If you think Americans are mad now, just wait a few months

Some guesses as to how long it will take the real pain to arrive.

“Liberation Day” seems so long ago now. I remember reading about the madness just 26 days ago, sitting at the kitchen table in an Airbnb in downtown Tokyo, getting ready to go to a book event. I recall just staring at the list of tariff rates, almost unable to believe that a sitting U.S. President would do something so destructive to the U.S. economy. I knew in that moment that I would be writing about tariffs and their downstream effects for a very long time.

You’re probably tired of hearing about tariffs all the time. I know I am. But that’s the problem with major disasters; they don’t give you the luxury of ignoring them. The unfortunate truth is that although people are already getting very mad, the real economic pain of tariffs hasn’t even hit yet, and when it does, it’s going to absorb even more of our attention for at least the next year or two. That’s what happened with the financial crisis of 2008 and the Great Recession of 2009-11, and that’s what happened with Covid. Trump’s tariffs will define the era that you and I live in now.

Anyway, before I get to the point of today’s post, I have a bunch of podcasts to share. I usually post podcasts in my regular roundup, but I’ve been cutting back on those, because tariffs and other Trump policies have been absorbing so much of my mental energy. Over the last two weeks I’ve gone on a bunch of podcasts, and tariffs have been 95% of the discussion. So they really do fit with today’s topic.

Here’s a podcast I did with Andrew Yang, about tariffs:

And here’s the YouTube link, in case you like seeing my talking head.

Here’s an episode of the Search Engine podcast that I recorded with P.J. Vogt:

This one isn’t as much about tariffs per se; it’s about the national debt. But the two are intimately linked, because capital flight due to tariffs is raising borrowing costs for the U.S. government, and making the national debt harder to finance. Also, whether the Fed raises or lowers interest rates depends a lot on whether tariffs end up increasing or decreasing inflation (which I’ll get to later in this post).

Anyway, here’s another podcast about tariffs, this one with Andrew Xu, who is a very underrated interviewer:

Next, Hexapodia, my podcast with Brad DeLong, is back after a year on hiatus! This week we talked about a bunch of topics related to the Trump Era:

And here are three episodes of Econ 102 with Erik Torenberg, all of them about tariffs and the fallout from tariffs (capital flight, deindustrialization, etc.):

Anyway, tariffs are also the topic of today’s post. Americans are starting to get very angry about the tariffs, as they ought to. But so far the actual economic pain from Trump’s policies hasn’t hit — there’s been no big rise in unemployment, no cratering of GDP growth, no empty shelves and only a modest increase in inflation. So far it’s all just market movements, gloomy forecasts, and anger in the media.

So we’re in this strange holding pattern, a little like the period in World War 2 before the conquest of France. Humanity’s great superpower is that our intelligence allows us to see disasters coming before they strike. We saw a few people get sick from Covid, and we knew it would spread. We see global temperatures rising, and we know climate change is real. We hear about approaching armies, and we know to prepare our defenses.

A lot of Americans realize that tariffs mean that pain is heading their way, and it’s causing some to sour on Trump’s presidency.

Americans are getting increasingly mad at Trump

Trump started his second term with an approval rating that was slightly low in historical terms, but not abnormally low, and better than at the start of his first term. Unlike in 2016 he won the popular vote, along with every single swing state; it felt like he represented a national consensus this time.

