Does student loan forgiveness make economic sense?

It would have been a great idea in 2008. In an inflationary world, it's trickier.

“They hired the money, didn’t they?” — Calvin Coolidge

President Biden is thinking of canceling a large amount of student loans:

The political wisdom of this is unclear. Biden has been losing support from young voters, and presumably this is a move to win them back. But it’s not clear what young people want when it comes to student debt forgiveness — a recent Harvard poll found that while 85% of young voters want some kind of action on student loans, only 38% want total forgiveness for everyone. In fact, older voters seem to show the same pattern — only about 30% say there should be no debt forgiveness at all, but only about 20% say it should all be forgiven.

So if you believe polls, then the American populace at large would prefer some sensible middle path. By limiting the amount of debt that gets forgiven for each borrower, and by only forgiving debt for people below a certain income level, Biden clearly hopes to find this happy medium. Of course there’s also the possibility that Americans are simply in such a bitter, exhausted mood that they’ll get mad at student debt forgiveness even though they supported it before it happened. It’s always a risk. The 4 out of 5 Americans who don’t have student debt might decide that it’s simply an unfair giveaway, especially if they already paid their own loans off.

But politics aside, it’s important to ask whether student debt cancellation makes economic sense. In fact, there’s a strong argument in favor of it, but there are also some drawbacks and risks — chief among them being inflation and moral hazard. Ultimately I still come down in favor of some kind of loan forgiveness. But we need to take steps to minimize the risks, and to make sure that the way Americans pay for college is changed going forward so that we don’t find ourselves in this situation again. And even if we do that, the size of the numbers involved mean inflation is a real worry.

The case for student loan forgiveness

The first important thing to understand about student loans in American is that most of them are owned by the federal government.

In fact, the graph above understates true government ownership, which is probably over 90%.

As you can see from the graph, this wasn’t always the case; after the Great Recession, the government bought up most of the student loans from private banks. This is why the government now has the ability to cancel (most) student loans. And it’s why the government was able to pause interest payments since the start of the pandemic, which has already acted like a mini loan cancellation.

It’s also a sort of answer to the question of “If you’re going to cancel student loans, why not mortgages, auto loans, and credit cards?”. Yes, if the government wanted, it could buy and cancel all of these as well, but it would take an act of Congress, which is not happening. So it’s worth it to debate whether the government should enact a general debt jubilee, but in practical terms, it’s student loans or nothing.

Government ownership also affects the moral question of whether we should cancel student debt. Since 1998, student loans are non-dischargeable in bankruptcy. That means these loans are special — there’s no way to escape them and start over, the way there is with credit card or auto debt. In practice, some people just stop making the loan payments forever, but that means debt collectors are after them for the rest of their lives. And because the government owns all the loans, it means our government is now in the practice of running down regular citizens to collect debt that those citizens have no way to get out from under. That seems like pretty awful political economy — not a healthy relationship between the government and the governed.

There’s also the fact that lots of people who have student debt never actually graduated from college. Our government has tons of policies and programs to encourage poor people to get an education in order to get ahead in life, and it offers them copious student loans as part of this. But not everyone graduates — in fact, about 40% drop out.

So there are millions of low-income Americans out there who did what the government told them to do — took out loans, went to college — only to find out that they weren’t cut out for it. And now despite not actually getting the benefits of a college education, those people are still on the hook for that debt to the very government that encouraged them to make a life mistake. That seems kind of wrong, doesn’t it?

