Four things I got wrong since I started this blog

Keeping myself honest.

Pundits are not forecasters. Even though we occasionally make quantitative predictions, it’s not really our comparative advantage — that’s the job of people with big data sets and statistics packages. This makes it hard to hold us accountable for our mistakes. Deciding whether pundits were right or wrong involves a lot of personal judgement — both in choosing which predictions to evaluate and in evaluating how right they were. And so attempts to gauge pundits' prediction records will inevitably be exercises in extreme subjectivity.

That said, I think it’s still important to note where pundits got things wrong. This is not necessarily so we can separate pundits into “smart” and “dumb” categories; most opinion writers have some valuable point of view about something, and everybody will make some mistakes. Instead, looking at our records is a way of understanding our thought processes — our areas of expertise, our blind spots, our bouts of motivated reasoning. Understanding how a thinker thinks allows us to more easily separate the signal from the noise.

I noticed the New York Times did a recent series in which they asked their columnists to list something they got wrong. The responses are all pretty interesting (though some are less than humble). So I thought I’d list a few of the things I’ve gotten wrong since I started this Substack in late 2020. This will be especially useful for people who only subscribed lately, and may have missed my earlier mistakes. The four things are:

Missing the rise of meme stocks during the GameStop bubble

Thinking Covid relief spending wouldn't cause a consumption boom

Underestimating Covid variants

Overestimating the appeal and effectiveness of cash benefits

In each of these cases, I’ll try to explain what I got wrong and why, and where possible I’ll also try to point to someone who got it right. It’s good to diversify your sources of opinions and analysis!

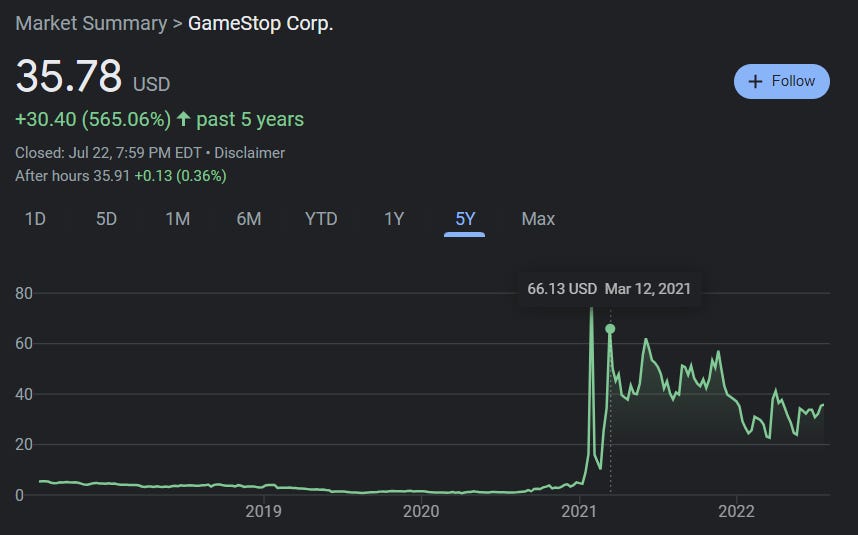

1. The Gamestop bubble (January 2021)

When Gamestop stock suddenly surged to insane levels in January 2021, I wrote a post predicting that this was a bubble that would soon crash, and listing several academic theories of why bubbles like this happen.

In fact, this prediction wasn’t actually wrong; Gamestop did crash hard, just a few days after I wrote my post. In technical terms, that meant my bubble call was correct, and if you had shorted GME immediately after reading my post, you could have actually made a lot of money.

But what I failed to anticipate was that the stock would then bounce right back to near its previous highs. Though GME has drifted downward since then, it hasn’t seen another spectacular crash, and it remains much higher than it had ever been before January 2021:

In other words, I failed to anticipate the rise of meme stocks — stocks whose prices are sustained at high levels due to persistent online attention.

