Decoupling isn't phoney

The global trading system is starting to rearrange itself, and it's mostly not Biden's doing.

If there’s one broad consensus in American policymaking circles today, it’s that global supply chains need to become less dependent on China. Whether you’re concerned about Chinese military capabilities, or import competition, or the risk of cutoffs of critical imports in an emergency, it seems like a bad idea to have every physical good on the planet made in China. So from Trump’s tariffs to Biden’s “friend-shoring” initiatives, U.S. leaders have begun pushing companies to either make things locally or import them from countries other than China.

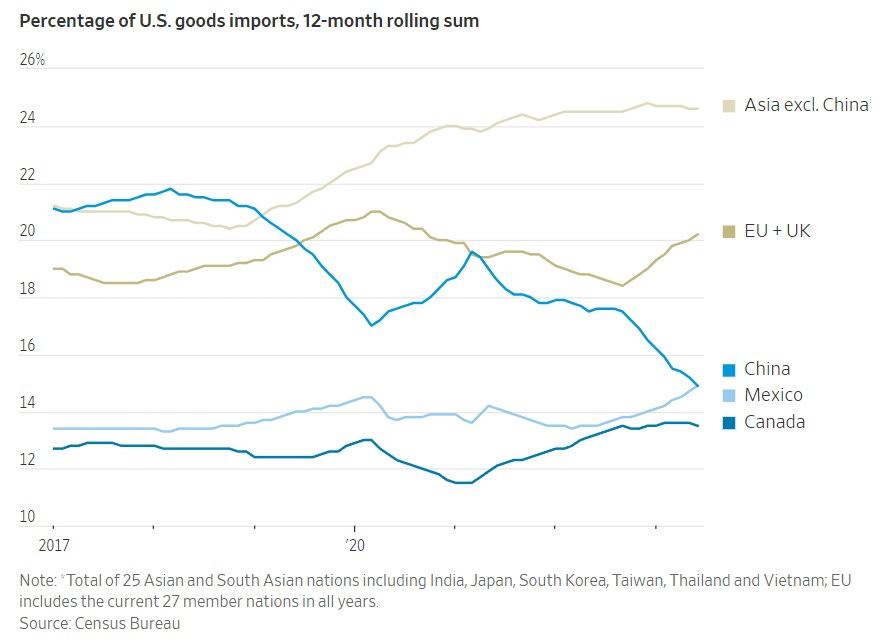

What’s astonishing is that this already seems to be happening, much faster than one might have naively predicted. China’s share of U.S. imports, which already took a hit from Trump’s tariffs before rebounding somewhat in the pandemic, is now falling relentlessly:

For advocates of friend-shoring, de-risking, decoupling, etc., this looks like a startlingly sudden victory.

But a few people are claiming that this change is a statistical illusion, and that U.S. dependence on Chinese imports hasn’t fallen. In a recent pair of articles, The Economist declares that “Joe Biden’s China strategy is not working” and offers to tell us “How America is failing to break up with China”. In the first and shorter of these pieces, they write:

The consequences of [the Biden administration’s] new thinking [on trade] are now becoming clear. Unfortunately, it is bringing neither resilience nor security. Supply chains have become more tangled and opaque as they have adapted to the new rules. And, if you look closely, it becomes clear that America’s reliance on Chinese critical inputs remains. More worrying, the policy has had the perverse effect of pushing America’s allies closer to China.

The Economist’s basic argument is that because many of the goods exported to the U.S. from countries like Vietnam contain a lot of parts and components made in China, “decoupling is phoney”. They write:

America may be redirecting its demand from China to other countries. But production in those places now relies more on Chinese inputs than ever. As South-East Asia’s exports to America have risen, for instance, its imports of intermediate inputs from China have exploded. China’s exports of car parts to Mexico, another country that has benefited from American de-risking, have doubled over the past five years…Supply chains have become more complex, and trade has become more expensive. But China’s dominance is undiminished.

