Yes, I know, it’s another post about inflation. There’s only so much you can write on the topic, but this seems to be a critical moment. The October data has seemingly broken some psychological dam — almost everyone admits that inflation is real now, and the debate has abruptly shifted to the question of what to do about it. Ideas are moving fast, and people are deciding what to think about the new landscape.

In addition, Biden is about to make a decision that could affect inflation more than anything else in his presidency. I’m not talking about fiscal policy, or any piece of legislation; in fact, all of Biden’s proposed bills combined are small potatoes with regards to deficits:

No, I’m talking about the choice of Fed chair. Biden is said to be considering whether to stick with Jerome Powell or switch to Lael Brainard, and both probably have the votes to win confirmation. The Fed chair has practically unilateral power over monetary policy, and at this point monetary policy is really the only thing our government can do to affect inflation over the next few years.

So this is a pivotal moment.

Unfortunately, what I see happening at this pivotal moment is that inflation is starting to get politicized. Inflation hysteria on the Right is only to be expected, not just because my expectations of the Right are lower, and not just because a lot of Republican voters remember the 70s, but because it’s in the GOP’s electoral interests to seize on and play up anything bad about the economy. But in response, progressives could easily just point to the strong job recovery and to the success of Biden’s Covid relief bill in raising incomes. Instead, I see a worrying tendency to play down the threat of inflation and label it a right-wing hoax:

It’s always very tempting to think that public opinion is generated by highly coordinated media propaganda campaigns, rather than just people caring about the stuff they care about. But in this case we shouldn’t give in to that comforting fable. People dislike inflation for a very clear and understandable reason: They think it makes their real wages go down.

The economist Robert Shiller — one of the pioneers of behavioral economics, and a master of survey research — did a survey in 1990 to figure out why people dislike inflation. His conclusion was that people think inflation makes their wages go down.

To summarize the main perceived costs of inflation briefly, the concerns people mention first regarding inflation are that it hurts their standard of living and a popular model they have that makes such an effect plausible apparently has some badly behaving or greedy people causing prices to increase, increases that are not met with wage increases.

And are people wrong about that? It’s a giant pain in the butt to negotiate for a raise at the best of times. And when inflation is going strong, the dollar number of a raise people have to ask for is even higher. Lots of people will just shy away from demanding those big numbers, and so their real purchasing power will fall behind. Furthermore, wages tend to only get negotiated once a year, so if inflation comes in higher than workers expect when they go in and ask for a raise, their wages end up falling.

Anyway, for whatever reason, it looks like inflation often does lead to drops in real wages. This happened in the early 70s and again in the late 70s:

And it looks like it’s happening again now. Even though wages have been rising strongly in dollar terms since the start of the year, when rising prices are factored in, it turns out that real wages have actually been falling:

As a result, disposable personal income — which got a huge boost from the relief bills — actually fell last month:

Now, it’s worth noting that there’s another survey, the Census Bureau’s Current Population Survey, that disagrees with these BLS numbers, and shows real wages climbing slowly in the last few months. It'll take more analysis to tell why this divergence is happening, and which data source has the right of it. But no matter what, seeing your wage gains almost entirely eaten up by rising prices has got to be nearly as frustrating as seeing your wage gains entirely eaten up by rising prices.

Think for a moment how frustrating this must be. This is an unprecedented opportunity for a lot of workers — a time when their bargaining power is higher than it’s been in decades, thanks to the pandemic and the residual impact of the relief bills (which gave workers a better outside option that let them demand better pay). This kind of opportunity probably won’t come again soon, maybe not in a lifetime. And yet here comes inflation, swooping in just in time to make their raises mean little or nothing.

It’s foolish to claim that this frustration is solely the result of media propaganda and disinformation. Workers don’t have to read the news to know about inflation; they just go to the store, or the car dealership, or the gas station, and they see higher prices. They know their money isn’t stretching as far as it did a few months ago; they don’t need Fox News or whoever to tell them.

Now that doesn’t mean there’s no partisan effect at work here. As is typical during Democratic presidential administrations, Republicans’ assessment of the economy have plunged much more than others’. But it’s worth noting that even Democrats and Independents have been getting less optimistic in the last few months:

They’re not all being tricked by a vast media conspiracy. No, current levels of inflation aren’t the economic catastrophe that screeching right-wing media is making it out to be. But it’s real, and people have every right to be upset about it.

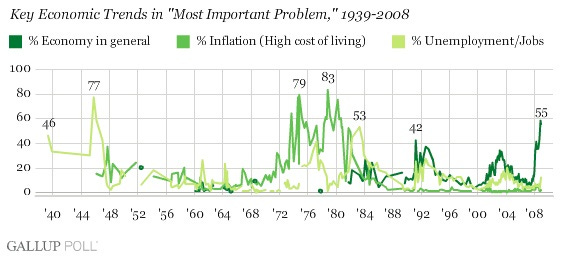

And things could get a lot worse. The experience of the 70s show that Americans get extremely upset about sustained inflation:

So this is the environment in which Biden has to make his big decision about who to appoint for Fed chair.

Fortunately, neither Powell nor Brainard is obviously an inflation hawk in the mold of Paul Volcker. Jimmy Carter appointed Volcker knowing full well that he was a hawk who would raise interest rates to crush persistent inflation. Volcker obliged, but the short-term economic pain he caused probably contributed to Carter’s defeat in 1980. Biden would be foolish to make such a move — inflation has a long long way to go before it’s as entrenched as it was in the late 70s, and appointing a Volcker would be premature. So it’s good that that’s not on the table.