In fact, economic theory does provide a basis for meme stocks being persistently overpriced. Harrison & Kreps (1978) show how in the presence of limits to arbitrage (i.e. in reality), the price of a stock is boosted upward by the most optimistic traders. In other words, if you have some silly person out there who’s willing to pay $40 for Gamestop stock just because it’s a stock that everyone on r/wallstreetbets happens to know about and talk about, and if there aren’t enough deep-pocketed short-sellers waiting to bet against that silly person, then the silly person gets to set the price. And even rational investors will often pay more than GME is worth based on fundamentals, because they know that eventually some other true believers will come along and overpay.

In fact, there is evidence for a “meme stock” effect even before r/wallstreetbets and Robinhood. Barber & Odean (2008) found that “individual investors are net buyers of attention grabbing stocks, e.g., stocks in the news, stocks experiencing high abnormal trading volume, and stocks with extreme one-day returns.”

Knowing this research, I should have emphasized the possibility that Gamestop would stay overpriced for a long time.

As for who got this one right, I don’t know of anyone who specifically predicted the 2021 meme stock boom in advance, but Matt Levine certainly had the most amusing real-time commentary.

2. The impact of Covid relief spending on consumption (February 2021)

This was probably my most important miss, since economics is (at least in theory) my area of expertise. In February 2021, as Biden was preparing to pass his big Covid relief bill, I wrote a post arguing that Covid relief spending didn’t provide very much fiscal stimulus — that instead, we should regard it as a form of social insurance. I wrote:

If you get a check during a pandemic, you’re not going to go out and spend it at restaurants and bars, because…well, there’s a pandemic. Instead, you’re more likely to stick it in the bank, pay down debt, or pay the back rent that you owe…

So basically, three things happen from the relief checks:

We redistribute wealth in response to an unexpected disaster (retroactive social insurance). This doesn’t cause much inflation or increase GDP much.

We put some idle resources to use (fiscal stimulus) and allow people to increase consumption. This increases GDP and prevents deflation.

We cause people to bid up the prices of consumer goods like food and Amazon merchandise without increasing production

Figuring out the risk of Biden’s relief bill requires predicting how much of the spending will go toward each of these three. Right now, folks like Blanchard and Larry Summers are discussing how much of (2) vs. how much of (3) there will be. But I think they’re basically ignoring (1).

I think that there will be a whole lot of (1). And I have data to back me up. An August 2020 paper by Olivier Coibion, Yuriy Gorodnichenko & Michael Weber found the following:

Using a large-scale survey of U.S. consumers, we study how the large one-time transfers to individuals from the CARES Act affected their consumption, saving and labor-supply decisions. Most respondents report that they primarily saved or paid down debts with their transfers, with only about 15 percent reporting that they mostly spent it. When providing a detailed breakdown of how they used their checks, individuals report having spent or planning to spend only around 40 percent of the total transfer on average. (emphasis mine)

This suggests that a majority of COVID relief spending goes to retroactive social insurance, not to fiscal stimulus. That means if you measure the multiplier for this spending, it’s going to be a lot lower than multipliers in traditional recessions like the Great Recession.

I had some theory and some evidence on my side for this prediction, and yet I ended up being very wrong about what would happen to consumption. Personal consumption expenditures surged in 2021 and stayed robust in early 2022, more than making up for the fall in 2020:

Formally, I can’t say that I know that A caused B here; we still lack solid research on whether and how the Covid relief spending caused this burst of consumption spending (and there are still a few people who claim it didn’t). So I’m not 100% sure I was wrong.

But at this point I’m pretty convinced I was wrong. We know that the U.S. was much more generous than most other rich countries in terms of direct fiscal transfers, resulting in higher disposable personal income during the pandemic:

And we know that although personal savings rates jumped when Covid relief was handed out, they didn’t stay high for long, and are now below their pre-pandemic trend:

It’s pretty clear that regular Americans spent more because they had more money, and that they had more money because the government gave them a bunch of cash. And it looks like a lot of this spending was delayed — people initially stuck their cash in their bank accounts, but eventually they spent down those savings in a big consumption binge.