Make no mistake: The general issue The Economist is talking about here is very real. The way we normally count imports and exports only takes into account where the final assembly was done; it doesn’t count the value of the components that the assembler has to import in order to create the final good. So when you see a label on your phone that says “Made in Vietnam”, the screen, the processor, the memory, the camera, and other components may not have been made in Vietnam. The true amount of economic value that each country exports to each other country is the amount it contributes to the final product, which is called “value added”. Here’s a good explainer from the St. Louis Fed, which includes a helpful explanatory diagram:

In fact, over much of the past 20 years, China’s trade surplus with the U.S. was much smaller in value-added terms than in gross terms. Because China used to import most of its high-value components from Japan, Korea, Taiwan, etc., the actual amount it exported to the U.S. was much less than the headline amount. In recent years this gap has shrunk to a modest size, due to China’s onshoring of component manufacturing.

So anyway, when The Economist says that decoupling is “phoney” and “China’s dominance [of supply chains] is undiminished”, it means that although China is exporting fewer finished goods to the U.S., it’s exporting the same amount of value added.

Startlingly, however, The Economist provides no actual data to support this claim. It does provide a few scattered data points, which I will quote here:

The latest official data, published in 2018, concerning exports by the Association of South-East Asian Nations (ASEAN), a regional club, show that 7% by value were actually attributable to some form of production in China. Fresher data suggest that China has only grown in importance since then. The country has increased its share of exports to [ASEAN]…In the first six months of the year Chinese sales of [electronics] in Indonesia, Malaysia, Thailand, the Philippines and Vietnam rose to $49bn, up by 80% compared with five years ago…

In the past year Chinese companies exported $300m a month in parts to Mexico, more than twice the amount they managed five years ago….In 2018 China provided just 3% of automotive parts brought into the Czech Republic, Hungary, Poland, Slovakia, Slovenia and Romania…China now provides 10% of all car parts imported into central and eastern Europe, more than any other country outside the EU.

This is incredibly thin and scattershot evidence on which to base a claim that U.S. dependence on Chinese production remains undiminished.

Yes, there are cases of Southeast Asian nations slapping their labels on Chinese goods and then sending them to America to allow Chinese manufacturers to get around tariffs. But look at the graph of U.S. import shares above, and you’ll see that if 7% of imports from Asia ex-China are due to re-exporting, that would only shave 1.7 percentage points off of Asia ex-China’s share — only a fraction of the 4 percentage point increase in U.S. imports from that region since 2019.

The Economist claims, of course, that that 7% number has since risen. But the evidence it provides — an increase in Southeast Asian imports of Chinese electronics — says nothing about how many of those new imports are components for goods bound for America. The Economist simply assumes, without evidence, that that’s what they are.

Similarly, The Economist notes a recent increase in China’s auto parts exports to Mexico, which they say is “more than half” of a total of $300 million a month (or $3.6 billion a year). So let’s say that China has increased its car parts exports to Mexico by $2 billion over the last five years. Well, Mexico’s car exports to the U.S. have increased by around $13 billion since 2017, which is a heck of a lot more than $2 billion. Mexico’s auto exports to the U.S. are around $100 billion a year, utterly dwarfing the amount of car parts it imports from China. Once again, The Economist’s numbers just don’t add up.

Finally, The Economist notes a rise in East Europe’s auto parts import share from China, from 3% to 10%. But those East European-made cars aren’t even destined for sale in the United States! Poland, for example, sells approximately 0% of its cars to the U.S. Same for Czechia. Hungary sells about 3% of its car exports to the U.S., which is minuscule. And so on.

So as best I can tell, The Economist seems to be picking random data points about countries importing more stuff from China, and just assuming, without evidence, or in direct contradiction of the evidence, that A) these imports are components that will be used to make stuff that countries then sell to the U.S., and that B) this quantitatively cancels out the shift in U.S. imports away from China.

