Nutty macroeconomic theories will ruin your country's economy

Resist the siren song of MMT, Bitcoin-omics, and Neo-Fisherism, and stick with what kinda-sorta works.

In Herbert Hoover’s memoirs, he discusses some very bad advice that he received from his Treasury secretary, Andrew Mellon, in the early days of the Great Depression. “Liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate,” Mellon reportedly thundered. “It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.”

This advice was part Protestant moralism, but some of it came out of the “classical” economic ideas of the time. The economy was thought to be a self-adjusting system that would return quickly to the optimal point and make use of any idle resources such as unemployed workers and shuttered factories. Hoover didn’t quite take Mellon’s advice — he did start a few programs aimed at coping with the Depression — but overall he had great difficulty overcoming the conventional wisdom of the time. As a result, economic activity cratered and unemployment spiraled for three years until Franklin Delano Roosevelt took over and started experimenting with new approaches. The more successful of those approaches (monetary easing, fiscal stimulus) eventually became incorporated into a new paradigm of economic management, commonly known as “Keynesian” economics.

The anecdote of Andrew Mellon and “liquidationism” illustrates an important principle: Bad macroeconomic ideas can easily wreck your economy.

This truth often gets lost in the hubbub of debate. There is a huge amount that humanity simply doesn’t yet understand about recessions, inflation, etc. So mainstream theory is full of implausible assumptions, has trouble making quantitative forecasts, and is ambiguous on many important questions. We still have recessions and inflation, so obviously we don’t have it all figured out — just a few general principles that kinda-sorta seem to help.

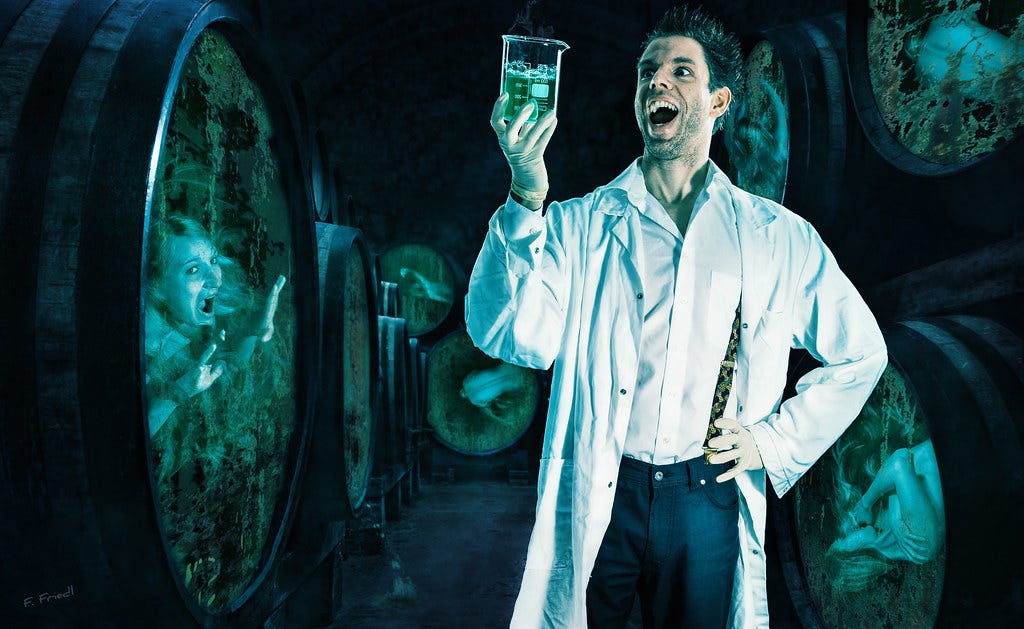

Because macroeconomics is still in its relative infancy, this can cause people to turn to wacky alternatives. Seductive peddlers of heterodox theories often claim that their paradigm offers the certitude and perfection that mainstream ideas lack. Leaders anxious for a quick and easy way out of an economic crisis will occasionally commit to one of these wacky alternatives out of wishful thinking, desperation, or simple gullibility. And their populaces suffer as a result.

Three recent examples I’ve seen are:

Turkey and Neo-Fisherism

Sri Lanka and MMT

El Salvador and Bitcoin-omics

Let’s start with the (relatively) least wacky of these, but the one that, thanks to one maverick leader, has done the most damage so far: Neo-Fisherism.