But there’s a danger on the opposite side as well. If Biden appoints a Fed chair whom everyone believes to be a huge inflation dove, then it’s possible that inflation expectations could rise, causing price rises to become a self-sustaining spiral. That would be very very bad, not just for the economy but for Biden’s reelection chances as well.

So Biden has to appoint someone who doesn’t look like they’re going to let inflation rip. But would Powell or Brainard be better for that job? On one hand, Powell is a known quantity. But one reason for the persistence of U.S. inflation — higher than what other rich countries are seeing — might be that Americans have started to doubt Powell’s commitment to inflation-fighting. Deserved or not, that lack of confidence could be a reason to switch.

What about Brainard? On one hand, progressives have been pushing for her, and progressives have also started to downplay inflation. This might imply Brainard is a dove who would let inflation rip. But I view this as unlikely, actually — it’s pretty clear that progressives like Brainard over Powell because of their differing stances on financial regulation. Brainard herself has been pretty tight-lipped about her general stance on inflation, other than to echo the general line that the Fed should wait and see whether supply crunches peter out.

So the question really boils down to whether it’s better to go with a known or an unknown quantity. And that depends on the Biden administration’s insider assessment of whether Brainard would inspire more confidence than Powell in terms of the Fed’s continued commitment to inflation-fighting. Ultimately the two could end up being much the same, but if there is any difference between their stances, the administration should probably pick the more hawkish of the two. Neither one is going to pull a full Volcker, but the Fed needs someone who’s willing to do what it takes — be that aggressive jawboning, tapering of QE, or even some small rate hikes — to keep inflation from getting out of control.

Because to ignore this problem wouldn’t just mean letting Americans’ wages get slowly eroded. It would putting Biden’s whole agenda, and his presidency, in jeopardy.

Update: Also, leaders blaming hoarders and speculators for inflation is always a bad sign, and this worries me a lot:

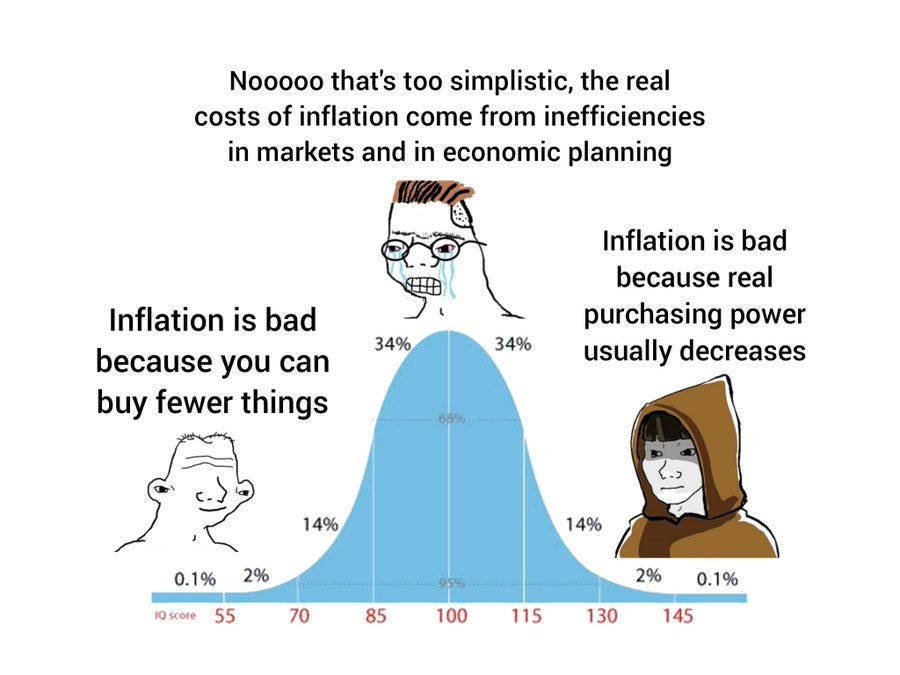

Update 2: Here is a good meme, via @EgirlMonetarism on Twitter:

Update 3: Some of the rhetoric coming from media progressives about inflation right now is just utterly insane. Stocks are way up. Real estate is way up. Crypto is way up. Every financial asset is way up. Real wages are down!! What the heck are these people even talking about? —>

Hearing your recommendation of David Roberts on the @ne0liberal podcast and then that... very bad thread by him on the same day was quite the experience. How “Inflation is a real thing” is seen as contrarian but “inflation is a nefarious media psy-op” isn’t, I’ll never understand.

Inflation fears = short-term-ism writ large.

Boots on the ground here, sourcing (and using) construction materials a big part of my work; so easy to see the giant lump{s) being slowly digested here - the influx of money, the paucity of materials, the 15+ month run up in demand.

If a Professional Imbecile like me (and all my peers who are also in the Hod Carrying trade(s)) can see this temporary situation - us Prof. Imbec. / Hod Carriers - whys can't youse professional credential-ists, wordy writers - chill the f*ck out, and learn how to do a better job 'splain'ing this temporary bullsh*tery, esp in the context of corporatist propaganda? / political posturing.

Fer sure, notable non-economist William Goldman's axiom, 'nobody knows nothing'* holds here too. How about - stick to fundamental principles, and it's all gonna be ok. Which - it is. Alls one has to do is look around at the fluctuations. And take the long view.