This delayed reaction calls into question some of economists’ methods for identifying fiscal multipliers. If government spending can cause a burst of consumption a year afterward, it means we can’t just look at the immediate response.

In any case, I got this one wrong, and Olivier Blanchard — whom I argued against in my post about Covid relief spending — got it right. He modeled Covid relief spending as a standard stimulus, instead of assuming based on evidence from 2020 that people would simply save most off what they received. He anticipated the possibility that the CARES Act of 2020 might have a delayed effect. And so he ended up predicting that the Covid stimulus bills, all told, would add substantially to aggregate demand — and therefore to inflation as well.

Jason Furman also got it right:

Overall this was a big victory for centrist macroeconomist types who kept their heads screwed on straight, applied simple traditional models, and refused to be swept up in the idea that 2008-12 and 2020 meant we were living in a new era where the old rules no longer held.

3. The importance of Covid variants (March 2021)

In March 2021 I wrote a post arguing that Covid was on the way out. My reasons included more efficient social distancing behaviors, large-scale vaccine production and distribution, and human immune systems continuing to evolve better defenses over time. And I also argued that new variants were not a big reason for concern:

In recent months, there has been an explosion of variant COVID strains. Some, like the UK (B.1.1.7) variant, are more infectious and spread faster. Others, like the South Africa (B.1.351) variant, are somewhat resistant to the antibodies that the human body produces to fight off the original version of COVID-19. Fast-spreading variants just mean we have to go faster on vaccination and be more careful with social distancing and masks. But antibody-resistant strains are the really scary one, because they raise the possibility that our vaccines — or acquired immunity from COVID infection — might not work against the new variants.

But initial data look encouraging. This handy chart from Eric Topol shows that the J&J vaccine and the (not yet approved) Novavax vaccine are still somewhat effective against the South Africa variant, which appears to be the most resistant one so far…The AstraZeneca vaccine (used in the UK but not yet in the U.S.) was not effective at all against the South Africa variant in terms of preventing mild infections. But that’s just mild infections — it may be able to prevent severe disease and death.

That’s really the key here — even if the South Africa variant or some other resistant strain can get around antibodies enough to produce a mild infection, vaccines will probably be able to stop it from putting you in the hospital. And that mild infection would presumably make you immune to the new variant as well.

Anyway, there’s even better news here: The mRNA vaccines were able to create neutralizing levels of antibodies against the key mutations in the South Africa variant, in the lab. That means that our top-of-the-line vaccines can still probably block the scariest existing variant. And remember, if the virus evolves more, these mRNA vaccines are very easy and fast to update for the new strains.

Nature is tough, but human technology is even tougher.

Obviously, I didn’t anticipate the emergence of the Omicron variant, which managed to get around both vaccines and natural immunity much more effectively than previous variants. Vaccines did end up providing a lot of protection against severe disease, as I predicted, which is why death rates have been so much lower in the more recent waves (except among the unvaccinated).

But what I also didn’t predict was that the administration — and other countries’ governments as well — would drop the ball on vaccine development. Nasal vaccines and pan-sarbecovirus vaccines would be incredibly helpful in suppressing new variants, but leaders around the world show surprisingly little interest in developing these. They’ve apparently chosen to live with Covid, treating it as just a more contagious version of the flu. And that decision extends to the general populace, who has basically dropped the social distancing behaviors that I lauded in my March 2021 post.

In other words, though Covid appears to be enduringly less deadly than it was when I first wrote my post, the improvement in the disease situation is a lot less than I had hoped. Obviously the people to pay attention to here are the true experts, Akiko Iwasaki and Eric Topol, who warned about the importance of variants even as I was dismissing it, and who are now the loudest and most respected voices calling for a renewed vaccine development effort.