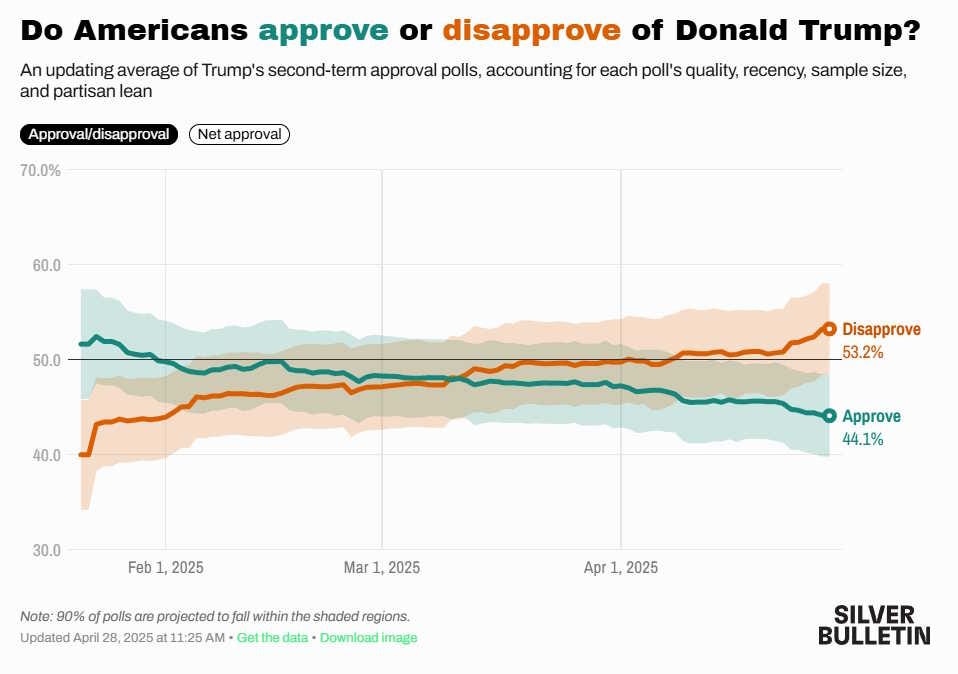

But the tariffs have already ended Trump’s “honeymoon” period. Trump has gone from around 12 points up in poll averages to 9 points down, with a significant portion of that shift happening after “Liberation Day”:

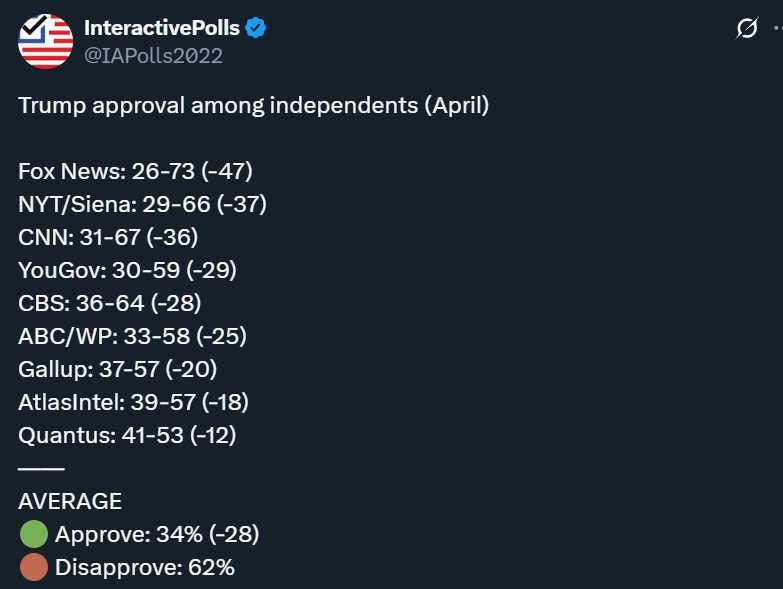

And among political Independents,1 his numbers are even more abysmal:

