Answering the techno-pessimists, part 3: The productivity slowdown

Past performance is no guarantee of future results.

This post is the third part in a series. The first part is here. The second part is here.

Earlier this year, as newfangled vaccines emerged to save us from a plague and green energy technologies seemed to rule out the worst-case climate change scenarios, a lot of us started writing posts that were gushingly optimistic about technological progress. But the curmudgeonly blogger at Applied Divinity Studies demanded that we techno-optimists back up our futuristic visions with hard data. So that’s what I’ve been attempting to do. The blogger’s four (heavily paraphrased) arguments are:

We’ve picked the low-hanging fruit of science

Productivity has been slowing down, why should it accelerate now?

Solar, batteries, and other green energy tech isn’t for real

Life expectancy is stagnating

I’m going to address these in reverse order. In my first post, I explained why life expectancy is still growing in most of the world, despite not actually being a great measure of technological progress in any case. In my second post, I explained why the green energy revolution is for real, and why it hasn’t yet juiced the productivity numbers. In this post, I’ll explain why those productivity numbers are limited as a measure of technological progress, why they’re hard to measure and to predict, and why they might accelerate in the years to come.

Technological progress and TFP are not the same thing

Generally, the main evidence that technological progress has slowed down comes from something called total factor productivity (TFP). Many of the Applied Divinity Studies blogger’s arguments rely on TFP as the fundamental measure of technology. So let me explain what that is.

Economists generally think that economic output (GDP) depends on two things: A) the amount of inputs like capital and labor, and B) technology, which turns those inputs into productive output. To measure TFP, you have to make an assumption about the functional form of the production function that transforms inputs into output. Usually we just assume something that looks like this:

Y is GDP, A is TFP, K is the economy’s total amount of capital, L is the economy’s total amount of labor, and α and β are just some numbers.

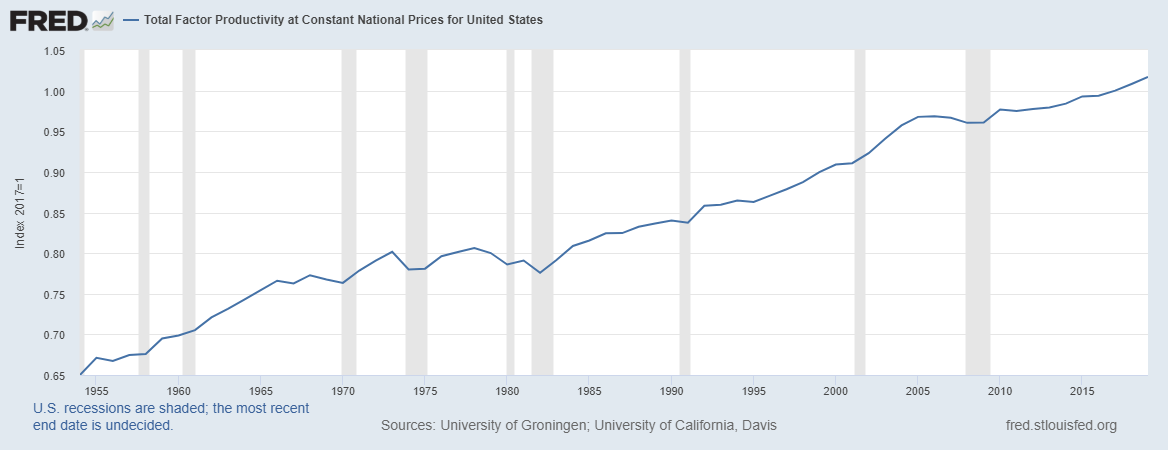

Using this method, we get something that looks like this:

This looks like mostly steady linear growth, punctuated by a couple of stagnations.

But we don’t want linear growth! We want exponential growth! A constant linear increase means that the percentage growth rate is going down. To look at the exponential growth rate, we should look at the logarithm of productivity:

As you can see, each period of productivity growth now looks a bit slower than the last, meaning that the exponential growth rate is slowing down.

In fact, if you adjust for the changing utilitization of capital and labor, as my PhD advisor Miles Kimball did in a paper with Susanto Basu and John Fernald, you find that the growth rate of “true” TFP has stagnated even more than the above graph would suggest. In other words, we’ve been using our machines and buildings and stuff more intensively, disguising some of the true TFP slowdown.

OK, so that’s the TFP slowdown. But here’s the thing: TFP is not the same thing as technology. The word “technology”, as we commonly understand it, includes stuff like computer chips, car engines, and procedures for making cement. Economists would broaden that definition to include things like business management techniques. But even with that broad definition, there’s plenty of stuff that can affect TFP that most of us would agree does not represent actual technology. For example:

If the government adds a bunch of burdensome regulations or taxes, that reduces TFP.

If people’s education level stops increasing, that lowers TFP growth.

If the population gets older, that can reduce TFP (since older workers are, on average, less productive).

If people spend more time goofing off at work, that can reduce measured TFP (since we’re overestimating the amount of labor input).

If people stop moving from less productive places to more productive places (for example, if housing restrictions drive up rents and keep workers away from superstar cities), that reduces TFP.