4. Cash benefits and Biden as the “Reagan of the Left” (2021)

In the early days of Biden’s administration, I was exuberant about the potential of cash benefits as a revolutionary economic policy tool. I wrote not one but two Bloomberg columns about it! In the first one, in March 2021, I wrote:

Biden’s $1.9 trillion Covid-19 relief bill has passed the Senate, clearing the way for it to become law. Much of the legislation is dedicated to handing out cash to individual Americans. This is a sign post for a tectonic shift that’s underway in U.S. policy thinking toward unconditional money transfers as the optimal way to help people in need…

[E]vidence is starting to pile up in favor of cash transfers. A 2018 literature review by Ioana Marinescu finds that various unconditional transfer programs tend to boost incomes, as well as health and education. And despite the widespread belief that welfare benefits encourage people not to work…the reduction in employment is negligible…

In other words, a handout, more often than not, is actually a hand up. This realization is fueling a growing consensus that cash benefits are the way forward for the U.S. Popular books and political campaigns are starting to advocate universal basic incomes. Think tanks like the Washington Center for Equitable Growth, with strong ties to the Biden administration, are advocating more cash benefits as the first line of defense against poverty.

And in the second one, in June 2021, I wrote:

Cash benefits have many of the advantages that tax cuts have. Republicans were drawn to the idea of tax cuts in the 1970s for many of the same reasons — they were simple, they put money in people’s pockets and let them decide what to spend it on.

But unlike tax cuts, which mostly benefit the rich since the rich pay a lot more taxes in the first place, cash benefits are far more balanced in terms of who gets the money. In addition to seeming fairer, that means cash benefits will have macroeconomic advantages as well. Since low-income people tend to spend a higher percentage of the money they get from the government, cash benefits will be better than tax cuts for boosting demand in the economy…

So in many ways, cash benefits are a best-of synthesis — they combine the Great Society’s compassion for the poor, the New Deal’s focus on providing security to the middle class, and the simplicity of Reagan’s tax cuts.

I still think I’m right about the economic advantages of cash benefits — the research isn’t settled on the subject, but I think the balance of evidence leans toward this type of program being more efficient and effective than our typical “workfare” approach to welfare.

But “efficient and effective” is not the same as “popular”. Most Americans turned out not to want Biden’s child tax credit — the centerpiece of his cash-based welfare program — to be made permanent. And some new research shows that workfare remains enduringly popular.

Even more importantly, cash benefits seem to have contributed at least somewhat to the dangerous and painful inflation that the economy is now experiencing. In fact, the fact that cash benefits are more stimulative than other forms of spending was explicitly one of the reasons I endorsed the approach in my second Bloomberg post! But because I didn’t anticipate the return of inflation, I thought this would be a plus rather than a minus. Like most of Biden’s economic advisors, I was still mentally stuck in the 2010s, in which stagnation rather than inflation was the main economic threat.

In fact, my mistake went beyond just cash benefits. I repeatedly wrote that Biden’s whole economic program had the potential to be as revolutionary as Reagan’s, pushing U.S. policy in a leftward direction for decades and giving future Presidents a template for how to address the country’s challenges. Sadly, it was not to be. In a recent post, I explained why I got it wrong:

The problem wasn’t just America’s perverse politics, or Joe Manchin’s intransigence. It was that Bidenomics was oriented toward fighting an economic recession/stagnation — basically, the problem that we faced in 2008-12 and the problem we briefly thought we were going to face when Covid struck in 2020. Instead, we got inflation, which rendered much of Biden’s approach not fit for purpose.

As I write in my mea culpa, I still think America needs a bold revamp of policy and a move to the left — just one that’s fairly different from what Biden tried to do. Instead, I think we need to focus on addressing high costs, with the “supply-side progressivism” and “abundance agenda” recommended by writers like Ezra Klein and Derek Thompson, and by the folks at the Niskanen Center. That will still involve a focus on government investment, but it’ll avoid costly subsidies to overpriced service industries, and it’ll mean more targeted forms of welfare in many cases.