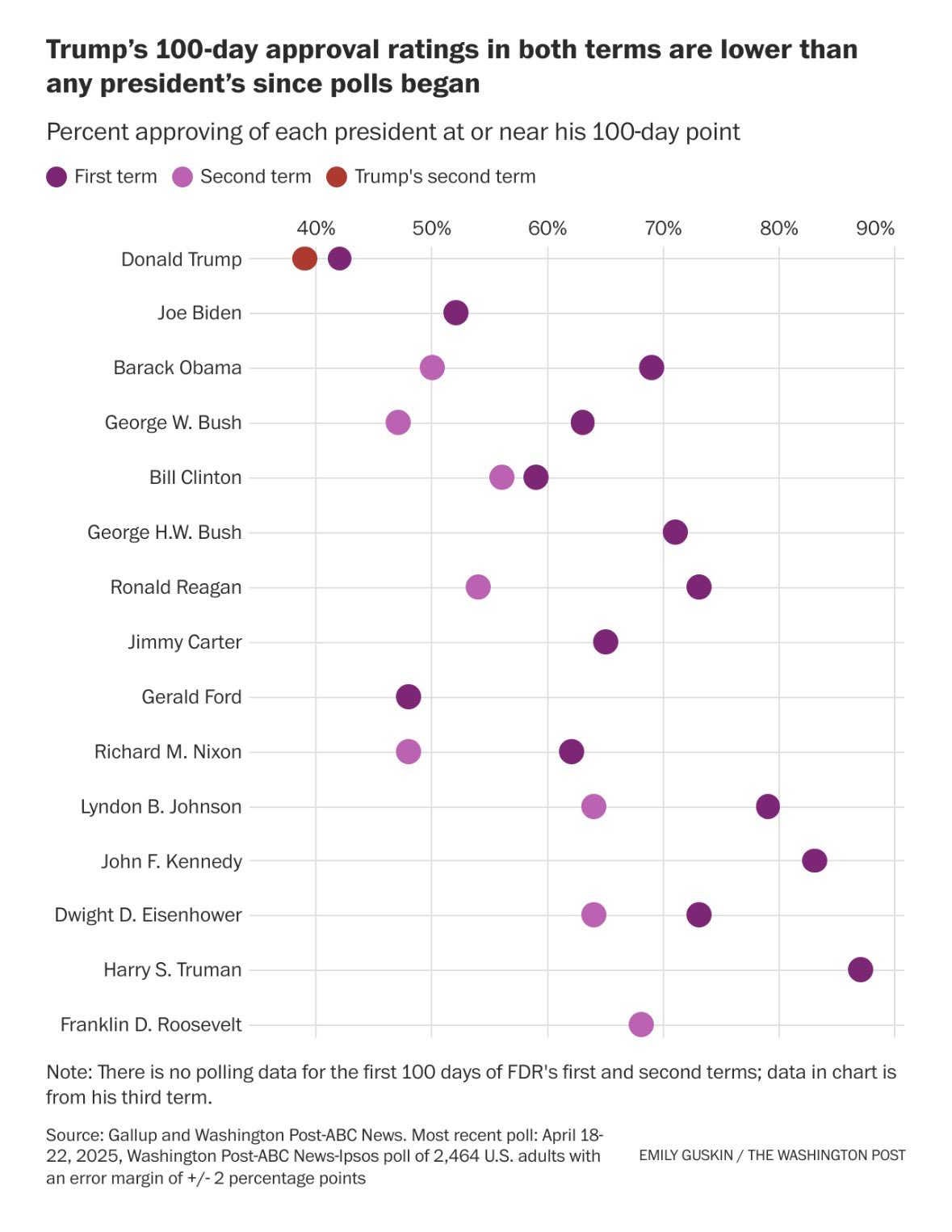

This is a historically rapid collapse in approval. Here’s a Washington Post poll comparing Trump 2.0 to previous presidencies (including his own first term):

The Republicans are polling lower as a party as well.

