In which Balaji gives away at least a million dollars

Also, the dollar is not going to collapse.

(Update: Balaji has settled this bet, giving $500k to James Medlock and $500k to GiveDirectly in Medlock’s name!)

Having known Balaji Srinivasan for more than half of my life, I can attest that he is a man of deeply held beliefs who is bold in his business dealings. Thus, if anyone I know was going to bet some pseudonymous internet rando a million dollars on an outcome that is incredibly unlikely to happen, it would probably be Balaji.

It all started when James Medlock, the pseudonymous twitter personality (whom I interviewed on this blog a couple years back) made a joke about hyperinflation:

The joke, of course, is that if the U.S. did enter hyperinflation, $1 million wouldn’t be worth very much, and so Medlock wouldn’t stand to lose much on this bet.

But then Balaji swooped in and actually offered Medlock a $1 million bet!!

Medlock quickly accepted the deal. People rushed forward to stake Medlock the 1 BTC that his end of the bet required. The plan is to put both Medlock’s 1 BTC and Balaji’s $1M in escrow with a third party (possibly business blogger Byrne Hobart), and then give everything to the winner. If Bitcoin is worth less than $1M in 90 days, Medlock gets everything; if it’s worth $1M or more, then Balaji gets everything.

Now, note that this is not exactly the same bet Medlock joked about. “The U.S. enters hyperinflation” is actually a very different thing from “Bitcoin goes to $1M”. It’s perfectly possible that a U.S. hyperinflation would also collapse the price of Bitcoin. But Balaji is ignoring this possibility.

Anyway, from a financial standpoint, this bet is very very bad for Balaji. 1 BTC is worth about $27,000 as of this writing. That means if Balaji “wins” the bet, and Bitcoin goes to $1M, Balaji gave up the opportunity to buy 37 BTC at a price of $27,000. He will thus wind up winning 1 BTC but losing 37 BTC, for a net loss of 36 BTC (or at least $36 million by that point). And if Balaji loses the bet, he loses $1M.

So either way, Balaji is 100% guaranteed to lose money on this bet, no matter what happens. It’s not a risky bet; it’s a sure loser. And unless both the dollar and Bitcoin crash in value, the amount of money Balaji will lose will be a very very large amount.

Why is Balaji making a bet that is sure to lose him money? He claims that he is doing this in order to bring widespread attention to the impending doom of the U.S. financial system and the U.S. dollar, and the switch to Bitcoin as the primary global currency. But this is overwhelmingly unlikely; the scenario doesn’t fit with anything we know about macroeconomic history. Balaji is going to lose his bet with Medlock.

On Twitter, Balaji wrote an explanation of how and why he expects hyperinflation to happen:

We have to define hyperinflation in BTC vs USD terms because all other fiat currencies can and will be inflated away. That is hyperbitcoinization.

This is the moment that the world redenominates on Bitcoin as digital gold, returning to a model much like before the 20th century. What's going to happen is that individuals, then firms, then large funds will buy Bitcoin. Then sovereigns like El Salvador (@nayibbukele) and tiny crypto friendly countries.

The big move will be when a US state like Florida or Texas, or a "normal" country like Estonia, Singapore, Saudi, Hungary, or UAE buys Bitcoin. And when @narendramodi tells India's central bank to buy Bitcoin, even as a hedge, it's over.

Why will it be so fast? Well, hyperinflation happens fast. We've seen digital pandemics (COVID), digital riots (BLM), and digital bank runs (SVB). Everything will happen very fast once people check what I'm saying and see that the Federal Reserve has lied about how much money there is in the banks. All dollar holders get destroyed.

The thing is, people are still tuned to an analog world where things get gradually worse rather than all at once. But there isn't much forewarning for a digital event — it's 1 and then it's 0. Just like the bank runs, except this is the central bank.

There are however two sources of forewarning. First is the chart of the long-term depreciation of USD vs BTC, from less than $1 USD per BTC to $25k USD per BTC. Much of the smart money has been voting against the dollar since the financial crisis. The end is a digital drop off a cliff, almost invisible on the chart — but highly visible in the world.

This tweet is the second forewarning. It'll be ignored and mocked by people who still trust the US establishment, even after the last few years. Who can't imagine that the US banks and media could be lying to them to this extent.

But they are. Just as they did in 2008, and over the last ten years. The digital devaluation of the dollar is coming and it's going to be intense.

History definitely doesn’t support Balaji’s assertion that hyperinflation happens with lightning speed. José Luis Saboin-Garcia, who studied episodes of hyperinflation in a large number of countries, found that they all go through a period of at least a year during which inflation is above 50% but not yet above 500%. In other words, Balaji is not just betting on a U.S. hyperinflation; he’s betting that thanks to digitization, a U.S. hyperinflation would happen faster than any hyperinflation has ever happened in any country in recorded history.

But anyway, let’s take a look at why Balaji thinks the dollar will crash in the very near future, and why that’s extremely unlikely to happen.