The Economist does present one other piece of circumstantial evidence — a working paper by Caroline Freund of the IMF that finds that countries that have been increasing their exports to the U.S. tend to be countries that trade more with China. But this is a very far cry from showing that China’s value-added exports to the U.S. have remained constant.

Thus The Economist made a bold claim that it was unable to back up with hard data. But that doesn’t mean the claim is false. As they say, absence of evidence is not evidence of absence. It still might be true that China’s value-added share of U.S. imports has remained constant! Until we get the value-added trade data from the OECD — which comes out with about a 5 or 6 year lag — we won’t really know for sure.

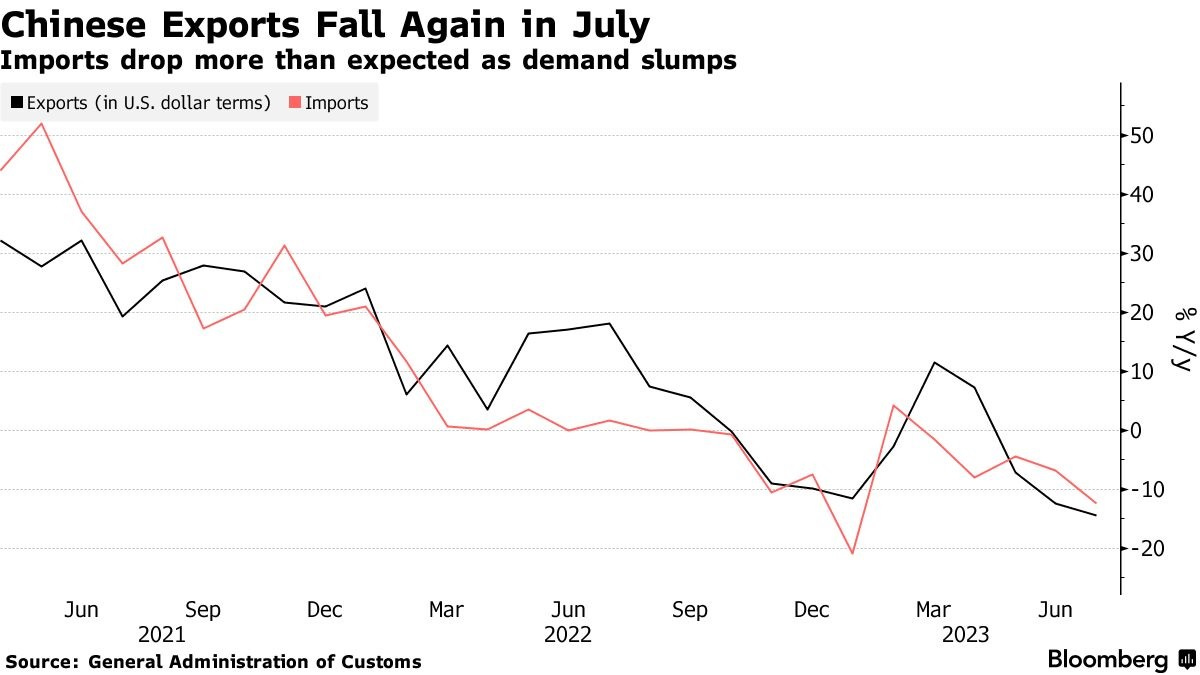

But there are reasons to think that at least part of the drop in U.S. dependence on Chinese imports is real — at least, the recent drop in the last couple of years. First, Chinese exports overall are down substantially from 2021:

Of course that’s not due to any sort of re-shoring policy, but some of it may be due to companies deciding to disinvest in China due to the risk of a war over Taiwan. FDI into China has probably been falling outright for a few years now; overall foreign investment in the country is now negative as investors race for the exits. If multinational companies no longer see China as a safe place to make things for sale in the U.S. market, that’s a definite tailwind for decoupling.

