Comparing "Morning in America" with 2023

Are we better off?

The blurry image above is from a 1984 Ronald Reagan campaign ad, officially called “Prouder, Stronger, Better”, but commonly known as the “Morning in America” ad. Here’s the whole thing:

The text of the ad reads:

It’s morning again in America. Today more men and women will go to work than ever before in our country’s history. With interest rates at about half the record highs of 1980, nearly two thousand families today will buy new homes, more than at any time in the past four years. This afternoon 6,500 young men and women will be married, and with inflation at less than half of what it was just four years ago, they can look forward with confidence to the future. It’s morning again in America, and under the leadership of President Reagan, our country is prouder and stronger and better. Why would we ever want to return to where we were less than four short years ago?

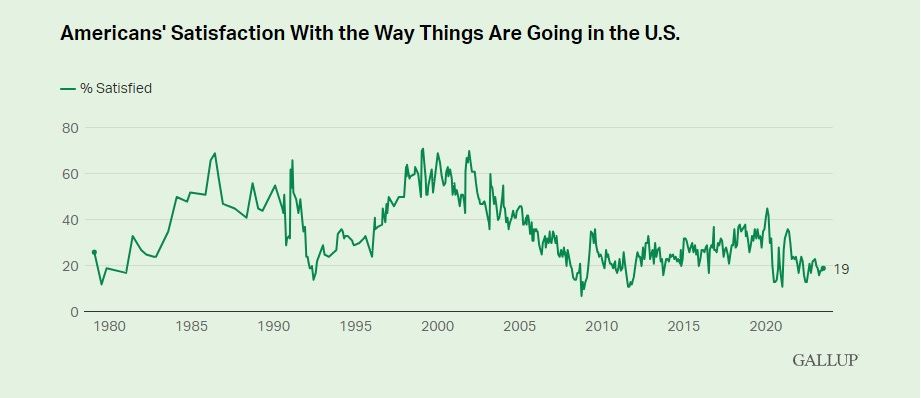

This ad has attained an iconic status in the memories of many Americans from that time, as the perfect encapsulation of the sunny optimism of the Reagan years and of Reagan’s reelection campaign. And indeed, the mood was very optimistic, with consumer sentiment and satisfaction with the country’s direction both having soared from the depths of 1980:

If “Morning in America” was a peak of optimism, 2023 is a trough of pessimism, as you can see from the charts above. Survey after survey shows that Americans see the current economy in a very negative light.

I wrote a post a week ago trying to think about why Americans might be so upset about the economy, when indicators like unemployment, wages, and inflation have all turned up in the last year or so. Other people have written very thoughtfully on the same topic. But today I want to do something slightly different — I want to compare the Biden economy of 2023 to the Reagan economy of 1984.

How does Biden’s economy do according to Reagan’s criteria?

Naturally, a President running for reelection will choose to highlight economic indicators that are most favorable to his own record. So judging Biden’s economy by the things that Reagan’s campaign thought he was getting right is actually a pretty tough standard. Nevertheless, 2023 actually comes out ahead on most counts.

Reagan’s ad trumpets five things:

High employment rates

Lower interest rates

Lower inflation

Lots of homebuying

A large number of marriages

So let’s do a little comparison. Prime-age employment rates in 1984 were around 76%, compared to 81% now.

The population was younger back then, so there were fewer retirees, but even so, the total employment rate was slightly lower in 1984 compared to now.

Now, I think it’s important to look not just at the levels of these economic indicators, but the recent changes, because people’s point of reference matters a lot. In both 1984 and 2023, high employment was a relatively new thing; in the U.S., we’ve just recovered from the Covid years, and the Great Recession is still within recent memory, while in 1984 the country was recovering from the stagflation of the 1970s and from the recessions Paul Volcker unleashed in order to fight inflation.