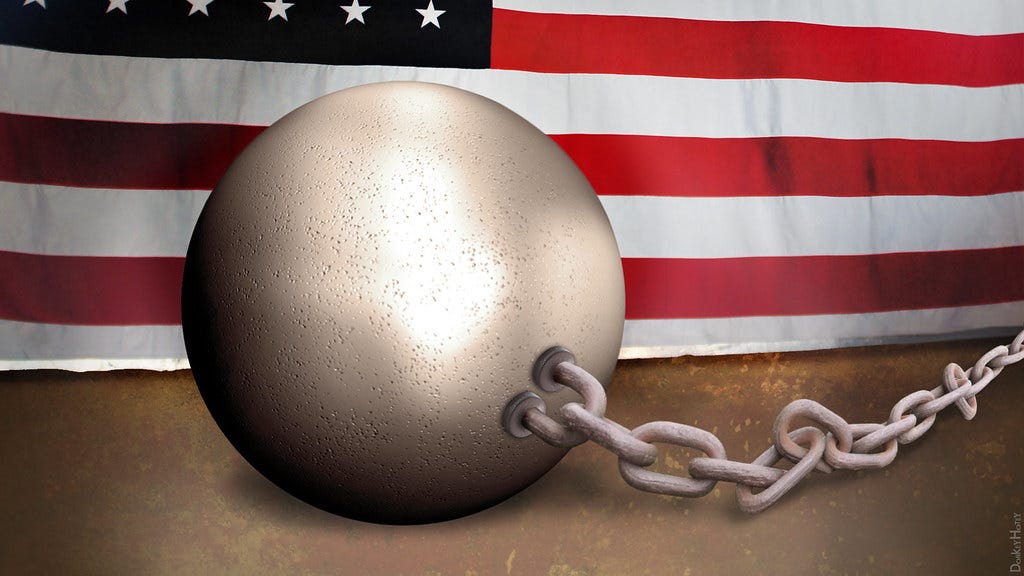

But student debt doesn’t just hurt borrowers. It hurts the entire economy, because it reduces economic dynamism. Debt acts as like a ball and chain around workers’ ankles, preventing them from starting businesses, changing jobs, or doing other risky but rewarding economic activities. If you have to make those loan payments every month, it severely constricts your options — you can’t afford to go very long without a steady income, so you’re tied to your current job.

There’s research to back this up. A recent paper by Krishnan and Wang finds:

[S]tudent debt is negatively related to the propensity to start a firm, particularly larger and more successful ventures…[Making] student debt completely non-dischargeable through personal bankruptcy reduced the likelihood of entrepreneurship by student loan borrowers that were already in four-year college at the time of this regulation. Moreover, an exogenous shock to the level of student debt due to the Higher Education Amendments of 1992 negatively impacts entrepreneurship rates for students already in four-year college at the time of this regulation. Entrepreneurs with more student debt are more likely to fall behind on their student debt payments[.]

The effect is modest but not trivial — $10,000 of student debt leads to a 7% reduction in the chance of being an entrepreneur. And in a second paper the authors confirm that this doesn’t just apply to small businesses, but to venture-funded fast-growing startups as well. As for job switching, there’s also evidence that debt stops talented young people from doing the jobs they want to do.

Economists have been worried for years about declining dynamism in the U.S. Lower rates of startups and job switching will tend, over time, to make the country poorer than it would otherwise be.

This rationale, of course, runs into one of the most commonly raised objections to student loan forgiveness — the fact that it’s a fiscally regressive policy. It’s possible to paint forgiveness as a trickle-down policy, giving money to the well-heeled professional-managerial class in the hopes that they’ll start businesses and create jobs and wealth.

In fact, the regressivity concern is overblown. While most student loan dollars are owed by high-income people, most of the people who owe student loans are not high-income. So because Biden’s proposal caps the number of dollars each person can get forgiven, high-income people who borrowed a lot of money will not get most of their debt cancelled.

And we should also think about what student debt does to the distribution of wealth. Because it makes it harder for people from modest backgrounds to start businesses, it tilts the entrepreneurial playing field toward those who come from wealthy families. That tends to reduce the churn among the wealthy, and to shield people with rich parents from competition. So cancelling student debt would be progressive in that sense.

So that’s the case for student debt cancellation. There are basically two reasonable cases against it — moral hazard, and inflation. The first of these is very manageable. The second may not be.

Moral hazard

Moral hazard, in this case, means that if we forgive student debt, it’ll encourage students to take out a lot more loans, because they’ll assume that another debt cancellation will eventually come along…and another, and another, etc. Eventually, the fear is that we trap ourselves in a toxic cycle, where everyone borrows a ton of debt because they know it’ll be forgiven, and the government is forced to forgive it each time because the consequences of not forgiving it as expected grow increasingly dire.

This is an absolutely reasonable worry. In fact, there is sort of a precedent for this — corporate tax holidays. Our tax system encourages companies to hold cash overseas, in low-tax jurisdictions, in the hope that at some point the U.S. government will give them a repatriation holiday, allowing them to bring the money back tax-free. And in fact, we did this in 2004 under Bush, and again in Trump’s 2017 tax bill.