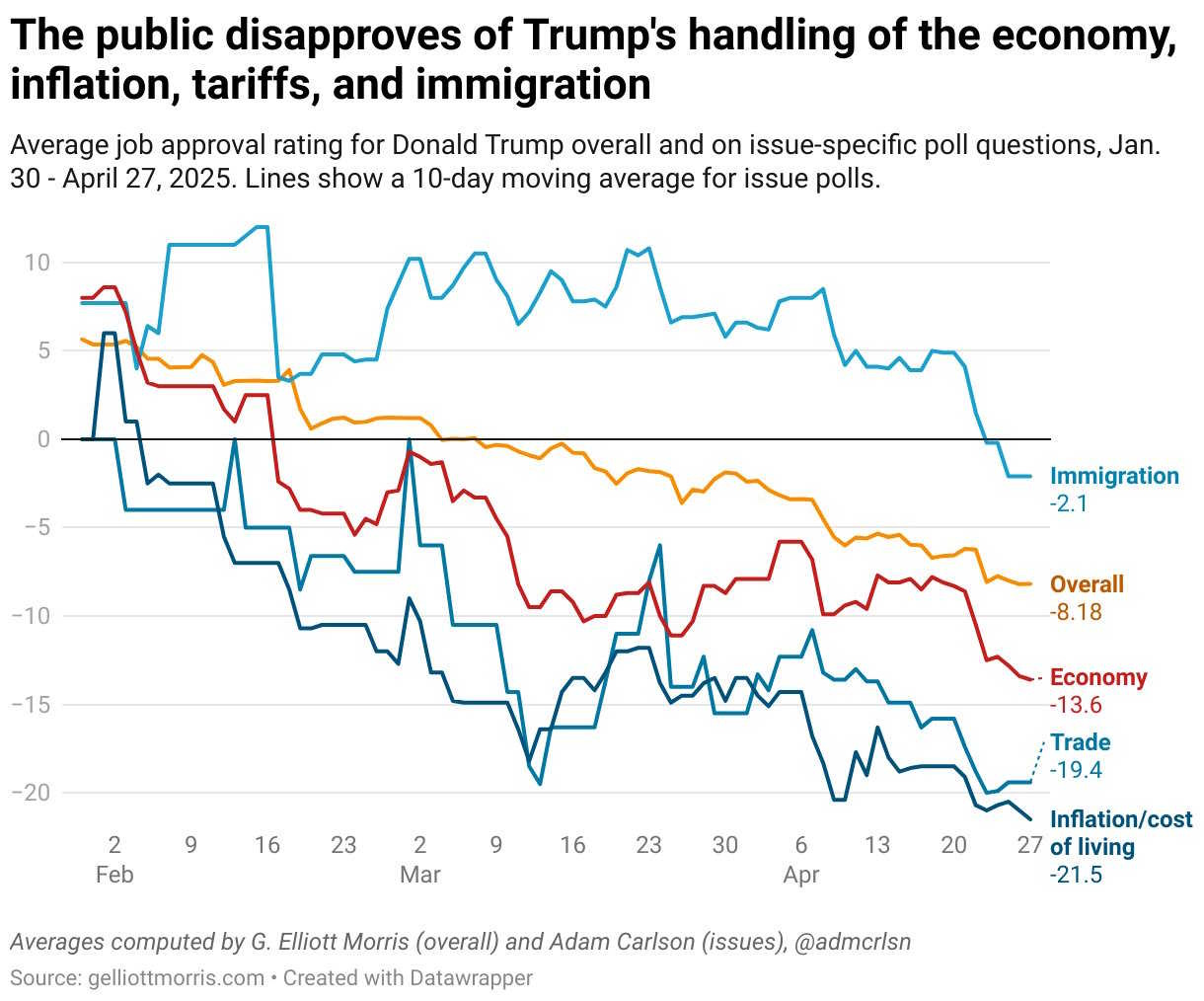

Tariffs are clearly the driver of this. Poll after poll shows that Americans disapprove of Trump on the economy, specifically:

Trump is…losing confidence among voters in his ability to handle the economy, an issue that he made a centerpiece of his 2024 bid for the White House and is consistently a top issue for voters. His sweeping tariffs injected volatility into the financial markets…Fifty-two percent of U.S. adults express confidence in Trump’s ability to handle the economy, according to the CNN/SSRS poll, a 13-point drop from December…The Washington Post-ABC News-Ipsos poll found that nearly three-quarters of Americans, 72%, think it is ‘very’ or ‘somewhat’ likely that Trump’s economic policies will cause an economic recession in the short term…The NBC News poll found that a majority of Americans disapprove of Trump’s handling of trade and tariffs (61%) and inflation and the cost of living (60%).

But interestingly, it’s not only the economy where Trump is losing support. For a while, his numbers on immigration held firm even as his economic numbers deteriorated. In the last couple of weeks, however, he’s begun to lose support even on his most popular issue:

One possibility is that as Americans sour on tariffs, they’re rejecting Trump in general, which leads them to reject his other policies as well. A second possibility is that we’re seeing a thermostatic opinion shift — a few polls show Americans becoming more positive on immigration since Trump was elected (though others show the opposite).

But on top of that, I think the case of Kilmar Abrego Garcia — the man illegally deported to a Salvadoran prison — is having a big effect. Trump’s response to the Abrego Garcia case has been very authoritarian, including the possible defiance of a Supreme Court decision. Even some Trump supporters like Joe Rogan and Bill O’Reilly have spoken out against Trump’s treatment of Abrego Garcia. Polls show strong majorities favoring his return, and even a sizeable minority of Republicans say Trump has “gone too far” in expanding the powers of the presidency. Americans also seem capable of distinguishing border security from the Abrego Garcia case — they still approve of Trump’s success in stanching the flow of asylum seekers across the southwestern border, even as they increasingly sour on his approach to deportations.

A number of people I talk to expect the deterioration in Trump’s approval ratings to stop at a fairly high “floor” of maybe 35%. This idea is probably based on Trump’s first term. But it’s important to realize that during Trump’s first term, up until Covid, Americans on the whole never suffered economically. The late 2010s featured low unemployment, robust wage growth, low inflation, and rising asset markets.

That’s going to change now. The real economy hasn’t begun to suffer from tariffs yet, but it soon will, and when it does, Americans will be hurt in a way that they never were during Trump 1.0. At that point we will see how much of a floor Trump’s approval really has.

So how long will it take the real pain to arrive? There will be a bit of pain in a month or two, especially in specific industries, but the worst is probably still at least six months away — and possibly much more.

The real economic pain has yet to arrive, but it’s on the way

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.