A soft landing is still the likeliest scenario

Falling demand will hit inflation. But there will be a price.

A couple of weeks ago, I wrote a post envisioning a future where interest rates go to 8%. I made it clear that this was only a possible bad scenario that people should have contingency plans for, not a forecast that people should expect to come true. In fact, I think the most likely outcome is a “soft landing” for the U.S. economy.

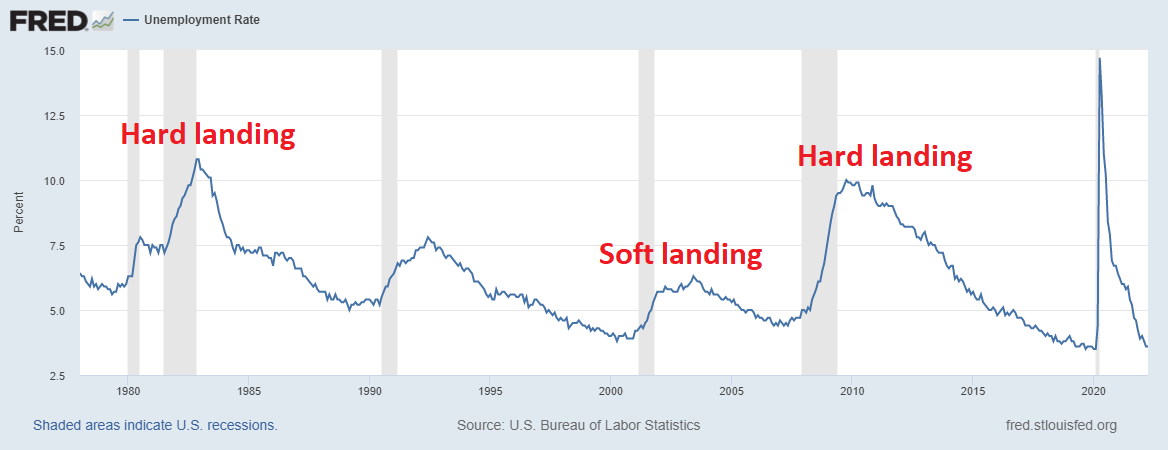

A “soft landing” sounds nice, and it is a hell of a lot nicer than the truly awful scenarios like runaway inflation or a deep and crushing recession. But that doesn’t mean it’s a painless outcome where inflation simply vanishes and economic growth continues apace. More likely, we’ll get a short and mild recession like the one in 2001:

Remember that the Fed and the markets are also expecting this. As I explained in that earlier post, if the Fed expected inflation to remain at its recent ~8% level indefinitely, it would raise rates to 8% or higher. The fact that it’s raising rates by much less than that (so far) means that it still expects inflation to come down without the need for a Paul Volcker-like crushing of the economy. And markets also expect inflation to be significantly lower over the next 5 years:

Of course predictions are hard, especially about the future, and especially about the future of the macroeconomy. So let me explain why a short and mild recession, and subsiding inflation, now looks like the most likely scenario.