Are big companies just better?

Superstars vs. ball-hogs.

In basketball, a lot of thought and analysis goes into figuring out whether a star player is really producing points and wins for his team, or whether he’s just a ball-hog. The economics of competition is kind of similar. There are basically two schools of thought. The first believes that big companies are big because they get lucky with a first-mover advantage and network effect, or because they use anti-competitive tactics to squeeze other players out of the market, or because they’re somehow favored by the government. The second thinks that big companies are “superstars”, and have some special sauce that makes them more efficient and productive than their competitors. Obviously, which school of thought you belong to is going to determine your attitude toward antitrust.

Of course, these “schools of thought” are idealized generalizations; lots of economists fall somewhere in the middle, and think that corporate concentration is maybe a little from column A, a little from column B. But inevitably, political battles end up breaking down along these lines. The Biden administration definitely seems to be charting a course toward the “big is bad” school of thought, hiring “Neo-Brandeisians” like Lina Khan and Jonathan Kanter to head up an aggressive new push against corporate concentration. Some believe that this is already putting a damper on merger activity. That is bound to generate some pushback.

One person who’s pushing back is my Bloomberg Opinion colleague and fellow econ blogger Tyler Cowen. Tyler is a well-known champion of the idea that big businesses are generally good for the country (he wrote a book making this case in 2019, and has blogged about it many times). Now Tyler points me to a paper by Sharat Ganapati, which finds a positive correlation between concentration and productivity in American industries:

Industry concentration increases are positively correlated to productivity and real output growth, uncorrelated with price changes and overall payroll, and negatively correlated with labor’s revenue share. I rationalize these results in a simple model of competition. Productive industries (with growing oligopolists) expand real output and hold down prices, raising consumer welfare, while maintaining or reducing their workforces, lowering labor’s share of output.

So if this is right, it’s consistent with the “superstar company” story — a few really well-managed companies are just better at what they do, so they crowd out the less productive companies, and consumers benefit from the higher productivity.

But there are a few caveats here. First, Ganapati doesn’t just find that concentration leads to lower prices; he also finds that these “growing oligopolists” lay off workers, reducing labor’s share of income. What’s the point of making cheaper stuff if workers can’t afford it? In fact, this is exactly the same problem raised by a pair of papers by Autor et al. from a couple years ago (and by a number of other papers). The fact that industrial concentration seems to coincide with a fall in the labor share is a powerful reason not to limit the focus of our thinking to aggregate consumer welfare -- in other words, a reason to take the Neo-Brandeisians’ concerns seriously.

But the second caveat is that simply finding an industry-level correlation between concentration and productivity growth doesn’t make a slam-dunk case that big companies themselves are actually driving the growth! You really have to look at the specific companies themselves. And Gutierrez and Philippon do exactly this in a 2019 paper called “Fading Stars”. They find:

We actually look directly at super star firms over the past 60 years in the US. What we find contradicts the common wisdom. We show that: (i) super-star firms have not become larger; super-star firms have not become more productive; the contribution of super-star firms to overall productivity growth has decreased by about 40% over the past 20 years.

What do Gutierrez and Philippon do, specifically? They simply get a bunch of data on individual companies — sales, employment, prices, output, and so on. This isn’t hard to get. Then they look at the top companies by market value — overall and within each industry — and check how fast these superstars’ productivity has grown (they also check the top companies by sales, just to make sure their conclusions hold).

First, they find that superstars are a little bit more productive than the average company. This, combined with rising concentration — i.e., more resources going to the big companies — means that superstar companies are contributing a bit to productivity growth. This is what the authors call the “reallocation contribution” of superstars to productivity growth:

This would seem to support the Tyler Cowen thesis that big, efficient companies are helping us grow by occupying more of the economy. BUT, this is not the only way that big companies contribute to productivity growth! There’s also the matter of how fast their own productivity grows. And here, the superstar contribution looks much less positive. Gutierrez and Philippon find that the “Hulten contribution” — i.e., how much these superstars would have contributed to productivity growth if their share of the economy hadn’t chaned — was impressively large in the 1990s but collapsed around the turn of the century:

So even as they were hoovering up more resources and taking over their industries in the 2000s, these giant companies stopped growing their own productivity. And if you combine these, you find that the latter effect dominates; superstar companies’ overall contribution to total U.S. productivity growth fell after the year 2000, even as their dominance within their industries began to rise:

Some other measures of big-company outperformance also collapse around 2000 — for example, sales per employee:

But interestingly, non-superstar companies’ productivity growth (red dashed line in the graph below) continues for most of the 2000s and 2010s, even as the smaller companies lose market share:

In fact, when Gutierrez and Philippon look at the famous 2015 OECD paper about how a few highly productive “frontier firms” are increasingly pulling away in terms of productivity, they find that those companies tend to be small — maybe $50-$80 million in sales. (Maybe it’s those smaller companies who deserve the name “superstars” instead of the big ones?)

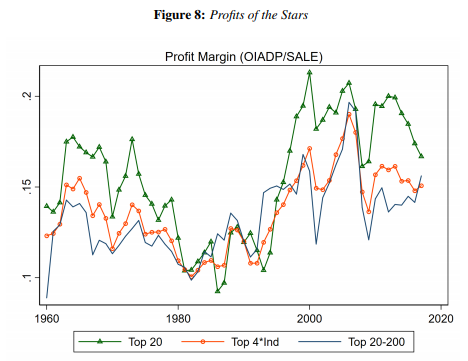

But anyway, even as the giant superstars’ contributions to productivity growth faded into near-insignificance after 2000, their profit margins soared to unprecedented levels:

Looking at these trends suggests a very different story than the one Tyler, or other supports of big business, might tell. It shows giant companies increasingly losing their productivity edge but sucking up more resources and making more profit. In other words, this supports the idea that much of what looks like superstar performance is actually just hogging the ball.

Of course, superstar companies’ real contribution to productivity growth depends on a third thing: How their presence in the market affects smaller companies. Does their growing market power starve smaller firms of resources, or does it drive them to greater feats of productivity in an attempt to keep up? That’s not something we can know from looking at these trends.

But in any case, the slowing productivity growth of giant companies, together with their rising market share and profit margins, suggests that we shouldn’t be so quick to buy the soothing story that highly efficient big companies deserve their market share because they’re showering us with a bounty of cheap goods. There’s something else going on here, and it should worry us — and worry the regulators too.

Update: An economist who shall remain nameless pointed out to me that the Ganapati paper shows that industries with growing concentration show increased productivity with flat prices, suggesting increasing markups…That is consistent with the story that big dominant companies are using market power to squeeze more money out of consumers.

Gonna just start referring to Russell Westbrook as a rent seeker whenever he does something hoggish.

Coincidentally recently read the part of Book IV in "Progress and Poverty" where George examines this issue. My sense is that these companies are good for much of their lifecycle but eventually need a little pruning.

Why does showing higher productivity in more-concentrated industries support the "superstar" explanation? If marginal productivity is *decreasing* in each input to production, and oligopoly distorts the economy by producing too little of a good, then we should expect more concentrated industries to have higher average productivity. I'm not sure what empirical strategy one could use to tease out these two effects since both imply a causal relationship from higher concentration to higher productivity.