I have to admit, I really like Andrew Yang. His book (which I reviewed on Twitter) evinces a deep and sincere concern for American workers — and simply for human beings in general — that is all too rare in public life, or anywhere really. His sincerity and altruism are plain to see, and this probably has a lot to do with why he’s the front runner in the New York mayoral race.

When it comes to the details of policy, Yang has sometimes stumbled. But he doesn’t deserve nearly the amount of grief he gets. While Yang can certainly stand to improve, his ideas have been evolving to be more realistic and pragmatic, and his focus on universal cash benefits is the right one for the times. What Yang needs now is to shift his justification for that policy — and to get some good economic advice.

Yang’s New York UBI is good stuff

In a New York Times op-ed, Paul Krugman criticizes Yang’s UBI proposals:

Is [Yang’s] universal basic income proposal a good idea?

No, it isn’t. It’s both too expensive to be sustainable without a very large tax increase and inadequate for Americans who really need help…

[T]he Yang proposal to pay $12,000 a year would cost…well over $3 trillion a year, in perpetuity. Even if you aren’t much worried about either debt or inflationary overheating right now (which I’m not), you have to think that sustained spending at that rate would both cause problems and conflict with other priorities, from infrastructure to child care.

Yet these payments would also be grossly inadequate for Americans who actually did lose their jobs, whether to automation or something else. The median full-time worker in the United States currently earns about $1,000 per week.

The point is that for now, at least, the best way to provide an adequate safety net is to make aid conditional. We can and should provide generous aid to the unemployed; we can and should provide aid to families with children. But sending checks to everyone, every month, is just too poorly focused on the real problems.

Krugman is probably right about the $1000-a-month “Freedom Dividend” that Yang proposed during his 2020 presidential campaign. $3 trillion a year is 15% of GDP and about 62% of the current federal budget. That would require either enormous, burdensome tax increases, deep cuts to other spending, or explosive deficits on a scale far beyond anything that has been seen before — and all to provide a cash benefit not nearly big enough to replace a job.

But replacing a job shouldn’t be the goal for unconditional cash benefits. Instead, the purpose of unconditional cash is to grease the wheels of capitalist life — to give people that extra boost they need to pay their parking tickets, or deal with a health emergency, or buy a little more nutritious food for their kids, or just make it to the end of the month when they’re a little short. That little extra margin of safety and security makes daily life more emotionally tolerable. And it gives people a little bit of a springboard to self-improvement, because freeing them from the minefield of daily risks and hassles allows them time and mental space to plan their next move, whether that’s a better job, a small business, or a move to a different city.

That probably doesn’t require $1000 a month. But Yang is no longer proposing $1000 a month. His proposal for a New York City basic income is $2000 a year, which is far smaller and more doable. It’s also targeted; it would be given only to the 500,000 New Yorkers with the greatest economic need. That’s just $1 billion a year, barely more than 1% of New York City’s annual budget.

In fact, this is very similar to a real-world experiment recently completed in Stockton, CA. In that experiment, 125 people were randomly selected from low-income neighborhoods to get $500 a month — about three times what Yang is offering. The cash didn’t deter people from getting jobs; in fact, people who got the cash were more likely to be working full-time at the end of the experiment. They also reported feeling better emotionally and thinking more about their future. (I recently interviewed Michael Tubbs, who was the mayor of Stockton when the experiment was conducted.)

That sounds like a success to me. And it comes on the heels of quite a lot of economic research showing that unconditional cash benefits don’t stop people from working. This is a policy whose time has come, and Yang’s vision for a New York City version is perfectly affordable.

We need those robots

Andrew Yang’s Freedom Dividend was not really workable, but the idea was useful — it focused Americans on thinking about the possibilities of cash benefits. The main thing propelling the idea into Americans’ minds was the series of COVID relief bills, but Yang’s single-issue advocacy almost certainly helped.

Yang’s big shortcoming, however, was the reason he gave for wanting a UBI. The right reasons involve reducing poverty and decreasing risk and hassle. But Yang very vehemently argued that basic income was needed because automation was about to cause mass unemployment.

The “rise of the robots” is a very common fear that people have; in fact, workers have been afraid of being replaced by machines for centuries. But while it’s certainly a theoretical possibility, there’s tons of evidence that it’s not happening right now.

I laid out that evidence in a series of Bloomberg posts over the past few years. Just to recap:

Productivity has been increasing only slowly. If we were in the middle of an automation boom, we’d see productivity increase quickly.

Employment was very good before COVID hit — near all-time highs. If we were seeing automation cause mass human obsolescence, we would expect fewer people to have jobs.

Wages were growing pretty robustly before COVID hit. If automation was putting competitive pressure on humans, we’d expect to see wage growth slow; instead, it sped up. And wages grew most robustly for workers at the bottom of the distribution, whom you might imagine would be most vulnerable to being automated.

