Omicron update, Inflation update

Get your booster shot. And trust in the Fed.

I was going to write a regular post today, but there’s important developing news about two of my favorite regular topics — Omicron Covid and inflation. So I’ll put on my journalist hat and see if I can explain what’s going on there.

Omicron

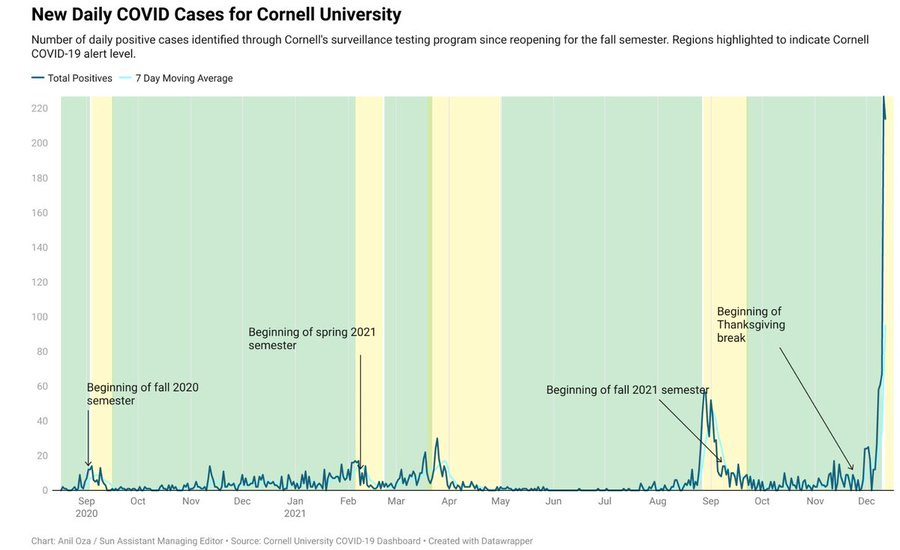

First, Omicron. To say that the new variant is on its way, at this point, is utterly old news. It is here. Via the Cornell Sun, here’s a graph of cases at Cornell University, which just decided to close down:

Previous waves don’t even slightly compare. And here, via Theo Sanderson, is a graph of cases in London, where high-quality genetic surveillance allows us to differentiate Omicron from Delta:

Omicron is already at double-digit percentages in NYC. This thing is already here, and soon it’s going to be absolutely everywhere. Travel bans were ineffectual, as everyone should have known they would be. No mitigation measures — lockdowns, school closures, bar closures, etc. — are going to stop this beast, as China is painfully discovering.

So what should regular people do to avoid a trip to the hospital? You should wear a mask indoors, but your most effective move by far is to get a booster shot if you haven’t already gotten one. The U.S. is very far behind on boosters, due to some truly terrible messaging failures by our public health authorities, so I know there are a lot of you out there who haven’t gotten a third shot. Remedy that.

Because boosters are effective against Omicron. Not fully effective — there’s still a chance, even with three doses, that you’ll come down with this new variant. But a booster shot will likely save you from going to the hospital or dying. Here’s data from Pfizer:

And here’s data from Moderna:

Note how much more effective 3 doses is relative to 2 doses. We’ve been calling the third dose a “booster”, which makes it sound like this optional add-on to the main vaccination sequence. But really, these vaccines should have been 3-shot sequences all along.

Why are third shots so powerful? Lots of people think of vaccines as just shots of antibodies that wane over time, but they’re really not like that. As Paul Bieniasz explains in this excellent thread, each shot of the vaccine causes your body to spend effort inventing new ways to fight coronavirus, and the more shots you get, the more cool defenses your body comes up with:

OK, so what about those rumors that Omicron is less deadly than other forms of Covid? Once again, it’s way too early to be sure about this. We’re dealing with unknowns, and it’s important to be cautious. But that said, there are now some real glimmers of reasons for optimism. Rory Hester has been doing a great job keeping track of the data coming out of South Africa’s Gauteng Province, and it’s notable that ICU admit rates actually went down when Omicron struck:

The case fatality rate also plunged.

