At least five interesting things for your weekend (#45)

Intel; Canada's economy; infrastructure and state capacity; East Asian development; race in America; corrupt nonprofits

It’s late on a Saturday night, and here I am writing econ blogs instead of going out and partying. I’ll let you decide if that makes me a workaholic, a recluse, or both! Probably both.

Anyway, it’s podcast time! First, I went on TechFreedom’s Tech Policy Podcast, mostly to talk about Cold War 2 stuff:

And I have two episodes of Econ 102 for you this week. First, another political one on Kamala, Trump, and Biden’s legacy:

And for a more econ focus, here’s an episode where Erik and I talk about AI’s impact on the software industry and on white-collar jobs more generally — as well as various other topics:

Anyway, on to this week’s list of interesting things! The theme for this week is “economic growth and development”.

1. Intel’s troubles and American short-termism

Intel stock took a huge nosedive today, losing over a quarter of its value. That’s only top of a big long-term decline since 2021. The company is worth less than a third of what it was at its peak in 2021:

The trigger for today’s decline was Intel’s announcement that it was going to going to cut 15% of its workforce and suspend dividend payments to shareholders. The longer-term drop is related to Intel’s falling revenue, which has plummeted since 2021:

The long-term story of Intel’s woes is by now well-known. The company grew fat and complacent from relying on its old line of business — supplying ever-better CPUs to server farms — and kept missing new markets and new business models as a result. TSMC’s foundry business proved more efficient than Intel at pushing the boundaries of chip manufacturing — using EUV lithography tools that Intel itself paid to invent, and then ended up not using. NVidia became the master of designing GPUs for AI, while a bunch of other companies like ARM and Samsung mastered low-power smartphone processors. Intel suffered from a classic case of Clay Christensen-style disruption.

On top of that, several short term factors are weighing on Intel. The post-pandemic chip shortage turned into a glut, slamming Intel’s sales and profits. U.S. export controls on China cut off Intel’s sales to Huawei.

Some commentators, seeing Intel’s woes, are rushing to declare this a failure of industrial policy. For example, here’s the WSJ editorial board:

In other bad industrial policy news, Bloomberg reported this week that Intel is planning to cut thousands of additional jobs. This would be the chip maker’s third large workforce reduction since Congress passed the $280 billion chips subsidy bill that CEO Patrick Gelsinger lobbied for. Intel has been awarded $8.5 billion in grants and up to $11 billion in loans to expand U.S. manufacturing production.

While chasing subsidies, Intel missed out on the AI boom, which has cost it dearly as competitors surge ahead. Now it’s playing catch-up. When government steers capital, companies sometimes get distracted and drive into a cul-de-sac.

At the New York Post, Stephen Moore and Phil Kerpen declare that “Biden-Harris wasted $8.5 billion in taxpayer money to lose 15,000 jobs at Intel”.

Now, spending on Intel might indeed turn out to be a waste — someday. But it’s pretty ludicrous to say that Intel’s cost-cutting moves and stock price drops reflect the failure of CHIPS Act subsidies. The $8.5 billion in subsidies to Intel were announced in March 2024, in a non-binding preliminary memorandum. It is now August 2024, less than five months after that announcement. That means it’s very possible that zero dollars have actually been disbursed to Intel so far. Certainly, the majority of the subsidy money remains unspent.

It’s a little bit silly to criticize the results of a policy that hasn’t even been implemented yet.

Meanwhile, Intel’s turnaround plans — including a foundry business like TSMC’s and investments in AI chips — are still in the early stages. One reason profits have fallen at Intel is that it’s investing heavily. Bloomberg reports:

The company reports revenues divided between product groups and its manufacturing operations, with factories undergoing a massive upgrade and a build-out program that’s weighing heavily on profits…Revenue is improving at what [Intel] calls its Foundry unit, gaining 4% from a year earlier to $4.32 billion.

Furthermore, Intel’s suspension of a dividend signals that it’s planning to invest its earnings in its own business, rather than returning cash to shareholders. Paying dividends is what companies do when they don’t have ways to profitably reinvest the money; this is why growth stocks don’t tend to pay dividends. This is just Corporate Finance 101.