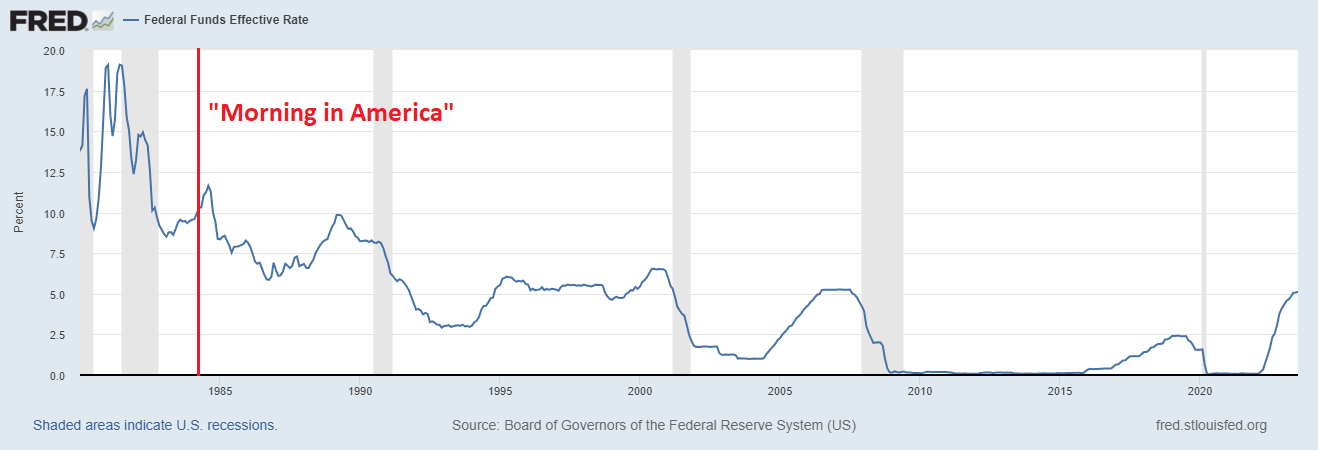

Now let’s look at interest rates. When Reagan trumpeted the lower rates that were helping people to afford homes, mortgage rates were around 13% or a little higher. As of 2023, rates are about half that:

Here, though, the recent changes tell two different stories. Rates in 1984 had fallen quite a bit from the highs that Volcker had pushed them to just a few years earlier, while in 2023 rates have risen sharply. It’s much easier for Americans to finance their homes now than in 1984, but it’s getting harder, whereas in 1984 it was getting easier.

As for the federal funds rate (i.e. the “interest rates” you read about in the news), that was about twice as high in 1984 as in 2023, though it had come down significantly since 1981:

How about inflation? In 1984, the year-over-year change in the CPI — i.e., the “headline inflation” you see reported in the news” — stood at around 4%, while right now it’s a bit lower at 3%:

Once again, 2023 beats “Morning in America” when it comes to the absolute numbers. In terms of recent changes, it’s harder to say. In 1984, inflation had come down from a very high peak of almost 15% just a few years earlier, but had recently bounced back a little bit. In 2023, inflation has fallen, but the drop has been more recent — just over the last year. So which one looks better depends on your choice of reference point.

How about homebuying? Single-family home sales are at about the same level now as in 1984 in terms of raw numbers. When you adjust for population, sales are slightly lower in 2023 than in 1984 as a percent of the prime-age (25-54) population — 5.45 per 1000 people right now, compared to around 7 per 1000 people in 1984:

Both periods have seen a recent rise in homebuying, though there was a brief dip during the shaky economy of late 2021 and early 2022. The longer-term trend looks better in 2023, as we’re still on the long road to recovery from the depths of the housing crash.

In fact, in terms of homeownership rates, 2023 looks significantly better than 1984:

In fact, despite Reagan’s sunny rhetoric, homeownership was on a slight downward trend when he ran for reelection.

And finally, how about marriages? Here, 1984 clearly wins, because Americans are simply much less likely to get married in this day and age.

So anyway, those are the five things Reagan trumpeted in his ad. On most counts, the economy of 2023 looks better than the economy of 1984 did. The only points on which “Morning in America” really comes out ahead are:

Interest rates have been rising in 2023 vs. falling in 1984.

Inflation had been falling for longer in 1984 than in 2023.

Homebuying rates were a little higher in 1984.

Marriage was much more common in 1984.