Basically, he thinks that hyperinflation will come as a result of a massive failure of U.S. banks. The idea is that the Fed’s interest rate hikes have made essentially all U.S. banks insolvent, by lowering the values of their bond portfolios. This, he believes, will cause depositors to flee the banks for the safety of Bitcoin.

There are several reasons to doubt this chain of causality. First of all, rate hikes haven’t yet been nearly enough to make most banks insolvent. Banks have a pile of cash that they keep around, called “equity capital”; as long as losses on their assets are less than this cushion, they’re still solvent. Rate hikes have weakened banks’ financial position, but only a few outliers like Silicon Valley Bank actually became insolvent (yet).

Second, and more importantly, giant waves of bank failures typically don’t cause hyperinflation. Instead, they typically cause deflation. The worst wave of bank failures in U.S. history came at the start of the Great Depression, when about one in three banks failed. The result was not inflation but massive deflation, with prices falling by about 10% in 1932 alone.

Why did bank failures cause deflation in the Depression? Because people responded to bank runs by making fewer purchases, which caused companies to lower their prices. When companies lower their prices, that’s deflation. Companies also laid off workers, which caused the laid-off workers to spend less, exacerbating the vicious cycle. Tyler Cowen put it succinctly in a blog post earlier today:

Let’s say there is a big hole in the solvency of a banking system. Left unaddressed, that is radically deflationary. Demand (and other) deposits will disappear, crushing aggregate demand. Cascading financial failures will occur elsewhere, again with negative demand effects. If a government “prints money,” or more likely creates new electronic bookkeeping entries, that offsets the deflationary pressures. These bailouts may have other negative effects, such as on future moral hazard and rent-seeking, but they won’t bring hyperinflation.

Now I don’t want to put words in Balaji’s mouth here, but he might argue that because Bitcoin exists now and didn’t exist in 1932, things are just totally different now. Instead of keeping cash under their mattresses or rolled up in old socks when the banks fail, Americans will now trade their dollars for Bitcoin, thus crashing the value of the dollar.

That is, to put it bluntly, incredibly unlikely. First of all, Americans in 1932 may not have had Bitcoin, but they had gold, and yet there was no flight from dollars to gold — in the U.S. or any other country. Second, Bitcoin is a risky asset, and if Americans want to move their cash from banks to risky assets in response to a wave of bank failures, they can just buy stocks and real estate instead of Bitcoin.

But even more importantly, a massive bank failure means that bank lending will also crash. If there are no banks, there are no banks to make loans! And bank loans, as we all know from Econ 101, create money. Fewer loans means fewer new dollars. And when dollars become more scarce, the value of dollars goes up. That is called deflation.

So Balaji’s scenario, in which bank failures lead to hyperinflation, is simply not going to happen.

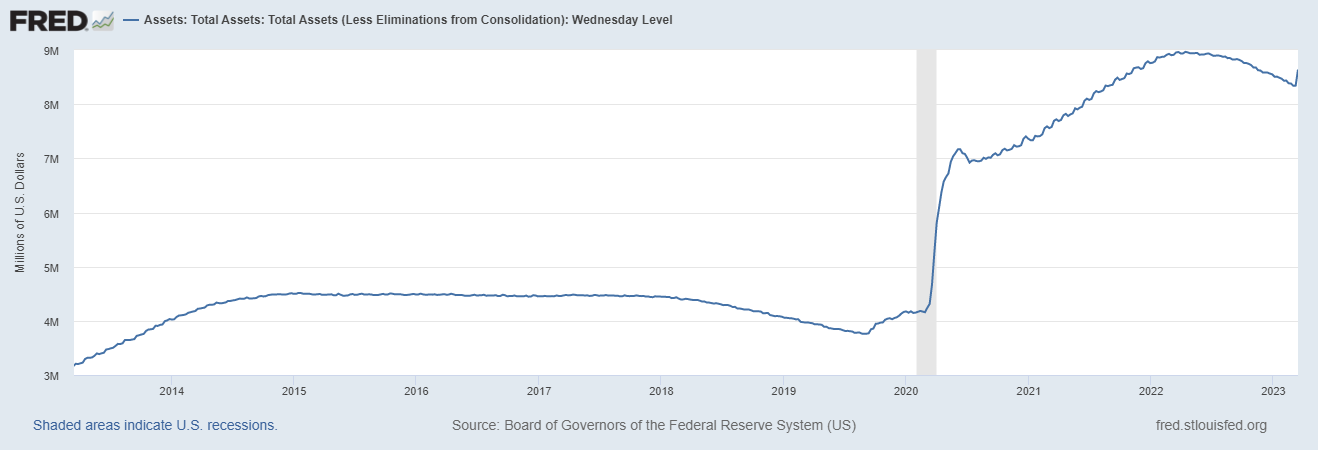

But in fairness to Balaji here, there is a way that bank weakness could lead to greater inflation. The scenario, which I outlined in a post last week, starts with the fact that in order to prevent bank failures, the Fed is loaning money to banks. It has already lent $300 billion in the past week. This pumps more money into the economy, which partially cancels out the effect of interest rate hikes (which take money out of the economy). In other words, those emergency loans represent a form of monetary easing.