And Intel’s job cuts, painful as they are for the workers affected, are a cost-cutting move that will free up more cash to invest in the company’s recovery plan. Whether that plan will succeed isn’t clear yet, but if you were going to turn a company like Intel around, this is probably how you’d start.

Steve Glinert (a previous Noahpinion guest contributor) has a good thread where he acknowledges Intel’s missteps and challenges, but expresses frustration with the short-termism implicit in the current round of doomsaying:

The rush to declare Intel’s struggles a failure of industrial policy is emblematic of the crippling short-termist mindset that America has allowed to set over the past few decades. It’s the same brain worm that led the same people to declare Obama’s cleantech loan programs a failure because of Solyndra, when those same loan programs boosted Tesla to become the world leader in electric vehicles — with a market cap worth far more than every penny the U.S. government spent on the entire loan program.

Industrial policy takes time. If you think that just announcing some subsidies, without even writing the checks, should be enough to boost a company like Intel to world domination within five months, you’re living in a fantasy land of your own creation. I don’t know whether or not Intel will turn itself around, but if the doomsaying of the WSJ’s editorial board represents all the patience America can muster, we might as well resign ourselves to living in the Chinese Century.

2. What’s wrong with Canada’s economy?

Canada has turned in a disappointing economic performance over the last decade, coming in behind most other rich countries — even slow-growing ones like the UK and Japan:

Canada’s productivity levels were close to those of the U.S. in 1980, but have fallen far behind since then:

This poor performance is a bit of a mystery. Canada is located right next to the fast-growing U.S. It has avoided a financial crisis or other economic calamity. It has arguably the world’s best immigration policy, with a massive continuous influx of high-skilled immigrants. So what’s wrong?

RBC Economics has come out with the first plausible-sounding answer I’ve seen. In a recent article, they argue that Canada’s problem is a combination of low levels of investment and slow productivity growth, caused by regulatory red tape, a lack of R&D, and a pivot from manufacturing and technology to lower-productivity-growth industries like construction and services:

Some of the causes of Canada’s long-term slowdown in economic growth are well-known and clear. Let‘s start with an inefficient regulatory and administrative approval system at all levels of government, which has unintentionally increased internal barriers to trade and growth. Infrastructure chokepoints and red tape further make international trade more difficult than it should be. Those have contributed to lower Canadian business investment, and with that, an overweight of capital going to buildings and construction…

Canadian businesses invest substantially less than in the U.S.—about half as much per worker in aggregate…[P]art of the slowing in investment has been from a pullback in investment in the Canadian oil and gas sector…But, businesses have also invested a substantially smaller share of GDP in the manufacturing sector in Canada than in the U.S. over the last decade…

Businesses have long argued that an inefficient project approvals backdrop is making investing in Canada relatively expensive…

A patchwork of regulatory and administrative rules across different municipalities and provinces is complicated and unintentionally restricts trade within Canada…The International Monetary Fund has estimated that internal trade barriers (for example, regulatory differences across regions, paperwork requirements for businesses in multiple jurisdictions, and certification differences that limit labour mobility) cost the equivalent of a 20% average tariff between provinces…

[T]here remain significant bottlenecks where Canadian infrastructure significantly underperforms. The country’s turnaround times at ports are among the longest in the world…Canada also ranks poorly on “ease of exporting” in global rankings by the World Bank largely due to high document and paperwork costs…

Productivity in Canada lags in most industries versus the U.S., but the Canadian economy is also overweight in construction, where productivity growth has been slower.

Investment in residential structures accounts for twice the share of GDP in Canada (6%) than in the U.S. (3%)…Canada invests about 40% less (as a share of GDP) in intellectual property products (IPP) overall—with a larger weighting towards mining exploration activity. The manufacturing sector invests about just a quarter of what the U.S. invests in IPP relative to the industry’s GDP footprint…

The service sector (home to 80% of Canadian workers) must also be part of any solution to productivity challenges…Canada’s large public sector education and healthcare industries are much less productive than in the U.S. by 70% and 50%, respectively.

As for policy recommendations, there’s some easy libertarian stuff here — slash land-use regulation and red tape at ports, harmonize provincial regulation to enable internal trade, and cut corporate taxes. That’s the low-hanging fruit.