On everything else, 2023 wins. Americans are significantly more likely to have jobs now, interest rates are much much lower, and inflation is a bit better.

Some more numbers

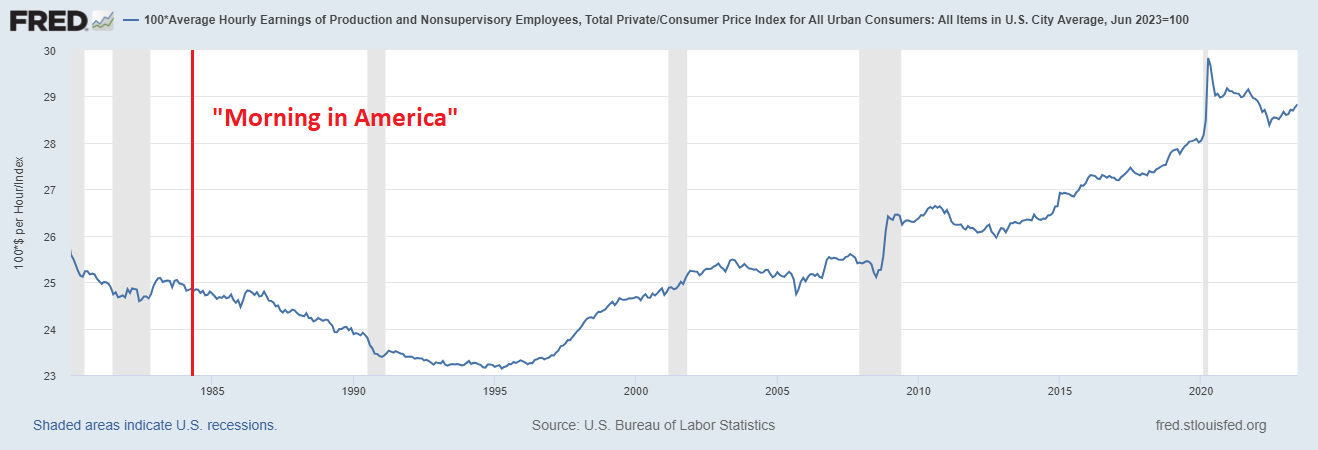

Although those are the five things Reagan’s ad cited, there are other economic indicators we could look at. For example, wages. Real wages are on a rising trend in 2023, but back in 1984 they were in the middle of a long stagnation:

We could also look at income. Real disposable personal income is on a rising trend in 2023 as it was in 1984:

The story is a little more complicated, of course. Disposable income took a big dip in 2021 and early 2022 thanks to inflation, while in 1984, rising inequality meant that more of these gains were flowing to the rich. (Sadly, we won’t get 2023 median income numbers for quite a while.)

