Does the yield curve tell us a recession is coming soon?

What the tea leaves really tell us.

My generation has a sort of PTSD from the Great Recession. Seeing so much of the economy just collapse was an epochal event in our formative years, and those formative experiences tend to leave their mark. Since that calamity, many have been jumping at shadows — predicting that the quantitative easing of the early 2010s would cause hyperinflation, that the rate hikes of the mid-2010s would cause a recession, that the expansion of the late 2010s would “die of old age”, that Covid would create another Great Depression, and so on. None of those pessimistic predictions panned out; since around 2012, the U.S. economy has gone from strength to strength.

But that doesn’t necessarily mean we aren’t headed for a recession now. In fact, we might be. Actually, that’s always the case, since macroeconomic forecasters are very, very bad at predicting recessions more than a few months in advance. That’s true for forecasters in the private sector, academia, and the government. No matter what method we use, we know very little about where the economy will be in 6 months, and essentially nothing about where it’ll be in 9 months.

A lot of people would disagree with that statement, though. In the finance world and in the financial press, there are a lot of people who think that you can see a recession coming well in advance, using something called the yield curve. When there’s something called a “yield curve inversion”, you’re supposed to get a recession 6 to 12 months later. Historically, this indicator has looked pretty reliable. The last four or five times we got a yield curve inversion, there was a recession (a gray bar on the graph) shortly afterwards:

In fact, that pattern mostly holds if you go back to the 1950s. The only time we got a “false positive” from this indicator was way back in 1966. One false positive out of eight or nine (depending on how you count) is a pretty decent track record.

And the other main thing you should notice from the graph is that the yield curve inverted very recently. In fact, the inversion happened in November 2022, over a year ago. So the most commonly used indicator of impending recession has been flashing red for a while now. In fact, in an episode of Econ 102 that I just recorded, the asset manager Itay Vinik argued that a recession is coming, and used the yield curve as his Exhibit A.

And in an election year, when the fate of the country could very well hinge on Americans’ economic mood, the question of whether we’re about to have a recession is very important.

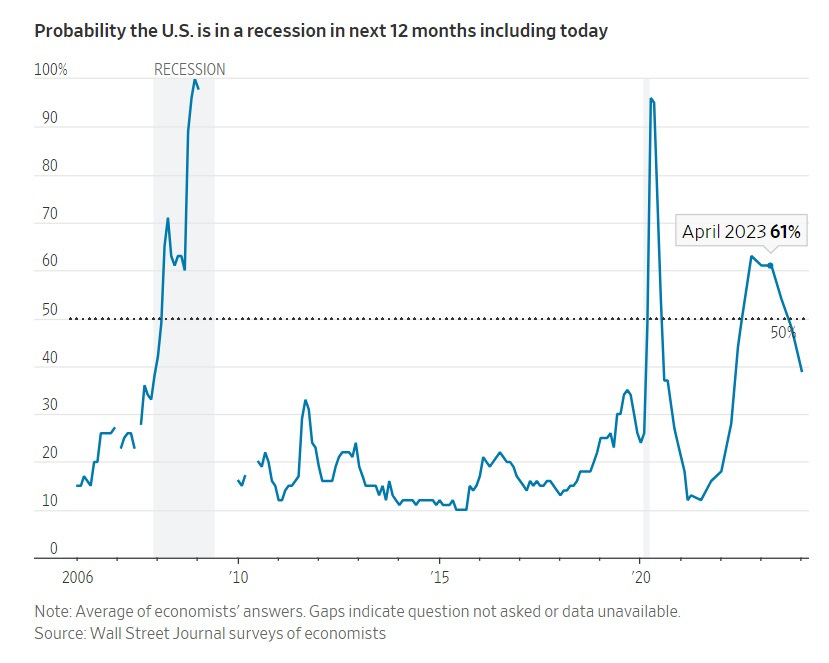

But it’s also true that in the 14 months since the yield curve inverted, we haven’t seen a recession yet — or even anything close to it. The Wall Street Journal does a monthly survey of economists, and in early 2023 they gave a greater than 60% probability of a recession within a year. As of this month, it’s down to below 40%:

The good economic news just keeps rolling in on every front:

The American consumer ended 2023 with a burst of economic good cheer…The biggest factor arguing for improved sentiment is that the Dow Jones Industrial Average and Nasdaq reached record highs in December, and the S&P 500 is on the verge of doing so…

The rate of inflation has plummeted, especially the core personal consumption expenditure deflator that the US Federal Reserve uses as its guide for setting monetary policy…That means expectations of lower interest rates, which have not only driven share prices up but should also help drive a more functional housing market. New starts leapt upward in the most recent data, helped in part by lower mortgage rates…

The cascading effect of the good news continues with the impact of a lower inflation rate on real wages…[E]ven politically conservative small business owners who say the economy is terrible also say they are planning to add workers.

For this to be happening 14 months after the biggest and longest yield curve inversion since the early 1980s suggests that there’s something wrong with the indicator — that it doesn’t always signal weakening economic conditions. I think I have an idea of what that is. But first, let’s talk about the basics of what the yield curve is, and why people think it should predict recessions.