If a few big companies become more dominant, that can lower TFP, either via monopoly/monopsony power, or just by reducing dynamism in the economy.

If demand shifts from sectors where technology is progressing rapidly (for example, manufacturing) to sectors where it’s progressing slowly (e.g. services), that can reduce TFP growth, even if the rate of technological innovation in each sector remains exactly the same.

A lot of this stuff is, in fact, happening. American educational attainment is growing more slowly (after all, we can’t stay in school our whole lives!). In recent years, college attendance has plateaued, even before COVID; in fact, for White and Black students it fell a bit:

Meanwhile, geographic mobility is way down, people are switching jobs less, and various other measures of dynamism are down. And demand has definitely shifted from physical goods to services:

As for burdensome regulation and goofing off at work, the jury is still out.

But basically we’re seeing a whole lot of things happen that tend to reduce TFP growth but that have nothing to do with slowing technological progress! We can invent economically useful stuff just as brilliantly as in the past, but if the above stuff happens, TFP will still slow down.

In fact, in a recent book called “Fully Grown: Why a Stagnant Economy Is a Sign of Success”, the brilliant growth economist Dietrich Vollrath — whose excellent blog you should absolutely read — argues that most of the slowdown in TFP comes from slowing educational attainment, lower geographic mobility and economic dynamism, and and the shift from goods to services.

Now, slowing technological progress might cause decreased business dynamism (since less new tech means less fuel for new startups). But in general, most of these things are not caused by a slowdown in the rate of scientific discoveries or product innovations. That calls the entire technological stagnation theory into question.

And it also means that if we see a wave of inventions but slow TFP growth, it doesn’t necessarily mean that those inventions didn’t boost TFP! It could just mean that other things were happening at the same time that held TFP back. In other words, if college attendance stays flat or declines, cities keep excluding newcomers by banning construction, and consumers keep shifting to services, it could be enough to obscure most of the impact of a 2020s tech boom. But that doesn’t mean the increase wasn’t there! Technological innovation might be the only thing preventing TFP from slowing down even more, or even falling outright.

In fact, I think there’s a fair chance this is what will happen in the 2020s. BUT, we should also admit that the future isn’t written in stone; TFP has sped up and slowed down before, and it might do so again.

The TFP trend can change quickly

As they say, “The trend is your friend til the bend at the end.” Part of the case for future stagnation relies on looking at TFP trends and predicting that these trends will continue. But that’s not set in stone. For example, in the 1990s and early 2000s, productivity growth accelerated temporarily, to something like its old level. Here, let me borrow Dietrich Vollrath’s graph (made from Basu, Fernald and Kimball’s data):

Something like that red line could happen again. Maybe for another 10 or 15 years, maybe for longer. We just don’t know.

In fact, economists Nicholas Crafts and Terence Mills make exactly this point in a recent paper. They write:

Is the econometric evidence to be preferred to techno-optimism or techno-pessimism?…[F]orecast trend TFP growth based on estimated trends over the previous 20- or 25-year window exhibits considerable variation and does not show monotonic decreases…

[A]verage realised TFP growth…over 10 year intervals…has also varied substantially over time…[T]hese 10-year-ahead outturns are not well predicted by recent trend TFP growth. In particular, sharp reversals of medium-term TFP growth performance are not identified in advance. Indeed, forecasting on this basis would have missed the productivity slowdown of the 1970s, the acceleration of the mid-1990s, and the slowdown of recent years – in other words, all the major episodes during the period!

[M]edium-term TFP growth is very unpredictable. Recent performance is not a reliable guide, implying that an econometric estimate of low trend productivity growth currently does not necessarily rule out a productivity surge in the near future. The precedent of the 1990s is witness to this. [Also], a smoothed estimate of trend TFP growth has changed only slowly over time and is well above recent actual TFP growth. This suggests that pessimism about long-term prospects can easily be overdone.

In other words:

It’s really hard to predict TFP trends.

If you smooth out the trends, it looks like we’re due for another burst of TFP growth, though really who knows.

In other words, no matter how much evidence you marshal to show that the TFP stagnation is real, it might not indicate a technological slowdown, and TFP itself might have a boom soon. That doesn’t prove that techno-optimism is justified for the 2020s. But it means that looking at recent TFP trends and saying “See? Stagnation is our destiny!” is definitely not warranted.

In fact, in Tyler Cowen’s 2011 book The Great Stagnation (the most subtle and circumspect of the stagnationist books), he identifies non-technological factors as contributing to the stagnation, and he predicts that both technology and productivity growth will bounce back. Stagnationists would be well-advised to read that book!

I could be convinced that solar and biotech (and maybe ML) will be GP technologies that will boost TFP in a not so distant future. But in an economy where services dominate it seems to me the aggregate boost as to be somewhat contained or of short duration as the IT boost in the mid 90s. What do you think?

One thing:

- I'm not sure about that college enrollment graphic. My understanding is college enrollment is countercyclical, and 2010 was different than 2017 as far as the state of the US economy: for example, 2010 and 2017 had unemployment numbers of ~9% and ~4% respectively.