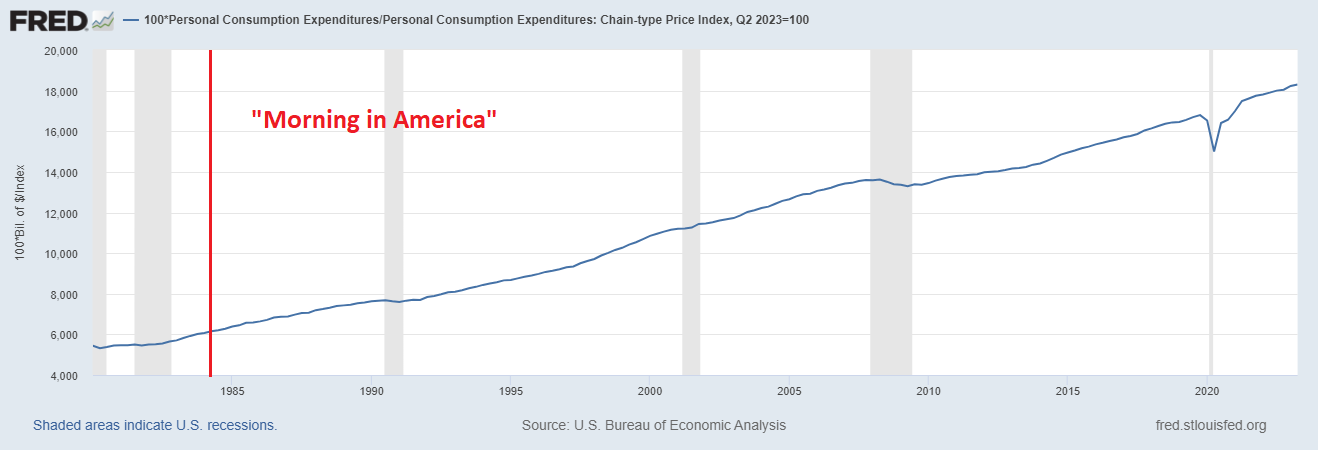

Yet another indicator we could look at is consumption. Real personal consumption expenditures were on a pretty smoothly rising trend in 1984 as they are in 2023:

One final thing we could look at is wealth, but this is a subtle and complicated indicator. America’s middle class has most of their wealth in their houses. If house prices go up, it means homeowners are richer, but it also means that first-time homebuyers have a harder time breaking into the market. Conversely, if prices go down, it makes it financially easier to afford a home, but creates a big drop in wealth. So while house prices might matter in people’s minds when comparing 1984 and 2023, I’m not sure how they matter.

So how do we bring back “Morning in America”?

The point of these comparisons isn’t to lecture Americans on why they should be happier with the economy they have. It’s to figure out how to make them happier. If Reagan managed to do it, then maybe Biden can do it too.

Looking at these economic indicators, the clearest difference between “Morning in America” and 2023 is about timing. When Reagan ran his famous ad, inflation had been falling for three years, and interest rates had been falling for two or three years. As of 2023, inflation has only been falling for one year, and rates haven’t even started to come down yet. So in terms of the cycle of inflation-taming, 2023 looks more like 1981 or 1982 — when consumer sentiment and voter satisfaction were still down in the dumps.

That’s moderately good news for Biden’s reelection campaign. If inflation keeps coming down for the next year, and the Fed starts to cut rates as a result, there’s a good chance that people will realize that the scary, painful economic episode of 2021 to mid-2022 is now over and better times are ahead, and consumer sentiment might shoot up the way it did in 1983. Of course, if that happens without a recession, as it looks like it might, so much the better for everyone involved.

But of course it’s also possible that the optimism of 1984 was about much more than just economics. By the time Reagan ran for reelection, the wave of social unrest that peaked around 1970 and had a minor resurgence around 1976 looked like it was now firmly in the rearview mirror. Whereas even if my optimistic predictions come true, the peak of the 2010s unrest was only 2.5 or 3 years ago. The nation is still in a shaky, nervous, bitter, exhausted mood after the coup attempt, the riots, the street battles, “cancel culture”, and the surge in crime. Even under the best of circumstances, it’ll still probably be a few years before we can really begin to move on from that.

Reagan’s sunny optimism in 1984 might therefore have included an important subtext, not captured in the economic numbers his campaign cited in that famous ad. “Morning in America” might have been about the dawn of a new era of (relative) social peace, a new political equilibrium that, if not necessarily to everyone’s liking, at least meant that Americans were no longer burning down their cities and Presidents were no longer trying to assume dictatorial powers. If that’s the case, Biden will have an uphill battle convincing Americans to feel optimistic based on economic numbers alone.

. . . "after the coup attempt, the riots, the street battles, 'cancel culture', and the surge in crime." It was not a coup attempt, much less the oft-trumpeted "armed insurrection" . . . and those fomenting or at least ignoring if not cheering the riots, street battles, cancel culture, and surge in crime are from the left. And we will not be "moving on from that" as long as the same people who caused the disruption are still running the show.

And, as in the last essay by Noah attempting to show how well off our economy is, the problem of our national debt is not even mentioned. Due to my work, I move in circles from corporate executives, small business owner, tech startups, tradesmen to retirees and there is a nagging concern from all of them that our level of debt is unsustainable and that much of the money being spent is wasted. I know no one who honestly believes that their children's lives will be a little bit better than their own and that is the cloud casting a pall over every other consideration.