If American businesses and investors look at those emergency loans and decide that the Fed isn’t serious about fighting inflation, we could see a rise in inflation expectations. A rise in inflation expectations could cause more inflation to become a reality — a self-fulfilling prophecy. And if the Fed is unwilling to tighten monetary policy further in order to fight that spiraling inflation, out of fear of collapsing the banks — a condition some economists call “financial dominance” — it could, in theory, eventually lead to hyperinflation.

So that’s your hyperinflation scenario, right there — not a bunch of bank failures, but misguided Fed action to prevent bank failures at any cost. (Update: Balaji does seem to have this scenario in mind.)

I should say, though, that this scenario is incredibly unlikely. Hyperinflation is so incredibly destructive for an economy that the Fed would probably let massive numbers of banks fail (thus causing deflation) rather than allow hyperinflation to get started.

Also, we’re talking about some incredibly extreme scenarios here. So far, the amount of money the Fed has had to pump into the banking system has not been particularly huge.

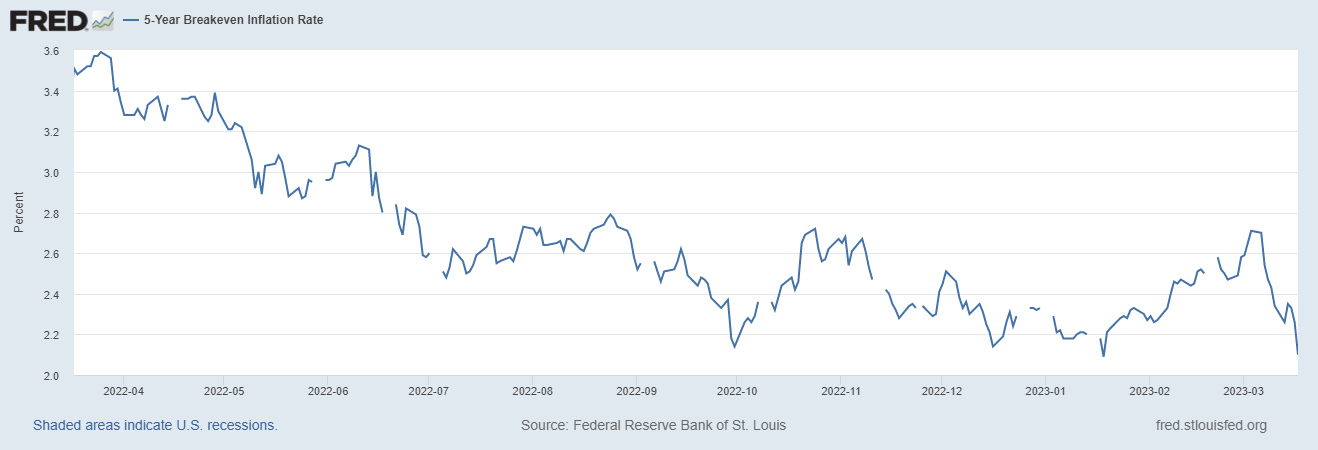

Anyway, markets so far don’t see much chance of hyperinflation. The 5-year breakeven inflation rate, which measures bond traders’ expectations of inflation in 2028, is back down to right around 2%:

Note that inflation expectations have fallen quite a bit since the run on Silicon Valley Bank. Bond traders, unlike Bitcoin enthusiasts, understand that bank failures cause deflation, not inflation.

So anyway, not only is Balaji going to lose money on his bet, he’s going to lose the bet outright. Balaji may have successfully predicted the coronavirus pandemic, but this time, his crystal ball has led him awry.

It also seems likely that Balaji’s bet will reflect badly on the public image of Bitcoin, and the whole narrative associated with that cryptocurrency. Some people have theorized that Balaji is just giving away $1M in order to draw attention to Bitcoin and thus pump up its price, which will raise the value of his own portfolio. But the longer-term impact on Bitcoin’s price seems just as likely to be in the opposite direction. When no hyperinflation materializes by summer, and Balaji gives a million dollars to a pseudonymous Twitter personality, it will make Bitcoin’s whole story of macroeconomics look out of touch with reality. Throwing money away to draw attention to a bet on Bitcoin, and then losing the bet, does not seem like it would be a good way of creating popular enthusiasm for Bitcoin.

But anyway, what do I know? The vagaries of financial sentiment are mysterious. Maybe some investors really will flood into Bitcoin, and Balaji’s wealth will go up as a result of his bet.

And even if it doesn’t, Balaji will be OK. He’s a very rich man, so losing $1M (or 36 BTC) will not materially impact his net worth. And Medlock, who is no poor man himself, has promised to keep only $300,000 of the bet, giving the rest to charity and taxes. So in the end, everyone wins from this bet. Including you, the readers, who get a chance to be entertained by some Twitter drama. And including me, because I get a chance to explain some macroeconomics.

I kind of wish Balaji had made the bet with me instead, though. I would have given all the money to rabbit rescues, as I do with the proceeds of every bet I win.

Not worth the post. Balaji is simply a crank.

The buried lede here is that Medlock is already loaded? No hating, just appreciating.