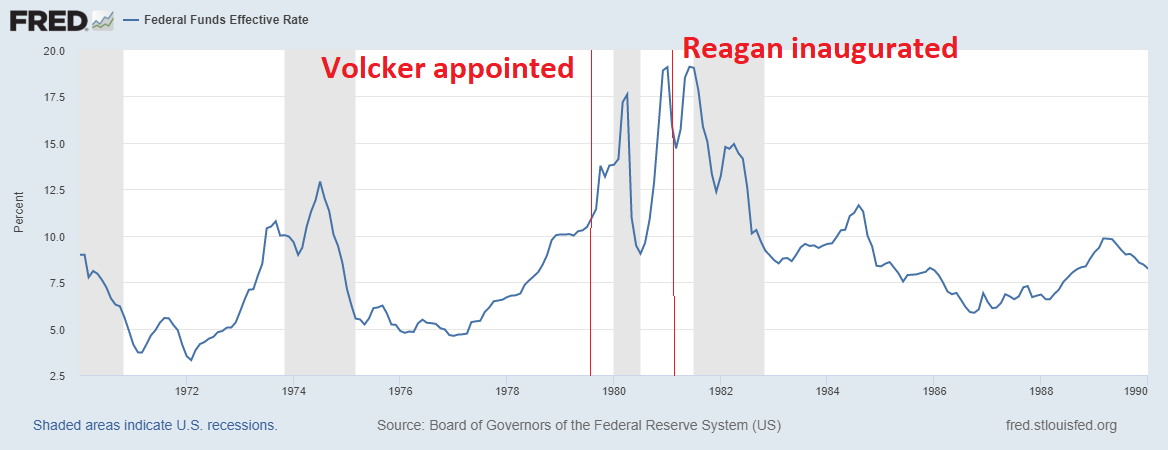

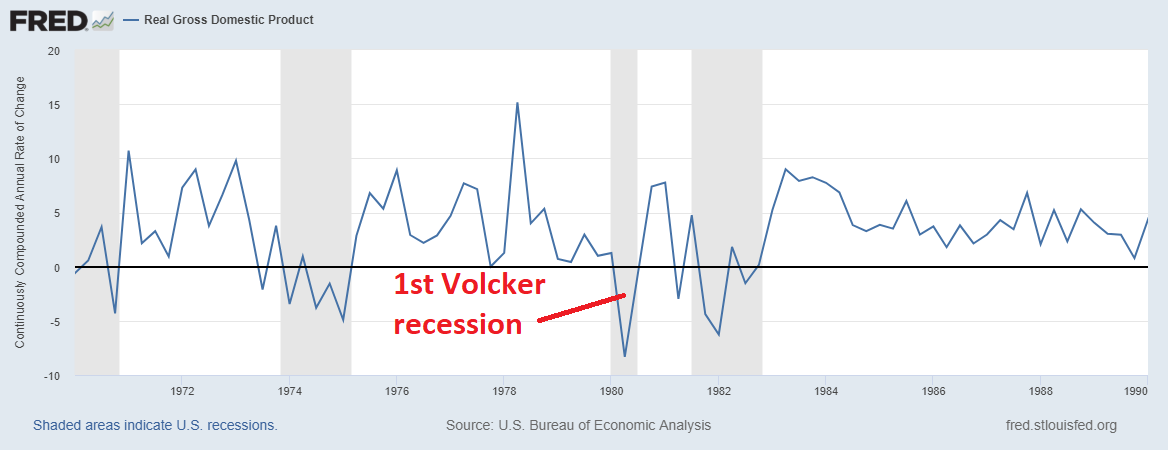

Most economists believe that sustained inflation, such as what we saw in the 70s, is the result of some combination of loose monetary policy and fiscal deficits. In the 70s, the Fed probably did run loose monetary policy, contributing to the inflation of that period. This ended under Paul Volcker, who raised interest rates until people realized that the Fed no longer tolerated high inflation. This came at a great cost — two sharp recessions.