There is one reason to expect this not to happen, though. In addition to buying up most of the outstanding student loans, the federal government now makes most new student loans. So even if students want to borrow more, the government may not choose to lend to them.

In fact, the right thing to do would be to have the government lend less going forward. There is evidence that making student debt more available pushes up tuition. Lucca, Nadauld & Shen (2017) report “a pass-through effect on tuition of changes in subsidized loan maximums of about 60 cents on the dollar”, meaning that 60% of the money we’re lending to students — and then forcing them to pay back with interests — just gets fed directly to university budgets. Loan subsidies and other policies that increase credit supply to student borrowers are thus responsible for a portion of the runup in tuition that we saw over the past few decades.

Yes, this money winds up in the pockets of universities, and it’s good for governments to fund universities. But there are better ways to do it than this. Instead of garnishing the future earnings of our youth in order to fund administrative bloat in our institutions of higher learning, the government should simply spend a lot more on university research. If we decide we want to pay more for undergrad education, we should simply do that the simple way, by dishing out more government funding to state universities, and by giving kids Pell grants instead of loans.

There’s another thing the government can do in order to fix the moral hazard problem — shift toward a system of income-based repayment in the future. We’ve already been doing some of this, but we should make this the norm for all student loans, as in Australia. In other words, only people for whom the gamble of going to college pays off will have to pay the money back. Of course that means interest rates on student loans will have to rise (to reflect greater risk of non-repayment), meaning credit supply will fall.

But that’s OK. In the end, it’s part of a needed winnowing of the bloated higher ed model that we’ve developed since the 90s. College administrators have partied and splurged at the expense of workers, and this system simply couldn’t continue. Student loan forgiveness can be the start of a process by which we force our higher ed sector to be leaner, meaner, and less dependent on turning dropouts into indentured servants.

Inflation

So if this were where the discussion stopped, I would say “Yes, go ahead, forgive the student loans”. And in fact I did say this back in 2018. Regressivity and moral hazard simply aren’t sufficient counterarguments.

But inflation might be. There are an estimated 43 million student loan debt holders in the U.S. That means that if the max forgiveness per person is just $10,000, we could see up to $430 billion in loan forgiveness. That’s a significant sum — almost 1/4 of the size of Biden’s Covid relief bill back in early 2021.

Biden’s bill may have been necessary to get the economy back on its feet quickly (a topic I’ll address in a future post), but it almost certainly raised inflation — maybe by about 3 percentage points in 2021. And in fact, loan cancellation is exactly the kind of thing that would tend to exacerbate demand-driven inflation — rising consumption, which is pushing up prices, is currently being largely funded out of excess household savings, and debt forgiveness would simply increase that consumption potential.

Now, if student loan forgiveness raised inflation by 0.7 percentage points, that wouldn’t be a huge increase, especially with inflation now at over 8%. But it could help cement a popular belief that the U.S. government simply doesn’t care about inflation that much. And that could help kick off a spiral of rising prices, as high expectations become a self-fulfilling prophecy. And that spiral would absolutely necessitate the Fed raising interest rates to punishing levels, causing a deep and painful recession.

We really don’t want that. Low-income workers are the people who get hurt the most in big recessions. It would be truly wrong to punish the U.S. working class en masse simply in order that educated Americans wouldn’t have to pay as much of the money they borrowed.

In other words, student loan forgiveness would have been an excellent policy back in 2010, when inflation was sluggish and consumer demand was in the dumpster. But in this inflationary environment, the danger of doing anything that pours fuel on the fire means that the bar for expansionary policies like loan forgiveness is higher. And the economic upside of student debt cancellation, while real, is relatively modest.

Given the dangers posed by inflation, it might be a good idea — political considerations aside — for Biden to wait until 2024, when inflationary pressures may have subsided. In the meantime, simply making student loans dischargeable in bankruptcy, and shifting to a more income-based repayment system (including retroactively, for people with existing loans) would be the safer route. But I guess if Biden thinks that loan forgiveness will pump up youth turnout in the midterms, and that this is worth the risk of sending businesses the message that the U.S. government doesn’t care about inflation, then go for it.

Canceling debt is a short-sighted, purely political play. Forcing universities to reign in ridiculous tuition costs, on the other hand, would *actually* make a long-term difference.

I’d love a detailed follow up post on how to reduce the moral hazard piece. I’m not a debt cancellation proponent but I could stomach it if we actually fixed the underlying issues in the education system.