To the extent that falling investment in China is due to corporate de-risking, it’s probably eventually going to spread all the way up the supply chain. If you’re a U.S. company that moves production from China to Vietnam because of the risk of war, and your Vietnamese factory is importing most of its parts from China, you’ll know it. And you’ll know that you’re still exposed to China risk, and you’ll look around for alternative places for your Vietnamese factory to get its parts and components. That might take time — years even, given China’s dominance of manufacturing. But as long as the risk of conflict stays high for years, companies will keep looking for ways to build entire supply chains that never run through China. And they will succeed.

Second, Alfaro and Chor (2023) find some evidence in favor of reshoring of production from China — i.e., moving production to the U.S. instead of to Mexico or Vietnam. By definition, reshoring can’t involve the sort of “phoney decoupling” that The Economist talks about. They also find that Vietnam’s exports to the U.S. have become more capital-intensive “upstream” goods — not the kind of shift you’d see if Vietnam were merely importing Chinese upstream components and then slapping together.

Now, in fairness, Alfaro and Chor do find one big trend that they believe constitutes evidence of continued U.S. dependence on China: Chinese FDI into countries that export a lot to the U.S. (The Economist also mentions this briefly). The idea here is that if the companies that own the Vietnamese and Mexican factories that make stuff for the U.S. are Chinese companies, the U.S. is still dependent on China in some way.

Well, that’s one way of looking at it. But if the factory is in Vietnam, that means that even if the owner is Chinese, it’s Vietnamese workers who are getting paid, and it’s Vietnamese workers who are learning from working at the factory. Eventually, some will break off and form their own competing, domestically-owned factories.