Of course, it’s easy to delude ourselves into unreasoning optimism in the face of an onrushing threat. It will still be weeks or even months before we know for sure whether Omicron is a step in the hoped-for transformation of Covid into yet another common cold virus, or whether it’s just another deadly super-variant. But interestingly, there is now some research showing a possible mechanism by which Omicron might be both more contagious and less harmful. A new study from the University of Hong Kong shows that Omicron replicates much more quickly than Delta in the upper airways, but much less quickly in the lungs, where Covid does its real damage. A thread from the always-excellent Muge Cevik explains the results:

Also see this thread from Francois Belloux explaining the possible scenarios — both optimistic and pessimistic — for Covid’s evolution, and some of the evolutionary principles at work:

So let’s cross our fingers and hope Omicron doesn’t cause another massive wave of death. But in the meantime, get your dang booster shot. In the meantime, our government really needs to accelerate the distribution of Paxlovid, a drug that effectively treats Covid in its early stages.

Inflation

OK, on to inflation. The big news here is that Fed Chair Jerome Powell has announced that the Fed is tightening monetary policy. There are three pieces of this:

The Fed is going to accelerate the tapering of quantitative easing so that QE is over by March.

Powell announced that the Fed intends to hike interest rates three times in 2022.

The Fed will also be looking to reduce the size of its balance sheet (a move which will probably be anti-inflationary).

As Bloomberg’s excellent John Authers explains, markets were already expecting this move; interest rate expectations for the next year increased across the board after Powell’s announcement, but only a very little bit. The Fed had been signaling for weeks now that its formerly blase attitude toward the current bout of inflation is long gone, and that it now takes the threat very seriously. Market expectations of future inflation, as measured by the 5-year breakeven rate, had already been trending down for a month, and ticked slightly lower after Powell’s speech:

In other words, the Fed appears to have inflation expectations under control. A combination of tough talk and moderate action have reassured the market that the central bank has not become cavalier about rising prices.

A lot of people, especially progressives, had been terrified of Fed tightening, thinking that this could send the economy into a tailspin. But Powell was never going to pull a Volcker here. Inflation is high compared to recent years, but it’s not yet out of control; the Fed didn’t have to bring inflation way down like in the early 80s, but merely to keep inflation expectations under control to prevent the emergence of a self-fulfilling runaway upward spiral.

And it looks like the Fed is successfully doing just that. The stock market surged following the announcement of tightening:

If people believed Powell were going to raise interest rates enough to actually force inflation back down to 2% in the face of ongoing supply chain disruptions, we would not see stocks going up. They would be crashing, because we’d be about to face a recession. The fact that stocks are up means that people now believe that Powell has successfully engineered a soft landing for inflation. Barring devastation from Omicron, employment will continue its rapid, healthy recovery.

But by the same token, don’t expect inflation to go back down to 2% soon. Powell is putting a lid on inflation, not slaying it. This is as it should be. Inflation is largely persistent because of ongoing disruptions to global supply chains, and one basic principle of monetary policy is that you don’t use policy to try to fight a supply shock. Instead you let it run its course, and use monetary policy to keep the resulting inflation from spiraling out of control.

That’s bad news for workers whose raises will be eaten up by rising prices. Low single-digit inflation will still probably cause popular discontent, and may hurt Democrats at the polls. But the alternative — smashing the economy and throwing millions back out of work just to drive inflation down a few percentage points — would likely be even worse.

So if there’s one unifying message for these Covid and inflation updates, it’s this: Many of our institutions are more functional than we tend to think. Regarding Omicron, our public health authorities didn’t encourage boosters, but the Biden administration has allowed and endorsed them, our providers have rolled them out very widely very fast, and our scientists invented them in the first place. Meanwhile, our central bank looks like it’ll manage to keep a lid on the most significant inflation in four decades without hurting the economy.

Those look like some reasonably functional institutions to me.

Thanks for mentioning the effectiveness of our institutions. They need all our support.

You emphasis the supply shock as a cause of inflation. However there has been a huge increase in demand as consumer switched spending from services to goods, presumably for pandemic related reasons. Also actual supply has increased. It is really a demand shock.