But it was Jimmy Carter who appointed Volcker as the Fed chair, in 1979. Volcker was appointed specifically to do this job, as he was known as an inflation hawk, and Carter recognized inflation as America’s biggest economic problem. Volcer hiked interest rates all the way up to 17.61% under Carter, causing the first of the two Volcker Recessions in 1980.

That recession probably contributed to Carter’s loss. The fact that Carter knew taming inflation would probably cause a recession shows how seriously he took the problem.

But did Carter contribute to the inflation with loose fiscal policy? Hardly. He inherited a modest deficit from his predecessor, Gerald Ford, and kept it at about the same level throughout his presidency:

He also didn’t change spending much.

So Carter’s deficits were much smaller than Reagan’s in the 80s. That suggests that fiscal deficits were not really what was driving inflation in the 70s (since deficits rose and inflation fell under Reagan). Instead, it was monetary policy, which tightened thanks to Carter’s appointment of an inflation hawk. Reagan, of course, gets partial credit here for keeping Volcker on for a while (before eventually firing him). But Carter is the one who did the heavy lifting here, taking the risk of a recession in an election year — which might have been part of what did him in.

2) Carter was the Great Deregulator, not Reagan.

Reagan campaigned on promises of deregulation, and he appointed people to regulatory agencies who tended to use a light touch. But when it comes to actual deregulatory policies implemented, Carter did substantially more than Reagan. He deregulated airlines, energy, trucking, railways, telecommunications, finance, and more.

Don’t take my word for it — take it from the libertarian Foundation for Economic Education!

Carter gets a very bad rap, particularly from libertarians and conservatives, but it's not entirely clear why…Carter's most lasting legacy is as the Great Deregulator. Carter deregulated oil, trucking, railroads, airlines, and beer.

The libertarian magazine Reason, another inveterate opponent of regulation, concurs:

Reason has never been shy about praising Jimmy Carter for his role in deregulating airline ticket pricing and interstate trucking (and beer!). Over at AOL News, B. Kelly Eakin and Mark E. Meitzen remind us of [the Staggers Rail Act], a third transportation-related deregulation success that Carter pushed.

Much of Carter’s deregulatory agenda came from the people he appointed. For example, there was Alfred E. Kahn, an economist whom Carter appointed to chair the Civil Aeronautics Board. Kahn was a hardcore deregulator, testifying to Congress that “The superiority of open markets…lies in the fact that the optimum outcome cannot be predicted.” Many of his other appointees had similar ideas. The administration was so deregulation-minded that it even discussed systematic limitation of regulation as a permanent policy:

In 1980, President Carter’s Economic Report of the President discussed proposals to “develop a ‘regulatory budget,’ similar to the expenditure budget, as a framework for looking at the total financial burden imposed by regulations, for setting some limits to this burden, and for making tradeoffs within those limits.

How about Reagan? Despite his fiery rhetoric, Reagan during his two terms in office managed to pass only two pieces of legislation that make it onto Wikipedia’s list of significant deregulations — deregulating buses and savings & loans (oops). Carter, during his one term in office, passed seven major pieces of deregulatory legislation. Here’s Wikipedia’s list:

1977 – Emergency Natural Gas Act

1978 – Airline Deregulation Act

1978 – National Gas Policy Act

1980 – Depository Institutions Deregulation and Monetary Control Act

1980 – Motor Carrier Act

1980 – Regulatory Flexibility Act

1980 – Staggers Rail Act

1982 – Bus Regulatory Reform Act

Much of Carter’s deregulation came toward the very end of his presidency, so Americans didn’t really feel the effects til Reagan was in office. This, in addition to campaign rhetoric and partisan stereotypes, might be why Reagan is generally remembered as the Great Deregulator. Really, it was Carter.

3) Reagan didn’t increase defense spending by much.

A lot of people on both sides of the political isle think Reagan embarked on a giant peacetime defense spending boom, forcing the USSR to bankrupt itself trying to keep up. To evaluate this claim, I’ll rely on some graphs from the excellent Jose Luis Ricon. In dollar terms, Reagan certainly did boost military budgets:

But note when Soviet spending rose and fell. It soared during the 1970s, rose only slightly through Reagan’s first term in office, and then began to plunge. This seems to cut against the narrative that the USSR was striving to keep up with the U.S. If anything, it suggests that Reagan’s buildup was a reaction to a Soviet buildup that had begun under Carter!