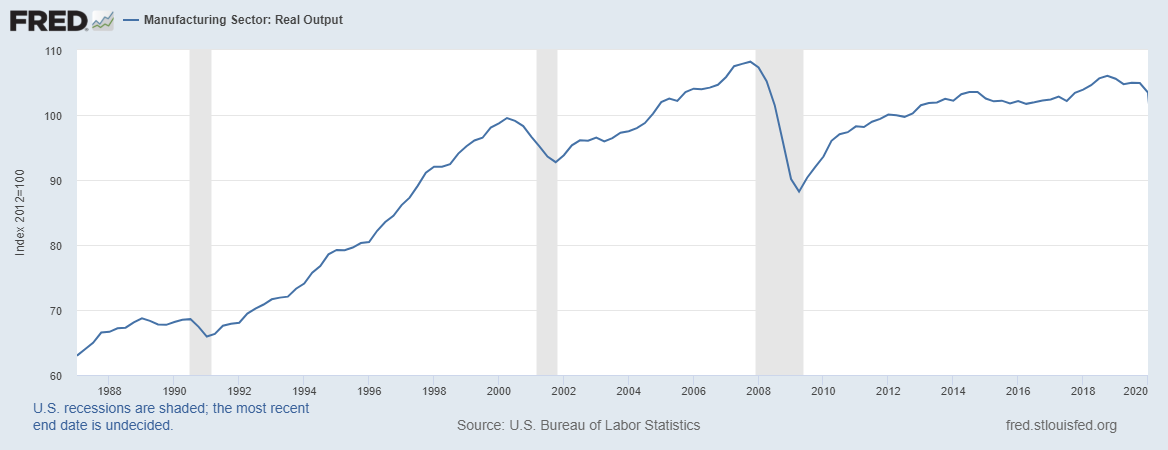

Manufacturing output was flat. Traditionally, manufacturing has been the sector that was easiest to automate. If robots are more productive than humans, and these robots have been replacing humans, you’d expect to see manufacturing output go up. Instead, it peaked in 2007.

So the evidence is clear: As of 2019, the U.S. was not experiencing the “rise of the robots”.

Of course, that doesn’t mean mass automation couldn’t make humans obsolete someday. But as of today it’s still science fiction. A bunch of organizations — the OECD, Citigroup, PwC, the WEF — regularly put out reports darkly warning that some huge percent of our jobs are “at risk of automation”. But these studies are worse than useless.

Their main methodology is to go around asking engineers what kind of existing jobs they could make a machine to do; naturally the engineers say they could replace a lot of stuff. But even if the engineers are right, they’re actually talking about replacing tasks, not replacing jobs; the two are very different. As job tasks get replaced, the same humans might be able to spend their time doing more productive stuff — they’re still employed, and they get paid more (or get paid the same but have more leisure time). Meanwhile, mass automation will increase society’s income, which will increase labor demand and create whole new categories of jobs that these studies don’t even try to think about.

So the studies are useless, and they encourage some very bad policies, like Bill DeBlasio’s idea for a robot tax. This is a really awful idea because not only is it unnecessary, but it would slow down innovation — exactly the thing we want government to subsidize instead of tax. And taxing robots would severely harm our competitiveness relative to China, where robots are being embraced with breakneck speed. You’ll notice that South Korea, Germany, and Japan — rich countries that are doing well in manufacturing and are certainly not suffering mass unemployment — have many many more industrial robots per capita than the United States. We’re already behind, and bad policies like robot taxes would put us even further behind.

Yang isn’t proposing a tax on automation (yet), but he needs to stop using fear of automation as a way to sell UBI. Besides the fact that the evidence is against it and it encourages bad policies, the “rise of the robots” narrative calls for a UBI that’s much bigger than anything Yang — or anyone — can possibly muster. If automation makes humans obsolete, we’re going to need a hell of a lot more than $167 a month, or even $1000 a month. It’s just not doable.

Instead, Yang should focus exclusively on the actually good justifications for UBI: Poverty reduction, risk and hassle reduction, and a springboard to self-improvement.

Yang needs some good advice

Yang has some other good policy ideas — notably, his plan for large-scale housing construction, using community land trusts and public housing. But in general, his economic agenda beyond UBI and housing is a little thin. Here’s Yang’s vision of a “human-centered economy”:

The Yang administration will directly tackle poverty with the largest basic income program in our history. It will open a People’s Bank of NYC so our public funds can be reinvested directly in our people and our communities. The administration will make it easier for small businesses to be compliant with regulations, and work with them to build their customer base. It will work with entrepreneurs to create a new start-up culture in NYC that will ensure the next big tech companies are homegrown. And it will keep its focus on human metrics - working to reduce poverty and homelessness, increase economic security, and build a human-centered economy that puts people above profits.

Beyond the basic income, it’s just not clear what this involves. Much more specifics are needed!

To this end, Yang needs a crack team of economic advisors. In the presidential campaign, his econ policy advice team was extremely thin and didn’t have anyone with a PhD. That needs to be remedied forthwith. Yang needs some professional economists to advise him, not just because they’ll have good policy ideas, but because they’ll help him avoid bad justifications for good policies (like the “rise of the robots” boondoggle).

My #1 recommendation would be Ioana Marinescu, who has done an amazing job rounding up the research on basic income, as well as doing some of the best research herself. Marinescu is an incredibly skilled, versatile, and flexibly minded economist, whose interests and knowledge are very broad; if I were Yang, I’d give her a call.

In general, I think Yang simply needs more technocratic expertise. He may talk about “doing the math”, but at heart he’s a populist — he cares deeply and sincerely about regular people, and his impulse is simply to reach out and help them. That’s a great impulse, and seemingly very rare for a politician. But the problem with populism is that it has to be tempered by technocracy — in addition to the desire to help people, you’ve got to have plans that will actually get the job done. Populists are sometimes wary of technocrats, but they should remember that all the most successful economic policy reform programs had plenty of knowledgeable advisors.

I’m optimistic about Andrew Yang. He’s a good guy, in a world with far too few good guys. And his big idea is a good one, especially in its updated, realistic form. But to take the next step, I think he needs some wise counselors at his side.

Just wanted to say to everyone: this is such a high quality comments section! Well done us.

I agree on Ioana Marinescu. See Andrew Yang Isn’t Doing His Signature Policy Right https://www.nytimes.com/2021/03/16/opinion/andrew-yang-ubi-nyc-mayor.html) | Bryce Covert