But that doesn’t seem like it’ll be enough to do the trick, because the sectoral shift from tech and manufacturing to construction and services will still be a problem. Canada needs to think about dipping its toes into the waters of industrial policy. Exactly what that could look like is a topic for a longer post.

3. If you want good cheap infrastructure, build up state capacity

America has a big problem building infrastructure. Our roads and trains cost much more per mile than other rich countries. There are a number of reasons why this is the case, including land-use regulation, NIMBYism, and broken government contracting processes. But one reason is simply that the U.S. lacks state capacity. We used to have a bunch of highly competent government bureaucrats who knew how to get roads and trains built; then, starting in the 1970s, we fired a bunch of those workers and let much of the in-house expertise decay into nothingness. In its place we hired a bunch of expensive outside consultants whose goal was maximizing their own payouts from the government, rather than providing high-quality infrastructure for the citizenry at a reasonable cost to the taxpayer.

This has been one conclusion of the Transit Costs Project, a panel of experts that has devoted years to studying the problem of rail costs in the U.S. In a recent report on how America could actually build high-speed rail, they reiterate the importance of in-house expertise vs. outside consultants:

With a bank of rail experts in Washington and universities churning out grads with relevant skills, individual projects could reduce their reliance on consultants and do more work in-house. (This was also a recommendation of a previous Transit Costs Project study about local mass transit.) To take a related example, for the price of one consultant contract to study whether to put trash in garbage bins or not, you could hire 10 in-house experts for four years to create a culture of trash expertise at the heart of local government.

But this isn’t just speculative. BART, the Bay Area’s commuter rail service, has been replacing its rolling stock (that’s a fancy name for train cars), which it calls the Fleet of the Future project. It has been accomplishing this within a reasonable time frame — not as fast as Japan would, but much faster than we’ve come to expect from California infrastructure projects. And unlike most other California infrastructure projects, Fleet of the Future has come in way under budget!

In a recent update, BART explains the secrets of their success:

BART’s popular Fleet of the Future project has just completed one milestone, with the final car of the original contract now ready for service…In the six years since the first Fleet of the Future train first went into service, the new trains have gone from a surprising sight for riders to an everyday part of their trip….

The increased pace in production and delivery of the new fleet has been essential to the transition. Car manufacturer Alstom is now delivering 20 cars a month to BART, almost twice as many as the 11 cars a month stipulated in the original delivery schedule…

The quicker tempo of deliveries is one of the reasons the Fleet of the Future project is expected to come $394 million under budget. Another big cost saver was BART’s decision to have its own highly experienced staff do more of the engineering work in house. The project team, led by John Garnham, has included engineers who have successfully completed new rail car projects at other agencies. (emphasis mine)

State capacity, folks. It really works. America needs more and better bureaucrats for things like infrastructure, because the alternative is to throw huge amounts of taxpayer money at inefficient outside contractors.

4. Why East Asian countries got rich

For well over half a century, economists have been having a wonky but very fascinating debate about how poor countries get rich. The question is how important capital investment is, relative to improvements in technology, education, regulatory policy, industrial structure, trade, urbanization, and other things that get summarized under the name of total factor productivity or multifactor productivity. The answer is important, because the more important capital investment is, the more poor countries can catch up simply by pouring more money into building factories, infrastructure, housing, and offices. Whereas the more important TFP is, the more countries need to focus on making difficult institutional and structural changes in order to keep growing.

Thirty years ago, Paul Krugman wrote an article called “The Myth of Asia’s Miracle”, in which he argued — based on the work of Alwyn Young — that most East Asian countries (with the exception of Japan) had grown fast not because of TFP, but because of high levels of capital investment. Klenow and Rodriguez-Clare (1997) disagreed, arguing that TFP growth stimulates more capital investment, so that we should attribute more of the East Asian growth miracle to TFP than Krugman and Young do.

Interestingly, Klenow and Rodriguez-Clare’s revised methodology still claims that Singapore grew mostly through capital investment. But Hsieh (2002) argues that if this were the case, Singapore’s return on capital would have fallen a lot more than it did — thus, he concludes that Singapore, too, grew fast mostly by learning to do things better instead of just investing more.