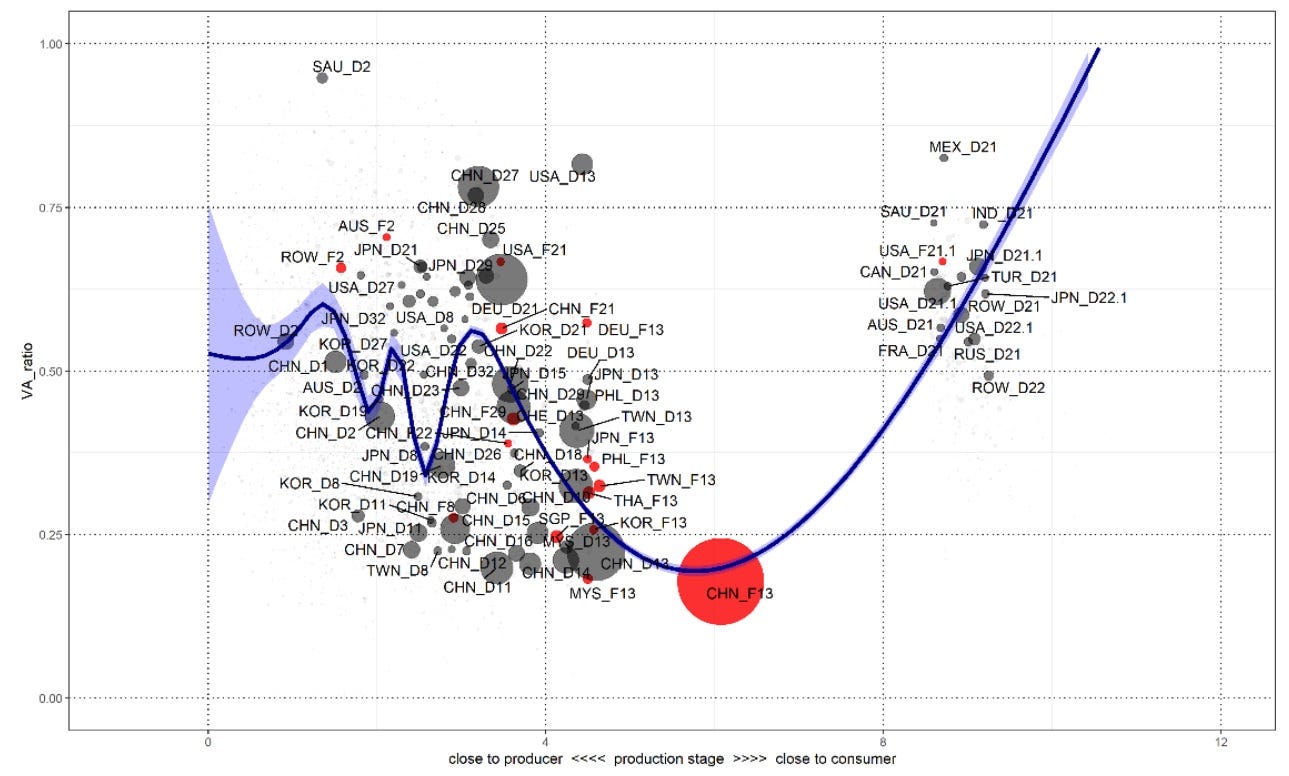

In fact, this is exactly what happened with China. For decades, multinational companies used China as a cheap production platform, until Chinese entrepreneurs learned their tricks and learned how to level the playing field and move up the value chain. Remember that as recently as 2013, China itself was still largely stuck at the bottom of the “smile curve”, doing low-value assembly work using imported foreign components.

Chinese people learned how to produce high-value components themselves. If you think Vietnamese and Mexican people won’t eventually learn to do the same, I think you should probably have a little more faith in the universality of humanity’s ability to learn how to make stuff.

This will take time. Decoupling is not an instantaneous process. China spent two decades becoming the workshop of the world; the rest of the developing world isn’t going to mirror that accomplishment in one or two years.

But there are reasons to think the process is just getting started. Although the Economist articles present decoupling as being driven by Biden’s policies, the truth is that the U.S. government has barely begun to push. Export controls are narrowly focused on the chip industry, and the Inflation Reduction Act isn’t really about decoupling at all. Other than that, all Biden has done so far is a set of investment restrictions that was very weak and narrowly targeted at a couple of high-tech industries, some minuscule investments in onshoring of critical minerals, and some minor deals with allies to share the benefits of green energy tax credits. He kept Trump’s old tariffs on China in place, but didn’t strengthen them.

That means that so far, most of the decoupling that’s being done is being driven by the prudent decisions of private companies and investors — natural market forces, rather than the visible hand of government policy. There’s no reason to expect those forces to reverse themselves — even setting aside the threat of war, every nation has seen some manufacturing activity leave for cheaper countries once costs rise. And meanwhile, the engine of U.S. government policy — and European government policy, etc. — is just revving up. Once policymakers figure out which policies actually speed decoupling without injuring the economy, you can expect them to double down on those.

This is only the very beginning of the decoupling story.

I can’t believe the Economist would allow such a half-baked and circumstantial article on such an important topic and frame trends in global trade all on Biden’s trade policies! One can be critical of Biden’s lack of a free trade push with allies (TPP + EU, etc) without being naive about China. Decoupling might be less ideally efficient in the short-term, but it will be more secure and eventually supply chains like Vietnam and India will become more efficient as they industrialize further.

Many "illustrious" publications seem to start with the conclusion and then wing the "data" to support it. The Economist seems to be joining that category. The premise of the article i.e expecting impact of decoupling to show in data in 3 years (assuming start from Trump tariffs and really accelerating post Covid) is in itself highly unrealistic.

China has built its industrial base over 35-40 years - Schenzhen SEZ started in 1980 and i suppose it would have taken another 4-5 years to gather momentum - replicating even a portion of China's manufacturing base would take atleast a decade because China is today the only country that has an ecosystem at huge scale not just for the final product but all the base materials that go into it, any competitor would only have a part of that chain today. Further one can never discount how businesses might respond if China policy were to veer back to pre Xi days. Nevertheless one can be optimistic that the once bitten businesses and governments would want a plan B in all scenarios and diligent work towards friend shoring should eventually show results thet even The Economist will have to grudgingly acknowledge.