Two unpopular predictions I’m sticking to

So there are four things I got wrong over the last year and a half. I also think there was a lot I got right, but I’ll save that for another post.

As a coda, though, I do want to mention two predictions I made that a number of people tell me I was wrong about, but which I still think are correct. First, there was my argument that passing the bipartisan infrastructure bill, back in late 2021, would not substantively affect the chances of passing Biden’s Build Back Better bill. Now, with BBB dead, some people think I got this wrong — that Democrats should have done as Pramila Jayapal and a few other progressives initially proposed, and held the infrastructure bill hostage in order to force Manchin to vote yes on BBB. Obviously, we did as I suggested, and we failed.

But I still think I was right. I think that Manchin’s behavior with regards to BBB — constantly offering compromises that he would accept, then going back on his word and refusing those compromises, until finally he just declared that he wouldn’t vote for anything at all — indicates a deep-seated desire to halt Biden’s economic agenda. Whether this is because of Manchin’s ties to the fossil fuel industry or just some kind of personal vendetta isn’t entirely clear. But a guy who rejects every possible compromise isn’t the type of guy who would capitulate just because progressives also refused to pass a modestly sized infrastructure bill. In other words, people who tell themselves that Dems had some sort of leverage over Manchin are just fooling themselves, and looking for a target for their frustration.

A second prediction I’m sticking to is that popular unrest has peaked in the U.S. I made that prediction back in the summer of 2021. Since then, we’ve had quite a number of mass shootings, including at least one that was a rightist terrorist attack. We’ve also had continued attempts by Trump and his followers to set the stage for a theft of the 2024 presidential election. And we’ve had the Supreme Court overturn Roe v. Wade and issue a number of other decisions that are allowing red-state Republican governors and legislatures to rapidly alter the country’s social landscape. How can I say, given all this, that unrest is dying down?

Well, a couple reasons. First, “unrest has peaked” is not the same as saying “unrest has declined”. It simply means that it’s no longer continuing to ramp up. In 2020 we saw protests that some thought would turn into a genuine revolution in America, and in January 2021 we saw the country’s first real coup attempt. Nothing we’ve seen since then has been as broad-based as the former or as threatening to social stability as the latter. The big exception — as I noted in my post — is if Trump & co. try to steal the 2024 election, sparking a constitutional crisis and possible civil war. If that happens, unrest will soar to new heights and I’ll definitely have been wrong.

But let’s cross that bridge when we come to it. In the meantime, mass shootings don’t indicate broad-based unrest — they’re consistent with my prediction that a shrinking fringe of American society would continue to get more and more radical even as the bulk of the populace became more disengaged. And conservative SCOTUS decisions, while they might eventually cause persistent unrest, are not themselves a sign of popular unrest, because they happen at the elite level. So I still stick to what I said in my original post.

I’m currently in grad school studying policy, and I’ve been very involved in cash transfer research over the past 6 months. I too have been shocked by just how married Americans continue to be to the idea of “workfare.” Even my fairly progressive grandparents balked when I described the CTC to them - “but how do you make sure they’re not just spending it on whatever they want and not working?” Survey data backs this up - most people aren’t keen on the idea of just handing out money.

But I do think there’s still lots of “room for growth” in public opinion here. When normal people see the poverty alleviating effects of the CTC, they tend to be impressed. I’m a former cash aid skeptic who was converted by good arguments and data! I think people like readers of this blog should continue to champion these sorts of policies, and in another 5 or 10 years, we could see some real shifts in public opinion.

Very much like your post Noah. I often disagree with some of what you say, but I applaud your willingness to revisit your priors. We are all human after all, even the smartest amongst us. Inbound information is filtered through sometimes biased, sometimes ignorant filters, and we ourselves have our own limitations and biases, as we must. The healthiest amongst us is only on this planet for about 35,000 days, and our productive working lives are maybe half that much. Honest individuals do what they can to try to make the world a better place. Way to go.