In other words, it looks like catch-up growth requires a lot of TFP growth, not just capital investment.

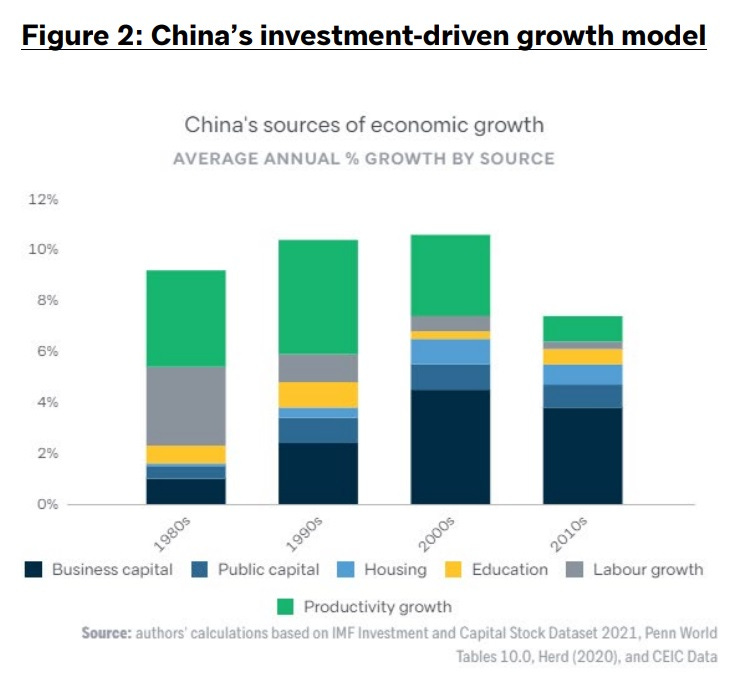

So how about China? Basil Halperin has been keeping track of the debate, which he summarizes in a recent thread. Basically, a bunch of papers, such as Zhu (2010), apply the newer growth accounting methodologies, and find that up until 2008, China’s TFP grew very rapidly — about as fast as other East Asian “miracle” economies did in their day. Yes, China was investing a ton in the Deng, Jiang, and Hu years, but it was also absorbing a ton of foreign technology.

But then productivity growth slowed down. Halperin pulls data from a number of sources that all agree that China’s TFP growth slowed enormously after 2008. The charts all pretty much say the same thing, so I’ll just post my favorite one:

In fact, during this time, Halperin calculates that China’s TFP growth fell below that of India:

So basically, China transitioned from TFP-based growth to investment-based growth after the Great Recession. That’s a highly simplified story, but that’s our best guess as to what happened.

The question now is whether China can transition back. The optimistic view — from China’s perspective, anyway — is that the real estate bust will shift resources back to manufacturing, and that Xi Jinping’s massive and unprecedented industrial policy will give a big boost to TFP growth. The pessimistic view is that the shift from TFP-growth growth to investment-based growth in 2008 reflects the inherent limitations of China’s state-driven model, and that it will fall short of countries like Japan and South Korea in terms of living standards. Basically, the question is whether Xi Jinping’s China is more like a newer, bigger South Korea, or more like a newer, bigger Soviet Union.

5. Hanania on race in the 2020s

Richard Hanania is a pundit whose work I generally do not like. His typical analysis relies heavily on racial and gender stereotypes, and he gets a lot of stuff wrong. But ever since a major expose thrust him into the limelight last year, Hanania’s takes have at least, occasionally been more measured and reasonable. And I must give credit where credit is due here, because I think that he had a very good take on the recent “White Women for Kamala” and “White Dudes for Harris” events.

Basically, Hanania argues that after a decade of singling White people out for collective castigation, the progressive movement is accepting White people as just another racial interest group worthy of inclusion in the coalition:

One thing right-wingers love is to complain that you can only have affinity groups for blacks and other minorities…Along comes the Kamala campaign and says it’s ok to be white. That is, as long as you’re a good person, which means supporting reproductive freedom, not being “weird,” and voting Democrat. We’re all in this together.