Anyway, though, when we look at Reagan’s defense buildup as a percentage of GDP, it looks much less impressive:

Historically, this looks like small potatoes. Of course, it was peacetime, and the (proportionally) far bigger military outlays of earlier decades had been for the purpose of fighting wars. But this was a surprisingly low price tag for facing down a rival superpower! And though the Soviet data is spotty, you can see that they by no means bankrupted themselves matching Reagan’s defense spending; their outlays were proportionally far lower than they had managed during World War 2, and fell during Reagan’s term in office.

So this is another historical narrative that has clearly been exaggerated.

4) The fall of the USSR is more complicated.

So did Reagan actually win the Cold War? The fall of a superpower like the USSR is a very complex phenomenon, and it’s hard to give a definitive answer to why the U.S. actually won the Cold War. I’m certainly no expert in Soviet history or politics. But the most convincing economic explanation I’ve heard for the Soviet collapse in the late 80s comes from Yegor Gaidar, a Soviet official who later became Prime Minister of Russia. In his 2007 book Collapse of an Empire, Gaidar tells the story of how the USSR gradually transitioned from a sclerotic manufacturing-based economy to a sclerotic petrostate. When oil prices collapsed in the oil glut that began around 1985, the rigid Soviet economy — which has also over-regulated trade, agriculture, and a bunch of other stuff — collapsed right along with them.

But why did oil prices crash? Essentially, the oil shocks of the 1970s caused a lot of non-OPEC producers to increase production and/or exploration, resulting in a delayed but massive increase in supply. The U.S. was not a big part of this — despite the completion of the Trans-Alaska Pipeline System in 1977, and executive orders by Carter in 1979 and Reagan in 1981 deregulating oil prices, U.S. production rose only a tiny bit:

The energy glut that dealt the USSR its final economic deathblow came not from anything America did, but from the actions of a bunch of other countries — the UK, Brazil, India, Egypt, Oman, Malaysia, and so on.

Militarily, though, it’s worth pointing out that the USSR’s big military defeat came in Afghanistan. And though that war lasted until 1989, the crucial initial decision to arm the Soviets’ mujahideen opponents came from — you guessed it — Jimmy Carter.

So in terms of ending the Cold War, Reagan mainly held a course that Carter had initiated — arm the USSR’s opponents, boost oil production, and issue moral condemnations of the USSR while engaging in arms limitation talks with it at the same time.

What are the lessons here?

So what do we learn from the misunderstandings surrounding these two Presidents? One lesson, obviously, is that the narratives we tell about history are largely constructed after the fact, by actors who have a stake in painting a certain picture of the recent past. But another is that successful policy takes a long time to work. Carter deregulated, appointed a tough inflation-fighter to the Fed, and funded the USSR’s military opponents. But it wasn’t until the 80s that the economy boomed, inflation came down, and the USSR weakened and fell. In 1980, when Reagan beat Carter for the presidency, it still looked as if nothing was working and everything was still going wrong — even though the crucial policy steps that would turn things around had already been largely taken.

Another lesson, I think, is that American policy is driven less by ideology and presidential personality than we think. There was far more continuity than rupture between Carter and Reagan. (And we’re re-learning this lesson now, watching Biden continue Trump’s trade war, his hawkish approach to China, and even some of his restrictive immigration policies, while leaving much of his tax reform untouched.) We Americans tend to act as if every presidential election is a cataclysm that will determine the fate of the nation, and occasionally this is true — but usually, there’s probably less at stake than we think.

I don't know enough to say that Carter was a great president. However, I am certain that he is the only president who has led a life I would be proud to have led myself.

The Trump thing isn't a good example. What made Trump bad wasn't just his policies, it was his approach to politics. Democracy is important, the norms of democracy are important. No one who flouts it, left or right, in first world countries, should be exempt from opprobrium.