It seems “woke” on the surface, but it’s actually a sign that liberals are moving away from woke. In 2020, something like this wouldn’t have even been possible. Talk of “whites” in left-coded spaces only occurred in the context of flogging them for their sins. In 2024, you can be a white dude for Kamala and it’s totally cool. The symbol for “White Dudes for Harris” is a trucker hat, showing self-deprecating humor and membership in a movement that is not at all weird or neurotic about race.

White people receive the message that Democrats do not consider you the problem. You’re welcome into the coalition. There’s even a Zoom call you can join, and don’t worry, it won’t be just Robin DiAngelo telling you how much you suck. Kamala has made clear that she’s *only* considering white men for VP…

Republicans have been caught flat-footed. Conservatives want to portray these events as a kind of 2020 DEI struggle session, and they can find clips backing up that view, but people who have attended say that there was actually very little of that…

What else can conservatives say in response? I’ve seen a little bit of “why can’t we have a whites for Trump thing?” Well, who’s stopping you? It’s a free country. Organize “whites for Trump” and see what happens…There will be no “Whites for Trump” event because the campaign would never allow it, understanding it would be a PR nightmare. “Whites for Trump” would draw sewer dwellers, instead of the nice, seemingly normal people that came out for Harris…

We can now all see the hopelessness and stupidity of white nationalism, which wants to argue that the 220 million American whites who are at each other’s throats over social issues and values should unite under one umbrella because they share the same interests. The only way white identitarianism would have had any hope is if liberalism stayed in summer of Floyd mode indefinitely, where you push anti-white rhetoric so blatantly and aggressively that it causes a natural reaction.

Whites for Kamala completely defuses any hope of building a broad white identitarian coalition.

This sounds basically right to me. White people are not yet a numerical minority in America — and depending on how many Hispanic and multiracial Americans define themselves as White, they may never be. But events like “White women for Kamala” show that the progressive movement may simply decide to treat White progressives as just one more minority identity group in a rainbow coalition.

And I think Hanania is also right that if this happens, it will take a lot of the wind out of the sails of white nationalism and rightism in general. For most people, being part of a minority group in a rainbow coalition probably sounds like a better deal than fighting a grim race war to try to expel other groups en masse or break up the nation just to be a supermajority again.

But at the same time, I think there’s another vision that’s even better than the rainbow coalition. If national identity can be strengthened, and the salience of racial identities weakened, Americans wouldn’t have to define their place in American society by the circumstances of their birth. The proper counter to progressive identitarianism will never be White nationalism; it will always be American nationalism.

Update: I also like Hanania’s take on progressives re-embracing patriotism and the American flag. I don’t think it’s quite true yet, but I think it’s what should happen, and maybe by the end of this decade it will.

6. San Francisco nonprofits are both corrupt and ineffectual

In 2022, there was a big tech bust that deprived the city of San Francisco, and the state of California in general, of a lot of tax revenue. At that point, San Francisco began taking a harder look at the nonprofits to which it has famously outsourced many of its social services. Unsurprisingly, many cases of incompetence and outright corruption are being discovered.

The SF Standard is the best news outlet reporting on this ongoing series of investigations. For example, here’s a story about the Dream Keeper Initiative, a San Francisco city effort to help its rapidly dwindling Black population:

In February 2021 [San Francisco announced] the Dream Keeper Initiative, a landmark piece of legislation that promised to redirect $120 million to address issues caused by systemic racism…Over the last two and a half years, Dream Keeper’s successes have led to more than 1,300 people getting jobs or business training…Investments have been made in healthcare for Black mothers and infants…There’s also the Downpayment Assistance Loan Program, which has distributed more than $24 million to help 57 people purchase homes, a path to upward economic mobility…But despite the many good deeds of Dream Keeper, the initiative has become a bookkeeper’s nightmare…

SF Black Wall Street, a nonprofit that advocates for Black entrepreneurship, has received more than $2.3 million through Dream Keeper…But nearly a third of that money was spent on just two Juneteenth parties…that cost more than $700,000 to produce. That is more than the total amount ($660,000) SF Black Wall Street has spent on small business grants…

A closer inspection of IRS filings for SF Black Wall Street shows that one co-director, Tinisch Hollins, did not report taking a salary while doing 20 hours of work a week. Instead, she redirected tens of thousands of dollars in administrative fees to Ujima Global Consultancy, an LLC she created…[Dream Keeper Director Sheryl] Davis said she was not aware that directors of some of Dream Keeper’s nonprofit partners have set up shell companies, or that some directors have been giving themselves substantial raises — in the tens of thousands — immediately after the infusion of millions in city funds…

Dr. April Silas, CEO of the Homeless Children’s Network, which has received more than $3.7 million from the Office of Economic and Workforce Development, saw her salary increase from almost $232,000 in 2020 to more than $283,000 two years later…Davis confirmed that the Homeless Children’s Network was recently cut off from city funding…

One recipient of Dream Keeper money, J&J Community Resource Center, made headlines after its director tried to get booze and cigars reimbursed.

And here’s a story about SF Safe, a nonprofit that works with the police:

The fired former executive director of a San Francisco nonprofit has been arrested and charged with 34 felonies related to the misuse of more than $700,000 in public funds…Kyra Worthy, 49, of Richmond faces charges that include misappropriation of public money, submitting fraudulent invoices, theft, wage theft and check fraud during her tenure as head of SF SAFE, a nonprofit that partnered with the San Francisco Police Department…Worthy is accused of failing to pay more than $500,000 to subgrantees of a city contract, embezzling more than $100,000 from SF SAFE for personal use and committing wage theft against employees…

Prosecutors allege that Worthy’s mismanagement led to the 48-year-old charity ceasing operations in January, despite receiving millions in public and private funds over five years…Worthy allegedly spent lavishly on parties and events, even as the nonprofit struggled financially. Prosecutors say she spent more than $350,000 on luxury gift boxes in 2022-23 and nearly $100,000 on a single event called “Candy Explosion” in October 2023…In 2018, she allegedly paid her landlord $8,000 using three nonprofit cashier’s checks, telling accountants the funds were for community events…Court documents state Worthy spent more than $90,000 of nonprofit money in 2019 and 2020 on a home healthcare worker for her parents in North Carolina. She reportedly created vague invoices and categorized these payments as community meeting expenses and a District 10 safety project…

Prosecutors further allege Worthy stopped paying payroll taxes for 27 employees from September 2023 to January, when SF SAFE shut down. Court documents say she continued issuing regular paychecks, leading employees to believe taxes were being paid…The alleged wage theft totaled about $80,000 over four months. Worthy is accused of falsely claiming that full wages and taxes were paid when submitting invoices for a city contract…A holiday party, which was not a fundraiser, allegedly cost $56,000.

The practice of farming city services out to nonprofits is simultaneously a way of wasting giant amounts of money, and an invitation to corruption. The SF city government should be building up its state capacity to provide these services in-house instead of lobbing money at nonprofits.

That said, there also may be government corruption going on here. Sheryl Davis, the city employee who runs the Dream Keeper initiative, has also been accused of misuse of funds:

Allegations made against Davis in the whistleblower complaint range from using city funds to pay for trips for family and friends to designing contracts to be less than $10,000 to avoid formal reviews.

Records obtained from the city show that Davis [herself] charged the city for more than $51,000 in reimbursements from 2020 through the first half of 2023. That total was almost $22,000 more than the second-highest department head…Davis wrote a children’s book last year that netted her more than $10,000 in outside income. She acknowledged that the city did make one “bulk” purchase of the book but said she was unsure of how many copies.

So SF clearly has some cultural problems here. The nonprofit problem is important, but overall what’s needed is a crackdown on people who see the city government’s budget as their personal piggy bank.

"If national identity can be strengthened, and the salience of racial identities weakened, Americans wouldn’t have to define their place in American society by the circumstances of their birth." Right!

Practically speaking, most Americans are mutts; our individual backgrounds are a mix of cultures, races, religions, etc. So America is not a country of white people, it is a country of mutts. Seen this way, whiteness is inadequate to express what it is to be American.

When muttness replaces whiteness in the American imagination, the Melting Pot will be achieved.

As a Canadian, I would LOVE if you do indeed write a longer post on the economic situation in my country. It’s certainly depressing that it has become like it is because it will affect us in the long term.